Supermarkets offer backing for transparent system of live fuel pricing

The Business and Trade committee move onto fuel inflation – another factor that has hit households in the last year – and they win a commitment towards a new system of price transparency.

Q: What has caused the increase in fuel prices – both outside and within your control?

Tesco’s Gordon Gafa says the “unfortunate war in Ukraine” caused a significant increase in fuel prices.

More than 90% of the cost at the pump comes from input costs, taxes and duties, he says. So the ‘significant spike’ in prices was mainly due to factors outside Tesco’s control.

Q: But you have huge purchasing power, you buy in bulk, so what can you do to help?

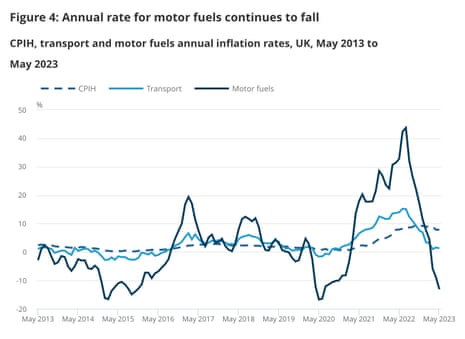

Gafa says prices are around 16p per litre lower today than at the peak of the surge (last week’s inflation report confirmed that prices are indeed lower than a year ago)

But, he claims that Tesco has little control over the wholesale fuel prices it pays, despite buying from eight different suppliers.

Q: There is little transparency over pricing – unlike in Northern Ireland – have you given any thought to improving this?

Gafa says Tesco pricing is structured to ‘compete locally’, with prices spread by about 10p per litre around the UK.

On transparency, he points out that prices are displayed on large screens outside Tesco stores (!) (not that motorists want to drive around looking for good deals).

Unimpressed MPs point out that fuel retailers have to display prices outside their forecourts.

Gafa says Tesco would “welcome more transparency” on fuel pricing, and would welcome a system such as in Northern Ireland where drivers can check the average fuel prices at every petrol station online (this has been credited with keeping prices lower in NI).

Q: Would you all commit to a system to give live fuel price transparency?

Kris Comerford, chief commercial officer at Asda, and Rhian Bartlett, food commercial director at Sainsbury’s, both reply “yes”.

Morrisons CEO David Potts is slightly more equivocal, saying that his supermarket would be happy to look at “anything that can benefit consumers”.

Key events

Brexit ‘cliff edge’ poses threat to UK electric car production, warns industry chief

Jasper Jolly

The growth of electric car production in Britain is under threat from a Brexit “cliff edge” in January unless the EU agrees to delay new trade rules until 2027, industry leaders have warned.

Electric cars exported from the UK to the EU will have to meet tighter “rules of origin” in the new year, which mean batteries must be sourced from within the two trade partners or face 10% tariffs.

However, as UK and European manufacturers are reliant on batteries from Asia, tariffs appear all but inevitable under the rules.

Mike Hawes, the chief executive of the Society of Motor Manufacturers and Traders (SMMT), said:

“There is huge potential for growth, and that growth is now at risk from tariffs.

“We’re saying basically suspend that requirement, and just let the regulation that’s currently in place flow through to 2027, which is the next threshold.

“We need to make sure those [tariffs] aren’t applied or else there is the real potential that the [electric vehicles] EVs are more expensive and face a tariff whereas petrol diesel don’t.

The warning comes as the SMMT holds its regular summit, where trade secretary Kemi Badenock has spoken:

“A successful UK economy relies on a successful auto industry. So we want to do everything we can to support you & help you thrive. We can’t have economic growth without the auto sector. We can’t have levelling up without the auto sector”@KemiBadenoch #SMMTSummit pic.twitter.com/IcHHLGF9hd

— SMMT (@SMMT) June 27, 2023

The GNB Union have hit back at Asda’s claim this morning that they are not threatening workers in the South of England with ‘fire and rehire’ tactics.

As covered earlier, Asda’s chief commercial officer Kris Comerford told the Business and Trade Committee that the supermarket does not use fire and rehire tactics, as he defended removing a 60p per hour supplement for some workers.

Nadine Houghton, GMB national officer, says:

“This is a truly staggering interpretation of events by Asda bosses.

“GMB is currently engaged in consultation with ASDA who are threatening 7,000 workers in stores in the South East with the sack if they don’t accept a 60p pay cut during a cost-of-living crisis.

“If that’s not fire and rehire, I don’t know what is.”

Meanwhile in America, factories have reported a jump in demand for long-lasting products.

New orders for US manufactured durable goods jumped 1.7% month-over-month in May 2023, following an upwardly revised 1.2% rise in April, beating market expectations of a 1% decline.

This is the third month of rising durable goods orders in a row.

Andrew Hunter, deputy chief US economist at Capital Economics, says increased demand for aeroplanes was partly responsible.

The 1.7% m/m rise in durable goods orders in May was stronger than we had expected, even accounting for a big rise in the volatile commercial aircraft component. But the wider evidence still suggests that business equipment investment has further to fall.

Commercial aircraft orders rebounded by 33% m/m, echoing the big rise in orders reported by Boeing. Although that was partly offset by a slump in defence aircraft, overall orders for transport equipment rose by 3.9% m/m last month.

While inflation stayed painfully high in the UK last month, at 8.7%, it has dropped in other countries, including Canada where it’s at a two-year low.

Data just released shows that the Canadian Consumer Price Index rose by 3.4% year over year in May, following a 4.4% increase in April.

This is the smallest increase since June 2021, Statistics Canada reports, due to a drop in gasoline prices (18% lower than a year ago).

May Canada Inflation rate comes in at 3.4%. This could reduce the pressure for the Bank of Canada from hiking on July 12th.

— Vince Gaetano (@VinceGaetano) June 27, 2023

In other retail news, Boots has revealed a surge in online shoppers helped bump up its sales over the latest quarter.

The chain said its retail sales, which incorporates beauty, health and electricals products among others, jumped by 13.4% over its third financial quarter.

It reported strong demand for its beauty and skincare range, with No7 products flying off the shelves.

Its online platform saw sales surge by a quarter compared to the same period last year as consumers shopped from home and put more items in their baskets.

The retailer’s pharmacy arm also reported a 5.7% sales increase over the quarter, PA Media adds.

Parent company Walgreen Boots Alliance reported a cut in third-quarter earnings to $0.14, down from $0.34 a year ago, with lower demand for Covid-19 vaccine and tests hitting sales.

It has also cut its profit forecast for this year to $4.00-$4.05 per share from $4.45 to $4.65. This is due to “consumer and category conditions, lower Covid-19 contribution, and a more cautious macroeconomic forward view,” it adds.

Here is a clip from today’s hearing:

Today the @CommonsBTC questioned UK supermarkets over key figures and the Groceries Code Adjudicator regarding food and fuel prices.

Inc. @Asda CCO, Kris Comerford, who shared how they’ve been supporting customers through the cost-of-living-crisis – in this clip. #inflation pic.twitter.com/qev38AIRj7

— CBI (@CBItweets) June 27, 2023

MPs also focused on the hefty pay packets enjoyed by UK supermarket chiefs.

Q: How can Sainsbury’s justify paying almost £4m in bonuses to CEO Simon Roberts, on top of his salary, in a cost of living crisis? He’s on £2,298 per hour, and workers are getting £11 per hour?

Rhian Bartlett, food commercial director at Sainsbury’s, has the unenviable job of defending her bosses pay packet. She points out that board directors’ salaries are set by the remuneration committee, and published, so she can’t comment further on it.

Q: Today’s discussion is taking place amid a cost of living crisis – how can you claim your purpose is to provide reasonably priced food for customers when you’re paying dividends and salaries?

None of these witnesses seems keen to address this point.

Supermarkets won’t back price caps on essential goods

Labour MP Ian Byrne then raises the IMF’s new warning that rising corporate profits have driven inflation in Europe (see details here) – at a time when baby formula is being locked up to prevent them being stolen.

Q: Would you, like your counterparts in France, support capping essential items?

Tesco’s commerical director, Gordon Gafa says it’s not possible to compare France and the UK

We don’t believe price caps would be helpful.

Asda’s chief commercial officer, Kris Comerford, agrees.

David Potts, Chief Executive Officer, Morrisons, also isn’t a fan

I would say competition leads you to the right price, actually.

The industry requires volume, and you’ll see it come.

Critics of price caps have argued they lead to shortages, as supermarkets will not want to sell products at a loss and suppliers will take their goods elsewhere.

Coming up on GMB 👇

🛒 Supermarkets say the proposal by Downing Street for a voluntary cap on the price of essential foods will fail to halt food inflation and lead to shortages in the shops.

❓Let teens set their own social media limits?

🏝️ @LoveIsland Host @MayaJama joins us… pic.twitter.com/v2k4MgP86t

— Good Morning Britain (@GMB) May 29, 2023

Asda’s chief commercial officer, Kris Comerford, is then challenged about its alleged ‘fire and rehire’ policy, hitting 7,000 staff in the South East.

Comerford says there was an ‘anomoly’ which means some staff received an extra 60p per hour supplement, due to the higher cost of living in London.

hat is being ‘fixed’, with an 8% pay rise for hourly paid staff last year and another 10% this year – he denies any ‘fire and rehire’ antics.

Supermarkets deny charges of ‘grotesque’ profiteering.

The supermarket bosses appearing before MPs today have insisted they are not guilty of ‘grotesque’ profiteering.

Q: The Unite union general secretary, Sharon Graham, have accused the UK’s supermarkets of a “grotesque display of profeering” at a time when many families are strugging to get food onto the table. What do you say to that?

Tesco’s commercial director, Gordon Gafa, denies it – saying supermarkets make 4p in the pound.

He reiterates that Tesco is not profiteering, saying:

We are the most competitive we have ever been.

Sainsbury’s Rhian Bartlett can beat that…saying her firm’s profit margins are even slenderer.

We make less than 3p in the pound. We’ve also seen profits step back.

Asda’s Kris Comerford says that the 25% drop in Asda’s EBITDA profits last year isn’t consistent with Unite’s claim.