Also in this letter:

■ Indian IT grabs global PE attention

■ PM Modi at Startup Mahakumbh

■ Jensen Huang on India and AI

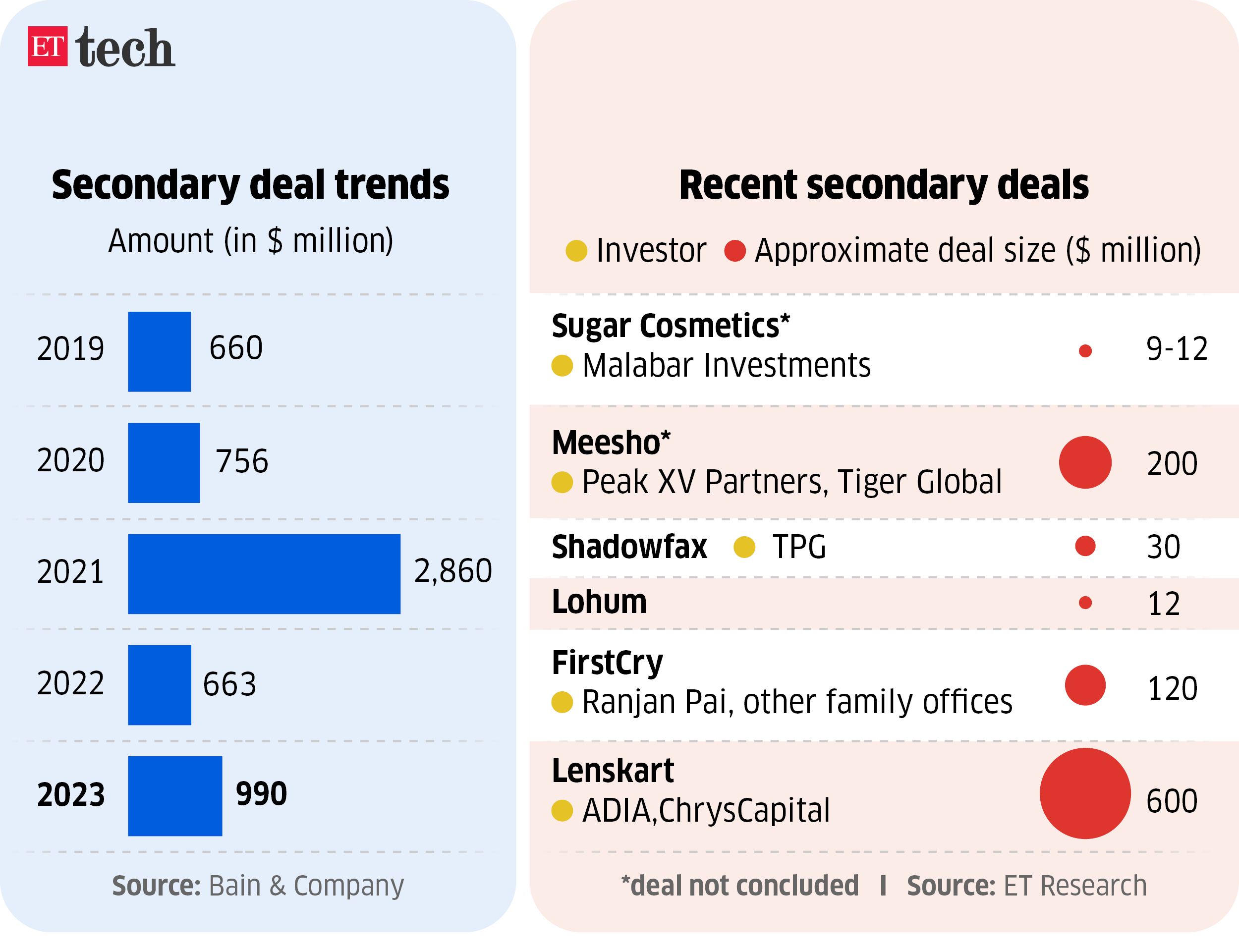

VCs looking for partial exits, investors eyeing IPO-bound firms push up secondary deals

With pressure to clock returns amid a prolonged slump in the technology market, venture capital investors are demanding exits from late-stage startups. In the past year, sizeable investment rounds of $50 million have included a significant secondary component that provides liquidity for pre-existing investors, industry executives told ET.

What’s happening? Industry sources told ET that existing investors in mid-scale startups are demanding exits even at reduced valuations. A Bengaluru-based startup offering supply chain solutions for retail businesses — last valued at around $300 million — is facing a major valuation cut, along with ongoing discussions for secondary deals, an executive told ET.

Why it matters: Meanwhile, venture funds, counting themselves among the earliest ones to have taken bets on the Indian startup boom in the previous decade, are being asked by their backers — limited partners — to deliver returns.

“Investors are in a baton exchange game…we invest early, and then the growth-stage investors come in,” said TCM Sundaram, cofounder of early-stage venture capital firm Chiratae Ventures, and among the first backers of Lenskart.

Jargon buster: A secondary deal is between existing and incoming investors, and the cash doesn’t go into the company. Some prominent deals in 2024 include:

The bottom line: Investors told ET there is a pickup in demand for secondary stakes in companies that are approaching potential initial public offerings (IPOs). Long-term investors are looking to derive public market value by acquiring stakes from venture capital firms with a comparatively shorter fund life.

“The supply was always there. I think the more realistic readjustment of valuation has created the demand for secondaries,” Prashanth Prakash, partner, Accel, told ET.

Nexus MD Sameer Brij Verma quits to open multi-stage fund

Sameer Brij Verma, one of the managing directors at Nexus Venture Partners, is likely to leave the VC firm to start his investment fund, sources told ET.

Driving the news: Verma is in talks to launch a multi-sector, multi-stage fund that will dabble in public markets. The fund size he’s looking at is anywhere between $150-200 million, said people in the know. His upcoming venture will look to hire executives who will work closely with the portfolio firms, a source told ET.

“The focus will be to bring in people who can help on the operating side. The strategy is to prepare startups to go public in 5-6 years with a valuation of $500-600 million.”

Background: Verma’s 13-year stint at Nexus saw him invest in startups like enterprise unicorn Postman, edtech platform Unacademy, and Infra.market, which sells construction materials. The focus was on consumer tech, enterprise, SaaS, healthcare, and business-to-business (B2B) commerce verticals.

Tell me more: Verma is expected to start marketing his fund among potential domestic and global limited partners (sponsors of funds) later this year. “This is a solo partner fund with the option of going beyond technology and consumer deals, which is mostly the remit of pure-play VC funds… The cheque sizes will start at $4-5 million but can go up to $10-12 million for scaled companies,” the source added.

Global PEs eye a bigger pie of India’s software services sector

Global private equity (PE) firms and PE-backed entities are showing more interest now in acquiring Indian information technology (IT) and software services companies. This has been fuelled by a substantial increase in growth capital investments within the IT services sector by global PE funds.

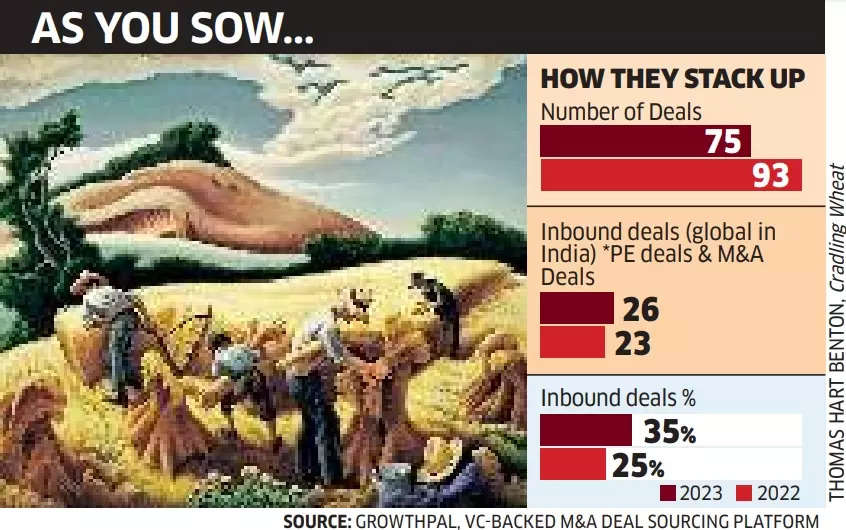

Data decoded: The number of PE firms holding stake in Indian IT services companies had doubled between 2019 and 2022 to more than 50, as per data from Avendus Capital. According to GrowthPal, an M&A deal sourcing platform, inbound deals from global investors betting on Indian firms rose 35% in 2023, faster than the previous year’s 25%.

Why the shift? Industry executives said one of the reasons for the interest could be because Indian IT firms are trading at a premium to their global counterparts due to their growth performance and potential.

Also, the startup space has become risky due to corporate governance and sustainability issues, leading to increased interest in the IT space where — even though these deals involve small and midsize firms — the models are time-tested.

Verbatim: “We are witnessing an increasing demand from Indian players looking to buy small to mid-sized IT services companies globally to get access to global clients, expand new geographies, build onshore and nearshore teams, and have a global footprint. Similarly, global companies are looking to buy small to midsize companies in India to build offshore teams, and expand capabilities and verticals,” said GrowthPal CEO Maneesh Bhandari.

Other Top Stories By Our Reporters

Startup Mahakumbh: PM urges startup founders to mentor young entrepreneurs | Lauding the entrepreneurial spirit of Indian youth, PM Narendra Modi on Wednesday asked successful founders to give back to society by supporting young entrepreneurs and academic institutions.

India’s IT will be the ‘front-office’ of world’s AI revolution: Nvidia’s Jensen Huang | India’s technology professionals are emerging to be the ‘front-office’ of the world’s artificial intelligence (AI) revolution by reskilling themselves with AI-native skills, Nvidia chief executive Jensen Huang said. “India has the largest population of IT professionals, there is no question they will be reskilled for AI.”

ETtech Done Deals

Pocket FM cofounder and CEO Rohan Nayak

Pocket FM secures $103 million in funding: Pocket FM, a leading audio entertainment platform, has raised $103 million in Series D funding led by Lightspeed with participation from Stepstone Group. The latest round brings Pocket FM’s total funding to date to $196.5 million.

Ultrahuman raises $35 million: Ultrahuman, which sells wearable devices and services that help users track metabolic health, has raised a $35 million financing round in a mix of equity and debt.

Global Picks We Are Reading

■ Meta just showed off Threads’ fediverse integration for the very first time (The Verge)

■ AI may not change your job, but it will transform government (FT)

■ 8 Google employees invented modern AI. Here’s the inside story (Wired)