U.S. Treasurys declined on Wednesday as investors fretted over the debt ceiling bill — which the House of Representatives is expected to vote on later in the day — and awaited key jobs data.

At 4:20 a.m. ET, the yield on the 10-year Treasury was trading four basis points lower at 3.656%. The 2-year Treasury yield was last down by more than four basis points to 4.4275%.

Yields and prices have an inverted relationship and one basis point equals 0.01%.

Jitters over the Fiscal Responsibility Act, which would raise the U.S. debt ceiling and therefore prevent the government from defaulting on its debt as early as June 5, continued.

On Tuesday it cleared a key vote in the House Rules Committee with a 7-6 majority and is now expected to go before the House floor on Wednesday, according to a tentative House voting schedule.

It the bill passes the House vote, it would then also need to be approved by the Senate before it could come into effect.

Politicians on both sides of the aisle have criticized the compromise struck between President Joe Biden and House Speaker Kevin McCarthy. At least 20 Republicans said on Tuesday that they would vote against the bill.

Meanwhile, investors awaited April’s JOLTs job openings report due Wednesday, which could provide hints about the state of the economy and inform the Federal Reserve’s next interest rate policy decision. Several Fed officials are also due to speak on Wednesday.

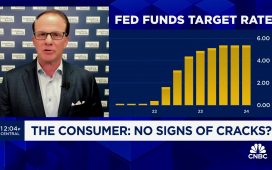

Uncertainty about whether the central bank will pause or continue with its rate-hiking campaign, which aims to ease inflation and cool the economy, at its June policy meeting has spread in recent weeks.