Thematic ETFs recorded outflows of $700m last quarter, but this rose to inflows of $193m once the Gender Equality theme was excluded, Rahul Bhushan, co-founder of Rize ETF, said.

Speaking to Investment Week about the publication of his firm’s ETF Fund Flows report, Bhushan said the massive outflows from the Gender Equality sector was likely due to shifts in “internal money” as asset managers move money within their ETFs.

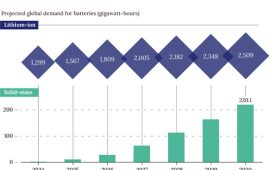

Throughout Q1, inflows were dominated by four themes, comprising 65% of inflows: Electric Vehicles and Batteries ($179m), Robotics, Automation and AI ($161m), Luxury Goods ($157m) and Circular Economy ($139m).

Clean Energy ETFs made the top three net outflows, losing $149m, which Bhushan attributed to an oversaturation of the sector, leading to excessive valuations.

Instead, investors haven taken part in a “broadening” of inflows, he said, with New Energy ($47m in inflows), Climate and Environment ($9m inflows) and Biodiversity ($6m inflows) expanding the investor toolkit.

Bhushan also noted the US Inflation Reduction Act had “spurred” investment into fields such as battery technology.

Despite the outflows from traditional green transition sectors such as wind, solar bucked the trend, adding $22m in inflows. Bhushan explained this was because many solar thematic ETFs were “quite new,” allowing money that had been waiting for the opportunity to finally find a home.

The dominance of robotics and AI was attributed to the explosion of chatbots over the quarter, as tools such as ChatGPT drew the attention of investors looking to benefit from the growth in new technology.

Cybersecurity also saw a major boost, with the theme attracting $108m in March, pushing flows into positive territory for the quarter with a net $58m bump. This was attributed to an uptick in performance compared to broad benchmarks, alongside a brightening outlook for the sector following the consolidation it saw in 2022.

Meanwhile, luxury goods fared well due to the re-opening of China and the anticipated power of the Chinese consumer, Rize ETF said.

Except for the Gender Equality theme, Infrastructure saw the largest outflows of the quarter, losing $257m. Bhushan explained that about 40-50% of the stocks in the theme were oil, gas and coal related stocks, which helped explain the outflows.

After a very strong year for the sector, which did “particularly well” in the rotation from growth to value, investors were likely taking to opportunity to reap profits and cash out, he said.

This was also the case for Agribusiness, with $102m in outflows, which saw “stellar” performance throughout 2022 as the price of food skyrocketed due to supply issues from the Russian invasion of Ukraine.