UK construction output falls again as housebuilding shrinks

Newsflash: UK construction output declined at a sharp pace again last month.

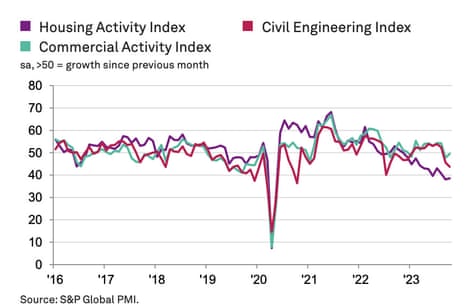

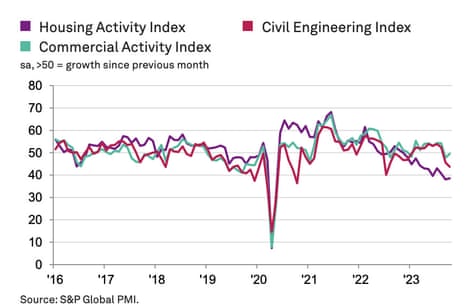

The latest poll of purchasing managers at UK construction firms has found that business activity falling for the second month running in October, amid a lack of new work to replace completed projects.

Housebuilding fell particularly sharply, as the sector was hit by falling buyer demand and higher costs.

Building firms blamed fragile client confidence and elevated borrowing costs, due to the surge in interest rates over the last two years.

The S&P Global / CIPS UK construction PMI has come in at 45.6 for October, up from September’s 45.0.

That’s the second-lowest reading since May 2020 and shows a marked decline in total construction activity (any reading below 50 shows a contraction).

The survey says:

House building decreased for the eleventh successive month in October and at a much steeper pace than elsewhere in the construction sector (index at 38.5).

Falling work on residential construction projects was widely linked to a lack of demand and subsequent cutbacks to new projects. Civil engineering activity also decreased sharply in October (index at 43.7) and the rate of decline was the fastest since July 2022.

Key events

Downing Street says it remains “committed” to supporting the steel industry, as we await news from Scunthorpe.

The Prime Minister’s official spokesman told reporters today:

“We are continuing to work closely with industry including British Steel to secure a sustainable, competitive future for the sector and its workers and we’ve offered a generous support package including £300m of investment for British Steel to cut emissions, safeguard jobs and unlock over £1bn in stakeholder investment.

“Now, ultimately, it is for British Steel themselves to manage commercial decisions for their company’s future.

“Obviously, I can’t specifically comment on their discussions but we will remain committed to supporting the sector.”

Mark Sweney

Sir William Lewis, the former editor of the Telegraph who had been linked to a potential bid for the influential right-leaning British newspaper, has been appointed as the publisher and chief executive of the Washington Post.

Lewis has held a string of high-profile positions including Rupert Murdoch’s News UK, Wall Street Journal and Dow Jones, and three years ago was included on a shortlist in the hunt for a new director general of the BBC.

The 54-year old, who recently co-founded the News Movement, which targets the younger social media generation that rely on platforms including YouTube, Facebook and Tik Tok, plans to halt plans to put together a bid in the £750m auction of the Telegraph.

Lewis will take up the role at the Washington Post, which was acquired by Amazon founder Jeff Bezos for $250m in 2013, on 2 January taking over from interim chief executive Patty Stonesifer.

Earlier this year, Fred Ryan, the chief executive and publisher of the Washington Post, left after almost a decade.

“Ten years ago, I made a commitment to the future of The Washington Post, inspired by its ambitious and consequential journalism,” said Bezos, adding:

“Today, I stand confident in that future knowing it is in the hands of Will, an exceptional, tenacious industry executive whose background in fierce, award-winning journalism makes him the right leader at the right time.”

Last month, the Washington Post announced plans to make 240 voluntary redundancies, about 10% of its workforce, because its “subscription, traffic and advertising projections” in recent years had been “overly optimistic”.

TUC general secretary Paul Nowak says:

“British Steel must halt these plans and get around the table with unions.

“Closing down the blast furnaces at the Scunthorpe plant would have a devastating impact on staff and the local community.

“Workers won’t stand back and watch as Britain’s steel industry is dismantled in real time.

“The Conservatives are presenting a false choice. Other countries have shown that it is possible to transition to zero-carbon steel making and protect good steel-making jobs for the future.

“We can do the same here. The UK badly needs a Biden-style industrial and climate plan.”

Unions have warned that job cuts at the Scunthorpe steel plant would be devastating for the area.

Charlotte Brumpton-Childs, GMB National Officer, says:

“GMB is deeply concerned over reports on the future of the British Steel plant at Scunthorpe.

“Any scheme that would close the blast furnaces in Scunthorpe would be another hammer blow for UK steel.

“Potential job losses on this scale would be devastating for the people of Scunthorpe.

“Formal consultation has not begun – although the business has started to talk to GMB and other unions about the various options on the table.

“GMB remains committed to debcarbonising the industry in a way that protects virgin steelmaking in the UK and the jobs it supports.”

Jasper Jolly

British Steel’s plan to replace the Scunthorpe blast furnaces with electric arc furnaces will be subject to consultation with unions, who are likely to argue against job losses.

Under the proposals the two blast furnaces at Scunthorpe would be replaced by an electric arc furnace at Scunthorpe and another at a site in Teesside, marking the return of steelmaking to Redcar, where the blast furnace was demolished last year after its closure in 2015.

It is understood that problems with the electricity grid connection at Scunthorpe would make it difficult to install a second electric arc furnace until at least 2029, forcing British Steel to look into other options.

British Steel plans to shut Scunthorpe furnaces putting up to 2,000 jobs at risk

Jasper Jolly

British Steel is expected to announce plans to replace two blast furnaces in Scunthorpe, in a move that would further reshape the UK steel industry and imperil the jobs of as many as 2,000 steelworkers, my colleague Jasper Jolly reports.

The company, owned by China’s Jingye, is expected to inform workers that the blast furnaces will be replaced by greener electric arc furnaces, at a meeting on Monday, according to people briefed on the plans.

Electric arc furnaces offer the ability to recycle scrap steel using clean electricity. However, they require far fewer workers than enormous blast furnaces that dominate the skylines of Scunthorpe and also Port Talbot in south Wales.

Tata Steel, which operates the Port Talbot plant, is planning a similar shift, although it delayed an imminent announcement last week.

However, there is an important difference between the two companies’ proposals: British Steel is understood to be considering keeping its blast furnaces open until the electric arc furnaces are in operation. That would put off any job losses for at least three years.

British Steel has not yet told workers how many jobs could be affected, but unions have estimated that as many as 2,000 fewer people could be required to operate the plant.

The BBC, which first reported the plans, said that British Steel had been offered £500m in UK government support to make the switch. That would match the package offered to Tata Steel.

We understand British Steel will announce a plan this afternoon to close its #Scunthorpe blast furnace which could lead to 2000 job losses. The furnace will be replaced by a greener electric arc facility which will take 2-3 years to build. pic.twitter.com/zwm1RSlMvU

— BBC Radio Humberside (@RadioHumberside) November 6, 2023

Information Commissioner apologises to Dame Alison Rose

Just in: Britain’s Information Commissioner has apologised to former NatWest CEO Dame Alison Rose, for suggesting she had breached data protection rules over the debanking scandal involving Nigel Farage.

Last month, an ICO report said that Rose had broken data protection rules, first by revealing to the BBC that Farage had a banking relationship with its private bank, Coutts; and secondly by providing “misleading information” that led the BBC to believe the bank was closing his accounts for purely commercial reasons, linked to his wealth.

But today, the ICO has apologised for ‘suggesting’ it had found she had broken General Data Protection Regulation (GDPR) rules.

The data protection watchdog says:

“The ICO recently investigated a complaint from Nigel Farage. The ICO’s investigation was solely into NatWest’s actions as a data controller.

“Our comments gave the impression that we had investigated the actions of Alison Rose, the former CEO of NatWest Group. This was incorrect. We confirm that we did not investigate Ms Rose’s actions, given that NatWest was the data controller under investigation.

“We accept that it would have been appropriate in the specific circumstances for us to have given Ms Rose an opportunity to comment on any findings in relation to her role and regret not doing so.

Finally, we apologise to Ms Rose for suggesting that we had made a finding that she breached the UK GDPR in respect of Mr Farage when we had not investigated her. Our investigation did not find that Ms Rose breached data protection law and we regret that our statement gave the impression that she did.”

UK construction fall: What the experts say

Last month’s cancellation of the northern leg of the HS2 rail line is a major issue for construction contractors, reports Max Jones, director in Lloyds Bank’s infrastructure and construction team:

Jones explains:

“Following last month’s HS2 decision, businesses are now turning their attention towards identifying opportunities from improvements to regional transport and infrastructure links. In turn, the investment will better connect towns and cities and boost economic growth, which could create additional opportunities for those in the construction sector.

“Looking at the near- and medium-term picture, contractors we speak to are mindful of risks building up across their supply chains. The concern is that contracts priced as the country was coming out of the pandemic have had their margins eroded by inflation, and this could eat into profits as projects are completed in the coming months.”

Toby Banfield, financial restructuring partner at PwC UK, says weak demand is hurting housebuilders:

“Sector headwinds showed little signs of relief in October, as the PMI recorded 45.6 in October, a marginal increase from 45.0 in September but the second-lowest reading since May 2020, fuelled by an eleventh consecutive monthly decrease for house building which continues to battle with sales weak demand which is prompting delays and hesitance with new projects.

Ongoing disruption to government infrastructure projects and the slowdown in the housing market is hurting constructors, says Kelly Boorman, partner and national head of construction at acccountancy firm RSM UK:

Boorman says there are signs of stabilisation:

‘This month’s slight uplift in the headline PMI to 45.6 brings surprisingly welcome news for the construction industry, especially after September’s steep drop. The increase was driven by an uplift in commercial activity to 49.5, which suggests stability is returning to the market and is a positive sign that construction output will continue to improve, albeit slowly.

The Bank of England’s decision to maintain its base rate at 5.25% for the second month, after 14 consecutive months of hikes is also encouraging, after months of disruption to pipelines with the housing market really feeling the pinch. It’s always a tough time of year for construction as we get into winter months, so hopefully this will facilitate some stimulation in the housing market.

The UK construction sector is being dragged down by high interest rates and low consumer demand for new homes, reports Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS).

Glen adds:

“The silver lining is that high borrowing costs are having their intended effect of putting the brakes on rising inflation. Previously suppliers were able to hike their prices in response to soaring demand.

Falling construction activity has now tilted the negotiations in favour of buyers and suppliers are having to pass on lower prices for raw materials like timber and steel. Supply chain pressures are also easing as a result of the lull in new work, with better availability of raw materials, a reduction in transportation costs and an improvement in supplier delivery times.

Glen adds that UK construction will probably face further challenging months ahead.

For the 11th successive month house building decreased in Oct. High interest rates holding back building momentum till their is greater demand. The knock-on effect = inc in sub-contractors & construction material & product prices drop (helped by cheaper transit costs) @SPGlobal pic.twitter.com/2RNRaTS0Xp

— Emma Fildes (@emmafildes) November 6, 2023

Construction costs are falling

There is one glimmer of good news, though – building costs are falling.

Today’s construction PMI shows that purchasing prices decreased at the fastest pace for over 14 years, as lower timber, steel and transportation costs were passed on by vendors.

Those cheaper raw material costs suggest that supply chain problems have eased, and also that weaker demand from building firms is forcing suppliers to offer more competitive prices.

Tim Moore, economics director at S&P Global Market Intelligence, explains:

“Total new work continued to fall more quickly than at any time since the initial pandemic lockdown period, which contributed to shrinking demand for construction products and materials during October.

Competitive pressure on suppliers to pass on lower commodity prices resulted in the fastest decline in input costs since August 2009. Sub-contractors meanwhile cut their charges for the first time in more than three years in response to a further downturn in workloads during October.”

UK construction output falls again as housebuilding shrinks

Newsflash: UK construction output declined at a sharp pace again last month.

The latest poll of purchasing managers at UK construction firms has found that business activity falling for the second month running in October, amid a lack of new work to replace completed projects.

Housebuilding fell particularly sharply, as the sector was hit by falling buyer demand and higher costs.

Building firms blamed fragile client confidence and elevated borrowing costs, due to the surge in interest rates over the last two years.

The S&P Global / CIPS UK construction PMI has come in at 45.6 for October, up from September’s 45.0.

That’s the second-lowest reading since May 2020 and shows a marked decline in total construction activity (any reading below 50 shows a contraction).

The survey says:

House building decreased for the eleventh successive month in October and at a much steeper pace than elsewhere in the construction sector (index at 38.5).

Falling work on residential construction projects was widely linked to a lack of demand and subsequent cutbacks to new projects. Civil engineering activity also decreased sharply in October (index at 43.7) and the rate of decline was the fastest since July 2022.

Today’s car sales figures show that fewer than one in four new battery-powered electric cars were sold to private buyers.

This, the SMMT says, underscores the need for fiscal incentives to encourage private consumers to switch to EV.

Overall, battery electric vehicle (BEV) uptake increased for the 42nd month in a row in October, by 20.1% to 23,943 units. That’s a slowdown on earlier in the year, though.