It’s been a pretty bad year for cryptocurrency, even if Bitcoin’s price is soaring once again. There were scandals involving FX and Binance that are still playing out and making everyone cautious about avoiding blockchain scams.

Many have written off blockchain games as an overhyped trend that is coming to its end. Billions of dollars have been invested in such games in the past few years, much to the chagrin of traditionalists in game development and among Western gamers in particular. They think it’s a bunch of scams.

But Yat Siu, executive chairman of Animoca Brands, sees this as a “cleanup year,” as he remains one of the biggest believers in blockchain games. In an interview with GamesBeat, Siu said, “We’ve cleaned up a lot of what needed cleaning up this year.” As a result, he sees 2024 as a strong year ahead, with a chance for a phoenix to rise again. Siu has to look on the bright side, as his company has invested in hundreds of blockchain game deals over the years.

Animoca Brands owns some of the companies that have weathered the “Crypto Winter” so far and emerged with high-profile projects that are reporting steady progress, like Blowfish Studios, maker of Phantom Galaxies, which has entered early access; nWay, the maker of Wreck League, a mech-focused fighting game for both Web2 and Web3 players; REVV Racing; and The Sandbox, a Lego-like metaverse for brands and user-generated content.

The test for these companies is whether they can get to mass adoption, Siu acknowledged. It’s easier to reach the mass market in Asia. Siu is encouraged that triple-A game companies like Ubisoft, Zynga and Square Enix are still investing in blockchain games.

In a survey of 526 people at blockchain game companies, a significant 19.8% of those surveyed believe that traditional game studios venturing into the realm of Web3 gaming will have the most positive impact this year, according to the Blockchain Game Association. And Siu’s still a fan of the metaverse, which his own company is pursuing with a project dubbed the Mocaverse. To Siu, it’s a matter of literacy; when gamers understand it’s about ownership of their own assets, they will come on board.

Here’s an edited transcript of our interview.

GamesBeat: Looking back, what kind of year did we see with blockchain games in 2023?

Yat Siu: The way I would describe the last 12 months is kind of a cleanup year. 2023 was a year in which there was a degree of purging, particularly of bad actors. Because of the way our industry works, it’s very much tied into everything else that’s happened. We were affected by FTX. Everyone’s been caught up in it. Which is interesting when you compare it to other industries. What might happen on the Nasdaq or in the finance sector doesn’t necessarily have an impact in other areas. Just because the stock market tanks, it doesn’t mean the gaming industry is affected. But in Web3, it’s all tied together, because it’s all built on the same infrastructure. A situation like FTX will impact blockchain gaming, because we’re on the same framework.

To me that’s healthy. We’ve cleaned up a lot of what needed cleaning up this year. It opens up 2024 as a strong year. It’s almost like a rebirth, the phoenix rising, when you consider where things were a year, a year and a half ago. A lot of people declared crypto is dead, blockchain is dead, metaverse is dead, play-to-earn is dead. Everything was supposed to be gone. Now, the end of the year, Bitcoin is over $40,000. The market’s going up. Blockchain gaming seems to have had a nice revival over the last 30-60 days. New games are launching. Activity is going up. To me the whole space is coming up. I’m not sure “rising from the ashes” is the right framing, but it does feel like a rebirth. The industry was never dead, but it’s coming back in a very strong way.

In our industry, a lot of people worried about what would happen to Binance. That was the albatross. People didn’t really know what would happen. The settlement makes a few things very clear. All of that builds up confidence for a strong close to the year and a strong start to 2024. Broadly speaking, I feel very positive.

GamesBeat: What challenges are still with us? What are some things that still have to be worked through so companies can grow?

Siu: The biggest challenge the industry faces is still how to get mass adoption. Fundamentals aside, the earnings are high. Value is being generated. Ubisoft’s most recent drop–it’s interesting to see how Ubisoft, when they tried an NFT drop a couple of years ago, it did very badly, but this one went very well. It shows a maturation of the market.

Particularly, coming from markets like Asia, mass adoption is harder. It’s not to do with any technical challenge. It’s to do with a mindset shift. The correlation we’re now seeing is that if you’re fully onboarded to Web3, if you have an appreciation of financial systems, if you have an appreciation of value, if you’re somewhat financially driven–it doesn’t mean you’re a pro trader. It just means that you understand what is value, how to predict it, what you should think about. It’s something that Web2 users, for the most part, never had to think about. There’s a large percentage of them who don’t have that mindset.

In the real world, the vast majority of the world is not financially literate. We all have bank accounts. But if you ask most people about their investment strategy, for example, they’d struggle to tell you what that is. A savings plan might be their investment strategy. Which highlights some of those issues. The same goes when you talk to people about their debt situation, like credit card debt. That comes from a lack of financial literacy, where people are spending things they don’t have. The whole system is built around that.

There’s a difference between how Web2 and Web3 users see things. In the Web3 world, everything is interwoven with finance. The utility may not be finance, but the fact that there’s a value there in cash, that you can see the price at any time, that you can trade it if you want to–the fact that there’s liquidity means that if you’re an onboarded Web3 user, you have to become more financially literate. Which, by the way, is an opportunity, broadly speaking, for society.

That’s the biggest challenge. Rather than the technology, how do we onboard them with more financial literacy?

GamesBeat: Do you think that you have made progress on some of the smaller goals, like the Asian consumers being more welcoming to Web3 games?

Siu: You can see that in the numbers. You can also see that in the narratives of the big companies. Big western game companies like Ubisoft, many of their consumers are saying, “What are you doing?” In Asia we don’t have that challenge. The big game companies are free to do it. Nobody is going after them because of it. That’s one thing.

The other thing we’ve made a lot of progress on is regulation. In Asia, regulation has been very pro. Our home base, Hong Kong, has now emerged as a Web3 leader in terms of policies, regulation, allowing trading of tokens, allowing people to have clear views in terms of exchange licensing procedures. Hong Kong is probably one of the most welcoming places in the world for things like NFTs and digital assets. That’s branching out to the rest of the region – Taiwan, Singapore, southeast Asia. And of course Japan has been very positive too.

Generally speaking, you can tell that those markets are very positive. The middle east is another strong market for Web3. You find a lot of people in places like Dubai or Abu Dhabi, they’re very familiar with NFTs, versus someone in the U.S. who might look at you very funny depending on where you are. They’ll wonder what the hell you’re talking about.

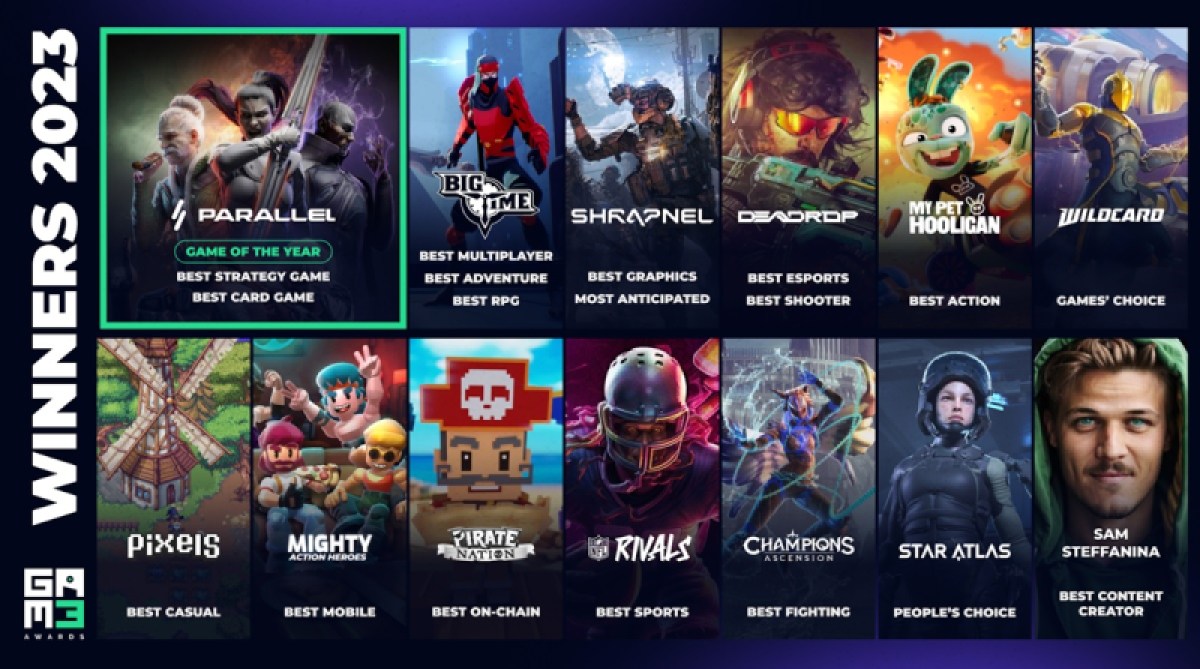

GamesBeat: I was a judge for a game contest put on by Magic Eden recently, and it seemed like the quality was a lot higher than in years past.

Siu: That, to me, is natural. Billions of dollars were invested in Web3 gaming over the last few years. It would be surprising if there wasn’t a rise in quality. If you think back to the early days of mobile gaming, many game studio producers said, “I’ll never make games for mobile. That stuff’s junk. That’s not what we do.” People used to really crap on Candy Crush. Social gaming like FarmVille, people would say that those aren’t real games. History has shown otherwise.

Games take a really long time to make. Over the course of the next two or three years, and the two years prior, the development of all the games that were funded in 2021 and 2022–they’re coming out. You’ve seen this already as a judge, but also in 2024. Games are often delayed in their launches. We all just got excited for the GTA trailer, a game that won’t be out until the year after next. And then you have people complaining about how a blockchain game isn’t out next month.

It’s not that different, really. It has more to do with the bias that has come about. But the visual quality, the gameplay, the mechanics of the game will be very much the same quality as any other games out there. The difference is now you have the ownership layer, which provides many new meta-game possibilities.

GamesBeat: There were some interesting strategies that I saw with some games, like Wreck League. Taehoon Kim put it well when he described the symbiotic relationship between Web3 players and Web2 players, how they need each other.

Siu: What you find is that there’s a lot of experimentation happening. One experiment is how you share value between these two ecosystems, Web2 and Web3. What REVV is doing–how do you take a Web2 consumer, since Web2 users are generally consumers, rather than an owner, and connect them with a Web3 user, who is typically an owner? The two paradigms are fundamentally different in how they interact with the product. The Web3 user claims ownership of whatever world they’re in. If they’re playing Wreck League, the owners need to be compensated for their ownership, which is what the Web2 users can provide.

We believe that every user, in due course, will be an owner. To us that’s the vision of Web3. But in the meantime, since the majority of the world is a Web2 consumer, not a Web3 owner, we have to bridge them. Things like what Wreck League is doing, or TinyTap, these are mechanisms that can bridge the two worlds until we get to the new full paradigm. Today, if you look at games like Axie Infinity, which is doing quite well, these are games that are now targeting more fully Web3 narratives. They’re saying, “We’re going to convert you all to Web3 and you’re going to play in a Web3 environment, a totally native environment.”

We went through this with mobile as well. People experimented with in-app purchases, trying to find the right model. Is it freemium and then unlock? Is it selling in-game items? Angry Birds was just an unlock. There was no paying for items. That happened later. The new business model started to emerge. The same is happening right now. We’re in the experimentation phase between models. The parameters are deeper. You have tokens and NFTs. There are more ways to derive value.

GamesBeat: It seemed like this year we saw a lot of migration from one chain to another. Things like Polygon, Immutable, and Ronin gaining different games that migrated from somewhere else. How do you analyze what’s happening there? We even saw the emergence of more blockchains, like Saga and Avalanche.

Siu: First of all, the way that we look at this–we like the fact that there are many chains, because they provide many alternatives. This is an imperfect parallel, but chains kind of act like app stores. They’re distribution vectors. One reason why, even today, people launch NFTs on Ethereum, despite the fact that it’s expensive, is because it offers the most value distribution. It’s not the most user distribution, but each user of Ethereum is more valuable. You want to reach that market. Why is Pixels doing well? Why did they switch over to Ronin? Because they tapped into the Axie Infinity audience, the base that was built up through Axie on Ronin. You’re basically leveraging the network effects of these various platforms.

Because we’re still early in the space, there are many opportunities to still succeed. The value that can be generated from a Web3 user is much higher. Going back to mobile again, I remember dozens and dozens of app stores. All these alternatives to Apple before it became the dominant market. It was a much better time for discovery. I liken to the days that radio was the way we found music, rather than Spotify. We had lots of choices. The industry really lost something.

I think the same is happening in the Web3 space with all these different chains building different things. It creates much more opportunity for indie game developers. Many more chances for growth. Each of these are building their own networks. They aren’t necessarily consolidating all into one. You have a real competitive market. When one game hops to another chain, or offers assets on multiple chains, the real winner is the studio. They have options. Imagine what the world would look like if we had, say, a dozen app stores, all roughly equal in size. We’d have a much more vibrant indie market.

GamesBeat: You wouldn’t be paying 30 percent.

Siu: Exactly. It would be competitive. It would be fair. If Apple were to charge you 30 percent, maybe they’d offer you promotion or a feature spot in return. This, to me, is how chains are currently operating. It’s a positive thing. But it’s still evolving. We’re not there yet.

GamesBeat: I still see some setbacks. Gods Unchained was out on Amazon Prime Gaming, and the ESRB hit it with an Adults Only rating. They reached a mass market through Amazon, but then the rating decision–it was based on the fact that it was a play-to-earn game.

Siu: This is part of the maturation. While these could be setbacks, they’re more like learning experiences over time. It doesn’t make sense for certain games, just because you can trade assets, that they receive a mature rating. You don’t have mature ratings on Pokemon trading cards, or baseball cards, or any other collectible out there. But to me that’s all part of the education. It comes down to where the value is in the game. If you’re out there selling an asset, that’s one element. But if an asset starts to appreciate in value because the community is interacting with each other in a third-party way, then obviously it’s not the same. That’s something more people have to be aware of.

It goes back to what I was saying about financial literacy. People are worried about this because they think that the people trading in these environments–if you’re trading between two parties and one of them knows a lot about trading, while the other one doesn’t know much about trading, you can understand why there might be a fear of being taken advantage of. That’s why you have rules built in place from a financial perspective. We didn’t have to do that before, because the scale couldn’t manifest the way it does in Web3. There is something there around the concern that people have, that they’ll be taken advantage of. Again, all of this is part of the education process.

GamesBeat: What do you predict for 2024? What kinds of things do you expect to happen?

Siu: 2024 will be very much the year of Web3 gaming. The big narrative is that many of the titles that were meant to come out in 2023 are all coming out in 2024 now. Product launches, token launches, NFT sales, whatever it is. 2024 will start very strong in Web3 gaming, followed by–not so much consolidation, but maturation. Now that the market is more competitive, what are the games that stand out? We’re going to find a number of games that will lead in their categories by the latter half of 2024.

It feels to me like mobile gaming in 2013 and 2014. We’re not quite at the point where you have the big winners, but you can start to see that we might have the next Supercell. We can identify the new next-generation titles that are coming out. We’ve made more than 40 game investments ourselves. We’re publishing a bunch of titles. We’re bullish about the segment and we’ll continue to make investments in it. We have our own stuff coming out as well. But that’s all tying it together in terms of growth in the space.

The other thing I would say is that this is also the reason we’ve started to focus heavily on Mocaverse. We perceive that in 2024, there will be major increases in the gamer numbers that are joining Web3. The scaling around that becomes hard. We’re talking about adding tens of millions of gamers into the field. One of the struggles we’ll deal with is how create interoperability. That’s why the Mocaverse idea is important. It’s the identity layer you can use to move across games in a decentralized faction.

Unlike Steam, where you have to go and use Steam, launch the game from Steam, here you just have to use your own identity, and your identity can be shared across any game you want. This will solve things like KYC, like distribution. That can be helpful, because if you recall, if you want to launch a game and sell NFTs, you might need KYC. You might want to KYC every single time. For a studio that’s extra money. For the end user it’s extra hassle. Just for that reason alone, there’s a value proposition. It becomes a decentralized distribution outlet, but one that’s owned by the end user.

Eventually what will happen is that if you want to target Mocaverse users, you can do so directly by saying, “Hey, I know you’re an action gamer. I know you’re into this kind of thing.” You can provide benefits and incentives for Mocaverse ID holders. “Hey, you love RPGs. Come try our game and we’ll give you something.” It’s a way we can create benefits that become user-centric as opposed to platform-centric.

GamesBeat: Do blockchain games have to start doing well before you see some kind of collective benefit, like the metaverse coming back?

Siu: Blockchain gaming is a big driver for metaverse. Although I would say that metaverse activity, the way we define the open metaverse–things like decentralized finance and what’s happening in Web3, it’s already in the metaverse. The financial structure is already here. That part’s doing okay. The financial layer is already creating employment. It’s that financial layer that’s allowed Web3 games to exist. If it wasn’t for DeFi summer, there wouldn’t have been an Axie. That base infrastructure continues to thrive and grow. As a result, everything else we see in Web3 gaming will evolve from there.

To me, Web3 gaming is adding fuel to the fire. It’s bringing more people to the platform. It’s bringing more liquidity to the economic framework, which in turn helps other games coming in, because now there are more customers. The whole thing builds on top of itself. When you think of the platform parallels, it’s what happened when Google built this incredible platform. It built network effects from within. If I go to the app store, we used to have a top 10 or top 20. You’d download an app based on that, or on recommendations. That was a form of discovery.

Unfortunately, because it’s a platform, it’s centralized. It’s not a true marketplace. It’s not a marketplace open to applications where people can compete with each other. It’s an editorialized marketplace where whoever runs the platform decides what you can see. You can’t compete with something and offer a better product to the end user, because you have no way of doing it. An editor somewhere decides based on their own preferences what they are going to show to the world. That’s the problem we have in Web2 that Web3 solves.

GamesBeat: Do you anticipate moving into Neom’s Line soon?

Siu: There’s quite a bit of work still to be done. I actually visited Neom. I just came back from there about a week and a half ago. There’s a lot of construction. But I will say, it’s nothing like what you would think Saudi Arabia is like. Most people think of the desert. The scenery is amazing. It’s beautiful. There’s another side to it. I’m really excited about what’s happening in Neom.

GamesBeat: Is that in some way one of the things that helps usher in digital innovation?

Siu: Oh, yeah. First of all, when you think about Neom–I would say Neom is very much aligned in the sense that it’s building a metaverse as well. It’s just one that’s physical. There’s nothing there and now they’re building something from scratch. Building entire economies with new rules that are very business-friendly. For us to be there relatively early, working with Neom in our partnership, we can help shape their Web3 strategy. That’s an opportunity not just for the Kingdom, but also for us, to demonstrate how we can perhaps create the right frameworks for other places, starting with a blank slate as far as what Web3 policy should look like. Hong Kong, Dubai, Singapore, they’re all doing amazing stuff. But when you start from scratch you can leapfrog them in terms of creating policies that are more innovative. It’s a sandbox, an experiment.

That’s what Neom really is. It’s this national sandbox for creating this new economic zone. It’s been done before. Maybe not in terms of the physical presence, what they’re doing with the Line. That’s pretty wild in terms of a city being built this way. But building an economic zone with new laws specifically designed to enhance economic growth that will impact the region, we’ve been there before, if you look at Shenzhen and other places like that. Eventually those rise to create things like Tencent. It all started in a similar fashion. People who are critical about this say it can’t be done, but it’s been done before. We look at Saudi and say, “We’ve seen this story before.” We’re excited about it.

GamesBeat: One worry that I would still have–it’s amazing to see how resilient the Web3 companies are, but at some point it feels like they all still need an economic push from a recovering global economy. If that’s slower in coming, then it might mean that everyone has to get used to the notion of a much longer gestation period for this industry, for consumers to come back. If there’s a worry, how much of a worry is that for you?

Siu: There’s a two-part answer to this. One, it’s true for everything. When there’s a global economic downturn–gaming has had the reputation of generally being resilient to economic downturns. It’s entertainment. It’s resilient in the sense that it’s entertainment that people retreat to. It’s low cost. However, having said that, the cost of making a game–it doesn’t become cheaper just because there’s an economic downturn. The studios carry risk. We’ve seen this, especially post-COVID. During COVID everyone was stuck at home. When we came out into the recovery from COVID a lot of studios weren’t hitting the kinds of numbers they’d grown to expect.

But as I said, every industry is affected by the markets, regardless of what you do. Web3 gaming is no exception. This industry is tied to blockchain as an industry, broadly speaking. To that point I would say that in 2024, the outlook for the markets is very positive. We don’t have any giant albatrosses that we ought to be worried about. I don’t foresee it, anyway. I didn’t foresee FTX either, so don’t take this as any sort of vision. But I don’t know that there’s another FTX or Terra type of scenario in the near to middle term. As I said earlier, a lot of people were worried about what would happen to Binance. The settlement made it very clear that customer funds are safe and now there’s monitoring by regulators and so on. All of that feels like we’re on the right track.

That means that in 2024, you at least have the element of uncertainty going away. That’s a good thing. The second thing, and we said this earlier, Bitcoin spot ETF provides a strong foundation. Right now the price increases in Bitcoin have come from the ETF narrative. That indicates another thing. Because you have large funds like BlackRock and Fidelity and Prudential–all of these things show that there is a larger adoption of crypto going to happen in Web3, which in turn drives things Web3 gaming. That’s what’s happened in the last 60 days, and it’s going to continue to grow over the coming year. The narratives generated are building up in a positive way.

If there was a worry I’d have for 2024, it’s that the rate that the market is recovering–it could also overheat very quickly. We’ve seen that as well, especially in 2021. The first half of 2021, everyone was feeling good. The second half of 2021 was wild and crazy. In the first half everyone was very positive about the growth of the industry. The entire NFT sales in that first half came to $2.5 billion. That’s a great number given where it was in 2020, which was still in the millions of dollars. It was massive growth. Then, in the last 30 days of the year, total NFT sales were somewhere between $1 billion and $1.2 billion. That’s one month. We’re going back to a $12 billion, $15 billion, possibly as much as $20 billion annualized run rate in NFT sales.

If that’s happening, our belief is that it will be more sustainable. People will be more cautious and more sensible. But the market has been known to run away from itself a bit. That’s probably the bigger fear. It’s not that the market is not fundamentally strong. It’s that the market can overheat very quickly. We end up creating a more rapid cycle as opposed to gentler, more sustainable growth. It will happen, but how jagged are the edges as we keep marching forward toward growth? Ideally, to bring in more people, you want to smooth out those edges.

GamesBeat: Are there any specific Animoca Brands things you expect to happen in 2024?

Siu: The broader launch of Mocaverse is a very tactical thing. Obviously, the full commercial launch of Sandbox is also in the works. When it comes to gaming specifically, hypercasual is important. We’re refocusing on that, going back to the mobile playbook. What brought people into mobile gaming and gaming in general? It was casual gaming. We think casual gaming is another way we can get new players onboard. The combination of gaming and Telegram is quite power. Gaming is probably the biggest platform on Telegram right now. That’s why we made the investment in TON. As a way to onboard people, Telegram has close to 700 or 800 million users. They can start playing games and get into Web3 that way. We’re hoping to broaden the space.

Those are all things we’re looking at as a way to expand the space – casual, and obviously things we’re doing in education. What TinyTap is doing is a big deal. It’s more grassroots. It’s what kids do. It’s bringing teachers onboard. Education is a vibrant space. It’s bigger than games, actually. It all ties in.

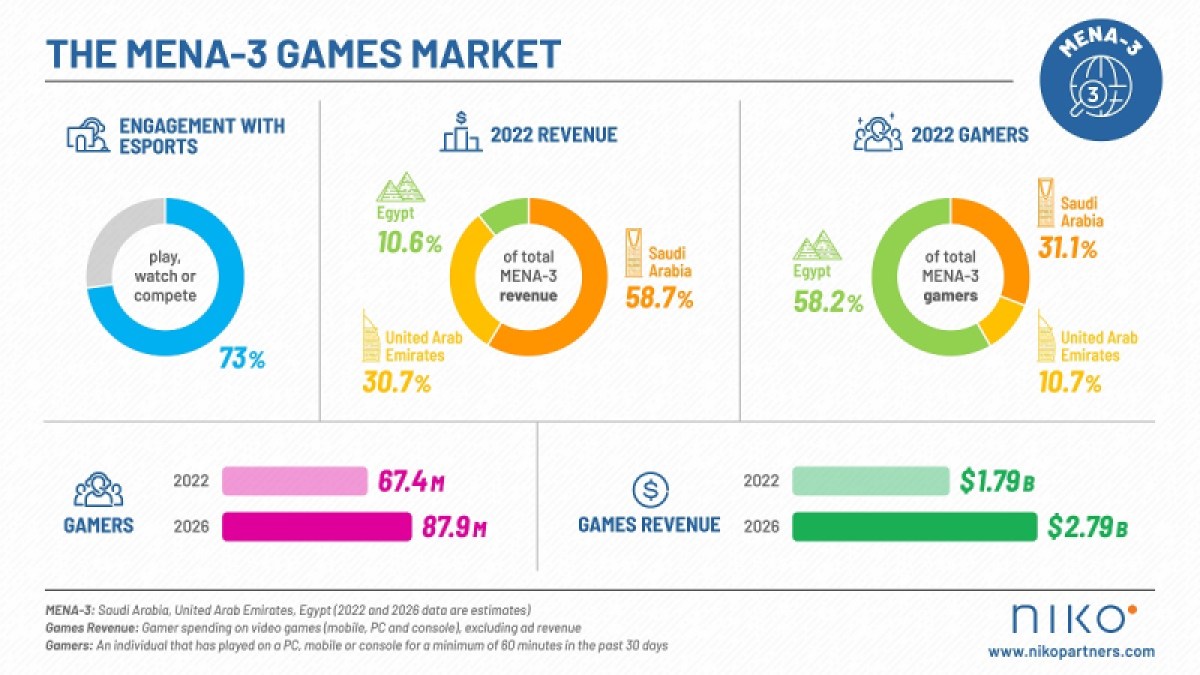

GamesBeat: If you look at the Middle East and Asia and the money they’re still pouring in, both to blockchain games and the game industry in general, it seems like this is a nice resource for the market that has given it a boost in capital when it needs one.

Siu: Yes, although I would say–the idea that Saudi money, for instance, is relatively easy money, is not correct. There’s a lot of homework that they do. If you think about it, we’re their first and only Web3 investment. That’s not proof that they’re just going around doling out cash. But they are very keen. We’re a quality company, and part of our mandate is to help bring more companies in the Web3 space into the Kingdom.

Places like Dubai and Abu Dhabi are very Web3-forward. They have a more distributed investor base. From a fundraising and capital standpoint, the UAE, for Web3, is probably leading, just because they have more knowledge and awareness about it. But the rest of the region wants to get there. It is a market.

The other market, of course, that’s almost taken for granted because they’ve been doing it for a while, is Asia. Asia has been actively funding Web3 projects since the beginning and continues to do so. It’s not just us, but other entities, VCs and funds. They’ve never stopped investing in Web3. It’s very different. I know that the U.S. has the global narrative, but so many VCs retreated in the last 12 to 18 months. In Asia they continued to invest. They continued to do stuff and grow.

It’s one of those interesting situations where the U.S. is no longer leading in a technology category, which is kind of unheard-of if you think about it. As a result, it doesn’t get the same airtime. An industry in technology is growing, and in some cases thriving and expanding, but in the U.S. it’s not. It seems almost–how is that possible? We don’t discuss this in the global media. Which is why, if you’re in America, you think blockchain is dead, the metaverse is dead, play-to-earn is gone. People who came to ApeFest or to Token 2049 in Singapore, it blew their minds. “People are excited about this stuff!” It almost felt like they went to a different universe. It wasn’t just moving to another country.

Media has changed. It’s driven very much by particular domestic narratives. Even though they want to paint it as an international story, it comes from such a domestic lens that–it’s a literal blind spot. Again, that’s very reminiscent of my experience building a business in Hong Kong and seeing the evolution of China. If you look at the west, everyone used to say that this can’t happen. “China isn’t going to work out. As an industry it’s not realistic.” You have to come here to see it and understand it. Also, maybe consider the markets here as well.

GamesBeat: How do you think the western gamer attitude, that blockchain games are all duds or scams, is going to turn around?

Siu: There are going to be narratives that change based on–I don’t know that you can get all of these gamers to switch around. It’s become almost like politics. It’s the politics of capitalism. If you’re pro-capitalist, you will be very happy with blockchain games and Web3. You’ll understand them. If you’re against capitalism, then I think you’ll broadly be against it. You think money is something that creates an unequal society, which has become a topic in American politics.

Let’s look at it from a geographical perspective. If you are in America, if you’re based in Miami, that’s probably the most capitalist place in America right now. It’s also one of the fastest-growing economies. If you were to go someplace that’s much more socialist in construction, even in parts of California, as you’ve probably experienced, then people will probably be against it, just out of principle. You see this reaction. You see that those who are against NFTs do not actually explain themselves rationally. Their eyes pop out. It’s a passionate response. It’s the kind of thing you see when people complain about politics.

Unfortunately, this means that even though this is broadly a net good–Web3 gaming can teach you about financial literacy and include you in the capitalist framework. It’s starting to delve into the whole issue of identity politics as well. I identify as someone who is this kind of person. I identify as someone who is against NFTs. It’s very hard to move someone out of that when they’ve created an image around themselves. Even if they’re wrong about it, they’ll say, “NFTs are scam.” They have to step out of that and say, “I was wrong, and I changed my mind.” That’s not easy to do, which is why I think it’s harder for that segment to get there.

America isn’t 100% against NFTs. It’s just that the ones who are against NFTs are the loudest. I liken it a bit to Trump voters. Trump voters don’t go out and say, “I’m voting for Trump.” They don’t necessarily agree with everything that Trump’s about. But they still voted for him, because on balance they thought he was better than the alternative. They just didn’t declare it. The polls all got it wrong because the ones who were fervently anti-Trump were the ones who were willing to talk about it, whereas the ones who weren’t were very quiet about it. They weren’t out there hammering it in the same way.

In America we have the same situation with blockchain games. A lot of people play these games. If you look at the stats, the IP addresses, they’re not gone. When you look at the NFT holders, it’s predominantly Americans. You just don’t see them out there waving their flag in the same way. It’s not as black and white as it may look like from a media perspective. They’re just not as vocal about it as the ones who are against it.

GamesBeat: It does seem ironic that the intention of Web3 was to help people with ownership and earning things, and it got twisted into, “This is one more plan to extract money from people.” That’s become the narrative, similar to other controversies over free-to-play games.

Siu: The other thing is that because game companies have extracted so much in the past, gamers are cynical. “This is just another scheme to take my money.” This is a real issue in the gaming world. Who is really Web3 and who’s pretending to be Web3? People talk about Web2.5. I am all for easy onboarding. I understand the idea behind Web2.5. But the problem is that quite a few companies, particularly the traditional game companies, are saying they’re Web3 because they want to make money like Web3. They still want to control like Web2.

What happens is you have the same extractive qualities. We’ve seen this with people selling NFTs and then not providing any utility. The cynicism in some cases comes from something that happened in the past, and so it’s not undeserved. For the gamer, they have to look at, who are the entities that actually respect this? How much do they believe in Web3? Are they managing their supply in a certain manner?

Again, it comes down to financial literacy, understanding how value could be formed. That’s something that can be learned quite easily. It’s not super hard. Gamers understand all sorts of complex mechanics when it comes to resource management, tactics and strategy, balancing. They can game systems out and understand how to come out on top. It’s just that they’ve historically been abused by this, and so they fear it. That feeling isn’t shared by the Asian audiences. In Asia people are generally more capitalist.

GamesBeat: In some ways, are we maybe going to follow the pattern of free-to-play? I don’t know exactly how long it took. Maybe 10 years? Eventually we had companies like Nexon valued at $20 billion.

Siu: One thing that will happen, and I think it will happen sooner–the value from ownership in Asia happens so much faster. The business model of being a Web3 game is ultimately superior. There’s an irony, and it’s that the more control you give up, the more value is created. That’s almost paradoxical. But just think about Bitcoin. Bitcoin could not be valuable if it was controlled by a single entity. Same with Ethereum. The more decentralized they can be–too much decentralization is more like chaos. But by the time you’re fully decentralized and community-owned, the value really starts to form. Economic power starts to develop.

That’s a different kind of company. It’s very hard, if you’re an EA or an Activision, to build something based on being decentralized. There’s going to be a slow period. But I think, very much to your point–Nexon wasn’t a big player in the game industry until fairly recently. Even though they’re owned by Tencent, whether it’s Supercell–even Tencent as a company, if you think about, it was mobile gaming that really took off for them, because of WeChat. The leaders in China were companies like NetEase, because of World of Warcraft. The era of PC gaming to mobile gaming evolved Tencent toward what it is today.

The next era belongs to these games where you have ownership. A generation of new companies is emerging who are going to be the players in the space, because legacy companies have to catch up. They have done that. EA and Activision have built up in the mobile space. Web3, I think, is going to follow the same pattern.

One thing I’ll close on, Web3 gaming has the potential to provide valuable life skills. Gaming is proven to provide valuable life skills, but not tangibly enough. People talk about leadership around being a guild leader in World of Warcraft, things like that. But these are very abstract. They’re not direct benefits. Whereas with Web3 gaming, there’s a direct benefit. I’m not talking about play-to-earn as a way to make money. That’s one element, but not the primary one. To me the biggest one is what happens afterward. You gain financial literacy.

Think of all the Filipinos that made Axie, who now have a wallet. In the Philippines now you can’t be elected in any of these village elections without being pro-crypto, because that’s their employment. That’s one side of it. But the other thing is, people who started out knowing nothing about money now have a much better understanding of financial value systems. This is something that’s still missing from the world. We’ve democratized information, so we have access to all sorts of knowledge. But when it comes to financial knowledge, we actually don’t know the differences. We don’t understand. That’s why things like Robinhood can still exist in the way they do.

Most of the world plays games. If we can play games and learn about financial systems and financial literacy, that can have a real impact on us. I think the world will look very different. We can create a new wave of literacy, which to me is the great hope and potential for Web3 games.

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.