- WIF investors have been sitting pretty so far, but this might change

- Key psychological level could determine whether WIF resumes its uptrend or crashes

The memecoin dogwifhat [WIF] has meandered between the $3.2-$4.1 levels over the past week. In fact, while its price action projected short-term bearish pressure, the higher timeframe outlook remained positive.

According to AMBCrypto’s technical analysis, market’s bulls need to be prepared for some losses. That being said, buying pressure has been relatively strong. Ergo, it will be interesting to see if the bulls can initialize another uptrend.

Market structure maintains a bullish bias

The 12-hour chart revealed WIF forming consecutive higher lows. The most recent one was marked in orange at the $3.189-level. This means that WIF has a bullish market structure on the 12-hour chart. A move below this level would mark a shift toward a bearish structure.

The RSI fell below neutral 50 and was an early signal that bearish momentum was likely to intensify. This could force prices below the aforementioned swing low.

On the other hand, the OBV has trended upwards over the past two weeks. It indicated a healthy amount of buying volume, even though the $4.1-resistance was not flipped to support. Therefore, investors can maintain their bullish long-term outlook.

Market bulls could face pain in the near term

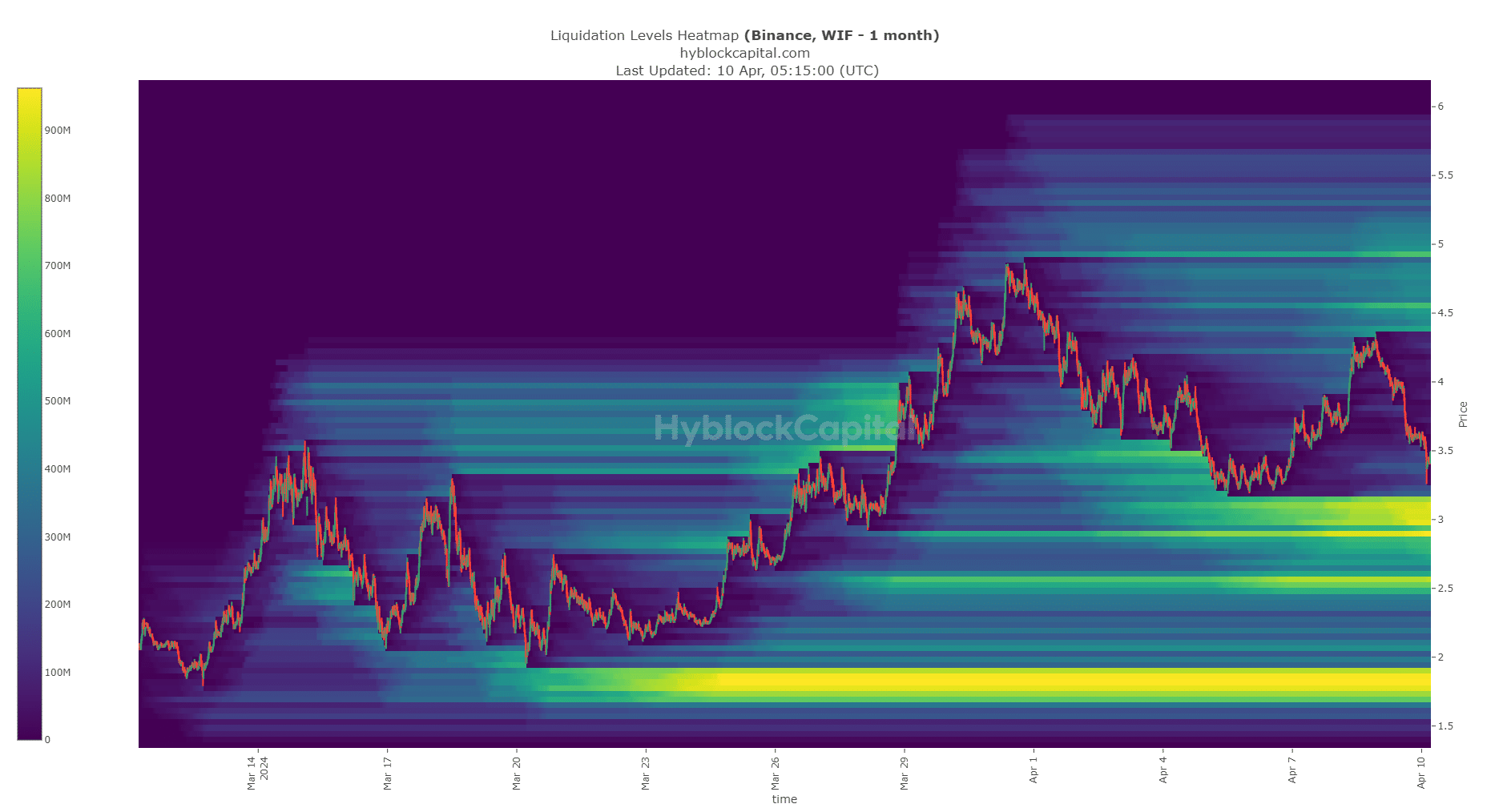

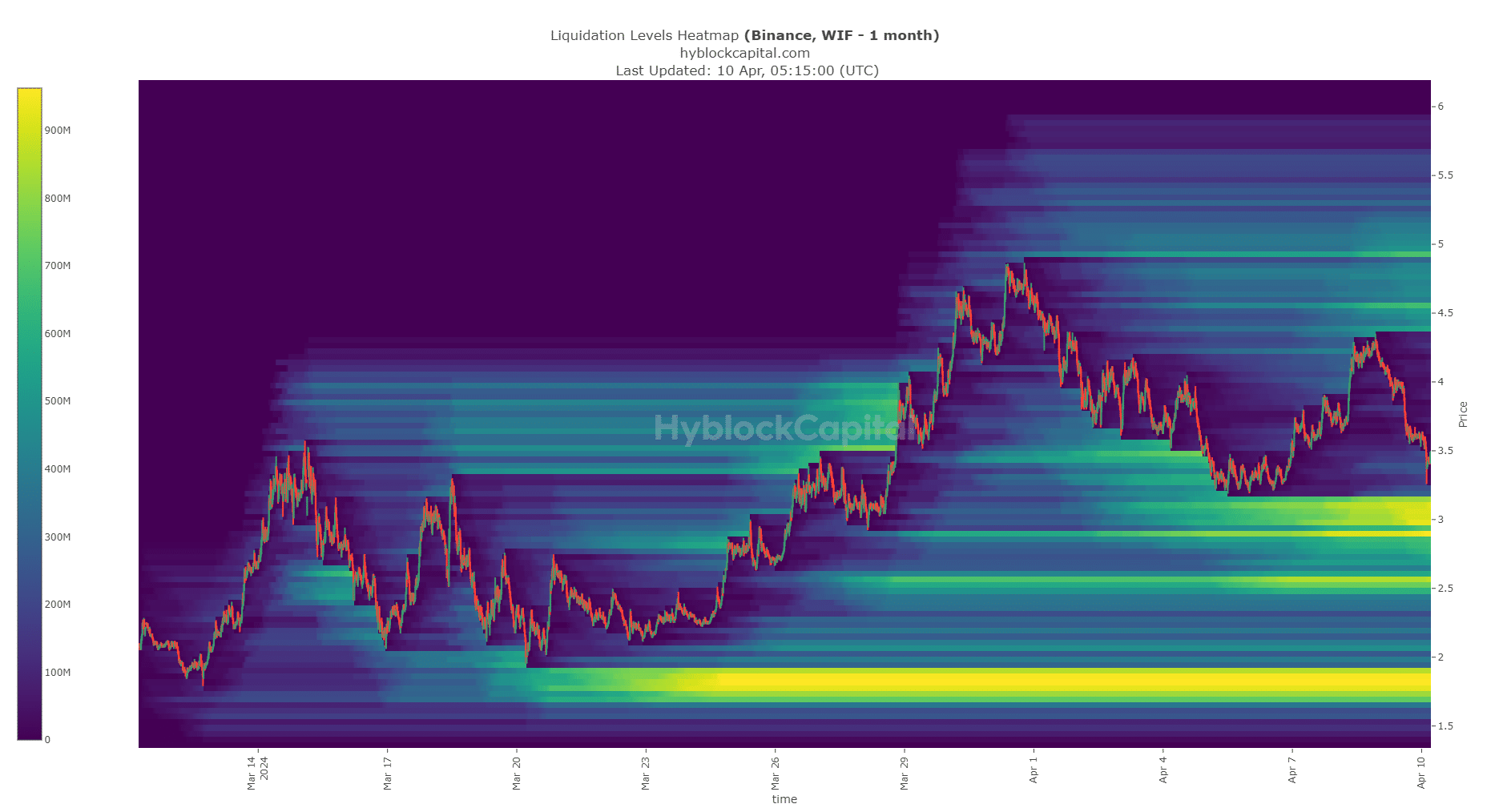

Source: Hyblock

The liquidation heatmap’s analysis highlighted the $3-zone as a critical pocket of liquidity. The $2.89-$3.14 zone is a pivotal area. A move to these levels will spark massive liquidations, and a drop below $3 could cause a liquidation cascade and a freefall in prices.

Realistic or not, here’s WIF’s market cap in BTC’s terms

However, the $3-magnetic zone could also see a brief test and a reversal. It appeared resilient and bulls must hope that the short-term downtrend sees a positive reaction from this area. If not, the $2.5 and $1.85 levels would be the next targets.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.