Receive free Chinese business & finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Chinese business & finance news every morning.

If you are seeking a defensive sector in China, an economy buffeted by debt crises and dirigisme, insurance could fit the bill. Insurers are enjoying a stronger-than-forecast surge in sales. The industry has bucked China’s trend for disappointing post-lockdown profits and stock prices.

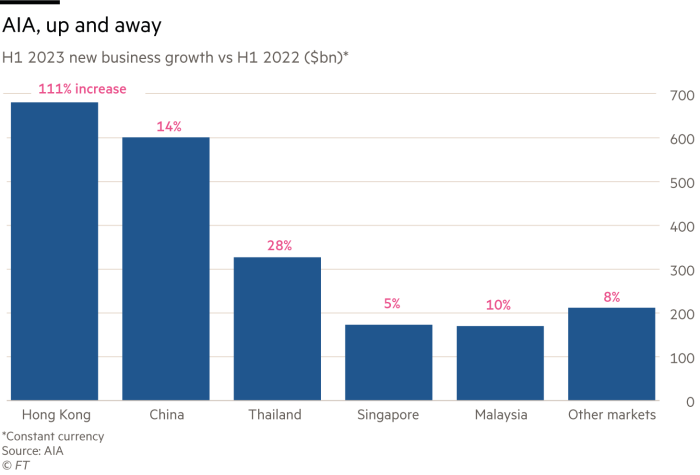

Hong Kong-based insurer AIA is benefiting from the boom. New business value, excluding currency moves, rose 32 per cent in the first half, beating expectations. The measure of expected profits from new premiums hit $2bn.

There are several reasons for the strong growth. First, mainland Chinese travellers have returned to Hong Kong. Some of them are picking up insurance products as part of their shopping spree in the city. The value of new business in Hong Kong, AIA’s biggest market, more than doubled.

Second, local sales agents have resumed their round of visits on the mainland, AIA’s second-biggest market. A slowing economy has made consumers more cautious, encouraging them to salt away rainy day money in insurance plans. AIA’s middle-class and affluent segments are showing rapid growth.

Lastly, a bond market fallout in China has triggered an exodus of savers from lossmaking securities into insurance policies, which in some cases guarantee principal.

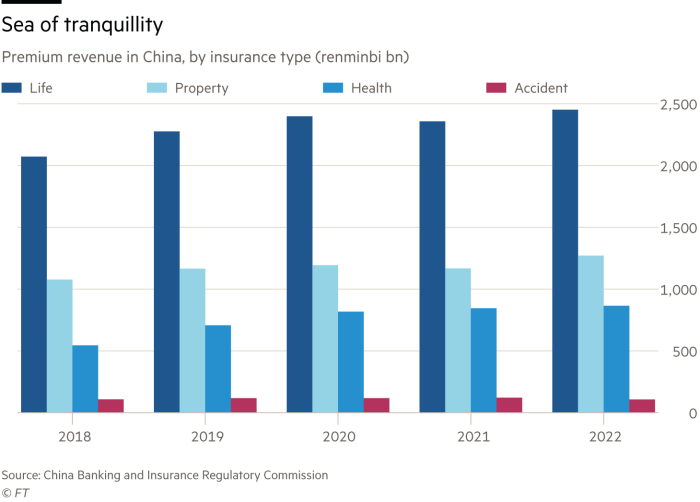

Growth in China is in its early stages. The country has a free but under-resourced public healthcare system. Insurance companies are creating demand for healthcare insurance, the fastest-growing category.

Shares of AIA are down a tenth in the past year. They are trailing mainland insurers, while retaining a steep valuation premium. The stock of China Life Insurance, the largest, has risen about a fifth in the past year to trade at 6.5 times forward earnings according to S&P Global. The group posted its best results since the pandemic in the first quarter.

Insurance has historically suffered fewer official crackdowns that some other sectors. Beijing has even eased restrictions on foreign insurance companies. About 50 of them now operate in China.

China is the world’s second-largest insurance market after the US. But total premium income to gross domestic product is about half the global average. That leaves plenty of room for growth.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.