UK retail sales contracted more than expected in March, as consumers continued to tighten their belts amid high inflation and rising borrowing costs, while bad weather kept shoppers away from the high street, official data showed on Friday.

The volume of retail sales, or the amount of goods sold in shops and online, fell 0.9 per cent between February and March, following a revised 1.1 per cent increase the previous month, according to figures from the Office for National Statistics.

The figure, which put an end to two successive months of rising sales volume, was lower than the consensus analyst forecasts of a 0.5 per cent decrease.

The decline was driven by poor performance among department and clothing stores, which saw sales volume fall by 3.2 per cent and 1.7 per cent, respectively, in March.

Some sellers reported that poor weather conditions were among the factors making consumers less willing to shop in March. According to the Met Office’s monthly climate summary, the above-average levels of rainfall made last month the sixth-wettest March on record since 1836.

“Department stores, clothing shops and garden centres experienced heavy declines as significant rainfall dampened enthusiasm for shopping,” said ONS director of economic statistics Darren Morgan.

Moreover, food sales fell by 0.7 per cent in March, following a rise of 0.6 per cent in the previous month, in part because fresh food shortages earlier in the month hampered grocery sales.

“However, the broader trend is less subdued, as a strong performance from retailers in January and February means the three-month picture shows positive growth,” noted Morgan.

Sales volume rose by 0.6 per cent in the three months to March, compared with the previous three months, marking the first quarterly rise since August 2021, according to the ONS.

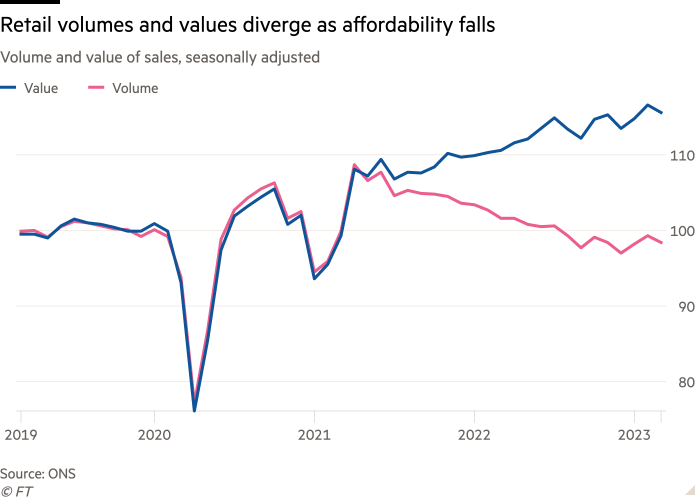

But this increase in volume was still outpaced by retail sales value — or the amount of money that shoppers spent — which increased by 1.1 per cent in the three months to March, as high inflation meant that people could buy less with their money.

On Wednesday, separate figures by the ONS showed the annual rate of UK inflation was 10.1 per cent in March, down only slightly from 10.4 per cent the previous month and still not far below its October peak of 11.1 per cent.

Food prices rose 19.1 per cent in the year to March, putting pressure on household budgets and eroding people’s disposable income.

As a result, the Bank of England is expected to increase interest rates for the 12th consecutive time, beyond the current 4.25 per cent, when the Monetary Policy Committee meets on May 11.

Despite this, “there are reasons to be a bit more optimistic looking forward [as] consumer confidence took a sharp upswing in April”, said Thomas Pugh, economist at RSM UK.

Earlier on Friday, research group GfK reported that its index of consumer confidence, a more timely indicator of how Britons view their personal finances and wider economic prospects, rose by six points to -30 this month.

Despite the uptick, the index remained well below its long-term average, indicating that a clear majority of respondents continued to report declining confidence, in line with data pointing to falling retail sales.