Receive free UK property updates

We’ll send you a myFT Daily Digest email rounding up the latest UK property news every morning.

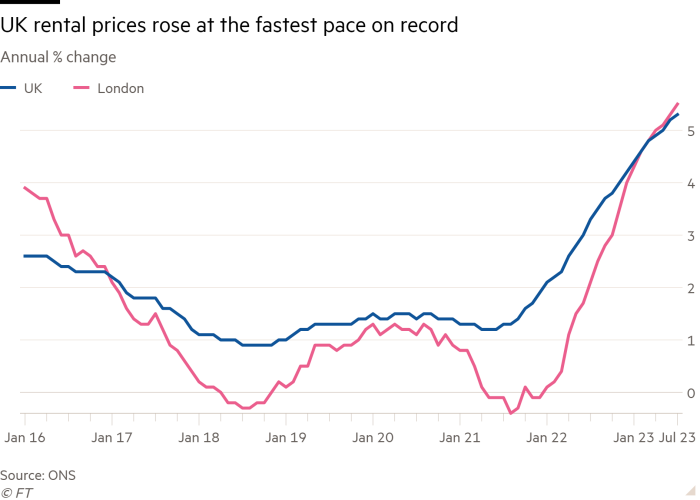

UK residential rents rose by the highest amount on record last month while house price growth declined in June, according to official data published on Wednesday.

Prices paid by tenants rose 5.3 per cent in the 12 months to July, the largest annual percentage change since the Office for National Statistics data series began in January 2016.

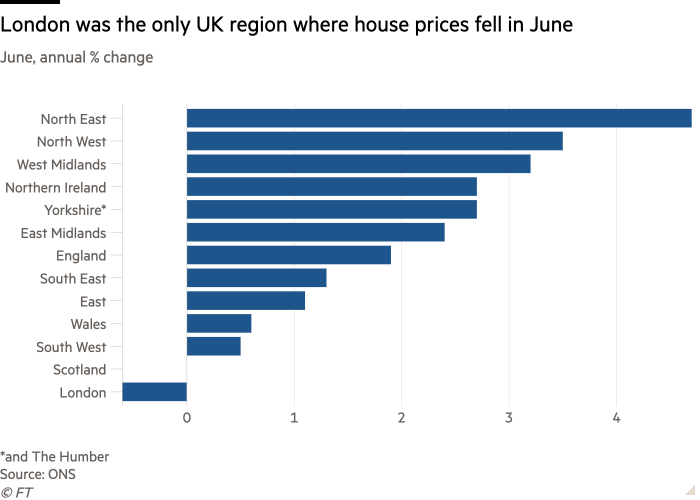

The ONS figures also showed house price growth slowing, rising 1.7 per cent in the 12 months to June, down from a 1.8 per cent increase in May and well below the peak of 14 per cent in July last year. It was also the lowest growth rate since June 2020, when the property market was hit hard by the first Covid-19 lockdown.

The contrasting picture shows the impact of higher mortgage rates on both sectors, with regulations adding to pressure on landlords to sell up.

The trends also reflect more people opting to rent instead of buy given the rising cost of ownership. Both were exacerbated in London where rents rose 5.5 per cent in the capital in July, the highest rate since the data series for the capital began in January 2006.

In contrast, house prices in the capital fell 0.6 per cent in June compared with the same month last year, the only region to register a fall. This was the first annual contraction in London since November 2019 and contrasted with a 4.7 per cent expansion in north-east England, which was the best-performing region.

“Longstanding affordability constraints mean that London continues to underperform and the gap between the capital and the rest of the country has become slightly less pronounced,” said Tom Bill, head of UK residential research at estate agent consultancy Knight Frank.

In June, the average mortgage rate rose to 4.6 per cent, the highest level since 2008 during the financial crisis, according to separate data by the Bank of England. This follows the steady increase in interest rates by the Bank of England as it battles persistently high inflation.

Nathan Emerson, chief executive of Propertymark, a trade body for estate agents, said that the price pressures on rents were exacerbated by the lack of available properties.

“There is a huge disparity in the number of properties available to rent compared to the continuously growing number of renters looking for a home, ultimately continuing to put pressure on rent prices,” he said as he urged the government to “urgently address the problem”.

Hollie Hart, lettings manager at a Winkworth agency in Crystal Palace, said the homes she was letting in the south east London neighbourhood were renting for up to 18 per cent more than they were last year.

“It’s quite crazy how the market is,” she said. “I would hope it starts to stabilise a little [after the busy summer period] but unless more properties come to the market, it’s going to continue to rise.”

The trends in the property market are likely to continue according to separate house price data for July by the lender Nationwide. It showed that UK house prices contracted at an annual pace of 3.8 per cent in July, the worst performance since 2009.

Many economists also expect that house prices will fall further in the months ahead as mortgage rates are expected to remain high for some time.

Gabriella Dickens, an economist at Pantheon Macroeconomics, forecast an 8 per cent fall in prices from their peak in September. “While the drop in energy bills and strong wage growth should free up some cash to put towards housing costs, caution among households remains high and expectations that house prices will fall further are entrenched,” she said.

Additional reporting by Akila Quinio