Stay informed with free updates

Simply sign up to the Climate change myFT Digest — delivered directly to your inbox.

The chair of the EU’s insurance regulator has said urgent action is needed to protect Europe from climate risk, as mounting economic damage from natural catastrophes raises concerns that some areas could be rendered uninsurable.

Petra Hielkema, head of Eiopa, which supervises the bloc’s insurers, said a steady rise in losses from natural disasters such as floods and wildfires needed to be addressed by firms, member states and broader society.

She proposed a range of solutions including tightening building rules, creating national and EU-wide schemes to share risks, and drawing more deeply on reinsurance markets. “All actors need to move,” she told the Financial Times.

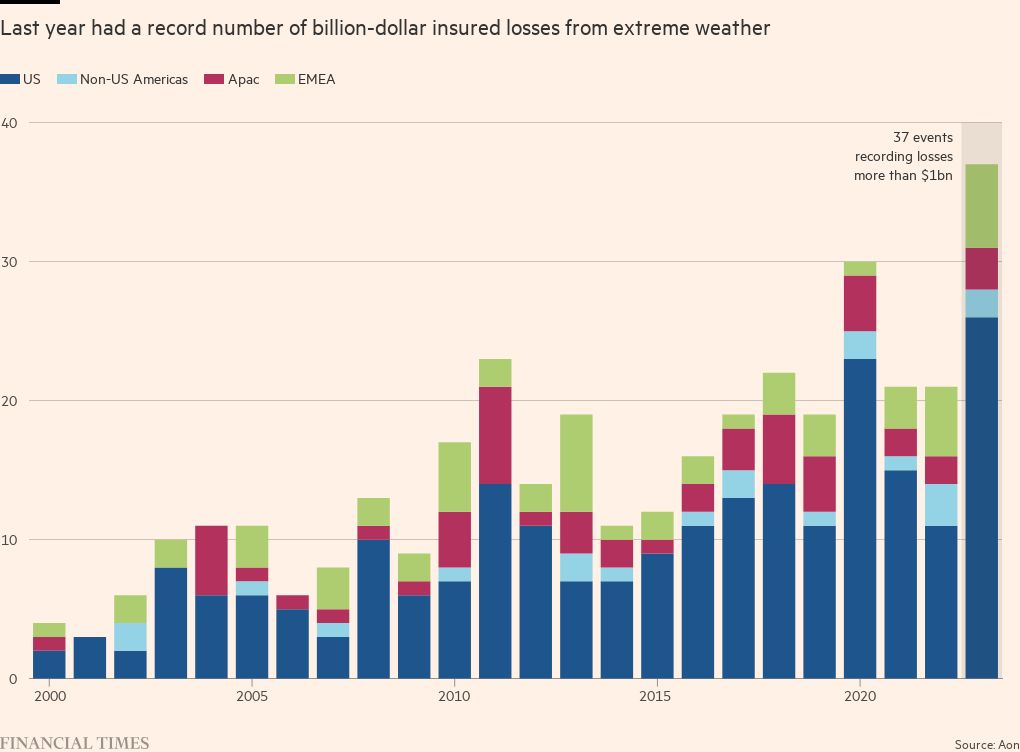

Her warning comes as climate change increases the frequency and severity of extreme weather events, pushing up the price of cover and feeding concerns of an “insurability” crisis. A string of big home insurers have halted new business in California, for example, in response to a surge in extreme weather losses.

Hielkema warned the industry against the “easy solution” of just excluding high-risk areas from coverage. “If you do that, you will, in the end, lose trust and lose your reason to be there.”

The EU suffered more than €50bn in economic losses from natural catastrophes in both 2021 and 2022, according to Eiopa data. That was more than three times the annual average in the previous decade.

On average, only a quarter of these economic losses at EU countries are insured, leaving a huge so-called “protection gap”.

Hielkema said EU insurers had started to raise concerns a few years ago, saying they would need to respond to the climate threat by raising prices significantly or excluding areas.

“What you now see is governments starting to realise that [responding to disasters] through just public spending might not be the best way forward. They are more and more open to discussions, and we also see more public-private partnerships develop,” said Hielkema.

Under such schemes, governments share losses from natural disasters with the insurance sector, or create structures to pool risk.

Floods in Italy, Germany and elsewhere last year led to further rises in the price of insuring homes and businesses against severe weather. Continental European commercial property insurance prices rose at the start of the year for the 22nd consecutive quarter, according to an index from broker Marsh.

Rising insurance prices were “a reflection of the risks, and the risks are going up, and they are going up quickly. It’s a call for action”, Hielkema added.

The regulator is pushing for adaptation measures including making buildings and agriculture more resilient to flooding. “Ultimately, there might even be areas where maybe you should no longer build,” said Hielkema.

Eiopa also wants insurers to simplify their policies. Recent flooding claims exposed policies that covered flood damage “depending where the water came from”, Hielkema said, which was “completely not understandable” for consumers.

The regulator also wants to make greater use of reinsurance markets, and aims to encourage investors to put more money into EU insurance-linked securities — such as catastrophe bonds, which pay out for certain extreme weather events.

Reinsurers have contributed to affordability problems, industry experts say, by charging much more for the cover they provide to primary insurers and tightening their terms. A relatively quiet 2023 for hurricanes meant they were able to post bumper profits.

Reinsurers “need to feel that it is not just about selling insurance and making a profit. It’s about responsibility as part of society”, Hielkema said.

Eiopa is helping to foster public-private schemes in countries including Italy that can ultimately make insurance more affordable and accessible. The regulator has also proposed an EU-wide scheme that could complement these arrangements with cover for the very biggest events.

Hielkema said any pan-EU scheme would need to be carefully calibrated to make sure individual states are pulling their weight on adaptation measures, among other considerations. “You would have to deal with several moral hazard issues.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here