Stocks rebounded from early declines to close higher on Thursday, despite economic data exacerbating concerns that interest rates are set to stay higher for longer than previously forecast.

The S&P 500 rose 0.8 per cent, while the tech-heavy Nasdaq Composite climbed 0.7 per cent, reversing two days of losses. Tesla was an exception to the positivity, becoming the worst performer in the S&P 500 with a decline of almost 6 per cent after it failed to specify when a new model would launch or what it might cost.

The broader gains came despite new data highlighting the strength of the US labour market. Jobless claims fell to 190,000 in the week ended February 25, fewer than the 195,000 predicted.

Signs of resilience in the US economy have counter-intuitively tended to spook investors in recent weeks, as they have been taken as signs the Federal Reserve will have to do more to bring inflation under control.

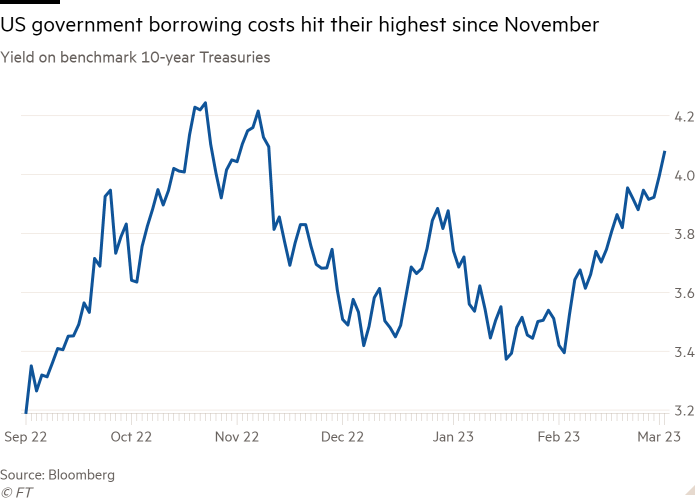

The data weighed on government bond prices, with the yield on the benchmark 10-year Treasury rising 0.07 percentage points to 4.06 per cent. Yields rise when prices fall.

The yield on the two-year note touched 4.94 per cent, its highest since 2007, before falling back to 4.90 per cent, roughly flat for the day.

A measure of the dollar’s strength against a basket of six peers gained 0.5 per cent.

The moves come after a sobering few weeks for investors who had hoped central bank interest rates on both sides of the Atlantic were close to peaking.

“Attitudes are in the dumps,” said Mike Zigmont, head of trading and research at Harvest Volatility Management. “We haven’t had a positive data point or headline in a while and the wait is weighing on both stocks and bonds.”

Signs of persistent labour market tightness in the US followed a smaller than expected decline in eurozone inflation, with prices in the bloc rising 8.5 per cent in February year on year. This was down from 8.6 per cent in January but more than the 8.2 per cent forecast by economists polled by Reuters.

Core inflation, which strips out volatile food and energy to give a clearer picture of underlying price pressures, rose to a new eurozone record of 5.6 per cent, up from 5.3 per cent the previous month. Economists had expected the figure to rise to 5.5 per cent.

However, European stocks followed a similar pattern to those in the US, recovering from an early dip despite the disappointing data. The Stoxx 600 closed 0.5 per cent higher, while London’s FTSE 100 rose 0.4 per cent.

Tim Graf, head of European macro strategy at State Street Global Markets, said nation-level data from Germany, Spain and France earlier this week had dampened “the surprise factor” of the eurozone figures.

The February inflation numbers nevertheless add to the pressure on the European Central Bank to continue raising interest rates in the months ahead.

“We have been forecasting a [half percentage point] hike at the [ECB’s] meeting in two weeks’ time and another in May, but further hikes at later meetings now look increasingly likely,” said Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics.

Separate data out on Thursday showed the eurozone’s unemployment rate was unchanged at 6.7 per cent.

Asian markets declined on Thursday as investors reassessed the optimism over China’s economic recovery that had buoyed equities to strong gains a day earlier. Hong Kong’s Hang Seng index lost 0.9 per cent while Japan’s Topix declined 0.15 per cent and the China CSI 300 fell 0.2 per cent.