Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Three decades ago, when I earned my crust as a Tokyo-based equity strategist, I discovered fine wine. More to the point, fine wine merchants found me. A tale was spun about an insufficient supply of bubbly at the worldwide millennium celebrations to come. Encouraged to beat the rush and put away some vintage champagne, I bought 10 cases of 1990 vintage Jacquesson.

You can guess the rest. Years later, after settling in London, more than enough bottles of fizz were available on New Year’s Eve 1999. And my hopes of selling extra bottles for profit were dashed. While top bottles from Bordeaux and Burgundy always found bids, champagne’s market remained an old-fashioned business for many years afterwards.

In recent years, though, vintage champagne has become a collector’s choice in the fine market. This top performer has in the past year lost some of its sparkle. Prices have tumbled. Nevertheless, some unusual characteristics of this market suggest demand will not simply drain away.

I would have easily sold my spare champagne today. Since the Covid lockdown, the market for fine vintage champagne has much more fizz. During 2020, cash-rich collectors recognised, as did fine wine traders, that top vintage champagne offered excellent relative value with, say, top white Burgundy. When the market saw that the 2008 vintage was the best in decades, prices began to climb.

Moët & Chandon had released the 2008 vintage of its celebrated Dom Pérignon at around £100 per bottle (in bond). Today that would cost 60 per cent more.

Collectors with time to spare during lockdowns, and excess savings, scurried around trying to find this 2008 vintage, as well as the highly rated 2012. A business that had relatively few specialist critics to offer their judgments — or even better, scores — suddenly had more attention from all wine merchants.

And these private collectors didn’t just pick up a case for the festive season. They loaded up with five or 10 times more. That was great news for a champagne market which had lost an important part of its business, the restaurant industry, which closed in spring 2020 for more than a year.

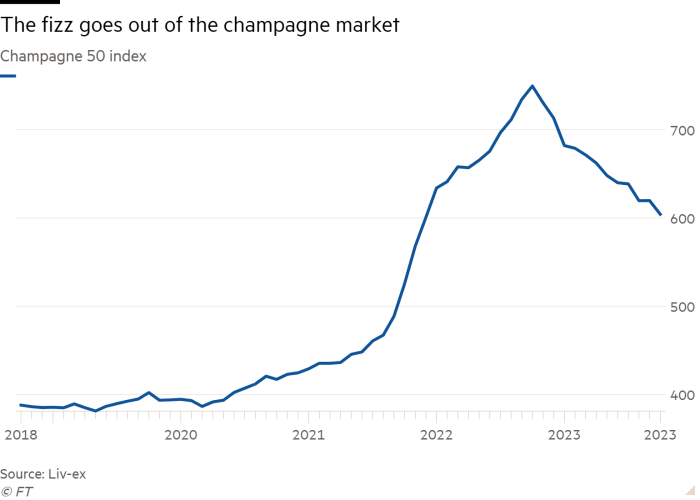

Champagne prices jumped. In some cases, the total value of bids for the top brands on Liv-ex, , the online wine marketplace. exceeded those of offers by nine times. The norm is a 50 per cent discount, points out Justin Gibb at Liv-ex. In the three years to October 2022, the Liv-ex Champagne 50 price index nearly doubled.

But the bubble in bubbly has popped, for now. “Speculative money came into the market, buying multiple cases when they really needed only one or two,” says Gibb. “They’re now selling these excess cases.”

Not surprisingly, those champagnes that had the biggest price surge have retraced more of those gains. Those speculators who loaded their cellars with cases of 2012 Roederer Cristal or 2004 Krug are suffering a hangover this year. Both have lost more than a fifth in price this year, according to data from fine wine merchants Bordeaux Index. That’s worse than most top champagnes, together down closer to 13 per cent.

Even if prices have dropped, the market for fine champagne has altered for good. To a certain extent it has caught up with fine Bordeaux and Burgundy. “Champagne for a long time was sold based on the brand. It was not so much about the critics,” says Jamie Graham at Brunswick Fine Wines. “But increasingly buyers want vintage bubbly. And critics are thus having more of an impact than before.”

A key feature of vintage champagne by the top makers such as Krug, Louis Roederer and Bollinger, as Nick Baker of The Finest Bubble says, is that “these champagnes are in the bottle [unlike en primeur Bordeaux] and well aged.” According to Roederer, its Cristal Brut 2008 was aged for over 10 years in its cellars before its release.

Thus critics can benefit from tasting these wines much closer to their peak, even though these bottles can keep for sometimes decades longer. Bordeaux’s annual en primeur tasting is a different beast, when reviewers must offer their views on very young wines.

Until very recently there were relatively few critics to advise buyers on vintage champagne. The FT’s own Jancis Robinson is one. She gave very high scores — 19.5 out of 20 — to the 2008 vintage, more than for those champagnes in the next best to follow in 2012.

Not all vintage bubbly went flat this year. The most respected grower champagnes — small estates which have provided the larger brands with grapes and wine — have held up in price. Partly this is due to their small output of sometimes a thousand bottles or less.

The novelty for some of these estates, producing all of their own very high- quality wine from estate grown grapes, has attracted buyers, notes Matthew O’Connell at Bordeaux Index. He points to the 2008 vintage of Egly-Ouriet which has risen 19 per cent in the year to date.

O’Connell still thinks a little perspective is needed. None of the most traded vintage champagnes on the BI platform over the past three years is up less than a fifth, while quite a few are up by over half.

Moreover, a significant portion of these bottles will be opened for special celebrations in the coming years, as they are already drinking well. That should use up any of the supply from the speculative period. Expect prices to settle in the coming year.