FTSE 100 hits new record

Newsflash: The UK’s FTSE 100 index has hit a new alltime high at the start of trading in London.

The blue-chip share index has hit 7926 points, as it surges over the record high set on Friday (which was the first since 2018).

As explained in the opening post, the rally comes as hopes build that the UK economy could fare better in 2023 than feared, with the NIESR thinktank predicting a recession could be avoided.

Shares are also benefiting from hopes that central banks could end their interest rate increases soon.

Victoria Scholar, head of investment at Interactive Investor, tells us:

The FTSE 100 has hit a record high again, surpassing Friday’s peak. Following a wobbly start to the week in which global equities were hit by concerns about a more hawkish path from the Fed after a strong US jobs report as well as heightened US-Sino tensions, the UK large-cap index has restored its bullish momentum.

Yesterday Fed Chair Jerome Powell said inflation is easing, raising hopes that the US could be approaching the peak for interest rates. A strong close on Wall Street with the Nasdaq closing up by 1.9% has helped drive a positive start to the European session.

Over a one-year period, Pearson is the best performing stock on the FTSE 100 followed by BAE Systems and Antofagasta. Over the past one month, JD Sports is the top performer with IAG and 3i in second and third place.

The pound is trading higher against the greenback driven by US dollar weakness against most European currencies today following Powell’s relatively hopeful remarks about the outlook for US inflation.”

Key events

Filters BETA

Microsoft has said it was committed to addressing the concerns raised by Britain’s competition regulator about its acquisition of “Call of Duty” maker Activision Blizzard today.

Rima Alaily, MS’s corporate vice-president and deputy general counsel, says:

“We are committed to offering effective and easily enforceable solutions that address the CMA’s concerns.”

“Our commitment to grant long-term 100% equal access to ‘Call of Duty’ to Sony, Nintendo, Steam and others preserves the deal’s benefits to gamers and developers and increases competition in the market.”

Her’es our news story on the UK’s competition regulator’s ruling that Microsoft’s $68.7bn (£59.6bn) deal to buy Activision Blizzard, the video game publisher behind hits including Call of Duty, will result in higher prices and less competition for UK gamers.

Shares in Activision Blizzard have dropped by 4% in pre-market trading.

They’re down to $72.70.The stock had already been trading at a substantial discount to the $95 per share value of Microsoft’s offer, given concerns that regulators might block the deal.

Back in the City of London, the FTSE 100 has climbed to a new alltime intraday high.

The index touched 7934.30 points, as traders continue to grasp hopes that inflation is easing, meaning borrowing costs could soon peak.

George Lagarias, chief economist at Mazars, says investors should be cautions, though.:

“The FTSE 100 broke yet another record, as a result of the general global equity rally. Despite the buoyancy, investors need to stop for a moment and think: what is driving positive sentiment?

Presently, it’s really one single factor: the belief that we are at, or very close to, peak interest rates. However, none of the major central banks have yet actually confirmed that they are pausing rate hikes. Given that we are in the midst of an economic slowdown, and possibly a recession, we would approach the rally with optimism, but also a lot of caution.”

The CMA’s ruling come just hours after the head of Activision accused Sony of “trying to sabotage” Microsoft’s takeover.

Bobby Kotick, the Activision chief executive, also told the Financial Times that a “fragile” UK government could miss a post-Brexit opportunity to attract thousands of jobs if it blocks Microsoft’s acquisition of Activision Blizzard (as the CMA is indeed threatening to do).

Kotick told the FT that UK prime minister Rishi Sunak is “smart” and “understands business”, Kotick said, adding that the UK government seemed to lack leadership.

He added:

“If I look at our hiring plans, we’re more likely to find the next 3,000 to 5,000 people that we need in the UK than almost any other country.”

Kotick also denied that the deal would hurt competition (as the CMA fears), saying:

“The whole idea that we are not going to support a PlayStation or that Microsoft would not support the PlayStation, it is absurd.”

CMA: Microsoft-Activision Blizzard deal would hurt competition and harm gamers

Breaking: the UK’s competition watchdog has provisionally concluded that Microsoft’s proposed $69bn takeover of computer games maker Activision Blizzard could result in higher prices, fewer choices, and less innovation for UK gamers.

In the provisional findings of its inquiry into the deal, just released, the Competition and Markets Authority has warned that the deal would result in a substantial lessening of competition in gaming consoles and cloud gaming services in the UK.

Microsoft announced in January 2022 that it would pay $68.7bn in cash for Activision, the firm behind Call of Duty, World of Warcraft and Candy Crush.

Today, the CMA says that in the gaming console world, Microsoft’s Xbox and Sony’s PlayStation compete closely with each other, and that Activision’s Call of Duty (CoD) is important to the competitive offering of each.

Microsoft, it fears, could restrict Call of Duty on the PlayStation. The CMA says:

The evidence suggests that, after the Merger, Microsoft would find it commercially beneficial to make CoD exclusive to Xbox or available on Xbox on materially better terms than on PlayStation.

We provisionally found that this would substantially reduce competition in gaming consoles to the detriment of gamers—Xbox and PlayStation gamers alike—which could result in higher prices, reduced range, lower quality, worse service, and/or reduced innovation.

The regulator also has concerns over cloud gaming services – fearing that Microsoft could make Activision’s titles exclusive to its own cloud gaming service, or available there on materially better terms than on rival cloud gaming services.

They say:

We provisionally found that, after the Merger, Microsoft would find it commercially beneficial to make Activision’s titles exclusive to its own cloud gaming service or available there on materially better terms than on rival cloud gaming services.

The CMA suggests that it could block the merger.

Alternatively, it could requiring a partial divestiture of Activision Blizzard, which could mean the sale of the business associated with Call of Duty, or the sale of either the Activision or the Blizzard segments of the company.

Price of diesel falls below 170p per litre for first time since March 2022

The price of a litre of diesel has fallen below 170p for the first time since last March, in a boost to some motorists and businesses.

Figures from data company Experian show UK forecourts were charging an average of 169.9p per litre on Monday.

It is the first time the price has been cheaper than 170p in 11 months, since the invasion of Ukraine drove up fuel prices.

RAC fuel spokesman Simon Williams said:

“This is good news for drivers of diesel vehicles as they have had to endure some tough times with the average price of a litre nearly hitting £2 at the end of June. Since then the price has tumbled 30p, saving more than £16 on a full tank.

But, if retailers play fair with drivers, the price should fall further still as the wholesale price is now back to a level last seen around the time Russia invaded Ukraine. Even with retailers taking a higher than average margin of 10p a litre, the price of diesel should really be 10p lower at 160p.”

Network Rail boss suggests Grant Shapps ‘galvanised’ workers to strike

The boss of Network Rail has suggested that government minister Grant Shapps “galvanised” rail workers into continuing strike action when he was transport secretary through “noisy political rhetoric”.

Andrew Haines said negotiations with trade unions have been conducted in a less confrontational and more “measured tone” since Mark Harper took on the role in October last year.

Widespread strikes over jobs, pay and conditions began in June 2022, when Mr Shapps was transport secretary.

Last June, Shapps accused the Rail, Maritime and Transport (RMT) union of a “total lie” over claims that he disrupted negotiations. In July, Shapps said the power of “these very militant, extreme-Left unions” to cause disruption should be curbed.

Asked whether Harper and his rail minister, Huw Merriman, have “changed the narrative with the unions”, Mr Haines said:

“They have taken some of the more robust rhetoric out and said ‘We’re prepared to talk, we’re prepared to meet’.

“The conversations are equally direct and blunt but they’re done in a measured tone that isn’t confrontational.

“The underlying realities haven’t changed but what that’s allowed us to do is avoid the distraction.

“It’s a harsh reality that, however well-intentioned, noisy political rhetoric, if anything it galvanised the workforce against settling.”

Haines made the comments during a question and answer session last night, after Harper gave the rail industry’s annual George Bradshaw address in central London.

The previous approach created a “them and us approach” and “demonised” rail workers, Haines said, adding:

“I’ve seen a very material change in the sentiment among Network Rail colleagues because the heat’s been taken out.

“However well-intentioned, bashing people up in the newspapers doesn’t work if you want to get people to vote for something.”

Shapps moved to run the BEIS department in October, and was yesterday named as the head of a new Department for Energy Security and Net Zero.

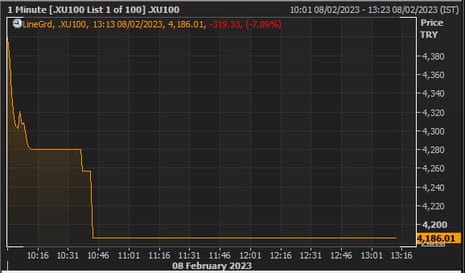

Turkey’s stock market halts trading after main index drops 7%

Trading on Turkey’s stock market has been suspended this morning after the country’s benchmark equities index fell 7 per cent.

Stocks dropped sharply again on Wednesday, following heavy losses on Tuesday after Turkey and Syria were hit by a devastating earthquake that has killed thousands of people.

The Bist 100, which contains the hundred largest companies listed on the Borsa İstanbul, has been suspended after dropping 7%. The index twice tripped a “circuit breaker” that is in place to calm trading this morning.

Turkey’s Borsa Istanbul says:

“Trading in Equity Market and Single Stock & Index Futures and Options Contracts in the Derivatives Market has been suspended.”

The stock market operator did not say when trade would resume.

According to Bloomberg, this is the first time that Turkey’s stock exchange has suspended trading in 24 years.

Last night, Turkish president Recep Tayyip Erdoğan declared a state of emergency in areas hit by the region’s worst earthquake in decades.

The earthquake has also put pressure on the turkish lira, which has tumbled to a record low this week. The lira weakened last year as Turkey’s central bank cut interest rates several times, which helped to push Turkey’s inflation rate to a 24-year high of 85.5% in October.

The earthquake will add to Turkey’s economic pressures. Md. Shabbir Ansari, senior insurance analyst at GlobalData, says:

“The preliminary estimate of economic loss due to the current catastrophic event is more than $1.0 billion, and it will take years for Turkish insurers to settle the insured losses.

The economic loss is expected to be more than two times the losses from a similar earthquake in 2020.

Emergency services are continuing to search for survivers from the earthquakes. And today, a container blaze at Turkey’s southern port of Iskenderun has been brought under control (our liveblog reports).

The FTSE 100 continues to hit new alltime highs this morning, and just touched 7928 points, up 0.8% today.

Federal Reserve chair Jerome Powell has soothed the markets with his comments last night about inflation easing, says AJ Bell investment director Russ Mould.

“Concerns that last Friday’s bumper jobs report would see the Fed react to what it perceived as an overheating labour market were eased, with Powell’s relatively relaxed response possibly reflecting the seasonal anomalies which often affect the January numbers.

“Whether Powell will remain so relaxed if the next set of payroll figures are similarly elevated is open to question and investors will be keeping a close eye on next week’s US inflation figures for January. If there is any sign of a renewed uptick in prices, then the market would likely respond very negatively.

“For now, the positive sentiment has allowed the FTSE 100 to reach new sunny uplands, hitting a fresh all-time high. Now the milestone has been achieved though there may be a bit of an inquest into why it has taken the FTSE 100 so long when many of its global counterparts were making records years ago.”

Maersk forecasts plunge in profits as container shipping boom ends

Shipping group A.P. Moller-Maersk has warned this morning that its profits will tumble this year as the transportation sector cools.

Maersk predicted that lower container volumes and freight rates would drive a roughly four-fold plunge in profits this year, after reporting record earnings for 2022.

Maersk benefitted from the jump in freight rates as in the pandemic, due to the surge in consumer demand and supply chain problems such as logjams at ports.

In its annual report, Maersk predicts that the global ocean container market could contract by as much as 2.5% this year, if global GDP growth remains muted.

It predicts underlying profits of between $8.0 and $11.0, down from the record $36.8bn recorded in 2022.

Vincent Clerc, Maersk’s new chief executive, has told the Financial Times that its customers, who include most of the world’s largest retailers, had over-ordered during the congestion of recent years.

That’s led to a glut now, meaning less demand for container shipments.

As Clerc puts it

“When this congestion goes away, you get more goods, your warehouses are full, your inventory is high.”

European shares have hit their highest level in over nine months this morning.

Investors are cheered by Federal Reserve Chair Jerome Powell’s remarks overnight about inflation starting to ease.

German gas giant Linde and Dutch paints maker Akzo Nobel have jumped 2.4% and 6.5%, respectively, after giving higher 2023 earnings forecasts, Reuters flags.

In CopenHagen, the OMX share index has hit a record high.

The pound is also having a decent morning, up half a cent against the US dollar to $1.2095.

Yesterday sterling hit a one-month low against the dollar, but is perkier today as the dollar languishe on the back foot.

Hopes that US inflation is easing are hitting the dollar, as Ricardo Evangelista, senior analyst at ActivTrades explains:

The greenback’s weakness started late on Tuesday, after a public address by the Federal Reserve Chairman, Jerome Powell, who mentioned that interest rates may end up climbing higher than previously thought but also acknowledged an ongoing disinflation process.

The markets chose to focus on the second part of Powell’s message, finding reasons to be cheerful in the fact that the Fed remains data dependent and therefore a pause, and even a monetary policy pivot in the not-too-distant future, could still be on the cards should inflation continue to stabilise.

With moderate optimism returning to the markets, the US dollar lost ground to other major currencies, halting the rally that followed Friday’s monster jobs report.