NatWest criticised after hiking bonuses

NatWest is facing criticism after hiking its bonus pool to £367m, from 298m a year earlier.

Fran Boait, executive director at campaign group Positive Money, points out that the taxpayer bailed out Royal Bank of Scotland, as NatWest was then known, after the financial crisis.

“NatWest is using bumper profits to deepen its bonus pool, not to support the public, who bailed it out just 15 years ago, and who are now footing the bill of the higher interest rates boosting those very same profits.

“It is completely unjust that bankers who create only more wealth for the already-rich get pay boosts whilst those who educate, transport and care for the public are forced onto picket lines for fair wages.

“Clearly the government was reckless in its decision to remove the cap on bankers’ bonuses, which needs to be reinstated, and should tax these unmerited profits in order to provide struggling communities with financial support.”

Banks such as NatWest have benefitted from higher net interest margins due to rising interest rates – lifted to tackle the inflation surge from the energy crisis.

Unite general secretary Sharon Graham is calling for a windfall tax on the banks:

“It’s offensive that government ministers are insisting NHS workers take another savage pay cut while their big City banker friends are given carte blanche to make billions.

“Rishi Sunak needs to put a real powerful windfall tax on the excess profits of the big banks. Like the energy companies, the greed of the big banks is fuelling the cost-of-living crisis.

An epidemic of profiteering has brought this country to its knees – workers are not responsible for it and should not have to pay for it. It is time the government held the big business interests that profit, while everyone else pays the price, to account.”

Key events

Filters BETA

Alex Lawson

More energy news: The bailed-out Germany energy giant Uniper has taken a €4.4bn hit

after losing control of its Russian subsidiary last year, our energy correspondent Alex Lawson reports.

The company, which was rescued by the German government last year, posted a record €19.1bn net loss for 2022 as it became one of the biggest corporate casualties in the fallout from the war in Ukraine.

Uniper agreed a bailout package with the government after it was left stranded by the drop in gas deliveries from Russia. It was once the largest importer of Russian gas in Germany.

Uniper said that it has been given no access to information from its Russian subsidiary, the power generation company Unipro, since last year.

On Friday, the company said it will overcome the problems generated by Russian gas cuts by 2024 at the latest.

Uniper owns the Ratcliffe-on-Soar coal-fired power station, which has formed part of this winter’s emergency contingency plans, as well as a string of gas plants in the UK.

UK supermarket chain Asda to raise staff pay by 10%

Sarah Butler

Asda is investing £141m in raising shop workers’ hourly pay by 10% by July, my colleague Sarah Butler reports.

Workers will receive an hourly minimum of £11 from 2 April and then £11.11 from 2 July – up from £10.10 at present.

The pay rise puts pay for hourly paid staff at Asda on a par with Aldi and Sainsbury’s, currently the highest payers among UK supermarkets.

Mohsin Issa, Asda’s co-owner, said:

“We appreciate the great job that our store colleagues do representing Asda while serving customers day in and day out.

We know that rising living costs are affecting customers and colleagues alike and recognise we have a responsibility to support them during these challenging times.”

The pay rise comes after Asda said it wanted to cut more than 300 jobs while 4,300 staff would receive a pay cut after the supermarket announced a swathe of changes to night shifts, Post Office outlets and pharmacies to cut costs.

The UK’s third largest supermarket chain, said 211 night shift manager roles were going and a further 4,137 staff would lose out on premiums of at least £2.52 an hour for working nights as it switched the restocking of packaged groceries and frozen food to daytimes and evenings.

In addition, Asda planned to close seven of its 254 in-store pharmacies, putting 62 jobs at risk, including 14 pharmacists.

Back on NatWest, the BBC points out how the bank has been quicker to pass on higher interest rates to borrowers than to savers, saying:

[CEO Alison] Rose said the bank has passed on interest rate increases to savers and claimed that the bank was “helping people build regular saving habits”.

But analysis for the BBC by financial information service Moneyfacts showed that the increase on standard mortgage charges far outstripped that on standard savings accounts – by a factor of six times.

Interest on the bank’s variable rate easy access savings account was increased by just 0.55 percentage points from 0.1% to 0.65% over 2022.

Meanwhile, over the same time its standard variable mortgage rate climbed more than three percentage points from 3.59% to 6.74%.

Technically, mortgage rates are priced relative to swap rates, which are influenced by movements in gilt yields (the interest rates on UK government bonds). Those yields, though, are set by market expectations of inflation and central bank interest rates.

Schiphol: We’ve never let so many passengers and airlines down before

Photograph: Evert Elzinga/EPA

Dutch airport management firm Schiphol Group has admitted that it let down passengers and airlines last year.

In its latest financial results, Schiphol Group resists the temptation to sugarcoat its performance. Insead, it announces that today it “publishes poor financial results for 2022”.

The group, which owns and operates Amsterdam Airport Schiphol, Rotterdam The Hague Airport and Lelystad Airport, made an underyling loss of €28m for 2022 after being hit by staffing problems.

It says “upscaling issues” overshadowed the operational performance of Schiphol, causing it to incur €120m of extra costs.

Ruud Sondag, CEO of Royal Schiphol Group, is engagingly blunt about the poor performance.

“Never before in Schiphol’s history have we disappointed so many travellers and airlines as in 2022.

Our efforts and hard work did not lead to the necessary improvements in the system and, as a result, we were not able to provide the service we wanted. 2022 will therefore go down as a bad chapter in our own history books. But it is also a chapter we will not forget, so that all new chapters we write will be better.

We are working hard on this, and in 2022 we started to implement structural improvements. Because we have to do better. And I am convinced that we can.”

There were severe delays at Schipol last year, as demand jumped as Covid-19 restrictions were relaxed. Staff shortages at security led to long queues, and flight cancellations. A wildcat strike by KLM ground crew also caused disruption last April.

NatWest’s financial results suggest its customers are more resilient than economists had feared,

Steve Clayton, head of equity funds at Hargreaves Lansdown, explains:

NatWest acknowledge that there is a gloomy case that can be made about the outlook as rising interest rates and high utility bills bite, but their customers are so far resilient.

Bad debt losses were just 0.09% of the loan book and much of that was assumptions about what’s coming next, rather than loans that have already soured.

In the currency markets, the pound is trading at its lowest level against the US dollar in six weeks.

Sterling dropped to $1.1913 this morning, the lowest since 6th January, despite hopes of a breakthrough in the Northern Ireland protocol.

The issue is that the dollar is strengthening after data this week showed that producer price inflation is higher than thought.

This has led to a ‘significant’ shift in market expectation for US interest rates this year, says Neil Wilson of Markets.com:

A fortnight ago markets priced in one more hike and 2 cuts this year – now pricing the chance of 4 hikes this year. The 2yr US Treasury yield has risen from 4.1% to 4.7% in barely two weeks.

The 10yr is now above 3.9%, its highest since November, from below 3.4% at the start of February. December 2023 Fed Funds implied rate has risen to 5.10% from 4.35%.

What’s this telling us as investors? Fundamentally, the market and perhaps the Fed were declaring victory on inflation too soon. It’s the old pivot narrative from last year but remember the Fed was never going to pivot and now can’t because it’s become data dependent; and the data won’t allow it.

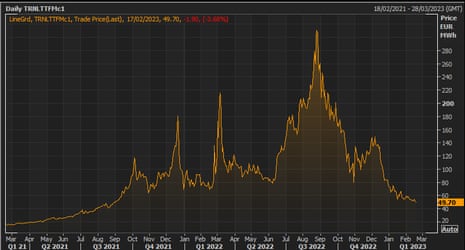

European natural gas prices fall to 18-month low as energy crisis eases

In the energy markets, the price of European natural gas has fallen to its lowest level in almost 18 months.

The European benchmark contract for gas delivery next month dropped 5% this morning to a low of €48.90 per megawatt hour, the lowest since the end of August 2021.

In late August 2022 the price surged over €300/MWh, when Russia intensified the squeeze on Europe by turning off the Nord Stream 1 gas pipeline for maintenance.

Gas prices have fallen after European countries scrambled to fill storage tanks to see them through the winter, and also cut demand, helped by a mild winter.

Salomon Fiedler, economist at Berenberg bank, says

Since Putin’s decision to invade Ukraine, natural gas has been the single most important driver of Europe’s economic fortunes.

Without the sharp reduction in Russian gas deliveries, Europe would now likely be enjoying above-average growth rates due to the post-COVID-19 rebound, instead of suffering near stagnation.

But at least Europeans have been able to avoid the worst outcome: outright gas shortages necessitating forced cut-offs, which would wreak havoc on the economy.

EU gas storage remains at reasonably comfortable levels, Fiedler adds:

On 14 February stores were 65% full – close to the maximum for that time of the year and 19ppt higher than the average for the 2015-20 reference period.

NatWest’s CEO, Dame Alison Rose, has denied that its jump in profits last year was just due to higher interest rates (which swelled its net interest margins).

Asked about the £5.1bn profits achieved last year, Rose told Sky News it was a “strong performance by the bank”.

She sad it’s due to the “continuing delivery of our strategy, and the strong support of our customers”.

Rose points out that NatWest stayed in the mortgage market during the disruption last year, caused by the mini-budget, and is continuing to “lend responsibly” to businesses.

Rose warns, though, that customers still face “challenging macroeconomic conditions”.

NatWest’s shares are still dragging the FTSE 100 index down this morning.

They’re down 6.25%, despite the bank swelling its profits last year.

Traders are calculating that the bank may not make such large profits from higher interest rates this year, as Russ Mould, investment director at AJ Bell, explains:

NatWest may have delivered its biggest profit since the financial crisis but investors are far more concerned about what’s coming next and that’s less positive.

“Income for 2023 is now guided to be lower than expected, with the key net interest margin metric also falling short. Costs are also set to be higher than forecast.

“While impairments are anticipated to be a bit lower than estimates the market may be cautious of taking NatWest at its word given the difficult backdrop for consumers and businesses which could lead to a big increase in bad debts.

“With the rate cycle nearing its peak the recent momentum in banking shares could be difficult to maintain. Whether this will act as a catalyst for the government to sell down more of its remaining stake remains to be seen.

“NatWest’s rescue by the state during the financial crisis means criticism of its tardiness in passing on higher interest rates to savers arguably carries more weight and that could have some impact on profitability.”

Kalyeena Makortoff

The chief executive of NatWest, Alison Rose, received a £5.2m pay packet in 2022, becoming the bank’s second-highest-paid boss after the controversial ex-banker Fred Goodwin, after the lender reported its largest profit since before the 2008 financial crisis.

The bailed out bank – which is still 44% owned by the taxpayer – revealed on Friday that Rose’s pay had soared by 46% from £3.6m a year earlier, partly because of the higher value of shares doled out as part of her long-term incentive plan.

NatWest increased the total bonus pool for its bankers to £367m from 298m a year earlier, after making bumper profits of £5.1bn in 2022, up 33% and the highest since 2007, when profits hit £10bn.

The rise in profits last year was partly as a result of a rise in loan and mortgage costs, exacerbating the wider cost of living crisis for borrowers.

NatWest criticised after hiking bonuses

NatWest is facing criticism after hiking its bonus pool to £367m, from 298m a year earlier.

Fran Boait, executive director at campaign group Positive Money, points out that the taxpayer bailed out Royal Bank of Scotland, as NatWest was then known, after the financial crisis.

“NatWest is using bumper profits to deepen its bonus pool, not to support the public, who bailed it out just 15 years ago, and who are now footing the bill of the higher interest rates boosting those very same profits.

“It is completely unjust that bankers who create only more wealth for the already-rich get pay boosts whilst those who educate, transport and care for the public are forced onto picket lines for fair wages.

“Clearly the government was reckless in its decision to remove the cap on bankers’ bonuses, which needs to be reinstated, and should tax these unmerited profits in order to provide struggling communities with financial support.”

Banks such as NatWest have benefitted from higher net interest margins due to rising interest rates – lifted to tackle the inflation surge from the energy crisis.

Unite general secretary Sharon Graham is calling for a windfall tax on the banks:

“It’s offensive that government ministers are insisting NHS workers take another savage pay cut while their big City banker friends are given carte blanche to make billions.

“Rishi Sunak needs to put a real powerful windfall tax on the excess profits of the big banks. Like the energy companies, the greed of the big banks is fuelling the cost-of-living crisis.

An epidemic of profiteering has brought this country to its knees – workers are not responsible for it and should not have to pay for it. It is time the government held the big business interests that profit, while everyone else pays the price, to account.”

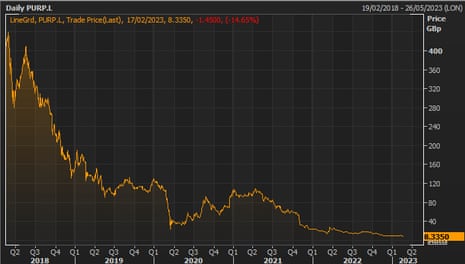

Online estate agent Purplebricks is looking for a buyer, after issuing a profit warning this morning.

Purplebricks now expects to make a loss of between £15m and £20m on an adjusted EBITDA basis, worse than the £8.8m expected in December.

The company told shareholders this morning that its turnaround strategy, focusing on profitable areas, had caused more disruption to sales than expected, meaning new instructions from home sellers were lower than expected.

Shares in Purplebricks have dropped 15% this morning to 8.3p, a record low. They floated at 100p in late 2025, and five years ago they were worth £4 each.

In recent years the company has faced legal action from 100 estate agents who argue that they were in effect employed by the company so should be entitled to holiday pay and pension contributions. It also set aside up to £9m after its lettings business failed to follow law protecting tenants’ deposits.

Today, CEO Helena Marston says Purplebricks’ market value does not reflect its ‘upside potential’:

“We have undertaken a huge amount of work in the last 9 months to improve our sales business, raise standards, establish Purplebricks Financial Services, and stabilise lettings, all of which means the Company has never been in better shape for the future.

Yes, the actions we have taken have caused more short-term disruption to our Q3 performance than anticipated, but we remain confident in returning to positive cash generation in early FY24. We recognise that our upside potential is not currently reflected in our market valuation, which is why the entire Board has therefore concluded that a strategic review is now in the best interests of all shareholders.”

The writing is “purple” on the wall. Purple bricks shares slide 12% “The Group now expects to deliver revenue for FY23 of between £60 million and £65 million, and an adjusted EBITDA loss of between £15 million and £20 million.”

— Emma Fildes (@emmafildes) February 17, 2023

Getting back to the latest retail sales figures, Philip Shaw of Investec says it is “notable” how high street spending has taken the strain of the cost of living crisis.

He says:

-

UK retail sales volumes picked up by 0.5% in January after a revised 1.2% decline in December (as covered in our introduction).

Consensus and Investec estimates had been for a 0.3% fall. Sales ex-fuel climbed by 0.4%. Food store sales slipped by 0.5% on the month, while non-food outlets saw a 0.6% increase. Within the latter category though, sales in textiles and clothing stores dropped sharply, by 2.9%. Meanwhile volumes in non-store retailing (mainly online retailers) were buoyant, recording a gain of 2.0%.

-

The retail sales series is notoriously volatile and especially so around the Christmas and New Year period. Accordingly we would hesitate to read too much from this specific data point. Indeed the background remains unequivocally weak. Sales volumes are now 5.1% lower than a year ago and we would note that there was only one monthly increase during the entirety of 2022.

UK fuel imports jumped 119% last year

The UK spent more than twice as much importing fuel last year than in 2021, due to the energy price shock.

New figures just released by the ONS show that the value of fuel imports increased by 119% in 2022, an increase of £63.6bn.

This was driven by the price of gas reaching record levels last year, says the ONS, adding:

-

High fuel prices have had a knock-on effect on the pricing of other commodities, with increased transport and production costs contributing to rising prices across most commodities.

-

The Russian invasion of Ukraine disrupted trade in multiple commodity types, resulting in changes to trade partners for the UK and increased import prices.

More expensive fuel helped to push up the cost of all UK imports by 32.3%, or by £155.5bn last year.

The ONS says:

Goods imports increased steadily throughout 2022, with imports from both EU and non-EU countries substantially higher.

Soros: Adani crisis will spur ‘democratic revival in India’

George Soros also suggested last night that the crisis at beleaguered conglomerate Adani Group could lead to a “democratic revival in India” – remarks that have prompted anger in New Delhi.

Speaking in Munich ahead of the Security Conference which started today, Soros cited the report from Hindenburg Research which accuses Adani Group of “brazen stock manipulation”, “accounting fraud” and “money laundering.”

Adani has denied the allegations, but has seen the value of companies in the conglomerate tumble.

Soros suggests the charges could harm India’s prime minister Narendra Modi, as business tycoon Gautam Adani is a close ally.

Soros sais:

Adani Enterprises tried to raise funds in the stock market, but he failed. Adani is accused of stock manipulation and his stock collapsed like a house of cards. Modi is silent on the subject, but he will have to answer questions from foreign investors and in parliament.

This will significantly weaken Modi’s stranglehold on India’s federal government and open the door to push for much needed institutional reforms.

I may be naïve, but I expect a democratic revival in India.

This has caused a backlash in India this morning, where cabinet minister Smriti Irani has accused Soros of interfering in the country’s electoral process.

She called on the Indian population to respond in unity to “foreign powers who try to intervene in India’s democratic processes”.

Hannah Ellis-Petersen, our South Asia correspondent, has looked at the links between Adani and Modi here:

George Soros calls for weather control to fight climate change

George Soros, the veteran philanthropist and former financier, has called for scientists to use experimental geosolar technologies to create white clouds over the Arctic, to protect it from melting.

In a speech last night, before the 2023 Munich Security Forum began, Soros warned that the melting of the Greenland ice sheet “poses a threat to the survival of our civilization”.

Soros said “human ingenuity” must be deployed to repair “a previously stable system”, before climate change reaches a tipping point.

Soros explained that he had sought advice from climate scientist Sir David King, after extremely warm weather was recorded in Greenland in July and September 2022.

“The melting of the Greenland ice sheet would increase the level of the oceans by seven meters”, Soros warned, but King – who has advised the UK government on climate – has a theory, and a plan to combat the problem.

Soros explains:

He [King] has developed a theory which is widely shared by climate scientists. It holds that the global climate system used to be stable but human intervention disrupted it. The Arctic Circle used to be sealed off from the rest of the world by winds that blew in a predictable, circular, counter-clockwise direction, but man-made climate change broke this isolation.

The circular wind used to keep cold air inside the Arctic Circle and warm air out. Now cold air leaks out from the Arctic and is replaced by warm air that’s sucked up from the south.

This explains, among other things, the Arctic blast that hit the United States last Christmas and the cold wave that hit Texas recently.

The Arctic Ocean used to be covered by pristine snow and ice that reflected the sun in what is called the “albedo effect”. But rising temperatures have caused the ice to melt and the Greenland ice sheet is no longer so pristine; it is covered by soot from last year’s forest fires on the West Coast of America, Arctic shipping and other causes.

Sir David King has a plan to repair the climate system. He wants to recreate the albedo effect by creating white clouds high above the earth. With proper scientific safeguards and in consultation with local indigenous communities, this project could help restabilize the Arctic climate system which governs the entire global climate system.