UK INFLATION HITS 17-MONTH LOW

Newsflash: The UK’s inflation rate has fallen to its lowest level since spring 2022, the start of the Ukraine war.

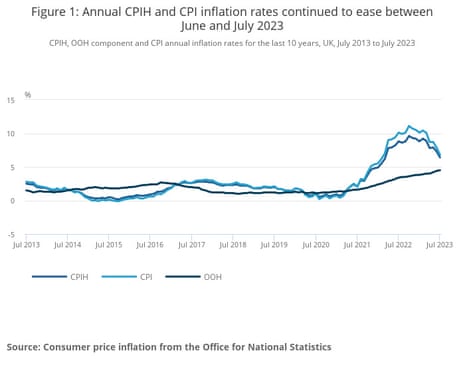

The Consumer Prices Index rose by 6.8% in the year to July, the Office for National Statistics reports, down from 7.9% in June, meeting City economists’ expectations.

That’s the lowest inflation rate since February 2022, and further from the peak of 11.1% set last October.

But it still leaves inflation well over the Bank of England’s target of 2%.

More to follow…

Key events

UK inflation will continue to decline from here as lower energy and goods prices continue to feed through, predicts Thomas Pugh, economist at audit, tax and consulting firm RSM UK.

Pugh explains:

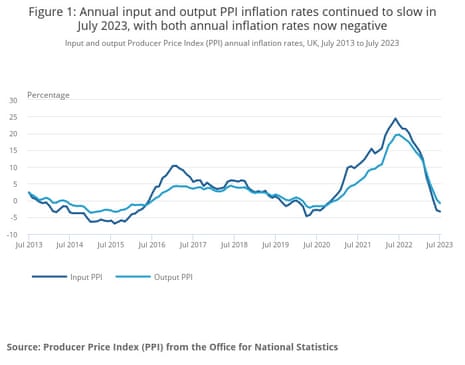

Output prices at factories fell by 4.8% in July – a good sign for future goods price inflation. What’s more, growing slack in the labour market as labour supply improves and demand for labour ease a little should reduce wage growth over the next year, limiting the risk of a wage-price spiral.

Pugh adds that the Bank of England is likely to raise interest rates again next month, but the peak in borrowing costs could be close:

Overall, inflation, especially core and services, is still too high for the MPC to tolerate, which, combined with fast wage growth, means another rate hike is September is a sure bet.

But cooling inflationary pressures means this can be another 25bps hike and that the peak in interest rates is not far off.

Petrol and diesel prices also pulled inflation down in July.

The ONS reports that motor fuel prices fell by 24.9% in the year to July 2023, compared with a fall of 22.7% in June.

Petrol cost an average of 143.2p per litre in July, down from 189.5p a year ago – when the surge in crude oil prices after the Ukraine invasion pushed up prices at the pumps.

Diesel dropped to 145.2p per litre, on average, down from 197.9p per litre in July 2022.

But on a monthly basis, petrol prices rose by 0.2p per litre between June and July, while diesel prices dropped by 0.5p in the month.

Rail fare increase is a “delicate difficult decision”

Today’s inflation report means that national rail fares will rise by less than 9% next year, but it’s not clear yet quite how much extra passengers will pay.

July’s retail prices index measure of inflation, or RPI, rose by 9.0% in the last year, the ONS reported this morning.

Although RPI is a discredited measure, it is used to price many price increases – and traditionally, rail fare increases have been based on the July RPI reading.

However, the government said yesterday that any rail fare increase will be below RPI, matching their policy a year ago (when fares rose in line with wages).

This morning, Treasury minister John Glen told Sky News that the increase for 2024 hasn’t been decided yet.

Glen said:

“We have said that we will keep it below inflation. Obviously I will be working closely with Mark Harper, the Secretary of State, on what mechanism to use.

But there are tough decisions now around how to use his budget in a way that suits commuters and suits the economy as a whole, delicate difficult decisions. We have not come to the end of that discussion yet.”

The Green Party has urged ministers to freeze rail prices.

Their co-leader, Adrian Ramsay, said yesterday:

“This government is moving in completely the wrong direction. Fuel duty has been frozen since 2011, while air passenger duty cuts this year will be a disaster for the climate crisis by encouraging people to fly more.

“This is despite the fact UK rail passengers are already paying more to travel by train [2] than flying and are faced with some of the most expensive tickets in Europe.

John Glen: Inflation is too high

John Glen, chief secretary to the Treasury, has agreed that UK inflation is still ‘too high’.

Speaking to Radio 4’s Today programme, Glen says:

I recognise that whilst this is great progress today, inflation is too high.

Getting inflation down, and halving it this year, is the government’s top priority, Glen says, insisting:

We’re on track to do that.

Q: Inflation has come down because global oil and food prices have fallen. What in the government’s plan has contributed to inflation coming down today?

Glen argues that the government’s fiscal responsibility has helped….

Well, I certainly think if if I was deciding as Chief Secretary, with the Chancellor and Prime Minister, to borrow a lot more money or to spend a lot more money, it would have an effect.

Q: That’s something you haven’t done…what have you actually done that has contributed to the fall in inflation?

Glen argues that keeping a grip on the financial purse strings is an active choice, when there are pressures to spend more.

As he puts it:

I can tell you, to hold to the budgets that we set out in the spending review in an inflationary environment when there are massive calls to spend money all the time is an active choice.

Glen claims the opposition are “going to spend a lot more, and borrow a lot more”.

Inflation down but recession risk now high, IPPR warns

Although inflation has fallen, the UK now faces a “high” risk of recession, warns the IPPR thinktank.

The IPPR fears that the recent increases in UK interest rates, to a 15-year high of 5.25%, will drag the economy into a contraction.

Dr George Dibb, head of IPPR’s Centre for Economic Justice, said:

“It’s good news that headline inflation is lower, especially with energy bills coming down, but there is a very real risk that a recession may soon overtake price rises as the main economic concern.

Other countries have brought inflation under control quicker than in the UK, with more support for households and workers avoiding unnecessary pain.

The financial markets are expecting another increase in UK interest rates, in September, to at least 5.5%, with rates forecast to hit 6% by early next year.

But, as Dibb points out, monetary policy operates with a lag – so another hike could simply “kill” the recovery:

“Interest rate hikes take up to a year and a half to fully filter through to the economy. One year from now, ‘pass the parcel inflation’ might be over, but further interest rates might also have killed the recovery – there are already signs of falling consumer confidence and rising unemployment.

“Even today it’s important to note that while inflation might be falling, prices are not. Households are still struggling with high prices, especially those on the lowest incomes. By supporting households and businesses with energy costs, making businesses play their part, and supporting renters, countries like Spain have shown that inflation can be brought down without the economy going into tailspin.”

Rachel Reeves correctly flagged earlier that inflation, at 6.8%, is still higher in the UK than in many other major economies.

For example, in the US, inflation was just 3.2% in July, slightly up from 3% in June.

In the eurozone, annual inflation was 5.3% in July, with inflation estimated at 6.5% in Germany, and 5% in France.

Japan’s inflation rate was 3.3% in June, with July’s figures due on Friday.

While China has slipped into deflationary territory, with its consumer price index down by 0.3% year-on-year in July.

Core inflation stubbornly high

Worryingly, core inflation was a little higher than hoped last month.

Core CPI inflation, which strips out energy, food, alcohol and tobacco, rose by 6.9% in the 12 months to July 2023.

That’s slightly higher than the 6.8% which economists expected.

Although annual goods inflation slowed, from 8.5% to 6.1%, services inflation increased to 7.4% to 7.2%.

Oliver Blackbourn, multi asset portfolio manager at Janus Henderson Investors, warns that core inflation “remains stubbornly high” at 6.9% and is now slightly above the headline level.

Blackbourn adds:

This presents a headache for the Bank of England (BoE) as it will want to see this less volatile measure decline to suggest that cost pressures are sustainably returning to target.

“Core inflation suggests a stickier underlying inflation dynamic as services cost growth continued to accelerate.

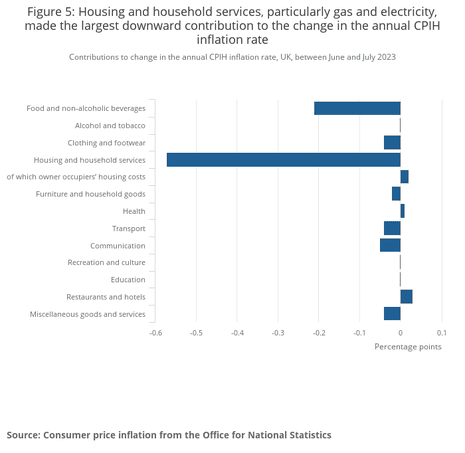

Data: Why UK inflation slowed

Inflation is measured using a wide basket of goods, to track how the cost of living changed.

Here’s the key changes, that pulled annual inflation down to 6.8% in the year to July.

-

Food and non-alcoholic beverages: 14.8%, down from 17.3% in June

-

Alcoholic beverages and tobacco: 9.4%, up from 9.2% in June

-

Clothing and footwear: 6.6%, down from 7.2% in June

-

Housing, water, electricity, gas and other fuels: 6.8%, down from 12.0% in June

-

Furniture, household equipment and maintenance: 6.2%, down from 6.5% in June

-

Health: 8.9%, up from 8.2% in June

-

Transport: -2.0%, down from -1.8% in June

-

Communication: 7.1%, down from 9.5% in June

-

Recreation and culture: 6.5%, down from 6.7% in June

-

Education: 3.2%, matching June’s 3.2%

-

Restaurants and hotels: 9.6%, up from 9.5% in June

-

Miscellaneous goods and services: 6.0%, down from 6.5% in June

Inflation: the political reaction

Political reaction to this morning’s inflation report is flooding in.

Chancellor of the Exchequer Jeremy Hunt claims the government’s ‘decisive action’ has pulled inflation down, saying:

“The decisive action we’ve taken to tackle inflation is working, and the rate now stands at its lowest level since February last year.

“But while price rises are slowing, we’re not at the finish line.

“We must stick to our plan to halve inflation this year and get it back to the 2% target as soon as possible.”

But shadow chancellor Rachel Reeves points out that inflation is still high, and also “higher than many other major economies”.

Reeves adds:

“After 13 years of economic chaos and incompetence under the Conservatives, working people are worse off – with higher energy bills and prices in the shops.

“Labour’s plan to build a strong economy will make working people better off by boosting growth, improving living standards and cutting household bills.”

Food and drink inflation falls, but still high

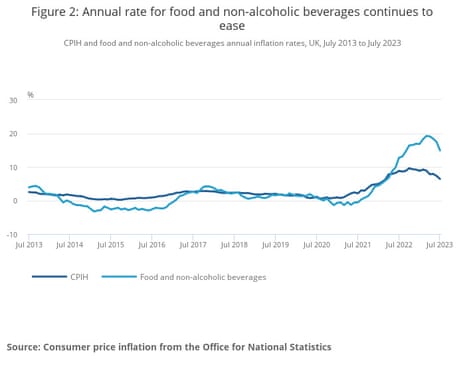

Food inflation slowed last month, but prices are still sharply higher than a year ago.

Food and non-alcoholic beverage prices rose by 0.1% between June and July 2023, compared with a rise of 2.3% between the same two months a year ago.

That pulled the annual rate of inflation for food and non-alcoholic beverages to 14.8% in July, down from 17.3% in the year to June.

The easing in the annual rate was widespread, with inflation falling in 10 of the 11 areas of food and drink products, the ONS says.

Three of the ten classes also saw a fall in monthly price between June and July 2023, including milk, cheese and eggs – reflecting recent milk price cuts by supermarkets.

The second-largest downward contribution came from the bread and cereals category, where annual inflation slowed to 9.8% from 11.4% in June.

Matthew Corder, ONS deputy director of prices, says inflation “slowed markedly” in July, for the second month running:

“Inflation slowed markedly for the second consecutive month, driven by falls in the price of gas and electricity as the reduction in the energy price cap came into effect.

“Although remaining high, food price inflation has also eased again, particularly for milk, bread and cereal.

“Core inflation was unchanged in July, with the falling cost of goods offset by higher service prices.”

Falling energy prices pull down inflation

Falling gas and electricity prices provided the largest downward contributions to UK inflation in July.

That’s because the UK’s energy price cap was lowered at the start of July, to £2,074 a year for a typical household, below the government’s energy price guarantee of £2,500 per year.

The ONS says:

Prices of gas fell by 25.2% between June and July this year, but rose by 0.1% between the same two months a year ago.

Prices of electricity fell by 8.6% between June and July this year but rose by 0.4% between the same two months a year ago.

On a monthly basis, consumer prices fell by 0.4% in July alone.

Annual inflation slowed again in July 2023.

▪️ Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 6.4% in the 12 months to July 2023, down from 7.3% in June

▪️ Consumer Prices Index (CPI) rose by 6.8%, down from 7.9% in June➡️ https://t.co/wLiGaS7wZC pic.twitter.com/XnTmQZwiFq

— Office for National Statistics (ONS) (@ONS) August 16, 2023

UK INFLATION HITS 17-MONTH LOW

Newsflash: The UK’s inflation rate has fallen to its lowest level since spring 2022, the start of the Ukraine war.

The Consumer Prices Index rose by 6.8% in the year to July, the Office for National Statistics reports, down from 7.9% in June, meeting City economists’ expectations.

That’s the lowest inflation rate since February 2022, and further from the peak of 11.1% set last October.

But it still leaves inflation well over the Bank of England’s target of 2%.

More to follow…

Today’s inflation report will be watched just as closely in Westminster as in the City of London.

Yesterday, Rishi Sunak – who has pledged to halve inflation by the end of this year – insisted that conditions are improving:

“We are making progress, the last set of numbers we had showed that inflation was falling faster than people expected.

“The plan is working. I think there is light at the end of the tunnel.

“If we get through this, people will really start to see the benefit in their bank accounts, in their pockets, as inflation starts to fall.”

But Labour got their prebuttal in early, pointing out that households have suffered badly in the cost of living squeeze.

The opposition accused Sunak of overseeing a £350 increase in monthly bills for the average household since 2021/22.

Shadow economic secretary Tulip Siddiq said:

“Families in Britain are worse off because of 13 years of economic chaos and incompetence under the Conservatives.

“We’ve had a decade of low growth, low pay and high taxes. Now families are paying the price of the Conservatives’ cost-of-living crisis with higher bills and prices in the shops.

“If Labour were in power today, we would introduce a proper windfall tax on the huge profits the oil and gas giants are making to help families with the cost of living.

“Labour’s plan to build a strong economy will boost growth, increase wages and bring down bills so working people are better off.”

Introduction: UK inflation report in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK may get some respite in the cost of living squeeze today, but inflationary pressures are not over.

The latest inflation report, due at 7am, is expected to show that prices rose at a slower rate in July, partly because households benefited from the drop in the energy price cap last month,

Economists predict the annual rate of inflation slowed in July, to around 6.8%, down from June’s 7.9%. That would be the lowest rate of price rises since spring 2022.

Yesterday we learned that basic pay is rising at the fastest rate in at least two decades, with regular wages rising by 7.8% in the April-June quarter. So today could bring a welcome return of rising real wages.

That would be a relief for workers, but could also encourage the Bank of England to raise interest rates.

And it’s important to remember that falling inflation does not mean prices are falling – simply that they are rising less sharply, compared to a year ago.

Henk Potts, market strategist at Barclays Private Bank, sets the scene…

“We expect the UK July inflation print to show a further moderation in price pressures. We anticipate headline consumer price index (CPI) to ease to 6.7% year on year, compared to the 7.9% increase registered in June. In our view the deceleration should primarily be driven by an easing of energy prices and reflect the decrease in the Ofgem price cap.

“We would also expect food, alcohol and tobacco price rises to continue to slow due to lower producer prices. We expect less progress to be made in services, where pricing is strong and wage growth continues to be robust.

“Despite the improvement in price pressures, the Bank of England is not yet in a position to declare a cessation of hostilities with its battle with inflation. We estimate that UK inflation will remain above the 2% target through 2024 and therefore expect a further quarter-point rate increase at the Monetary Policy Committee’s September meeting.”

The agenda

-

7am BST: UK inflation report for July

-

9.30am BST: UK house prices and rents data

-

10am BST: Eurozone GDP report for Q2 2023

-

11am BST: Ireland’s residential property prices data

-

1.30pm BST: US housing starts data

-

7pm BST: US Federal Reserve releases minutes of its last meeting