UK 30-year borrowing costs hit highest since 1998

Britain’s long-term cost of borrowing has hit its highest level since 1998 this morning, as the sell-off in the bond market continues.

The yield, or interest rate, on 30-year UK government bonds has hit 5.115% this morning, Refinitiv data shows.

That is above the levels seen a year ago in the panic after Liz Truss’s mini-budget.

UK 30-YEAR GILT YIELD RISES TO HIGHEST SINCE SEPT 1998 IN EARLY TRADE AT 5.115% – REFINITIV DATA

— First Squawk (@FirstSquawk) October 4, 2023

This rise in yields comes as the price of 30-year UK government bonds falls again, as investors anticipate that global interest rates will remain higher for longer than hoped.

Traders are now thinking inflation will be more sticky, so even if rates don’t rise much higher, base rate cuts will happen less quickly.

30-year gilt yield rises this morning to highest level since 1998.

Unlike a year ago, this move truly is global – big rout going on across bond markets. pic.twitter.com/nU0CXCtH0J

— Andy Bruce (@BruceReuters) October 4, 2023

Shorter-dated UK government bond prices are also weakening, with the yield on 10-year gilts hitting its highest since August this morning, at 4.669%.

These rising borrowing costs will give chancellor Jeremy Hunt less room for spending rises or tax cuts in his autumn statement, as they reflect the cost of issuing new government debt.

Big Breaking

UK 30-year gilt yield rose to its highest level since September 1998, reaching 5.115%.: Refinitiv

This is a significant increase from the yield of around 3.75% at the beginning of September, and it reflects the growing concerns among investors about the UK economy… https://t.co/6Eeaz6ePj6 pic.twitter.com/oGtJ4dRlcw

— QuickUpdate (@BigBreakingWire) October 4, 2023

This surge in UK borrowing costs comes amid a global selloff this week, with US Treasury yields hitting their highest since 2007 and German borrowing costs the highest since 2011 this morning (see here).

As explained in this morning’s introduction, traders fear the central banks such as the US Federal Reserve will keep borrowing costs painfully high for longer than hoped as they try to crush inflationary pressures, potentially creating a recession.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, explains:

The bond sell off has been bedding in with the yield on 30-year Treasuries shooting to levels not seen for 16 years.

This is already pushing fresh Federal borrowing into ‘ouch territory’ and there are concerns yields could inch even higher.

The sell off in long-term government bonds has been spreading in Europe too. Yields on 30-year gilts have headed above 5%, with investors demanding more interest to buy in, giving ministers less wiggle room to ease cost-of-living pain through tax cuts or public sector pay offers, particularly given the UK government’s self-imposed borrowing rules.

Key events

Eurozone business activity contracts again

The latest economic data from the eurozone has highlighted the economic slowdown in Europe.

The eurozone economy ended the third quarter with another contraction, according to the latest survey of purchasing managers.

S&P Global’s PMI survey shows that new orders at eurozone companies fell at the fastest rate in almost three years, while output fell across both the manufacturing and service companies.

Overall, the HCOB Eurozone composite PMI output index rose to 47.2, up from August’s 46.7, but still below the 50-point mark showing stagnation.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, explains:

“The HCOB Composite PMI for the Eurozone did rebound a bit. However, we can’t jump on the hope train yet. Blame it on new business, which is plummeting especially in Germany and France.

Accordingly, outstanding business continued to decline, and business expectations fell further below their long-term average.

Here’s a great breakdown of today’s market moves, from Bloomberg’s Sofia Horta e Costa:

The oil price, a good gauge of global growth prospects, is weaker this morning.

Brent crude has dropped by around 1%, to $89.99 per barrel, less than a week after hitting $97.69 per barrel.

Oil had been pushed up last month by supply cuts from Saudi Arabia and Russia, but is now sliding on fears that high interest rates will hit growth, and demand for energy.

Callum Macpherson, Head of Commodities at Investec, explains:

“Saudi Arabia has confirmed that its additional voluntary cut will continue as planned and so will remain at a 1mb/d cut during November.

Had equity and bond markets not fallen heavily in recent days, news of this confirmation that Saudi Arabia will continue to make the market tight, might well have lifted Brent from the high 90s through 100 $/b. But investors that had recently started to move back into oil on all the talk of prices reaching 100, have headed for the exit as oil has followed other markets lower and is now bumping along around 90.

Market attention has shifted from the focus on the short term tightness to the implications of interest rates staying higher for longer, the subdued macro environment that entails, and how OPEC+ plans to deal with that when it meets on 26th November.

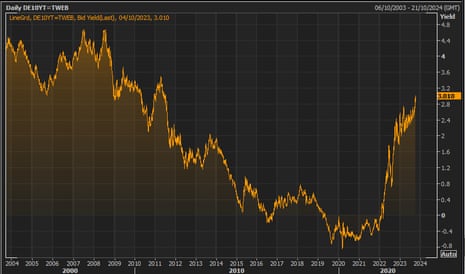

Here’s a chart showing the jump in Germany’s borrowing costs, amid the global bond rout:

Neil Wilson of Markets.com says the moves in the bond markets are also driven by concerns about government deficits, and structurally higher inflation in the West.

Wilson also points out that central banks are unwinding some of their bond-buying stimulus packages, which creates more sellers in the market.

Central banks are no longer buying bonds, they are selling them. This is a mechanistic explanation but simple and true – someone else has to buy the debt and there is a lot more of it now.

This can only result in lower prices, higher yields. The great bond bull market is dead, a new bear market is taking over – this is the paradigm shift we have been talking about for at least the last three years. This means stocks stuck in multi-year ranges – no new highs and the lows are not yet in.

He also reminds us of a classic quote about the power of the bond market:

An oldie but a goodie: Bill Clinton’s chief strategist James Carville once said that if he were to be reincarnated he’d want to come back as the bond market. “You can intimidate everybody,” he famously said. We are seeing some of this power now with some tremendous destruction of capital in fixed income markets.

It has the feel that something is about to break…but beware linear thinking.

The cost of insuring UK government debt against the risk of default has hit its highest level in a year this morning, but remains very low.

The cost of insuring against other government defaults using a credit default swap has also risen, as the rout in global bond prices shakes the markets. But again, we’re still at low levels.

Reuters has the details:

Five-year credit default swaps (CDS), a derivative that pays its holder in the event of an issuer defaulting, for UK sovereign debt rose 1 basis point on the day to 32 basis points, the highest since October 21 last year, at the tail-end of Liz Truss’s stint as Britain’s shortest-serving prime minister, according to data from S&P Global Market Intelligence.

French 5-year CDS rose to 28 bps, highest since May 18, from 27 bps at the last close, while Italian 5-year CDS jumped to 112 bps, their highest since May 11, from 109 bps on Tuesday, the data showed.

But to reiterate, these levels still show a very low risk of default.

For example, back in 2011, Greek five-year CDSs hit a record 1,600 bps, meaning it cost €1.6m to protect €10m of exposure to Greek bonds, as Athens headed towards a second bailout.

[Also, the UK should never need to default as it controls its own currency, and can print as many pounds as needed to service its debts. However, that is inflationary, and puts off bond buyers. There’s a good take on the history of all this here, by Bond Vigilantes).

Bill Blain: Are we risking a repeat of 1987?

This morning “the mood feels bleak”, reports Bill Blain, market strategist at Shard Capital.

In his latest Morning Porridge note (highly recommended, by the way), Blain says:

Stocks are having an existential crisis – it might be momentary, or maybe not. Bond yields rising on the expectation of higher for longer. The markets is concerned about debt quantum, currency stability and politics.

Graphs showing rising interest rates can spell trouble for stocks (No Sh*t Sherlock award to anyone that ever spotted that before.)

I can’t help but reminisce. We have been here before.

And by ‘before’, Blain is referring to 1987, which saw that global stock market crash of Black Monday.

October is often a shocking month for prices, Blain points out.

And cites an article by Bloomberg’s John Authers, which points out that several market commentators that have spotted the connection.

Authers (here) has produced several examples of “horror chart porn”, which show that the Nasdaq index’s progress this year is spookily similar to the Dow in 1987 (which was itself rather close to the Dow in 1928 to the Great Crash of 1929).

Various experts are now drawing parallels between the 1987 bond yield run up and the current one.

Of course, the past never repeats exactly, but it’s worth noting what happened next in 1987.

The bond yield correction was caused by a flight from stocks, which triggered a 20%… https://t.co/6A4dGZwj4o pic.twitter.com/gSFlQhteNj

— Paul Claireaux (@PaulClaireaux) October 4, 2023

This does not mean we are inevitably heading for another crash, of course. After all, US corporate earnings this year are expected to be rosy.

But concerns about a looming US recession are still looming.

Authers writes:

Even so, a recession, according to Tikehau’s Raphael Thuin, is still on the table as the lagged effects of the Fed’s aggressive monetary tightening finally trickle in. “The estimate is 12 to 24 months,” he said, referring to how long it usually takes for the rate hikes to hit the economy; the Fed started to raise the fed funds rate 18 months ago. “It’s exactly now. We are starting to see some effects.”

To Stuart Kaiser, Citigroup head of US equity trading strategy, the earnings season is more of a “wildcard.” He said he expects a repeat of the second quarter, which was “neutral at best for equities given a higher bar.

Or, as Bill Blain puts it:

Who are we trying to fool? Rising bond yields, higher for longer rates, recession fears, crashing consumption, yet stocks believing earnings could still push them higher? Are we at risk of a realisation moment and a repeat of 1987 or maybe something worse?

This week’s bond market gyrations are all about investors adjusting to interest rates remaining higher for longer than hoped, reports Mohamed El-Erian, chief economic adviser at Allianz and president of Queens’ College, Cambridge.

The yield on the 10-year US government bond is currently trading above 4.70%.

Simply put:

Last year was about #markets adjusting to higher rates. This year is about markets adjusting to rates staying high for longer.

The process of market adjustment is ongoing while that of the… pic.twitter.com/ANoD8xhqNx— Mohamed A. El-Erian (@elerianm) October 3, 2023

Reuters: UK regulator to push for probe into Amazon, Microsoft cloud dominance

There could be drama in the technology and communication world this week too.

Reuters are reporting that media regulator Ofcom will push for an antitrust investigation into Amazon and Microsoft’s dominance of the UK’s cloud computing market.

Ofcom is expected to issue a final report into cloud computing tomomorrow. Back in April, it indicated it could refer the market for investigation by the Competition and Markets Authority.

Reuters says:

British media regulator Ofcom will this week push for an antitrust investigation into Amazon and Microsoft’s dominance of the UK’s cloud computing market, according to two sources familiar with the matter.

Between them, Amazon and Microsoft enjoy a combined market share of 60-70% of Britain’s cloud computing industry. Meanwhile, their closest competitor, Alphabet’s Google, has closer to 10%.

BoE governor: There could be further large shocks ahead

The governor of the Bank of England, Andrew Bailey, has warned that there could be further ‘large shocks’ looming.

In an interview with Prospect magazine, published this morning, Bailey warns that further, unknown, shocks could be lurking ahead.

Here’s the key section of the interview:

He quotes approvingly a speech by the ECB president, Christine Lagarde, at the annual gathering of central bankers in Jackson Hole, Wyoming.

She described a world of economic fragmentation, where geopolitics is becoming more transactional and the risk of external shocks is commensurately higher.

“I think she’s right on that point at the moment, sadly, of course. And so this is important, because we have seen these shocks and I think we have to be prepared for whatever comes next. That there could be further large shocks that we don’t know about.”

🗞️ EXCLUSIVE: Bank of England Governor, Andrew Bailey, warns the UK economy could face “further large shocks that we don’t know about at the moment.”

Read the full @lionelbarber interview in the new issue of Prospect out today.https://t.co/fkP5DInaaG

— Prospect (@prospect_uk) October 4, 2023

Then again, it would be more surprising if there weren’t more shocks to come, given the last 15 years have seen the Great Financial Crisis, the eurozone debt crisis, Brexit, Covid-19, last year’s mini-budget, and war in Europe.

Both equities (shares) and bonds are under pressure today, reports Victoria Scholar, Head of Investment at interactive investor:

The US 10-year Treasury yield rose above 4.86%, hitting fresh 2007 highs. Long-term US yields hit 16-year highs while Germany’s 10-year yield surged above 3% for the first time since June 2011.

The moves have been driven by forecasts for higher for longer interest rates and strong US economic data that could embolden the Fed to carry out further tightening.

All eyes are on Friday’s labour market figures with a strong US jobs report likely to exacerbate the market’s nervousness.

UK 30-year borrowing costs hit highest since 1998

Britain’s long-term cost of borrowing has hit its highest level since 1998 this morning, as the sell-off in the bond market continues.

The yield, or interest rate, on 30-year UK government bonds has hit 5.115% this morning, Refinitiv data shows.

That is above the levels seen a year ago in the panic after Liz Truss’s mini-budget.

UK 30-YEAR GILT YIELD RISES TO HIGHEST SINCE SEPT 1998 IN EARLY TRADE AT 5.115% – REFINITIV DATA

— First Squawk (@FirstSquawk) October 4, 2023

This rise in yields comes as the price of 30-year UK government bonds falls again, as investors anticipate that global interest rates will remain higher for longer than hoped.

Traders are now thinking inflation will be more sticky, so even if rates don’t rise much higher, base rate cuts will happen less quickly.

30-year gilt yield rises this morning to highest level since 1998.

Unlike a year ago, this move truly is global – big rout going on across bond markets. pic.twitter.com/nU0CXCtH0J

— Andy Bruce (@BruceReuters) October 4, 2023

Shorter-dated UK government bond prices are also weakening, with the yield on 10-year gilts hitting its highest since August this morning, at 4.669%.

These rising borrowing costs will give chancellor Jeremy Hunt less room for spending rises or tax cuts in his autumn statement, as they reflect the cost of issuing new government debt.

Big Breaking

UK 30-year gilt yield rose to its highest level since September 1998, reaching 5.115%.: Refinitiv

This is a significant increase from the yield of around 3.75% at the beginning of September, and it reflects the growing concerns among investors about the UK economy… https://t.co/6Eeaz6ePj6 pic.twitter.com/oGtJ4dRlcw

— QuickUpdate (@BigBreakingWire) October 4, 2023

This surge in UK borrowing costs comes amid a global selloff this week, with US Treasury yields hitting their highest since 2007 and German borrowing costs the highest since 2011 this morning (see here).

As explained in this morning’s introduction, traders fear the central banks such as the US Federal Reserve will keep borrowing costs painfully high for longer than hoped as they try to crush inflationary pressures, potentially creating a recession.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, explains:

The bond sell off has been bedding in with the yield on 30-year Treasuries shooting to levels not seen for 16 years.

This is already pushing fresh Federal borrowing into ‘ouch territory’ and there are concerns yields could inch even higher.

The sell off in long-term government bonds has been spreading in Europe too. Yields on 30-year gilts have headed above 5%, with investors demanding more interest to buy in, giving ministers less wiggle room to ease cost-of-living pain through tax cuts or public sector pay offers, particularly given the UK government’s self-imposed borrowing rules.

European markets open in the red

European stock markets have opened lower, as the bond market selloff continues to worry investors.

In London, the FTSE 100 index has dropped by 28 points, or 0.4%, to 7442 points, the lowest since 8 September.

The pan-European Stoxx 600 is down 0.5%, with Germany’s DAX index losing 0.7% at the open.

Nikkei slumps after bond market sell-off hit the Dow

Equity markest are also being hit by fears that the Federal Reserve will keep rates higher for longer to tame inflation.

Last night, the US Dow Jones industrial average shed 430 points, or 1.29%, in its worst day since March. The Dow is now in the red for 2023.

And in Tokyo today, Japan’s Nikkei 225 index has tumbled by over 2%.

Mark Haefele, chief investment officer at UBS Global Wealth Management, says investors had been too confidence that US interest rates would start to fall – and are now rethinking that idea:

“Recent developments support our view that markets had become overly confident in pricing a rapid easing of the Fed’s monetary policy. While we expect equity and bond market conditions to improve, we forecast choppy and range-bound trading in equity markets in the near term, as well as a reverse in the recent rise in longer duration yields.”

German bond yield hit highest since 2011

Germany’s government bonds are also caught up in the selloff, as trading begins in the markets this morning.

The yield (interest rate) on German 10-year bunds has risen above 3%, for the first time since 2011 [reminder, yields rise when prices fall].

Germany’s 30-year bund yields are also at a 12-year high, Reuters reports, rising by 5 basis points to 3.245%.

Tesco says food inflation will keep falling, as profits surge

Supermarket giant Tesco has predicted that food inflation will continue to fall, as it raises its profit guidance after a strong start to the year.

In its interim financial results, just released, Tesco signalled that the cost of living squeeze was easing.

Ken Murphy, Tesco chief executive, says:

Food inflation fell across the half and while external pressures remain, we expect that it will continue to do so in the second half of the year.

Yesterday, the British Retail Consortum reported that food prices in the UK fell on a monthly basis in September, for the first time in two years.

Tesco cites price cuts to items such as milk, pasta and cooking oil in June, and says that around 2,500 products were on average 12% cheaper than at the start of the year.

Tesco also reported an 8.9% rise in group sales, and a 13.5% rise in underlying earnings.

The group, which has a 27% share of Britain’s grocery market, now expected to make a retail adjusted operating profit of between £2.6bn and £2.7bn, up from a previous forecst of around £2.5bn.

On a pre-tax basis, profits are up 207%, rising from £396m to £1.217bn in the 26 weeks ended 26 August 2023.

Introduction: Bond sell-off intensifies as interest rate fears grip markets

Good morning, and welcome to our rolling coverage of business, the financial markets and the latest economic and financial news.

An accelerating bond selloff is driving up the cost of government borrowing, as the financial markets fret about high interest rates.

The yield, or interest rate, on 30-year UK government bonds has hit 5% for the first time since the panic after the mini-budget a year ago.

Across the Atlantic, the yield on 30-year US Treasuries hit a 16-year high last night, as the bond selloff rocked currencies such as the yen and the rouble.

Jim Reid, strategist at Deutsche Bank, explains:

The last 24 hours saw the relentless bond sell-off continue, with yields rising to fresh multi-year highs on both sides of the Atlantic.

Bond prices are sliding, pushing up yields, because investors fear that interest rates will remain high as central banks try to push down inflation. The selloff appears to have been triggered by stronger-than-expected economic data from the US, which showed a surprise rise in job vacancies in August.

⚠️BREAKING:

*U.S. AUGUST JOLTS JOB OPENINGS RISE TO 9.610 MILLION; EST. 8.800M; PREV. 8.920M

*HIGHEST SINCE MAY 2023

🇺🇲🇺🇲 pic.twitter.com/SuYTnRU8J1

— Investing.com (@Investingcom) October 3, 2023

That may force the US Federal Reserve to push borrowing costs even higher, as it tries to squeeze out inflationary pressures.

These high yields in the bond market indicate how much it will cost governments to issue new debt to pay for current spending needs. Two years ago, the UK’s 30-year gilt yield was just 1.5% – a great opportunity to borrow cheaply to fund long-term investment.

Also coming up today

The criminal trial of the former cryptocurrency mogul Sam Bankman-Fried will continue; it began yesterday with jury selection.

UK rail passengers face fresh disruption today, as train drivers hold another strike in a bitter, long-running dispute over pay and conditions.

Members of the drivers’ union Aslef at 16 train operators in England will walk out, coinciding with the final day of the annual conference of the Conservative Party in Manchester.

Railways will be high on the agenda in Manchester, with Rishi Sunak expected to confirm today that the northern leg of HS2 has been cancelled.

According to overnight reports, Sunak will say that the rail line will reach Manchester, but from Birmingham it will switch to use existing West Coast Mainline track.

The agenda

-

9am BST: Eurozone services PMI rreport for September

-

9.30am BST: UK services PMI report for September

-

11am BST: UN annual flagship report on the global economy published

-

1.15pm BST: ADP survey of US private sector payrolls

-

3pm BST: US services PMI report for September