Farmer: It’s a bad deal; UK gave away too much

UK farmers are concerned that the British government gave too much away with the Australia/New Zealand trade deal which began at midnight, creating a bad precedent for the future.

Farmer David Barton, the chair of the National Farmers Union’s Livestock Board in the South West of the country, fears there will be a cumulative effect

Barton, who runs a beef suckler herd and grows cereals, told Radio 4’s Today Programme that the UK gave away “so much on this deal”.

He said:

It is such a bad deal because they gave so much away and any other trading nation will want exactly the same deal. So it’ll be the communicative effect over time that will be the problem.

So it may not be Australia on its own, but it will be other nations that want that deal.

The United States will certainly want that same deal of unlimited access to the UK markets. It is an important market, it’s a lucrative market.

Barton also warned of the risk of a ‘race to the bottom’ on food standards, given the differences between the UK and Australian agriculture, saying:

A race to the bottom for cheap food is not the way to sustain food security in the UK.

Plaid Cymru MP Ben Lake, the party’s agriculture spokesman in Westminster, fears the trade deals mark the “beginning of a worrying chapter” for Welsh farming.

Lake warned:

“As negotiations progress with Canada and Mexico, it is crucial that market protections are upheld.

“The UK Government’s evident failure to champion the interests of the Welsh economy in previous negotiations underlines the importance of according the devolved nations a role in future talks.”

Key events

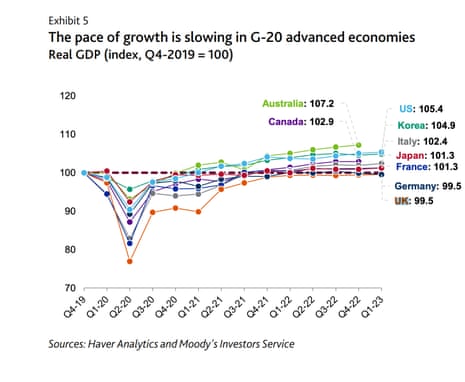

Moody’s predicts ‘mild recessions’ in the US, UK, and Germany,

Rating agency Moody’s has predicted there will be “mild recessions” in the US, UK, and Germany.

In a new report, Moody’s warns that tight financing conditions will lead to “a downshift” in global economic growth in the second half of this year, and also slow the recovery in 2024.

Moody’s predicts that the UK economy will contract by 0.1% this year, as the economy suffers from rising prices and high interest rates.

They predict that the Bank of England will raise interest rates by another quarter of one percent, to 4.75%, and keep monetary policy tight over the coming years, hitting spending and investment.

Moody’s says:

The UK’s relatively short-dated mortgage market means that around half of outstanding mortgages have a floating rate or will need to be refinanced at higher rates this year, which will reduce household disposable income

The money markets currently predict UK interest rates could peak near 5.5% by the end of this year, however, after inflation was troublingly high in April.

There are three principal risks to the global macroeconomic outlook, Moody’s warns: policymakers in advanced economies could fail to curb inflation, financial stability risks could materialize and spread through the economy, or a potential US government default if the US debt limit isn’t lifted in time.

Moody’s also predicts a mild recession in the US, despite policymakers reaching a tentative deal on the US debt limit to avoid a US default.

Annual US economic growth is expected to slow to around 1% in 2023 and 2024, just half the 2.1% recorded in 2022. But that includes a couple of quarters of sequential contraction, meaning a technical recession, which would push up unemployment.

Elsewhere, Moody’s says the steady decline in energy prices in Europe since the beginning of this year has provided much needed respite for households and businesses, leading to modest increase in growth in Italy and France this year.

But Germany’s economy is not expected to grow during 2023, having already dropped into recession in the first quarter of this year.

Moody’s says:

In Germany’s case, manufacturing sector weakness, labor shortages, high interest rates and sticky and elevated inflation cloud the economic outlook.

Monzo boss defends latest loss

Kalyeena Makortoff

Monzo’s CEO has defended the online bank’s latest annual loss, saying that profitability has been a “choice” for the online bank, which will be last among rivals Starling and Revolut to turn a profit when it swings into the black this year.

The online bank has reported a loss of £116m for the year to February, slightly less than the £199m loss a year earlier.

That was despite seeing revenues more than double to £355m, as its customer base, transaction fees, and loan book grew over the financial year. It gained a further 1.5m personal customers – bringing its total to 7.2m – helping deposits jump 34% to £6bn.

However, its revenues were offset by a jump in staff and investment costs, as well as money put aside for potential defaults that Monzo said was primarily linked to a growing loan book, rather than any signs of trouble among its borrowers.

Monzo CEO TS Anil said he wasn’t concerned about the fact that Monzo was lagging behind rival online banks like Starling and Revolut, both of which have now reported annual profits.

“We’ve always seen profitability as a choice, meaning if we had wanted to be profitable – and that was all we were solving for – we could be profitable many quarters ago.”

Instead, he said Monzo was investing in new products, staff and infrastructure, and that the losses were “completely in line with the plan” that has been backed by investors.

Furthermore, he said, the bank reported its first monthly profit in March and is now set to join its rivals with its first annual profit at the end of the financial year.

Monzo also revealed that TS Anil’s remuneration dropped to £2.6m from £4m last year, a figure that it said has previously been boosted by a relocation package and the vesting of shares in his pay packet.

Irish core inflation overtakes headline measure

In Ireland, core inflation has overtaken the headline cost of living measures – a sign that inflationary pressures are building.

New data shows that annual Irish inflation, on an EU-harmonised basis, rose by 5.4% over the last year, down from 6.3% in the year to April, the lowest since January 2022.

Worryingly, core inflation in Ireland accelerated to 5.7% from 5.2% a month earlier. That measure exclude the costs of energy and unprocessed food.

It’s the first time the rate of HICP excluding energy and unprocessed food has surpassed the headline rate since prices began to rise sharply in late 2021, Reuters reports.

It’s unusual for core inflation to be higher than the headline rate. Core inflation is designed to strip out the volatile factors that push up the cost of living, and to give a clearer picture of underlying price pressures.

In the UK in April, core inflation rose, to 6.8%, even though the headline inflation measure fell to 8.7%. If energy costs keep falling, and food price pressures abate, UK core inflation could potentially rise over the main CPI index too….

Back in the eurozone, inflation has dropped in Italy but remains painfully high.

The EU-harmonised index of consumer prices in Italy fell to 8.1% on an annual basis this month, down from +8.7% in April, statistics body ISTAT reported, which is higher than expected.

The fall was due to a drop in the annual inflation rates for energy, processed food and alcohol, transport services and industrial goods.

Today’s plan for a new CBI insists the organisation has cultural strengths, including a “Clear purpose”, a “collegial work environment” and “pockets of good practice” (despite the lack of consistent and well-established processes).

But it concedes there are cultural weaknesses, and identifies five:

-

Values and behaviours gap: The CBI lacks a shared internal cultural ‘glue’ or foundation of clear values and conduct to guide expectations of behaviours.

-

Lack of cohesive, consistent organisational leadership capabilities: Leaders, and the Board, have focused on external goals, with limited oversight of the organisation or attending to risks.

-

Under-developed skills for people and team management: Abilities and behaviours needed to manage people and teams effectively and inclusively have been under-valued and under-developed.

-

Inattention to people and culture function: People and culture/HR has not been prioritised as a core strategic function with sufficient oversight from leaders and the Board.

-

Under-developed and inconsistent infrastructure: There is a lack of clear or consistent structures and processes for decision making. Activities are driven by the priorities of the Director General, with deep organisational siloes.

The governance changes being proposed by the CBI include:

-

Accelerated changes in Board membership.

-

More frequent Board meetings.

-

An enhanced and additional committee structure, including a new People and Culture Committee.

-

An external expert Culture Advisory Committee chaired by Jill Ader and supported, amongst others, by Elizabeth Broderick, founder of Champions of Change Coalition.

-

A new Chair of Audit and Risk Committee, Victoria Cochrane, former Global Managing Partner, Risk Management at EY.

-

Annual re-election of the Board at the AGM.

The CBI is also pledging to produce a Business Manifesto for the General Election, by the end of 2023, and to engagae with ministers and officials to help shape economic debates.

You can read the CBI’s new proposals online, here: A renewed CBI.

Introducing them, president Brian McBride says:

For almost 60 years, the CBI has been the recognised voice of business in the UK, representing the common interests of businesses across all sectors of industry and all regions and nations of the country. In that time, we have also continuously curated and shared best practice from and across industry, as a further service to our members.

The irony contained in the latter point is not lost on me. Whilst striving to represent and support our members to the highest standards, we simultaneously underestimated the daily effort required to maintain a great culture and the operational excellence of a growing CBI. The consequences of that failure, you already know. We share a deep sense of responsibility to put things right, so that we can continue to support you through the vital representation that the CBI provides. This prospectus will tell you how the CBI has changed and is continuing to change, in order to do that.

Ffion Hague to evaluate CBI governance

The CBI has also hired board evaluation expert Ffion Hague to lead a “comprehensive” examination” of its governance structures and processes.

The findings of this work are expected to be shared with the CBI Board and with members by end of July 2023.

Brian McBride, CBI President, says:

“The need to bolster the CBI’s governance structures is something that has come through loud and clear during this period.

We are making significant and fundamental changes to improve our organisation for the better and for the people working in it. We remain determined to restore the confidence of our members, and that of our many stakeholders, in the CBI.”

Hague, a specialist in corporate governance, has been conducting board evaluations for over a decade, working with blue-chip companies including Vodafone, Schroders, Rio Tinto, Marks & Spencer and Centrica, and also the British Red Cross.

Ffion Hague married former Conservative leader William Hague in 1997, having worked in the Civil Service and taught the then-Secretary of State for Wales how to sing the Welsh national anthem.

She has also worked as a broadcaster, includig on the Welsh language TV channel S4C, and wrote a book on the women in prime minister David Lloyd George’s Life.

CBI to recruit new president as part of governance shake-up

Newsflash: The CBI is to recruit a new president as part of a governance overhaul which it has just unveiled.

The business lobby group, which is battling for survival in the wake of sexual misconduct allegations, says it will conduct an “accelerated search” for a successor to president Brian McBride.

McBride, the CBI says, will immediately start the search for his successor while he oversees the changes being implemented at the group. The handover will begin no earlier than 1 January 2024, they add.

This is part of a range of changes set out by the CBI this morning, to changes to its culture and to rebuild ties with government. They are outlined in a prospectus shared with members ahead of a crunch meeting and confidence vote by its members on 6 June.

The measures include creating a new People and Culture sub-committee of the CBI Board that will focus on people and HR matters at the CBI, and an external expert Culture Advisory Committee.

Voting opens on Wednesday, with the results expected to be announced soon after next week’s meeting.

My colleague Anna Isaac reports:

Developed while the group mothballed its activities in April and May, the turnaround plan aims to “transform” the CBI’s culture in the long term, the group said. It follows an independent investigation into its handling of complaints by the law firm Fox Williams and an examination of its culture by the ethics consultancy Principia Advisory.

“We are making radical and rapid changes to upgrade our governance structures and processes,” said the group’s new director general, Rain Newton-Smith.

She added: “Principia’s expert findings show that while our purpose and hard work to influence and inform on behalf of our members gives us a strong identity and motivates our staff, that focus has come at a cost. Blanket accusations of the CBI’s culture being toxic are not correct, but we have work to do to embed a consistent set of values for all of our staff.”

More here:

People getting a poor interest on their bank savings should “shop around”

Back in the UK, a government minister says that people who feel they are getting “very poor” interest on their savings from their bank should “shop around and find one that will pay a better rate”.

This is a hot issue, with banks slow to pass on the recent increases in Bank of England interest rates to savers.

Yesterday. Which? waned that the high street banks are shortchanging customers by hundreds of pounds every year, with measly savings rates.

Ttoday, Work and Pensions Secretary Mel Stride was asked by Kay Burley on Sky News what the Government should do about banks who are not offering competitive levels of interest rates for savers.

Mr Stride, who chaired the Treasury Select Committee for three years, said:

“I think, broadly speaking, the banking and financial services sector is a relatively efficient and highly competitive marketplace.

“So you would expect as one particular bank starts changing rates others to follow, but it is sticky, and of course, Government, the Business Department and Treasury and others are often involved in discussions with banks about exactly those kinds of things.”

Stride stressed it is a “free market”, before adding:

“My advice generally would be if you feel you’re getting a very poor rate with one particular institution is shop around and find one that will pay a better rate, and there are those out there.”

The UK’s City watchdog is introducing a new “consumer duty” this summer, which may may trigger a clampdown on those banks who are not offering fair rates to consumers.