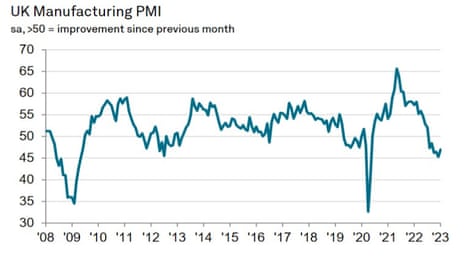

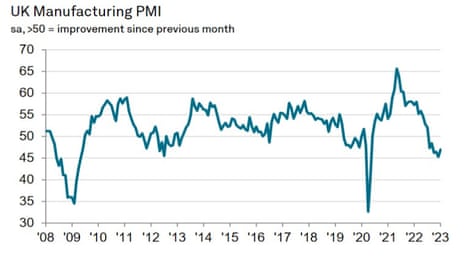

UK manufacturing contracts for sixth month in a row

The British manufacturing sector contracted in January for the sixth month in a row as it was hit by inflation, shortages and weak demand, according to the closely followed purchasing managers’ index (PMI).

The index reading for January was 47 points, below the 50 mark that signifies an expansion in output, according to survey compilers S&P Global.

That was higher than the December reading, which was the worst in 31 months. (If we were to exclude the pandemic, when factories big and small felt forced to shut, then it was a level not seen since 2009 in the financial crisis.)

Key events

Closing summary

The British manufacturing sector contracted in January for the sixth month in a row as it was hit by inflation, shortages and weak demand, according to the closely followed purchasing managers’ index (PMI). Even worse was the decline in the US manufacturing sector at the start of 2023, although the rate of decline slowed.

Meanwhile, the eurozone’s manufacturing downturn eased further in January and cost pressures faded, according to the PMI. Inflation in the euro area slowed to 8.5% in January, down from 9.2% in December, according to a flash estimate from Eurostat, the EU’s statistical office.

House prices in the UK continued to fall in January, sliding for the fifth month in a row, according to Nationwide, pushing the average cost of a home 3.2% below the peak seen last August.

Our other main stories today:

Thank you for reading. We’ll be back tomorrow. Take care – JK

US manufacturing decline continues in January – PMI

The US manufacturing sector continued to decline at the start of 2023, according to the latest PMI from S&P Global, although the rate of decline slowed.

The downturn in January was driven by a sharp contraction in new orders, a further drop in output and ongoing efforts to reduce inventories, with subdued sales from domestic and export markets.

Factory input costs and output charges rose at increased rates as price pressures strengthened again. Even so, business confidence ticked higher amid hopes of stronger demand in the months ahead, greater supply chain stability and investment in new products.

The S&P Global US Manufacturing Purchasing Managers’ Index posted 46.9 in January, up slightly from 46.2 in December and broadly in line with the earlier released ‘flash’ estimate of 46.8.

NatWest CEO Alison Rose under pressure from Treasury committee

Kalyeena Makortoff

NatWest CEO Alison Rose has come under pressure after refusing to appear in front of the Treasury Committee next week, where MPs hope to grill the largest banks over whether they are fairly passing on interest rate increases to savers (while simultaneously jacking up the cost of mortgages and loans).

Both the UK CEOs of Barclays and HSBC are set to attend, as is Lloyds Banking Group CEO Charlie Nunn. However, it’s understood NatWest has claimed a scheduling conflict and is instead offering to send the head of its retail bank, David Lindberg.

The refusal to send its top boss has raised eyebrows among MPs on the Treasury Committee, including chair Harriett Baldwin MP. She originally raised the issue during a hearing on Monday regarding diversity and representation in venture capital, saying it would leave the panel with an all-male cast. Baldwin said in a statement on Tuesday: “I am very keen that all the major banks’ top executives appear before our committee.”

NatWest declined to comment.

Darktrace boss hits back at short seller

Mark Sweney

The chief executive of Darktrace has launched a staunch defence of the embattled cybersecurity company saying it is run with the “greatest integrity”, refuting the allegations of irregular sales, marketing and accounting practices raised by a US-based hedge fund.

Poppy Gustafsson published a 1,200 word defence of the company she co-founded in 2013 aged 30, after its share price collapsed to a record low following the publication of a highly-critical 70-page report by the New York-based hedge fund Quintessential Capital Management (QCM) on Tuesday.

“We embrace the scrutiny of the public markets,” she said. “However, it is also important to refute any unfounded inferences about the listed business we are today and push back in the strongest terms on any suggestions that this is a business that is not being run with the greatest integrity.”

Gustafsson said that the purpose of publishing the lengthy statement was to “explain what we’ve done to establish and enforce robust processes in our business”.

“I stand by my team and the business I represent,” she added. “Our technology is world-class, created here in the UK by some of the brightest minds. We will continue to address any legitimate questions that may arise.”

Darktrace today launched a £75m share buyback of 35m shares in an attempt to bolster investor confidence.

Darktrace’s share price has fallen more than a fifth since it was disclosed on Monday that QCM had taken short positions betting against its future performance.

US stocks on Wall Street are expected to open lower ahead of the Fed decision (at 7pm GMT), while European shares are trading slightly higher.

The Fed is widely expected to raise interest rates by 25 basis points to 4.75%, following a series of bigger rate hikes last year to bring decades-high inflation down.

Markets have pencilled in a further 25bps rate hike in March. Investors will scrutinise Fed chair Jerome Powell’s press conference for any clues on the trajectory of interest rates.

The Bank of Canada recently signalled that it would pause after eight rate rises, triggering expectations that the Fed could soon follow suit, and possibly even cut rates towards the end of the year. Recent data suggests that inflation is easing.

Paul Ashworth, chief North America economist at Capital Economics, said:

The muted 106,000 increase in the ADP measure of private payroll employment will add to fears that the malaise in activity has spread to the labour market. Nevertheless, while this supports our estimate that non-farm payrolls increased by a below-consensus 150,000 last month, we would still urge caution about relying too much on the ADP measure, particularly in January when firms purge payroll records of employees who may not have worked for months…

On balance, we are sceptical this slowdown is primarily a temporary weather-related issue. Added to the weakness in activity, and the downturn in some forward-looking employment indicators like temporary employment and hours worked, it suggests that the easing in labour market conditions is gathering momentum.

US private job growth slows in January

Over in the US, the latest ADP jobs report showed private companies hired just 106,000 new workers in January, far fewer than expected, and down from an upwardly revised 253,000 in December.

Most of the hirings were in the hospitality industry, where bars, restaurants, hotels and others added 95,000 jobs.

ADP chief economist Nela Richardson said weather factors were at play and hiring was strong outside the week the firm uses to compile the report, CNBC reported.

In January, we saw the impact of weather-related disruptions on employment during our reference week.

Hiring was stronger during other weeks of the month, in line with the strength we saw late last year.

⚠️BREAKING:

*U.S. JANUARY ADP NONFARM PAYROLLS RISE BY 106,000; EST. 178,000; PREV. 235,000

*LOWEST SINCE JANUARY 2022

🇺🇸🇺🇸 pic.twitter.com/lDHR8iva6e

— Investing.com (@Investingcom) February 1, 2023

Andy Bruce from Reuters tweeted:

Bank of America reports 🇬🇧 consumer confidence rose in its latest survey – but still consistent with a mild recession.

👍 Pay growth on the rise (BoE:👎)

👍 Yet another survey showing inflation expectations receding pic.twitter.com/aehCCp1cPB— Andy Bruce (@BruceReuters) February 1, 2023

Back to our earlier story about the UK’s annual house price growth slowing to just 1.1%, the lowest rate since mid-2020.

Joanna Partridge

Entain, the owner of gambling brands Ladbrokes and Coral has raised its annual profit forecast after it benefited from customers betting on the men’s football World Cup.

The FTSE 100 company said it had seen a record number of customers in the final three months of 2022, an increase of 14% compared with a year earlier.

Despite the boost from the tournament, which took place in Qatar in November and December, Entain said this was slightly offset by disruption to some sports fixtures because of wintry weather.

Its shares gained 2% in morning trading on Wednesday.

You can read the full story here:

British Steel drawing up plan for 800 job cuts – Sky News

British Steel, the Chinese-owned company which runs two blast furnaces in Scunthorpe, is reportedly drawing up plans to cut 800 jobs, even as it discusses UK government support to upgrade the site.

Sky News reported that the cuts would arise from the closure of coke ovens, but that Scunthorpe’s two blast furnaces would continue to operate, citing an industry insider.

British Steel and Indian-owned rival Tata Steel have been in talks with the government over £300m in funding per company that would help them upgrade polluting blast furnaces to cleaner electric arc furnaces. However, the business secretary, Grant Shapps, has told the companies that they must guarantee a certain number of UK jobs until 2033 as part of any agreement.

The revelation of a job cut plan could also increase pressure on the government during the negotiations.

British Steel was bought out of insolvency by Jingye Group in 2019, after it had collapsed following a takeover by investment firm Greybull Capital. Jingye and Tata are both pushing for government support for the UK plants to match those of other nations such as France and Canada.

British Steel was contacted for comment.

One of the most fascinating corporate battles of 2023 so far has been the short seller Hindenburg against billionaire Gautam Adani. Shares in several of Adani’s listed companies comtinued to fall on Wednesday, a week after the first negative report.

Hindenburg accused Adani Group of “pulling the largest con in corporate history” – accusations that Adani has described as a “malicious combination of selective misinformation and stale, baseless and discredited allegations”.

Nevertheless, the report has prompted scrutiny of the group, and a stampede of money out of some of India’s most prominent companies. Reuters on Wednesday put the drop in Adani company valuations at $84bn (£68bn), citing data from Forbes.

Those losses are notable because it means that Adani’s wealth has dropped below that of Indian rival Mukesh Ambani, whose Reliance Industries is another conglomerate that dominates the commanding heights of the economy of the world’s largest democracy.

Adani slipped to 15th on the rich list, although with an estimated net worth of $76.8bn he will probably be able to get by. But that is below Ambani who ranks ninth with a net worth of $83.6bn, according to Reuters.

The power of the two tycoons in the Indian economy is enormous. The Economist in September wrote:

The duo’s rising influence over Indian business is undisputed. Many observers now talk of the “AA economy”. That is an exaggeration, but the combined revenues of the companies controlled by Messrs Adani and Ambani are equivalent to 4% of India’s GDP.

Reuters reported:

Shares in Adani Enterprises, often described as the incubator of Adani businesses, plunged 30% on Wednesday. Adani Power fell 5%, while Adani Total Gas slumped 10%, down by its daily price limit.

Adani Transmission was down 6% and Adani Ports and Special Economic Zone dropped 20%.

Eurozone inflation drops further to 8.5%

Euro area annual inflation fell to 8.5% in January 2023, down from 9.2% in December, according to a flash estimate from Eurostat, the EU’s statistical office.

Economists and traders around the world are watching for signs that the wave of inflation that is threatening to tip major economies into recession is easing. Lower inflation could mean less need to raise interest rates sharply, which could in turn allow economies to grow more.

Eurozone inflation reached 10.6% in October, so the headline measure has dropped by two percentage points since then.

Much of the inflationary pressure has come from energy prices, which surged following Russia’s full-scale invasion of Ukraine a year ago this month. But Eurostat’s early figures show how the pressure is easing – even if it is still quite high.

Energy is expected to have the highest annual rate in January (17.2%, compared with 25.5% in December), followed by food, alcohol & tobacco (14.1%, compared with 13.8% in December), non-energy industrial goods (6.9%, compared with 6.4% in December) and services (4.2%, compared with 4.4% in December).

An important side note: core inflation – excluding volatile bits of the index such as energy and food – was still at a record high of 5.2%. Still, any signs that the pressures on the economy have eased will likely be welcomed by economists.

Bestway increases stake in Sainsbury’s

Bestway has increased its stake in supermarket Sainsbury’s to 4.47%, as analysts had expected following the surprise announcement of its £200m stake last week.

The company is one of the UK’s largest grocery wholesalers and also the owner of Well Pharmacy stores and the Costcutter and Best-one convenience chains. It paid roughly £200m for a 3.45% stake in Sainsbury’s, making it the sixth largest investor in Britain’s second largest grocer.

The Guardian’s back-of-an-envelope calculations suggest the latest purchase would be worth another £60m. Shares in Sainsbury’s rose sharply on Friday in anticipation of further purchases – although the filing on Wednesday said that it bought the latest tranche on Friday.

4.5% is an interesting level: another 0.5% to 5% and Bestway would have the ability to force a company to put resolutions to a shareholder vote at an AGM or specially convened shareholder meeting. It has not made any signals that it intends to become an activist, but it is close to being able to exert significant influence (or it could team up with smaller shareholders to do so).

From Reuters:

Some analysts have speculated that Bestway wants to use the stake as leverage to get Sainsbury’s to collaborate in wholesale areas or pharmacy retail.

Privately owned Bestway traces its origins back to a corner shop called Kashmir opened in the capital in 1963 by its founder and chair, Sir Anwar Pervez.

It is a pretty amazing story, from an Earl’s Court corner shop to becoming a shareholder in one of the UK’s biggest and most prominent companies.

You can read more here:

It’s a fairly quiet day on financial markets so far. That is probably a result of investors having got into position ahead of the Federal Reserve chair Jerome Powell’s comments later.

The FTSE 100 is up by 0.1% at 7,778 points. Europe’s blue-chip Stoxx 600 index has gained 0.2%, while Germany’s Dax is up 0.1% and France’s Cac 40 is up less than 0.1%.

On the FTSE, it’s the packaging companies leading the way, while Ladbrokes owner Entain is also doing fairly well after raising its profit forecasts after the football World Cup pushed up gamblers’ losses.

It might be slightly too early to celebrate a turning point for UK manufacturers.

Glynn Bellamy, UK head of industrial products at KPMG, an accountancy firm, said:

It will be some months yet until manufacturers feel that the UK economy has turned the corner, but the first small signs that inflation may have peaked increased optimism slightly in January about cost pressures lowering soon and continuing to fall as the year goes on.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, said:

January’s S&P survey brings some hope that the downturn in the manufacturing sector is slowing down.

He said expectations of future orders might reflect “hope that lower energy prices will both reduce costs and trigger a strengthening in underlying consumer demand later this year.”

The total orders, export orders and output balances, however, all remained weaker in the UK than in the eurozone, suggesting that Brexit damage is continuing to build slowly, as contracts come up for renewal.

Maddie Walker, a managing director at Accenture, another consultancy, said:

It’s a mixed landscape for manufacturers right now. There are signs from across the economy that inflation is easing. However, the impact continues to be felt as energy costs and pricing remain well above the average that businesses have gotten used to.

Certain industries, such as car production, also continue to be hampered by semiconductor shortages and factory closures.

Six months of contraction effectively means that UK manufacturing is in recession. But is the worst over?

Almost 57% of manufacturers reported that output would be higher one year from now, and average input costs rose at the slowest rate for 27 months. So the squeeze may ease.

But the indicators of what is happening now suggest it is tough going. Companies are getting less new work, and they are struggling to get hold of raw materials and staff.

New work has, in fact, fallen for eight consecutive months, with fewer orders from the US, Europe and Asia – “especially China”.

“Ongoing port and Brexit issues also had an impact,” S&P Global said.

Rob Dobson, director at S&P Global Market Intelligence, said:

UK manufacturers faced a tough operating environment at the start of 2023, leading to reducing intakes of new business, declining production volumes and lower staffing levels. Weak demand at home and overseas, supply chain constraints, strikes and the continuing impact of high inflation all stymied the performance of manufacturers. Weak economic growth in the US, EMEA and across Asia is also dragging down new export wins, exacerbating the strain already caused by port delays and lingering Brexit complications.

There were some shoots of positivity developing, however. Rates of contraction are generally lower than before the turn of the year, a possible sign that we may be past the worst of the downturn in industry. Cost inflation also eased further, while supply chain delays were the least pronounced for three years. Manufacturers’ confidence is also reviving from recent lows, hitting a nine-month high, though the mood continued to be darkened by concerns about inflation and the possibility of recession.

UK manufacturing contracts for sixth month in a row

The British manufacturing sector contracted in January for the sixth month in a row as it was hit by inflation, shortages and weak demand, according to the closely followed purchasing managers’ index (PMI).

The index reading for January was 47 points, below the 50 mark that signifies an expansion in output, according to survey compilers S&P Global.

That was higher than the December reading, which was the worst in 31 months. (If we were to exclude the pandemic, when factories big and small felt forced to shut, then it was a level not seen since 2009 in the financial crisis.)