Receive free Vistry Group PLC updates

We’ll send you a myFT Daily Digest email rounding up the latest Vistry Group PLC news every morning.

UK housebuilder Vistry Group said it would return £1bn to shareholders and shift focus to its partnership business, which works with the public sector and housing associations to build homes.

Vistry said on Monday that its housebuilding division would merge with its “high return, capital light, resilient” partnerships division, formed after last year’s purchase of rival Countryside Partnerships in a £1.25bn deal.

Chief executive Greg Fitzgerald said the company’s partnership business had enjoyed robust demand in the first half of the year, despite “challenging” economic conditions.

“The scale of the social need for affordable mixed tenure housing across the country continues to increase,” he added.

Housebuilders have scaled back construction over the past year after sales were badly hit by rising mortgage costs and margins were squeezed by a jump in building costs.

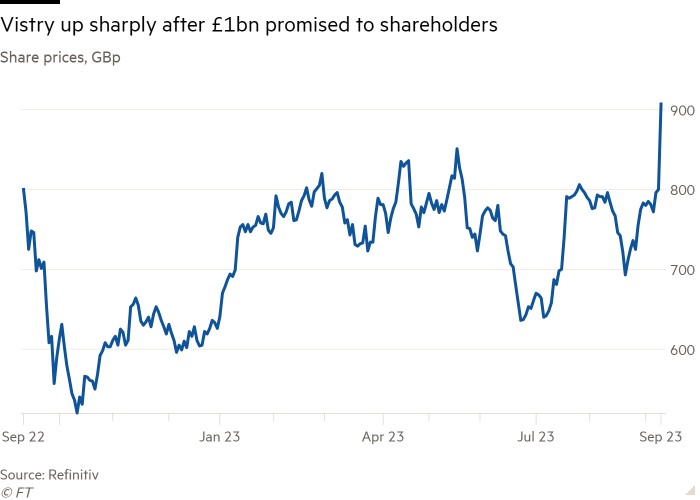

The shift in strategy “is expected to result in a significant release of capital” as assets from housebuilding are redeployed into partnerships, Vistry said. The prospect sent shares in Vistry up 13 per cent in late-afternoon trading.

The group’s partnerships division builds affordable homes in partnership with government bodies, local authorities and housing associations, using “mixed tenure” models such as shared ownership. This part of the business is less affected by volatility in the wider property market.

“The current weak market seems like an opportune time [for Vistry] to make this strategic move,” said Aynsley Lammin, an analyst at Investec, adding it would make the company “distinctively different” from other housebuilders.

House sales in the UK have slowed and are expected to fall to their lowest level since 2012 this year, according to property portal Zoopla as high mortgage rates and the end of a government support scheme for first-time buyers hit demand.

Lammin said affordable housing was more resilient than home sales in a downturn because it was less reliant on prospective buyers needing confidence in the market or having to find a mortgage deal.

“So long as the registered providers, local authorities and public rental sector have the funding there is a great need and demand for new housing from them.”

Revenues in Vistry’s partnerships division rose 7 per cent in the first half of 2023 to £954mn, while margins climbed to 11.5 per cent from 10.2 per cent. In housebuilding, revenues dropped 28 per cent to £824mn, with margins declining to 19.8 per cent from 22.4 per cent.

Partnerships had orders worth almost $3mn at the end of June, while housebuilding had orders of just under £1.3mn.