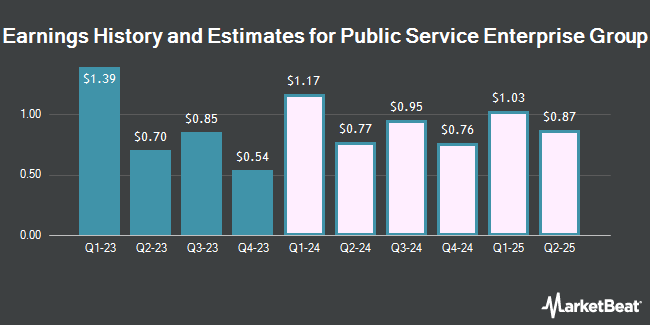

Public Service Enterprise Group Incorporated (NYSE:PEG – Free Report) – Analysts at Zacks Research increased their FY2025 EPS estimates for shares of Public Service Enterprise Group in a report released on Tuesday, March 26th. Zacks Research analyst R. Department now expects that the utilities provider will post earnings of $3.93 per share for the year, up from their prior estimate of $3.90. The consensus estimate for Public Service Enterprise Group’s current full-year earnings is $3.67 per share. Zacks Research also issued estimates for Public Service Enterprise Group’s Q4 2025 earnings at $0.69 EPS.

A number of other analysts also recently commented on the stock. Guggenheim downgraded shares of Public Service Enterprise Group from a “buy” rating to a “neutral” rating and set a $61.00 target price on the stock. in a report on Monday, January 22nd. JPMorgan Chase & Co. boosted their target price on shares of Public Service Enterprise Group from $68.00 to $70.00 and gave the stock an “overweight” rating in a report on Friday, December 1st. Morgan Stanley reiterated an “overweight” rating and issued a $70.00 target price (up from $61.00) on shares of Public Service Enterprise Group in a report on Monday. BMO Capital Markets dropped their target price on shares of Public Service Enterprise Group from $64.00 to $63.00 and set a “market perform” rating on the stock in a report on Tuesday, February 27th. Finally, TheStreet upgraded shares of Public Service Enterprise Group from a “c+” rating to a “b-” rating in a report on Wednesday, March 6th. One analyst has rated the stock with a sell rating, five have issued a hold rating and seven have issued a buy rating to the company’s stock. According to MarketBeat, Public Service Enterprise Group currently has a consensus rating of “Hold” and a consensus price target of $66.38.

Get Our Latest Report on Public Service Enterprise Group

Public Service Enterprise Group Stock Up 0.2 %

PEG stock opened at $66.78 on Thursday. The company has a current ratio of 0.67, a quick ratio of 0.46 and a debt-to-equity ratio of 1.15. The firm’s 50-day moving average is $61.14 and its two-hundred day moving average is $61.16. Public Service Enterprise Group has a 52 week low of $53.71 and a 52 week high of $67.02. The company has a market capitalization of $33.30 billion, a price-to-earnings ratio of 13.02, a price-to-earnings-growth ratio of 2.86 and a beta of 0.57.

Public Service Enterprise Group (NYSE:PEG – Get Free Report) last released its quarterly earnings results on Monday, February 26th. The utilities provider reported $0.54 EPS for the quarter, topping analysts’ consensus estimates of $0.52 by $0.02. Public Service Enterprise Group had a net margin of 22.81% and a return on equity of 11.53%. The company had revenue of $2.61 billion for the quarter, compared to the consensus estimate of $2.45 billion. During the same period in the previous year, the firm earned $0.64 EPS. Public Service Enterprise Group’s revenue was down 17.0% on a year-over-year basis.

Public Service Enterprise Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, March 29th. Investors of record on Friday, March 8th will be given a dividend of $0.60 per share. The ex-dividend date of this dividend is Thursday, March 7th. This is an increase from Public Service Enterprise Group’s previous quarterly dividend of $0.57. This represents a $2.40 dividend on an annualized basis and a yield of 3.59%. Public Service Enterprise Group’s payout ratio is presently 46.78%.

Insider Activity at Public Service Enterprise Group

In related news, CEO Ralph A. Larossa sold 1,374 shares of the business’s stock in a transaction that occurred on Monday, March 4th. The shares were sold at an average price of $63.00, for a total transaction of $86,562.00. Following the transaction, the chief executive officer now directly owns 153,721 shares of the company’s stock, valued at $9,684,423. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other Public Service Enterprise Group news, SVP Richard T. Thigpen sold 4,800 shares of the stock in a transaction on Thursday, March 14th. The shares were sold at an average price of $64.18, for a total value of $308,064.00. Following the completion of the sale, the senior vice president now directly owns 31,122 shares of the company’s stock, valued at approximately $1,997,409.96. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, CEO Ralph A. Larossa sold 1,374 shares of the stock in a transaction on Monday, March 4th. The shares were sold at an average price of $63.00, for a total transaction of $86,562.00. Following the completion of the sale, the chief executive officer now directly owns 153,721 shares of the company’s stock, valued at $9,684,423. The disclosure for this sale can be found here. Over the last three months, insiders have sold 6,574 shares of company stock valued at $419,108. Corporate insiders own 0.57% of the company’s stock.

Institutional Trading of Public Service Enterprise Group

A number of hedge funds have recently bought and sold shares of PEG. Vanguard Group Inc. lifted its holdings in shares of Public Service Enterprise Group by 13.0% during the 3rd quarter. Vanguard Group Inc. now owns 61,673,935 shares of the utilities provider’s stock worth $3,509,864,000 after acquiring an additional 7,103,657 shares during the period. JPMorgan Chase & Co. lifted its holdings in shares of Public Service Enterprise Group by 2.2% during the 3rd quarter. JPMorgan Chase & Co. now owns 33,020,997 shares of the utilities provider’s stock worth $1,879,225,000 after acquiring an additional 726,613 shares during the period. State Street Corp lifted its holdings in shares of Public Service Enterprise Group by 1.1% during the 2nd quarter. State Street Corp now owns 30,420,823 shares of the utilities provider’s stock worth $1,904,648,000 after acquiring an additional 324,392 shares during the period. Geode Capital Management LLC lifted its holdings in shares of Public Service Enterprise Group by 2.2% during the 1st quarter. Geode Capital Management LLC now owns 10,253,655 shares of the utilities provider’s stock worth $638,876,000 after acquiring an additional 221,305 shares during the period. Finally, Legal & General Group Plc lifted its holdings in shares of Public Service Enterprise Group by 8.4% during the 4th quarter. Legal & General Group Plc now owns 7,638,084 shares of the utilities provider’s stock worth $467,068,000 after acquiring an additional 588,839 shares during the period. 73.34% of the stock is owned by institutional investors.

Public Service Enterprise Group Company Profile

Public Service Enterprise Group Incorporated, through its subsidiaries, operates in electric and gas utility business in the United States. It operates through PSE&G and PSEG Power segments. The PSE&G segment transmits electricity; distributes electricity and natural gas to residential, commercial, and industrial customers; and appliance services and repairs to customers through its service territory, as well as invests in solar generation projects, and energy efficiency and related programs.

See Also

Receive News & Ratings for Public Service Enterprise Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Public Service Enterprise Group and related companies with MarketBeat.com’s FREE daily email newsletter.