- The whale transfer did not trigger a substantial rise in staked Ether deposits.

- ETH’s supply outside of exchanges was ten times more than the exchange supply.

A whale transferred 16,000 worth of Ethereum [ETH] from Binance to the Binance Beacon Chain on 21 July, Whale Alert revealed.

🚨 🚨 16,000 #ETH (30,332,595 USD) transferred from #Binance to Binance Beacon Deposithttps://t.co/s0GKXFqkrd

— Whale Alert (@whale_alert) July 21, 2023

How much are 1,10,100 ETHs worth today?

Originally launched in 2020, the Beacon Chain serves as the consensus layer of the Ethereum network while being responsible for the validation of newly-created blocks.

Although not as popular as Lido Finance [LDO] and Coinbase, Binance rebranded the Beacon Chain for ETH staking in April. In a statement released in the same month, the exchange noted that Wrapped Beacon ETH (WBETH) would be the new liquid staking token.

At the time, the exchange had also noted that the value of WBETH would increase in line with the daily Annual Percentage Rate (APR) of ETH staking.

Therefore, this whale transfer suggests that the decision of the exchange may have improved staking on the platform.

From Santiment’s data, Ether deposits on the Beacon chain have not had a stable direction. At press time, deposits were down to 10,900 ETH. This implies that, despite the whale transfer, the overall interest in committing ETH and validating transactions has not been impressive.

Despite the drop in deposits, withdrawals did not follow with a hike. At the time of writing, Ether withdrawals on the Beacon Chain stood at 2,784 ETH.

When comparing both deposits and withdrawals, one can infer that validators had more conviction in the long-term value of staking ETH rather than the short-term performance.

However, it is worth noting that most of ETH and staked Ether deposits were not on exchanges. According to Santiment, ETH’s supply on exchanges was 11.14 million. On the other hand, the supply outside of exchanges was ten times the exchange supply.

At 113.52 million, the supply outside of exchanges showed that participants would rather hold ETH in self-custody or stake on decentralized platforms.

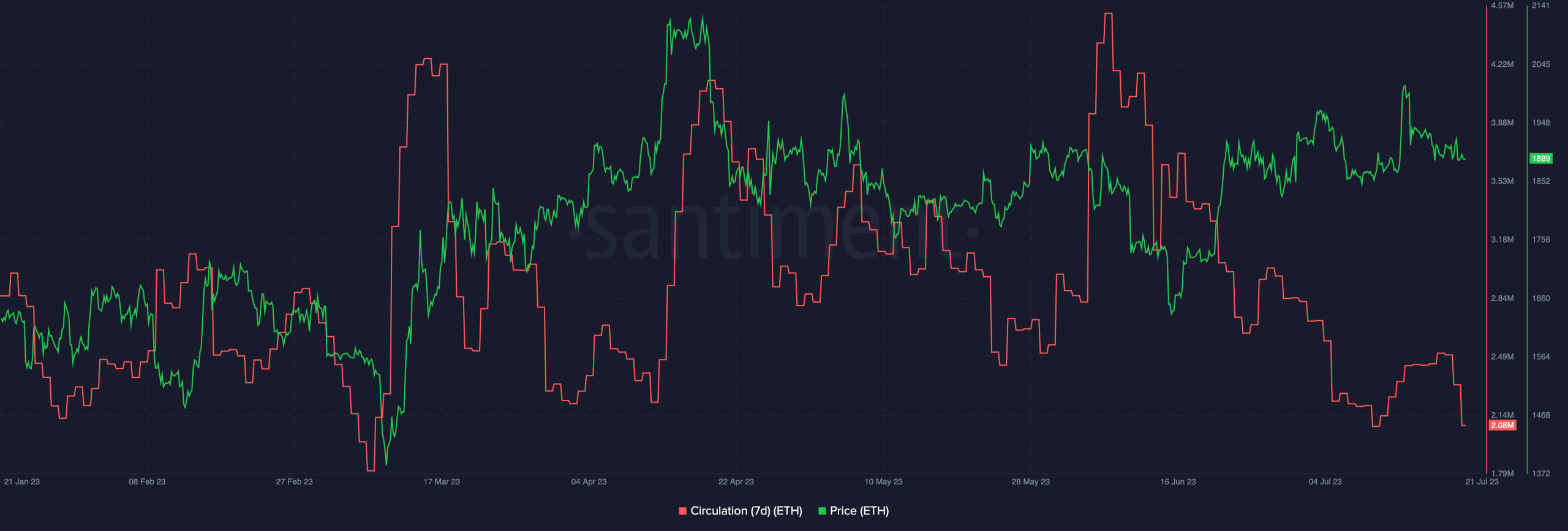

Meanwhile, ETH’s seven-day circulation had dropped. As of this writing, the circulation was down to 2.08 million.

Realistic or not, here’s ETH’s market cap in BTC terms

Circulation shows the number of unique coins or tokens used during a specific period of time. If the circulation had increased, then it would mean that a lot of ETH had been engaged in transactions.

But since the circulation decreased, it means that ETH used was not as much as it was a few weeks back. At press time, ETH’s price was $1,889— a 5.20% decrease in the last seven days.

![Ethereum [ETH] exchange supply and supply outside of exchanges](https://usercontent.one/wp/www.businessmayor.com/wp-content/uploads/2023/07/1689978814_289_Whale-takes-Ethereum-staking-to-Binance-Deposits-to-skyrocket.png?media=1711454622)