Uniswap V3 vs. Trader Joe AMM Models

Uniswap V3’s Concentrated Liquidity and Trader Joe’s Liquidity Book models are protocol level upgrades for liquidity efficiency in DeFi. Uniswap allows liquidity providers (LPs) to select custom price ranges, while Trader Joe uses discrete “bins” to allow LPs to define fixed price ranges for precise deployment of their liquidity.

Key Takeaways:

-

Increased liquidity efficiency improves the efficacy of services for end-users in DeFi, allowing for greater yield and sustainability and expediting the overall growth of DeFi.

-

Uniswap and Trader Joe have introduced models that aim to optimize liquidity efficiency – Concentrated Liquidity and Liquidity Book respectively.

-

We examine and compare each model whilst outlining the general improvements both have made for traders, liquidity providers, and the decentralized ecosystem.

Crypto markets trade around the clock and never sleep. Digital assets derive their financial value directly from user demand, introducing a more efficient valuation than in traditional equities such as stocks, where the valuation is merely a function of profit.

However, DeFi remains highly capital-inefficient for a myriad of reasons. The core contributors to this inefficiency are the fragmentation of the DeFi landscape. This extends beyond individual chains and can be conceptualized as including the two-tier system of centralized services and decentralized services. DeFi is also in a constant state of flux. Nascent protocols naturally begin as inefficient and grow more efficient with time; however, given the money lego system of DeFi, these inefficiencies often spill out into other areas.

As DeFi evolves and matures, these inefficiencies will naturally be closed by development on the protocol layer and increasingly by arbitrageurs who play a vital role in the ecosystem’s health and functionality, closing gaps and profiting in the process.

Uniswap V3’s Concentrated Liquidity model and Trader Joe’s Liquidity Book model provide excellent examples of liquidity efficiency upgrades at the protocol level. Throughout this article, liquidity efficiency will denote making the best possible use of currently available capital.

What is Liquidity and Understanding the AMM (Automated Market Maker) Model

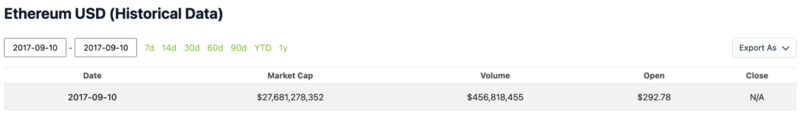

The word liquidity references how easy it is to exchange an asset; how quickly an asset can be bought or sold without impacting market price. Crypto’s overall liquidity has strengthened and grown massively. Compare Ethereum’s total market cap prior to the 2017 bull run with its market cap today:

2017 ETH Market Cap was $27,681,279,352, and its daily trading volume was $456,818,455

2023 ETH Market Cap is $251,586,840,870, and its daily trading volume is $9,272,832,786

Ethereum’s market cap has grown more than 800%, and its daily trading volume has increased by more than 1,000%. This volume remains split over various centralized exchanges and decentralized exchanges. But the general point that the current market would more easily consume a $10,000,000 Ether sell order than the 2017 market because of increased liquidity depth shows itself clearly.

Every trade requires a counterparty: a buyer needs a seller, and a seller needs a buyer. Centralized exchanges utilize an order book model that matches buyers and sellers. Centralized exchanges also rely on Market Makers (MMs) to provide deep liquidity on both sides, who profit by pocketing the difference known as the bid-ask spread.

A classic example of a Market Maker in crypto would be Wintermute, who recently received 40 million ARB tokens for market-making activities. Market Makers remain essential because low liquidity leads to slippage, and if the price point at execution varies from the predicted, traders will use another, more efficient service.

How the Automated Market Maker (AMM) Model Works

Uniswap’s success comes from implementing the Automated Market Maker (AMM) model, which has since become the blueprint for every subsequent decentralized exchange.

Instead of connecting two traders, a trader buying an asset uses the liquidity pool as their counterparty and requires no intermediary. The AMM model relies on liquidity providers who are incentivized through trading fees, and the ratio of assets in the liquidity pool remains constant thanks to smart contracts rebalancing the pools using a basic formula: x*y=k

Users provide liquidity in the form of LP tokens and participate in market-making activities, and this new model has allowed the permissionless trading of digital assets.

Uniswap V3 Concentrated Liquidity

Uniswap V3 was released in May 2021 and introduced the concept of Concentrated Liquidity. This model focuses on maximizing capital efficiency, leading to better trade execution and increased fees for LP providers.

The core innovation was to allow LP providers to select a custom price range: each LP provider has a custom price curve, and traders trade against the aggregate of these price ranges.

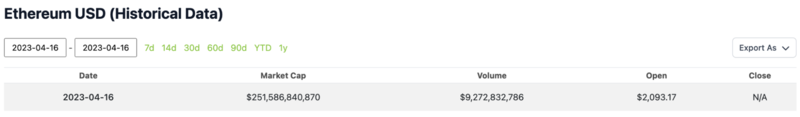

Source: https://app.uniswap.org/#/pools

Seen above is the pool for ETH-USDT. The full range has been selected, mirroring the standard liquidity distribution in V2 pools. The LP’s capital is distributed uniformly along the price curve, which has the advantage of being able to handle all price ranges between zero and infinity. Still, given that the vast majority of trading occurs within a narrow range, most of this capital goes unused and, therefore, is highly inefficient.

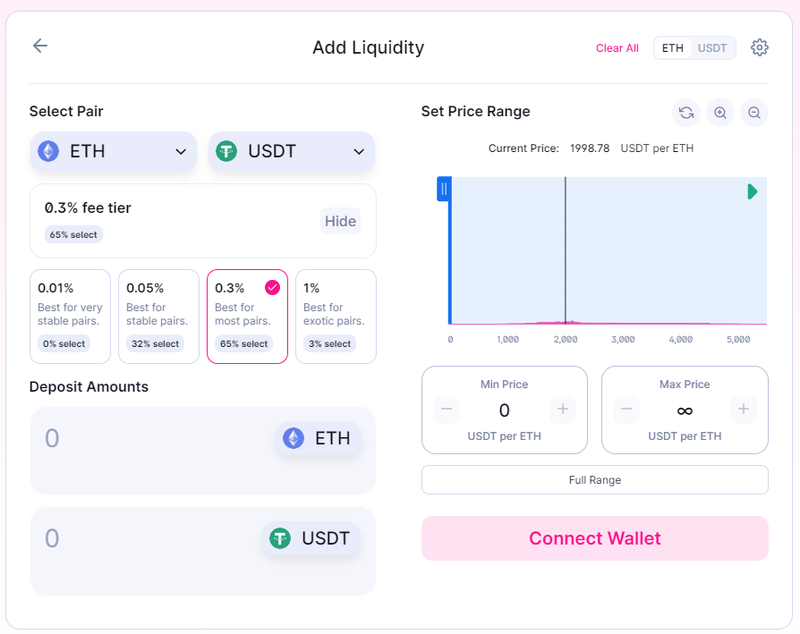

Source: https://app.uniswap.org/#/pools

In the above example, a custom price range for ETH-USDT has been selected. The LP provider will earn trading fees proportional to their liquidity contribution between the pre-defined range ($1,706 and $2,303). The majority of ETH trading has taken place here in recent weeks, and this custom range would allow the LP provider to earn a similar amount of trading fees with far less capital than a V2 pool or deploy the same amount of capital and earn more trading fees. In both scenarios, the LP provider is better off, and that is thanks to the improved liquidity efficiency.

Uniswap V3’s concentrated liquidity pools are especially advantageous to stablecoin pairings that trade in a narrow band – typically withholding the recent USDC depeg event – and in V2, often as much of 99.95% of supplied capital provided was never utilized in these pairings.

Game theory comes into play with V3 pools, as users can choose where to allocate capital. Thus some providers will target less likely but more profitable ranges, given a higher percentage of liquidity provision in that range, and others will focus on narrower ranges. This ensures reasonable distribution along the price curve.

Overall the V3 pools allow for greater liquidity depth, meaning lower slippage for traders and similar trading fees with a reduced capital amount for liquidity providers. The second-order effects see this saved capital put to productive use in other areas of DeFi. Concentrated Liquidity presents a brilliant example of how upgrades to liquidity efficiency at the protocol level benefit all users.

Trader Joe’s Liquidity Book

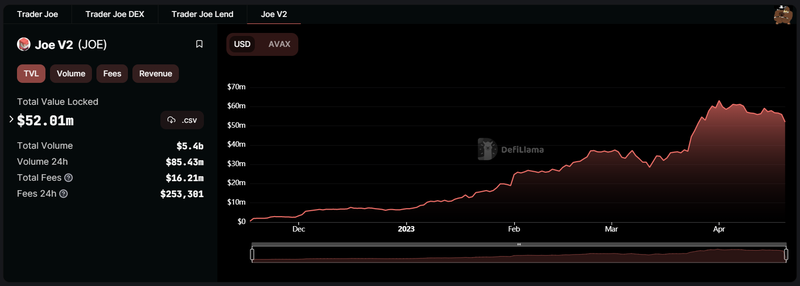

Source: https://defillama.com/protocol/joe-v2

Many know Trader Joe as the superstar DEX of Avalanche. However, Joe V2 has rapidly become one of the most popular DEXs on Arbitrum, gaining traction following the ARB airdrop and the rampant trading that took place. Trader Joe’s new Liquidity Book model powered this growth.

What are Bins in Trader Joe’s Liquidity Book Model?

Understanding bins is essential to understanding the liquidity book model. In Trader Joe V2 pools, liquidity is deposited into discreet bins. Each bin has a fixed price, and liquidity is placed separately into these different bins.

As long as the trade remains within the bin’s range, users who swap within a bin receive a fixed price, meaning no slippage and excellent price efficiency. All bins stack together, providing deep liquidity, and liquidity providers have the option to create more advanced strategies with different liquidity bin distributions.

The Liquidity Book Model

The Liquidity Book model is a new instance of the AMM model, dramatically improving liquidity efficiency and offering users far more flexibility regarding what they can do when providing liquidity. For example, they can DCA in and DCA out of positions without paying multiple swap fees and earning trading fees at the same time.

The Liquidity Book model, similar to Uniswap V3 pools, allows for concentrated liquidity, allowing liquidity providers to define custom price ranges. Instead of liquidity being evenly spaced across the price curve, it is deployed precisely, enabling greater trading fee generation. It has the added benefit of being able to process greater volume with less liquidity when compared to typical pools. In layman’s terms, the Liquidity Book can serve a large number of traders with the least amount of liquidity. This model moves away from the increasingly antiquated model where DEXs relied on attracting large amounts of captive liquidity to provide an efficient price.

Traders can enjoy zero slippage trades thanks to the Liquidity Book model and its use of ‘bins.’ Each bin is a single price point, and Trader Joe aggregates all these bins into a single liquidity pool. The ‘Active Bin’ contains both tokens in the pairing and determines the asset’s current market value. The active bin is the only bin that earns trading fees, and trades made in this bin suffer no slippage. The introduction of bins has upgraded even Uniswap V3’s concentrated liquidity, given the precision of the bins and the greater concentration of liquidity at more narrowly defined price points.

When all the liquidity from a bin has been used, the price moves to the next bin. And this dynamic structure is a key characteristic of the Liquidity Book model.

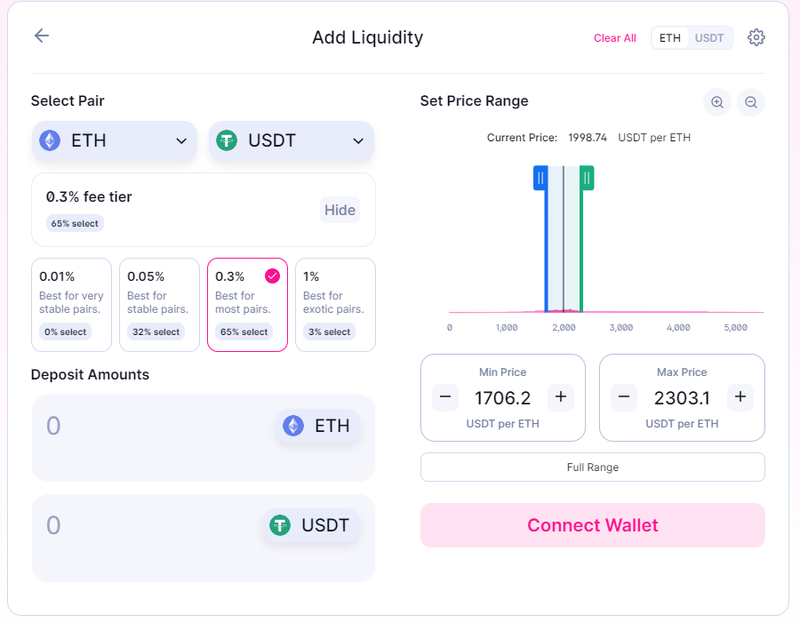

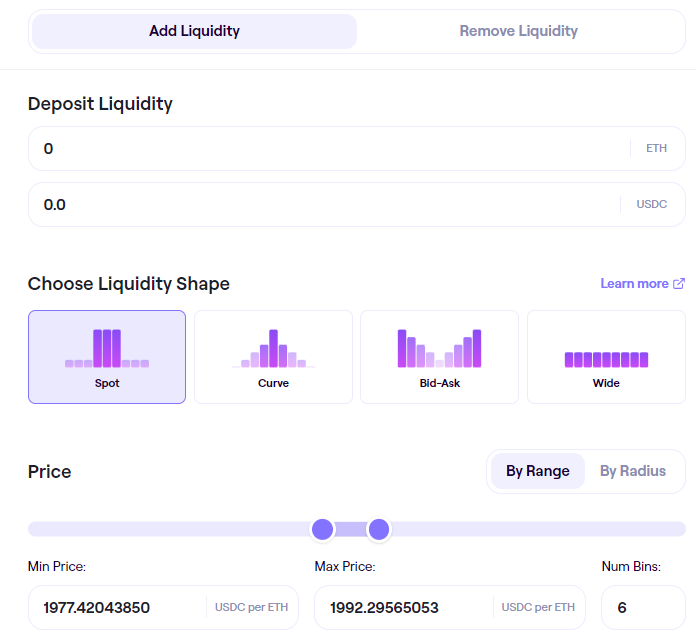

Source: https://traderjoexyz.com/arbitrum/pool

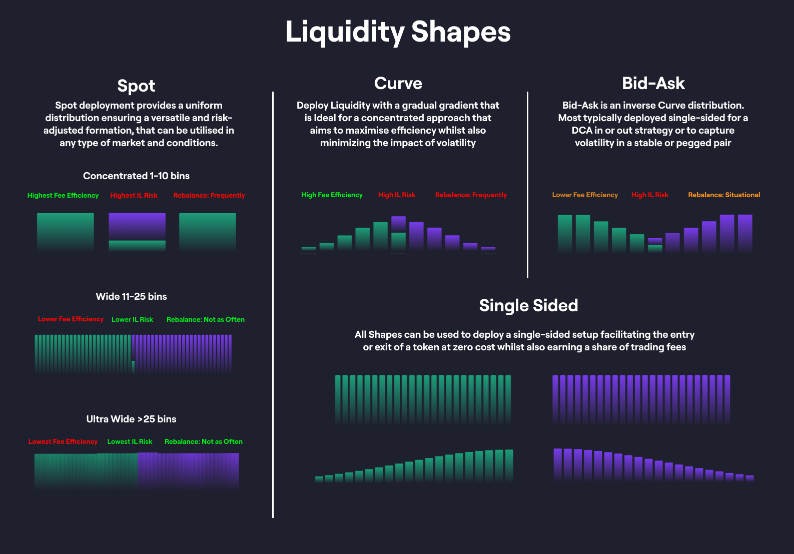

Featured above are the liquidity provider’s options when using Trader Joe V2 pools. Observable are four main shapes: Spot, Curve, Bid-Ask, and Wide.

Here’s a simple example of how users can utilize the Spot shape distribution:

Source: https://traderjoexyz.com/arbitrum/pool

In this pool ETH-USDC, liquidity providers can opt for the range above the current market price and supply only ETH to the pool. As the price of ETH rises moving through the bins, the user will steadily sell ETH in return for USDC. The range in the above example is relatively small, but users could select any price target they wanted – an easy option to DCA out of a position.

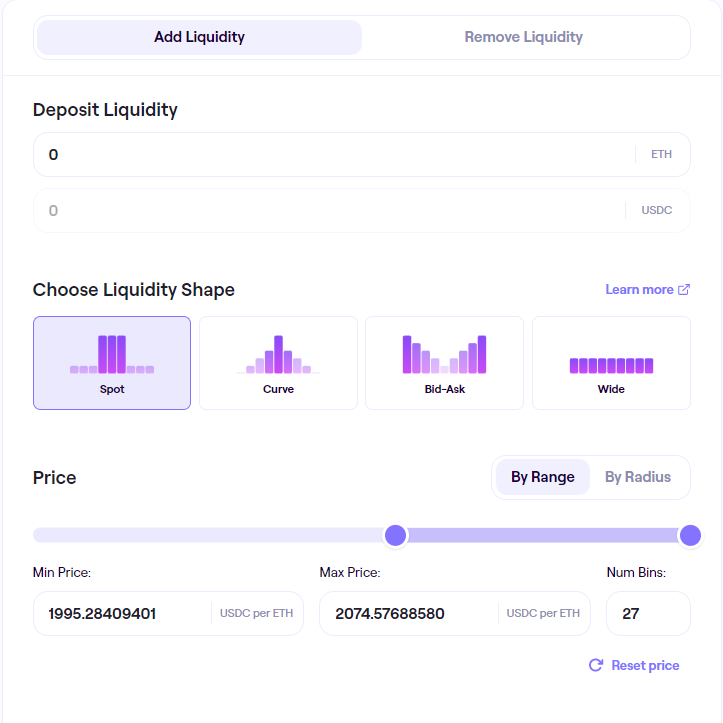

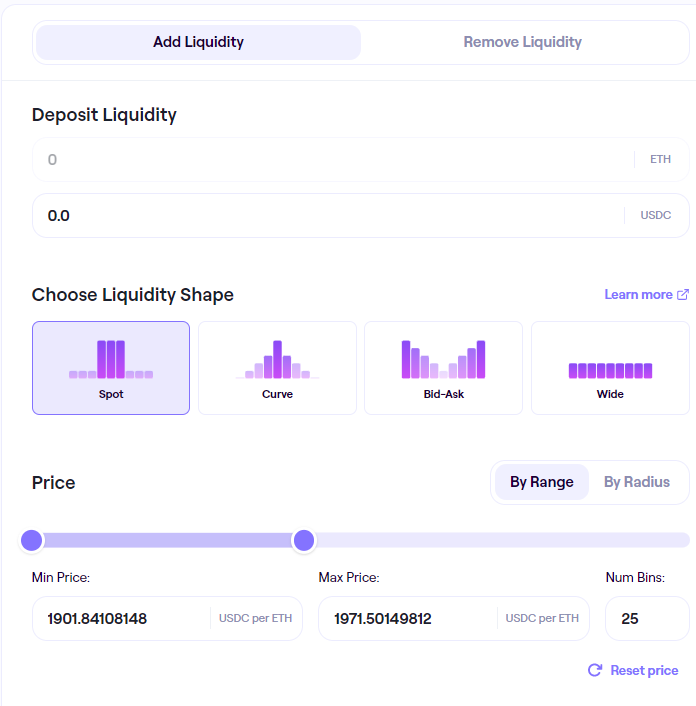

Source: https://traderjoexyz.com/arbitrum/pool

The reverse is also true; users can utilize the Liquidity Book model to DCA in by reversing the process and doing a single-side supply of ETH below the current market price. With both of these applications of the Spot shape, users enter or exit their position gradually with a single transaction and earn swap fees in the process.

The Spot shape gives liquidity providers incredible freedom and flexibility regarding how they deploy liquidity. The lower the number of bins, the more concentrated the liquidity; therefore, the greater their share of revenue of all the trades made in this band. In the same stroke, liquidity providers risk the greatest impermanent loss if the price moves outside this range.

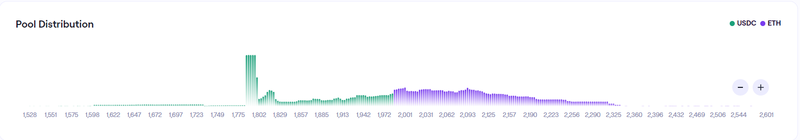

Liquidity providers can observe where other market participants have deposited liquidity on Trader Joe, and the above graphic shows the current liquidity distribution for ETH-USDC.

Above are several strategies outlined by Trader Joe, and users who want to provide liquidity can select a shape that best suits their goals. It is heavily recommended that users begin with test capital and develop their understanding of how the Liquidity Book model works before deploying all their funds.

In summary, the Liquidity Book model offers a new level of flexibility for liquidity provision, reduces slippage, and allows for more dynamic liquidity rebalancing, essentially opening up a new paradigm for traders and LPs within DeFi.

The Drawbacks

Impermanent Loss

Impermanent loss is the greatest danger any LP faces. In simple terms, impermanent loss is the difference in the value of the assets at deposit versus withdrawal. When the prices of assets diverge, the LP faces losses but hopes that the trading fees outweigh this. In many instances, it may be more profitable for investors to simply hold their tokens in their wallets rather than supplying liquidity.

In both models, liquidity providers face a greater risk of impermanent loss than traditional pools because liquidity is distributed in a narrower range. Impermanent loss will occur when the asset’s price moves outside the specified range; a slimmer range means greater chances of impermanent loss. But in exchange for this greater risk, LPs stand to gain more trading fees, a typical scenario where risk and reward increase in tandem.

An argument can be made that because Trader Joe’s Liquidity Book model allows for more specific liquidity provision, LPs will face the potential for the most significant impermanent loss in these pools. However, Trader Joe introduced the Volatility Accumulator, which monitors volatility judged by bin changes. The Volatility Accumulator automatically increases swap fees when volatility rises, helping protect LPs against impermanent loss.

Complexity

Uniswap’s V3 pools and TradeJoe’s Liquidity Book model have enabled more concentrated liquidity provision, greater trading fees for liquidity providers, and better trade execution with lower slippage for traders. But both remain more complex than the liquidity provision many crypto users have grown accustomed to. This added complexity could lead to more significant user error; hence the importance of trial and error with each model.

Specifically with the Liquidity Book model, liquidity providers are only limited by their imagination. Still, when markets become volatile, they can easily be pushed out of their bins resulting in impermanent loss, and it also requires a more active management style. But the nuances and complexities involved form part of the reward in this new era of liquidity provision.

Why Competition Drives Growth and Benefits DeFi

Uniswap’s V3 pools, on the surface level, remain slightly more user-friendly than Trader Joe’s Liquidity Book model. But the Liquidity Book model outpaces V3 pools when it comes to liquidity efficiency. The sheer amount of flexibility bins provide makes liquidity provision more exciting and profitable if done correctly.

The new level of capital efficiency introduced and fostered by both pools positively impacts DeFi, freeing up capital for other productive uses. As both DEXs are motivated to offer the best trading experience to attract users to their platforms, the continued development of liquidity efficiency at the protocol level within DeFi remains inevitable.

Tell us how much you like this article!

Kofi J

Kofi J has been active in DeFi since the 2020 summer explosion and has been rugged more times than he can remember. He hopes to make the decentralized economy a little bit more accessible through his prose.

Follow the author on Twitter @k_pangolin