Stay informed with free updates

Simply sign up to the UK inflation myFT Digest — delivered directly to your inbox.

UK inflation slowed less than expected in March, fuelling the debate over how soon the Bank of England will start cutting interest rates.

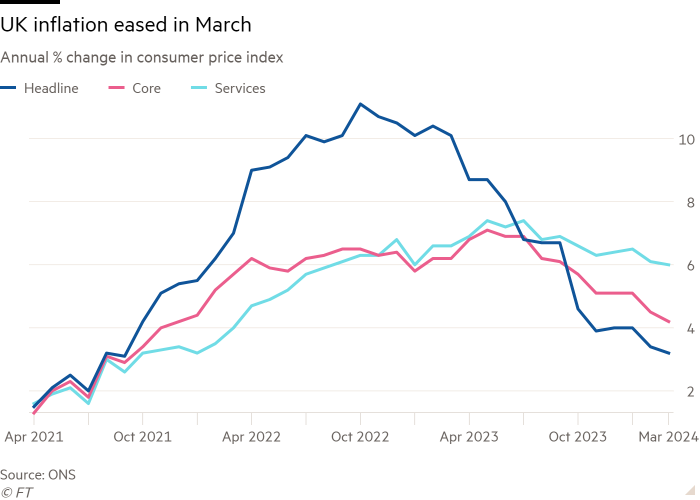

Consumer prices rose at an annual rate of 3.2 per cent, down from 3.4 per cent in February, the Office for National Statistics said on Wednesday. The figure was higher than the 3.1 per cent forecast by economists polled by Reuters and the BoE.

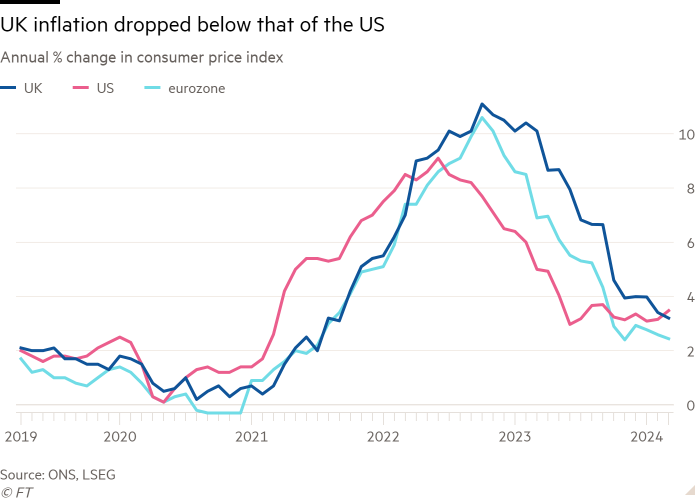

The March inflation rate was still the lowest in two and a half years, with the fall driven by food prices. It was also well below the 41-year high of 11.1 per cent reached in October 2022, and was lower than the US inflation rate for the first time since 2022.

Core inflation, which strips out energy, food, alcohol and tobacco, declined to 4.2 per cent in March from 4.5 per cent the previous month. Analysts had expected a decline to 4.1 per cent.

“The smaller-than-expected fall in CPI inflation raises the risk that inflation will follow the trend in the US and soon stall. The chances of interest rates being cut for the first time in June are now a bit slimmer,” said Ruth Gregory, economist at Capital Economics.

However Yael Selfin, chief economist at KPMG UK, said: “Today’s data are unlikely to move the needle for the Bank of England.

“We expect inflation to return to target later this spring, which raises the prospect of interest rate cuts from June onwards. Fewer rate cuts by the Fed are unlikely have a major impact given the more favourable inflation outlook and the ongoing weakness in the UK economy,” she added.

The UK data follows higher than expected inflation figures in the US, which prompted markets to slash their bets on how much central banks will cut interest rates this year. In March, UK inflation dropped below that of the US for the first time since early 2022 but remained above the eurozone figure of 2.4 per cent.

The Conservative party has pledged to ease price pressures ahead of the general election expected later this year.

Chancellor Jeremy Hunt said: “The plan is working: inflation is falling faster than expected, down from over 11 per cent to 3.2 per cent, the lowest level in nearly two and a half years, helping people’s money go further.”

On Tuesday, the IMF said it expected UK inflation to drop from 7.3 per cent last year to 2.5 per cent in 2024 and 2 per cent next year. At an event organised by the IMF in Washington, BoE governor Andrew Bailey said the question was how much evidence was needed of falling inflation before cutting interest rates.

“Our judgment with interest rates is how much do we need to see now to be confident of the [disinflation] process,” said Bailey.

“The dynamics for inflation are rather different now, between Europe . . . and the US. I think there’s more demand-led inflation in the US than we’re seeing,” he added.

Markets expect the BoE to start cutting interest rates in September or November with about 36 basis points of cuts forecast by the end of the year. This compares with about 40 basis points of cuts for the US and about 73 basis points for the European Central Bank.

The ONS data showed that the fall in UK inflation was driven by food prices, partially offset by rising fuel prices.

Food inflation slowed to 4 per cent in March from 5 per cent in the previous month and well below the 45-year peak of 19.2 per cent in March 2023.

ONS chief economist Grant Fitzner said: “Inflation eased slightly in March to its lowest annual rate for two and a half years. Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago. Similarly to last month, we saw a partial offset from rising fuel prices.”

Separate official data published on Tuesday showed wage annual growth remained elevated at 5.6 per cent in the three months to February, but with rising unemployment and economic inactivity, sending mixed signals about domestic cost pressures.