BoE’s Mann: Another interest rate rise more likely than a cut

The Bank of England is more likely to raise interest rates again than to start cutting them, says BoE policymaker Catherine Mann.

Mann, one of the more hawkish members of the Bank’s monetary policy committee, fears that there are “material upside risks” to the Bank’s inflation outlook.

Speaking at the Lámfalussy Lectures Conference in Budapest, Hungary, this morning, Mann cautions that the stabilization of headline UK inflation is not yet “the harbinger of a turning point towards a sustainable return to the 2% target”, given the sharp increase in food prices and services inflation.

Man says that the Bank should ‘stay the course’, after it raised interest rates to 4% last week.

It would be more of a mistake to stop tightening too soon, than too late, she argues, saying:

I am looking for a significant and sustained deceleration in higher frequency price increases and in the underlying inflation measures and expectations towards inflation rates that are consistent with achieving the 2% target.

Uncertainty around turning points should not motivate a wait-and-see approach, as the consequences of under tightening far outweigh, in my opinion, the alternative. We need to stay the course, and in my view the next step in Bank Rate is still more likely to be another hike than a cut or hold.

Key events

Filters BETA

Clothing retailer M&Co is to shut all of its stores later in the spring after being bought out of administration, PA Media reports.

The Scottish chain was bought by AK Retail after being put into administration for the second time in December.

However, branches around the UK announced on social media that the deal did not include the stores or staff.

M&Co has about 170 branches around the UK. The BBC reports that their closude could cost almost 2,000 jobs.

In a post on Facebook, the stores said:

“Unfortunately we haven’t received the news we would have hoped for during our administration period, and would like to share this news with you.

“As we haven’t received any funded, deliverable offers that would result in the transfer of the company’s stores or staff to a potential buyer, this means that all of our stores will close.

“The M&Co Brand has been purchased, but unfortunately this does not include a future for our stores, website or staff.

“We will trade all of our stores until Easter, and then begin the close down process. We will update you closer to the time, of our actual closing date.”

M&Co, previously known as Mackays, is said to have started as a pawnbroker in Paisley, Renfrewshire, in the 19th century but switched to selling clothes in the 1950s.

AK Retail said it is “considering all options”.

PC maker Dell’s decision to cut 5% of its workforce reflects the company’s sensitivity to consumer and corporate confidence, says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown:

The company had already limited recruitment and cut back on spending, with Cisco, HP and IBM also restructuring. To try and weather the incoming storm, it seems clear Dell required a much bigger hammer to try and knock the company into a more defensive shape and prepare for the AI future.

The company has been buffeted by the crosswinds unleashed as the era of cheap money came to an abrupt end and sales dropped following the pandemic surge. Many companies brought forward IT purchases during the crisis, as the world shifted to virtual ways of working, which has inevitably had an impact on future budgets. With interest rates hurtling upwards and more firms becoming cautious, there has been a double whammy effect on PC sales.

Banking news: The Rothschild family is seeking to take its Paris-listed investment bank, Rothschild & Co, private.

Concordia, the family-owned holding and Rothschild & Co’s largest shareholder, is poised to file a tender offer for the investment bank’s shares at €48 each, Rothschild said in a statement.

The price represents a premium of 19% compared to Rothschild & Co’s previous closing stock price as of Friday, at €40.25.

Shares in Rothschild & Co have jumped 17% to €47.20 this morning

The pound dropped to a one-month low against the US dollar this morning, despite Catherine Mann’s prediction that the next move in UK interest rates will be up, not down.

Sterling touched $1.2019, its weakest point against the dollar since January 6th.

Mann: tighten-stop-tighten-loosen policy boogie would be mistake

In her speech this morning, Catherine Mann argued against pausing the Bank of England’s hiking cycle so the central bank can assess the inflation dynamics.

Although such a pause would be welcomed by indebted households and businesses, Mann argues it would be a mistake to stop raising interest rates, and then restart. Such a move would be a “tighten-stop-tighten-loosen policy boogie”, she says (not an economics term I’m familiar with!)

As Mann put it:

If inflation indeed is more persistent, then Bank Rate will need to rise again after the pause, to be followed later with reversal. In my view, a tighten-stop-tighten-loosen policy boogie looks too much like fine-tuning to be good monetary policy.

It is both hard to communicate and to transmit through markets to the real economy.

Bloomberg: Dell to cut about 6,650 Jobs as PC sales plunge

Dell Technologies has become the latest tech firms to make thousands of job cuts as the IT sector is hit by slowing demand.

Dell is to eliminate about 6,650 jobs, Bloomberg reports this morning.

They say:

The company is experiencing market conditions that “continue to erode with an uncertain future,” Co-Chief Operating Officer Jeff Clarke wrote in a memo viewed by Bloomberg.

The reductions amount to about 5% of Dell’s global workforce, according to a company spokesperson.

After a pandemic-era PC boom, Dell and other hardware makers have seen cratering demand. Industry analyst IDC said preliminary data show personal computer shipments dropped sharply in the fourth quarter of 2022. Among major companies, Dell saw the largest decline — 37% compared with the same period in 2021, according to IDC. Dell generates about 55% of its revenue from PCs.

Clarke told workers that previous cost-cutting measures, including a pause on hiring and limits on travel, are no longer enough. The department reorganizations, along with the job reductions, are viewed as an opportunity to drive efficiency, the spokesperson said.

In another interesting development in the car industry, BMW are in talks with UK government over a £75m grant to guarantee production of electric Minis at its Cowley carworks in Oxford.

Sky News reported last weekend that the German auto giant was negotiating with officials at the Department for Business, Energy and Industrial Strategy over a grant from Whitehall’s Automotive Transformation Fund.

Exclusive: The German car manufacturer BMW is in advanced talks with UK government officials about a £75m grant from the Automotive Transformation Fund that would secure production of electric Minis at the company’s plant in Cowley, Oxfordshire. https://t.co/a9FkbOHPWv

— Mark Kleinman (@MarkKleinmanSky) February 4, 2023

Victoria Scholar, head of investment at interactive investor, says it is a highly welcome development for the British car industry after a very tough year.

The deal could provide a boost to the UK’s auto exports with the potential for job creations at a time when the UK economy is struggling with rampant inflation and sluggish growth. Macroeconomic headwinds including post-pandemic global supply chain bottlenecks caused chaos for UK car production last year resulting in a major slump last year.

2023 is set to be the year in which electric vehicle production kicks into high gear, a key growth opportunity for the global auto industry with the UK government keen to attract a slice of the pie. Despite its German ownership, MINI’s UK plants in Swindon and Oxford are still at the heart of its production line, ready to be exported abroad.

MINI’s unique style and range of models and prices have made it an extremely popular car among consumers particularly in urban areas. The explosion of electric MINI demand could provide a tailwind to sales ahead. In January, BMW said its full-year sales of electric vehicles more than doubled year-on-year. Mini’s electric hatchback was a bestseller, accounting for almost 15% of BMW’s EV sales in 2022.”

In the bond market, the bastion of the left-wing economic establishment, UK government debt prices have fallen today as traders anticipate future interest rate rises.

This has pushed up the interest rate, or yield, on short and long-dated government bonds. The two-year gilt yield has jumped by 14 basis points to 3.4%, from 3.27%, while thirty-year gilt yields are 9 basis points higher at 3.7%.

As well as Catherine Mann’s comments, investors are also digesting last Friday’s jump in US job creation. Although that was good news for America’s economy, it could lead to further US interest rate increases, as the Federal Reserve battles inflation.

Catherine Mann is probably right that we will see another interest rate rise before interest rate cuts, says Professor Costas Milas, of the Management School at the University of Liverpool.

However, this might be, to a large extent, due to divergence in inflation expectations between the Bank’s MPC and the public, he explains:

The MPC now forecasts UK inflation dropping below 1% two years ahead. The latest public expectations of inflation (in November 2022) “see” two-year ahead inflation at 3.4%.

Assessing inflation forecasts based on the median statistic reveals that the Bank has historically underestimated UK inflation by 0.37 percentage whereas the public has historically overestimated UK inflation by 0.70 percentage points.

This is very problematic: the public consistently expects much higher inflation than the Bank which (a) raises a credibility issue in terms of the BoE’s policy actions and (b) creates additional inflation pressures through, for instance, demands for higher wages. All these therefore call for higher than otherwise interest rates.

Over in the eurozone, consumer spending weakened at the end of last year as the slowing economy hit demand.

Eurozone retail sales dropped by 2.7% month-on-month in December, and were 2.8% lower than the previous year, a little worse than expected.

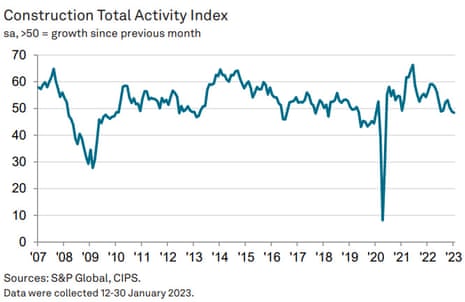

The drop in UK construction activity last month shows the impact of the recession, says Joe Sullivan, partner at MHA, the accountancy and audit firm.

For weaker companies cracks are starting appear, as costs rise, Sullivan warns, adding:

They can no longer just survive on cheap borrowing and past Covid-19 government initiatives. Well-run operations and companies will survive but must maintain a clear business plan, focusing on reducing contract risk and cost control.

Material price inflation may have eased but the cost of specialist labour and steel will still increase this year.

“Wrecking ball” of higher inflation and interest rates hits housebuilding

“The wrecking ball of higher inflation and interest rates” knocked UK housebuilding output to its weakest since May 2020, says Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply.

Glen says stretched mortgage affordability, which worsened after the calamatous mini-budget, impacted on the building of new homes.

He says:

“The continuing price pressures for energy and wages still remain a concern, along with the highest level of job shedding for two years and building skills remaining in short supply.

Evidently, there are still roadblocks ahead, but we should have faith that the sector can see a path through for better outcomes in 2023 after languishing in contraction in the last few months.”

Sharp fall in house building hits UK construction output

Britain’s construction sector has suffered its worst month in almost three years, as housebuilding was hit by rising borrowing costs.

UK construction companies reported another downturn in business activity during January, the latest survey of purchasing managers from S&P Global and CIPS shows.

Building firms blamed weaker client demand, and a slowdown in new projects in recent months due to rising borrowing costs.

House building was the weakest-performing category of construction output in January, shrinking at the fastest rate since May 2020. Lower volumes of residential work were attributed to rising borrowing costs, unfavourable market conditions and greater caution among clients, S&P Global says.

The surge in mortgage rates in recent months has weighed on the housing market, knocking demand for mortgages to the lowest level since the depths of the 2020 lockdown.

Commercial activity decreased for the first time in five months during January, reflecting softer demand and delayed-decision making on new projects. But civil engineering activity inched up, close to levels showing activity stabilised.

Overall, the Construction Purchasing Managers’ Index (PMI) dropped to 48.4 from 48.8 in December, hitting its lowest level since May 2020. Any reading below 50 shows a contraction, so this shows a drop in activity.

But, there are some positive signals – with business expectations rebounding from the low point seen last December.

Tim Moore, economics director at S&P Global Market Intelligence, explains:

For some firms, the recovery in business optimism to its highest for six months was driven by signs of a turnaround in new sales enquires at the start of 2023.

Other construction companies simply noted gradual improvements in the general economic outlook and hoped that confidence would return at a later stage this year to alleviate the current lack of momentum in the house building sector.”