Stay informed with free updates

Simply sign up to the US banks myFT Digest — delivered directly to your inbox.

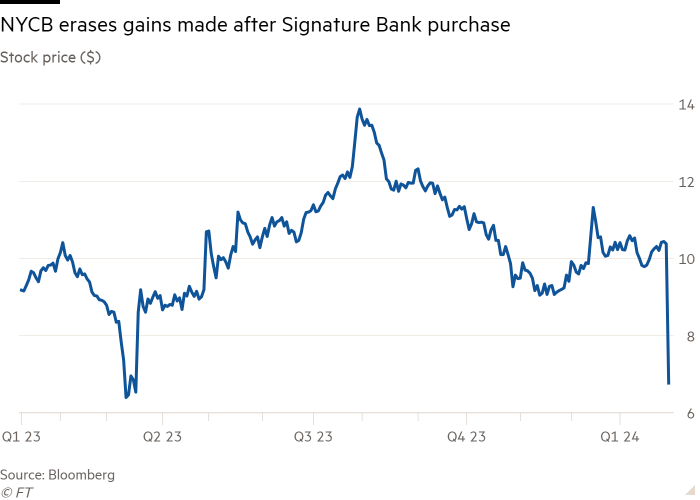

Shares of New York Community Bancorp plunged on Wednesday after the lender that bought failed Signature Bank in the middle of last year’s regional banking turmoil cut its dividend to boost its capital and reported a surprise loss.

NYCB had been seen as one of the winners of the 2023 crisis that sank Signature, Silicon Valley Bank and First Republic. The suburban New York-based institution last March acquired most of Signature’s deposits and just over a third of its assets including nearly $13bn in loans, in a deal arranged by the Federal Deposit Insurance Corp.

Investors at the time propelled NYCB shares higher.

Those gains were completely erased after NYCB reported its fourth-quarter results on Wednesday. The regional bank lost $260mn in the final three months of 2023, down from a gain of $164mn in the same quarter a year before. The bank blamed in particular a rise in expected loan losses, many of which emanated from loans tied to office buildings, bank executives said.

Thomas Cangemi, NYCB chief executive, was asked on a call with analysts about the Signature acquisition and the reason for the unexpected loan losses. He said the bank was cutting its dividend in order to remain compliant with banking regulations as a result of the takeover, which pushed the bank’s assets over $100bn and into a stricter requirement for the minimum amount of capital it must hold.

NYCB shares were down 36 per cent as of midday, having earlier dropped as much as 46 per cent. Other regional bank stocks also fell, with the KBW Regional Bank index declining more than 3 per cent.

As for losses, Cangemi said the bank had spent the fourth quarter stress-testing its commercial real estate loan portfolio, a portion of which it acquired with Signature, and had raised its estimate of expected losses on office loans.

Cangemi said the bank looked at “the general office weaknesses throughout the country. And we really did a deep dive in the office portfolio as well as thinking through payment shock and interest rate shock given the rise of interest rates that we’ve experienced over the past few quarters.”

Alexander Yokum, an analyst at CFRA, downgraded NYCB’s shares to “hold” on Wednesday, saying: “Our diminished view reflects falling confidence in management’s ability to integrate its recent acquisitions in an efficient manner.”

NYCB said its net interest margin, or difference between its loan profits and its funding costs, fell nearly half a percentage point, because of the need to raise cash and other liquid assets in order to meet increased regulatory burdens. The bank also said the integration of the Signature acquisition would take longer than expected, and may not be completed until sometime next year.

Cangemi also maintained that despite the longer than expected integration period the acquisition was going well. “In respect to Signature and the teams that we’ve built, they’re doing a phenomenal job as indicated in my prepared remarks, they’ve had a great year,” Cangemi told analysts.