Introduction: UK house prices drop 4.6% in year to August

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

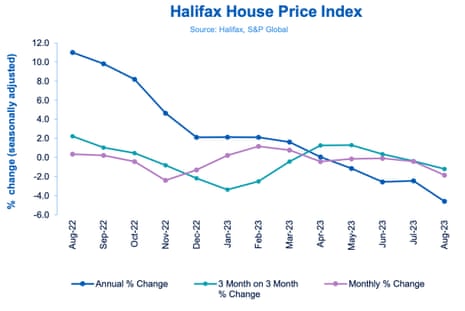

UK house prices have fallen at their fastest rate since the aftermath of the financial crisis, new data confirms this morning, as high interest rates cool the property sector.

Halifax, the UK’s largest lender, has reported that the average property price fell by 4.6% on an annual basis in August, down from the record highs seen last summer. That’s the largest year-on-year decrease in house prices since 2009.

The price of a typical UK home dropped to £279,569, down by around £14,000 over the last year, back to the level seen in early 2022. It leaves average prices around £40,000 above pre-pandemic levels.

That’s a bigger fall than expected, with economists having predicted a 3.45% annual fall.

On a monthly basis, the average house price fell by -1.9% in August, the largest monthly fall since November 2022.

Halifax reports that Southern England and Wales are seeing most downward pressure on property prices, with Scotland showing greater resilience.

Rival lender Nationwide reported last week that UK house prices fell 5.3% in August, the fastest annual drop in 14 years.

But there are signs that UK borrowing costs could be close to their peak. Yesterday, Bank of England governor Andrew Bailey said interest rates are probably “near the top of the cycle”, and predicted there willl be a further “marked” drop in inflation this year.

But for now, higher rates are cooling the markets.

Kim Kinnaird, director at Halifax Mortgages, says:

“It’s fair to say that house prices have proven more resilient than expected so far this year, despite higher interest rates weighing on buyer demand. However, there is always a lag-effect where rate increases are concerned, and we may now be seeing a greater impact from higher mortgage costs flowing through to house prices.

Increased volatility month-to-month is also to be expected when activity levels are lower, though overall the pace of decline remains in line with our outlook for the year as a whole.

Kinnaird adds that some prospective buyers deferred their transactions in the hope of some stability in the markets, and greater clarity on the future direction of rates in the coming months.

The market will continue to rebalance until it finds an equilibrium where buyers are comfortable with mortgage costs in a higher range than seen over the previous 15 years.

The agenda

-

7am BST: Halifax house price index for August

-

7am BST: German industrial production data for July

-

10am BST: Eurozone Q2 GDP (second estimate)

-

1.30pm BST: US initial jobless claims

Key events

Closing summary

Time for a recap….

British house prices have fallen at the fastest annual pace since 2009, mortgage lender Halifax said this morning.

With increases in interest rates cooling the market, prices fell by £14,000 over the past 12 months to £279,569, a drop of 4.6% – the biggest annual decline since 2009.

The average house price fell 1.9% in August alone, the biggest monthly fall since November 2022.

Halifax predicted that prices would continue to fall, with prices down sharpest in the South East of England in the last year.

The pound has continued to weaken today, as investors anticipate the Bank of England is close to ending its interest rate increases. Sterling dropped to $1.245, the lowest since June.

Growth in the eurozone was weaker than thought in the last quarter. Eurozone GDP rose by just 0.1% in April-June, down from a previous estimate of 0.3%, prompting fears of a recession later this year.

In other news….

Woking council has laid out a drastic package of cuts to local services after it in effect declared itself bankrupt earlier this summer, revealing a £1.2bn deficit racked up from a risky investment spree overseen by its former Tory administration.

The competition regulator is taking aim at the UK’s £2bn veterinary industry, amid fears that a surge in chain-owned surgeries may be leaving pet owners with dwindling choice and “eye-watering” bills.

British American Tobacco has reached an agreement to sell its Russian and Belarusian businesses to a group led by its Moscow management team

Workers should come into the office at least three days a week – and not just Tuesday to Thursday – to ensure clients are properly served throughout the week, according to the head of the world’s biggest insurance market.

And the Ryanair chief executive, Michael O’Leary, got a rude welcome in Brussels when he received two cream pies to the face while standing next to a cardboard cutout of the EU’s Ursula von der Leyen.

Recession fears after eurozone growth downgrade

This morning’s downgrade to eurozone growth in the last quarter, from 0.3% to just 0.1%, has raised fears that Europe could slide into recession later this year.

Capital Economics say:

The downward revision to the euro-zone’s second-quarter GDP data means the economy is now thought to have essentially flat-lined since the fourth quarter of last year.

With business surveys having turned down sharply in July and August, construction and industry struggling and the labour market easing, we suspect that the euro-zone will slip into recession in the second half of the year.

Rupert Jones

A new UK mortgage lender is launching home loans that allow people to fix their rate for up to 30 years. It may also let them borrow more money than standard deals.

Perenna claimed that by giving people certainty over what they pay for up to three decades, its deals would free borrowers from the interest rate turmoil that has caused many people to be hit with dramatically highermortgage costs this year.

The startup bank, which has just secured full approval from the UK’s main financial regulators, also said it was not ruling out offering one fixed rate for up to 40 or 50 years in future.

British American Tobacco says it will sell its last cigarette in Russia within a month, my colleague Rob Davies reports.

BAT has, finally, reached an agreement to sell its Russian and Belarusian businesses to a group led by its Moscow management team.

This will ending BAT’s presence in the world’s fourth-largest tobacco market a year and a half after it first pledged to do so in response to the invasion of Ukraine.

Woking to cut funding to sports pitches, arts, playgrounds and toilets to avert bankruptcy

Richard Partington

Woking council has laid out a drastic package of cuts to local services after its effective bankruptcy earlier this summer, my colleague Richard Partington reports.

The hefty cuts come after Woking revealed a £1.2bn deficit racked up from a risky investment spree overseen by its former Tory administration.

Plans include scrapping funding for all of the town’s sports pavilions and toilets, the closure of a swimming pool, cutting resources for parks, the arts, and ending council backing for some community centres, annual concerts, and its involvement in youth sporting events.

The troubled Surrey local authority also proposed scrapping millions of pounds in support for leisure centres, playgrounds and community schemes for young, old and vulnerable residents in an attempt to balance the books. It will launch a consultation on the proposals next month.

In a grim document setting out a wide-ranging austerity programme, it also revealed plans to remove funding for choir and dance classes for residents with Parkinson’s disease, as well as grants for a charity helping domestic abuse survivors, and a community transport scheme.

“It’s horrendous. I think residents were unaware really quite how bad it would be,” said John Bond, a former independent councillor in the authority.

Bond says:

“Who will want to come and live in Woking now? It’s going to affect everything, with the vulnerable suffering most.

“There is so much money owing, it’s going to go on for 10 or 20 years. The amounts are mind-boggling.”

Here’s the full story:

This morning’s data (see 9.38am) shown that companies anticipate slower price rises in the year ahead is “good news for the Bank of England,” says James Smith, developed markets economist at ING.

It provides further ammunition for the Bank of England doves, who are unhappy about further rate increases, Smith says. And could mean that the BoE only raises interest rates one more time in the current cycle, later this month.

Smith says:

The bottom line is that the Bank is likely to hike rates by 25 basis points again in two week’s time, but our base case is that this is the last hike in this tightening cycle. Governor Andrew Bailey’s indication that we’re near the top of the tightening cycle came wrapped with several caveats. But it fits into a broader communication exercise from the Bank that appears to be laying the ground for a pause.

Chief Economist Huw Pill’s reference to a “table mountain” profile for rates gave a further indication that the Bank is now more concerned about how long rates stay elevated rather than how high they peak. References to policy now being “restrictive” in the August policy statement pointed in this direction too.

A November hike is possible, but assuming we’re right about the direction of the dataflow and on the basis of recent BoE comments, we think a pause is still more likely at that meeting.

The Bank of England’s own survey of businesses is helping to make the case for one final rate hike in two weeks’ time, then a pause in November.https://t.co/EI0plO0x1q

— ING Economics (@ING_Economics) September 7, 2023

On Wall Street, shares in Apple have dropped by 3.5% at the start of trading, following reports that China has banned officials at central government agencies from using or bringing iPhones and other foreign-branded devices into the office.

That follows a 3.6% drop on Wednesday, when the Wall Street Journal reported that Chinese officials had been given the instructions by their superiors in workplace chat groups or meetings.

Reuters reported this morning that China has in recent weeks widened existing curbs on the use of iPhones by state employees, telling staff at some central government agencies to stop using their Apple mobiles at work.

Here’s Mike Scott, chief analyst at national estate agency Yopa, on this morning’s house price report from Halifax:

“The Halifax House Price Index for August shows a 1.9% monthly fall in the price of the average house, the largest fall that the Halifax has recorded since November last year. This has caused an abrupt jump in the annual rate of decrease, from 2.5% to 4.6%, which brings it closer to the figures reported by the Nationwide last week — earlier in the year, the Halifax was reporting significantly smaller annual falls than the Nationwide.

Mortgage interest rates now seem to have passed their peak, and Yopa expects that modest house price growth will resume next year, driven by wage increases, low unemployment and the shortage of housing. However, we do not expect a return to the kind of price increases that we saw between 2020 and 2022.”.

The sharp annual drop in UK house prices last month may make the Bank of England warier of raising interest rates higher, suggests Samer Hasn, market analyst at XS.com.

I believe that this sharp decline in house prices will give more warning signs about the risk of further interest rate hikes, which have already hurt the real estate market.

While we had seen a string of negative data on the UK economy, we are still seeing a contraction in manufacturing and service activities, albeit slower than expected, in light of the August PMI figures. This is despite the growth in construction activities with a stronger than expected construction PMI reading for August.

The money markets are currently indicating there is a 72% chance that the Bank raises interest rates later this month from 5.25% to 5.5%, down from around 85% earlier this week.

Smurfit Kappa in talks to merge and move listing to US

The City faces losing another blue chip company soon, after packaging firm Smurfit Kappa announced it is in advanced merger talks with US rival WestRock.

The two companies could combine to create a new global leader in sustainable packaging, called Smurfit WestRock, with over 100,000 employees.

It would be incorporated and domiciled in Ireland with global headquarters in Dublin, and North and South American operations headquartered in Atlanta, Georgia.

Smurfit Kappa is one of Ireland’s largest companies, and a member of London’s FTSE 100 index as well as being listed on Euronext Dublin. But those listings would be cancelled if a deal is agreed, with Smurfit WestRock’s ordinary shares listed on the New York Stock Exchange (NYSE) instead.

US jobless claims fall

Just in: Fewer Americans filed new claims for jobless support last week.

There were 216,000 fresh initial claims for unemployment benefits a drop of 13,000 on the previous week – and a low level in historic terms, despite the pressure from higher US interest rates.

It pulled the 4-week moving average down by 8,500, to 229,250.

JUST IN: United states Initial Jobless Claims 216K Expected: 234K Last: 229K

— Trader’s Dashboard (@Traderdashbored) September 7, 2023

U.S INITIAL JOBLESS CLAIMS ACTUAL: 216K BELOW EXPECTATIONS OF 234K (PREVIOUS 228K)

— Evan (@StockMKTNewz) September 7, 2023

Ryanair boss Michael O’Leary hit by pie to the face

The chief executive of Ryanair, Michael O’Leary, has had a cream pie pushed in his face outside the headquarters of the European Union today.

O’Leary was in Brussels to hold a press conference, where he was expected to complain about delays and cancellations to overflights over the summer due to French air control strikes.

Ireland’s Business Post reports that the pie was delivered by environmental activists in Brussels, adding:

Footage of the incident showed one of the women shouting: “Welcome en Belgium”, before adding: “Stop the pollution of the fucking planes.”

O’Leary, standing next to a cardboard cutout of Ursula von der Leyen, the president of the European Commission, quickly removed his jacket and sarcastically called “well done” to his retreating assailants.

According to French media, he then added: ”I have never had such a warm welcome. Unfortunately they were environmentalists and the cream was artificial. I invite passengers to come to Ireland where the cream is better.”

French word of the day: “entartré”. Ryanair boss Michael O’Leary gets greeted by climate activists in Brussels with a pie in the face. “Arrêtez la pollution avec vos putain d’avions.” https://t.co/Thz6KHRNHg

— Matthew Fraser 🇪🇺 (@frasermatthew) September 7, 2023

Germany’s industrial gloom has deepened today, after factories reported that production fell for the third consecutive month in July.

German factory output fell by 0.8% in July month-on-month, a larger fall than expected.

German industrial output fell again in July.

Production declined 0.8% from June, led by capital and consumer goods, according to the statistics office in Wiesbaden. The median prediction in a Bloomberg survey of economists was for a drop of 0.4%. The index for output showed the… pic.twitter.com/pCTu9TQBzH

— Tracy (𝒞𝒽𝒾 ) (@chigrl) September 7, 2023

Moody’s Analytics’ senior economist David Muir, fears the slump will pull Germany’s economy into a contraction this quarter.

“Germany’s industrial sector remains mired in contraction, driven by weak new demand from both home and abroad, lower backlogs of work, and destocking.

We expect the fall in manufacturing output will cause GDP to contract in the third quarter. And with new factory orders continuing to trend lower, it’s unlikely that the manufacturing sector will turn the corner by year-end.

But firms are holding onto staff, suggesting they seem the potential for a pickup further ahead, when lower inflation will allow real incomes to strengthen and the global economy should be on a firmer footing”.

Q&A: Why are house prices falling?

PA Media have published a handy Q&A about the state of the UK housing market:

What do the latest housing market figures show?

According to Halifax, year-on-year house price falls are now widespread across the UK. Across the UK as a whole, the average property value is around £14,000 less than it was a year earlier, according to the bank.

Halifax’s findings follow similar findings from Nationwide Building Society last week. Nationwide also said that, according to its index, house prices are on the sharpest annual decline it has seen in 14 years.

What is behind the price falls?

While there have recently been signs that some mortgage rates are settling down, rates are still significantly higher than they would have been a couple of years ago, making the cost of buying a home more expensive.

This means it has become more of a “buyers’ market”, with some sellers needing to adjust their expectations about the price they are likely to achieve.

Uncertainty about the wider economy may also be playing a part, with some buyers preferring to wait and see what happens.

What are the factors supporting house prices?

Supply shortages will help to keep house prices up in popular areas, while wage growth has also been strong, bolstering buyers’ incomes.

Is the picture the same across the UK?

According to Halifax, while house prices are broadly falling across the UK, they are holding up better in some places than others.

In Scotland, prices are down by 0.6% compared with a year ago, while in south-east England they have plunged by 5.0%. With house prices in southern England often being higher than elsewhere in the UK, these homeowners often have to find particularly big deposits and pay large cash amounts each month towards their mortgage. They may have been particularly affected by the sharp rise in mortgage rates.

Is my house now worth less than what I paid for it?

That will depend on when you bought it and what is happening in your local housing market.

It is also worth bearing in mind that, although house prices have been falling recently, Halifax says that the average UK house price remains around £40,000 – or 17% – above pre-pandemic levels.

Anyone with concerns about negative equity – when the amount they owe for their house is more than the property is worth – should speak to their lender.

Lenders are offering a range of support for those struggling with their mortgage payments, such as temporary switches to interest-only payments and extensions on mortgage terms.

Could the housing market see more property chains breaking?

According to website and news agency Newspage, some experts believe gazundering could be a growing threat.

Gazundering happens when someone reduces their offer, having previously agreed a higher price.

Lewis Shaw, founder of Mansfield-based Shaw Financial Services told Newspage: “At the eleventh hour, buyers are trying to pull a fast one and that’s crippling chains.”

David White, of Chelmsford-based mortgage broker Simply Lending, told Newspage that mortgage rate volatility is also hitting chains hard, adding: “Two primary causes of chains breaking are the down-valuing of properties and fluctuating mortgage rates.”

What about renters?

House prices may be falling but rents are still generally going up, according to recent reports.

The higher mortgage rates being paid by landlords will filter through to rental prices. There have also been signs that the supply of rental homes is being squeezed, which could perhaps be a sign of some landlords selling up due to the squeeze on any profits they are making.

What is next for the housing market?

Much of the hike in mortgage costs is still filtering through to households, as many people are on fixed-rate deals and are yet to re-mortgage on higher rates. Halifax suggests this lag could be a reason why house prices have been more resilient so far this year than expected.

Going forward, we may now be seeing a greater impact from higher mortgage costs flowing through to house prices, the bank suggests.

Further downward pressure on house prices is expected, going into next year, as people continue to adjust to higher mortgage rates.