Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

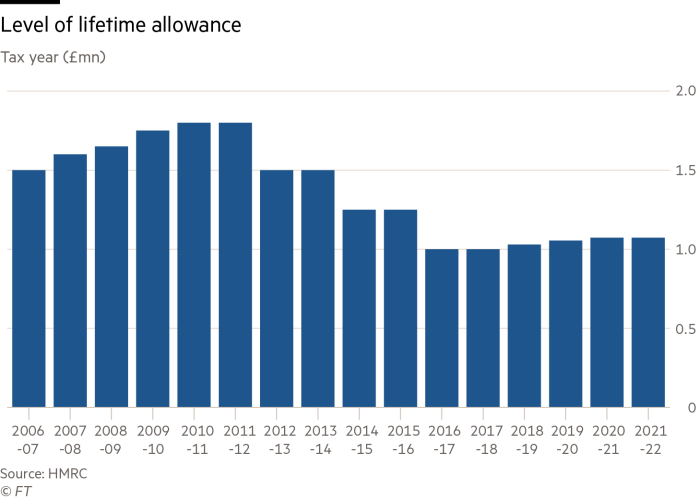

The major reforms to pension taxation implemented in 2006 introduced simplified lifetime and annual limits on the amount of pension saving which would enjoy the benefits of income tax relief. But since then, policy on the lifetime allowance (LTA) has been highly erratic.

After an initial period of pre-announced increases, it was then frozen, cut repeatedly in 2012, 2014 and 2016, each followed by a short freeze. A period of indexation followed, then another freeze.

But this is nothing compared with the turbulence we may be about to witness. What can savers expect? Who is likely to be hardest hit?

In his March Budget, chancellor Jeremy Hunt unexpectedly announced that the LTA would be abolished by April 2024, with the penal aspect of the LTA tax charge removed for 2023-24 as an interim measure.

But within hours, the Labour party indicated it would, if elected, reverse the policy. UK savers are thus in the strange position of currently enjoying the most relaxed rules on tax-privileged pension saving in decades, but with the threat of a limit being reimposed potentially within the next couple of years.

New analysis from consultancy LCP suggests around 250,000 people in the 55-64 age group could have an LTA issue if it were to be reinstated after the next general election at its previous level. This includes those who already have pension saving above the current LTA of £1,073,100 or who might expect to exceed that level before they retire.

But our analysis shows that reinstating the LTA would be far more than simply reinserting all of the references to the LTA in existing tax law, which the government is busy deleting. There are several major challenges which a new government would face. Tight legislative timing means some of these would require action this side of an election, a problematic suggestion; others might need addressing in the early weeks of a new government being formed.

A first key question is what reinstating the LTA would mean for senior public servants such as NHS doctors who are among the groups most likely to hit the limit by dint of relatively large defined benefit (DB) occupational pensions.

Hunt was explicit in his Budget statement that encouraging doctors to keep working rather than retiring for tax reasons was a key rationale for the abolition of the LTA. A new government would be equally keen to retain the services of experienced doctors, but the details of an alternative strategy are yet to be set out. Without a fully worked out plan, there is a risk that doctors may vote with their feet and retire to avoid the risk of potentially punitive taxation post-election.

A second key issue for an incoming chancellor is the changes in behaviour prompted both by the abolition of the LTA and its proposed reinstatement. A combination of the ending of the LTA tax charge and a substantial relaxation on annual limits on tax-privileged pension saving currently makes it possible for some higher earners to make large contributions into their pensions.

For a new government to impose tax charges on such enhanced pension pots might widely be seen as retrospective taxation. So there would no doubt need to be transitional protection for those who had already exceeded the old LTA limit before the election.

But the bigger challenge would be if individuals anticipated the reinstatement of the LTA and its tax charge by crystallising their pension savings before it could be reintroduced, thereby potentially escaping the reach of HM Revenue & Customs.

Passing legislation to reinstate the LTA would be complex and might not be possible by the start of the first financial year after the election. As a result, there would be a risk of an 18-month window (based on an autumn 2024 poll and April 2026 implementation) in which the government haemorrhaged tax revenues.

One possible response would be the introduction of emergency “anti-forestalling” legislation soon after the election. This could make it clear that the government was committed to reinstating the LTA and preventing individuals from taking advantage of the delay in implementing that policy. But such legislation would itself be complex and would need preparatory work to be undertaken this side of the election.

Assuming the LTA will be reintroduced, one option would be to start all savers off at zero in terms of the amount of the new LTA they had used up. But this would be very unfair, as those who had enjoyed and crystallised a lifetime of pension tax relief could in effect start again and enjoy yet more tax relief. So, it is likely that there would have to be a process for taking some account of past tax-privileged savings and treating this as “using up” some or all of the new LTA.

In particular, those who started drawing a DB pension might have a deemed LTA usage based on working back from their current regular pension. This was the approach taken in 2006 when the LTA was first introduced. More difficult might be taking account of past “crystallisations” of defined contribution savings, where the money taken out may no longer even be in a pensions “wrapper”, and is therefore potentially invisible to the tax authorities.

At first glance, for individual savers the current relaxed regime could provide an opportunity for more tax-privileged pension saving than would previously have been allowed. But the significant likelihood of a change in government and uncertainty over the extent to which any future tax changes would be retrospective create great challenges. Any major change to pension saving plans should not be made without expert and individually tailored financial advice.

There is no doubt that the financial advice industry will be working overtime over the coming months to help savers make the most of the current relaxation of pension tax limits, as well as thinking through the implications of a potential change of government. The challenge for an incoming government determined to reintroduce the LTA will be to plan ahead to make sure it can be reintroduced as quickly and effectively as possible.

Sir Steve Webb is a partner at consultants LCP. “Could the Lifetime Allowance come back?”, a report by LCP, is available at lcp.com