Jean-Christophe Babin, CEO of the Italian jewellery house Bulgari, picks up the B.zero1 Kada bracelet, costing about Rs 12 lakh, from a tray full of iconic jewels, at its store in Mumbai’s Jio World Plaza. “We are probably the only global jeweller to have Indian products such as the mangalsutra and the kada,” he says. “The mangalsutra sold out extremely quickly. We had to make it again,” he says. Bulgari’s mangalsutra costs over Rs 4 lakh. “But it’s always sold out at the stores.”

Bulgari’s jewellery and watches have been lapped up by Indians. “We recorded our best ever sales performance in India in 2023,” says Babin. According to consulting major Bain & Co, the luxury goods market, which includes personal luxury goods, jewellery, home décor, cars, boats and spirits, is now worth $17 billion in India, and is expected to be $90 billion by 2030.

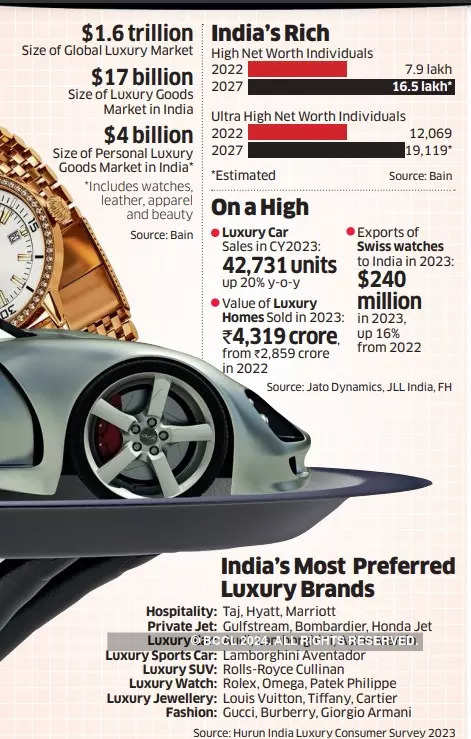

Out of the $17 billion market, the personal luxury goods market, which includes watches, leather, apparel and beauty, is $4 billion. The global luxury market, meanwhile, is gargantuan, at €1.5 trillion ($1.6 trillion). The club of rich Indians is growing—and they are devouring luxury. The number of high net worth individuals (HNIs), with asset value of at least $1 million, was 7.9 lakh in 2022, and is estimated to be 16.5 lakh in 2027. The number of ultra-high net worth individuals (UHNIs), with an asset value of at least $30 million, was about 12,000 in 2022 and could cross 19,000 by 2027, according to Bain.Meanwhile, Mumbai has overtaken Beijing as Asia’s billionaire capital for the first time, with 93 members in the exclusive league, according to the Hurun Global Rich List 2024. That is showing. Luxury players have recorded high sales in category after category. Luxury car sales in India touched a record high of 42,731 units in CY2023, up 20% year-on-year, according to Jato Dynamics, thanks to growing disposable income and the propensity among buyers to uptrade after the Covid-19 pandemic. The trend is expected to continue in 2024, fuelled by new launches and rising aspirations.

2023 was also a year of record sales, albeit on a small base, for super-luxury cars that are priced above Rs 2 crore. Lamborghini, whose models start from Rs 3.8 crore in India, sold 103 units last year as against 92 units in 2022. Meanwhile, luxury sports carmaker Porsche reported its best retail sales in India, with 914 units in 2023, up 17% from 2022. Luxury housing, costing Rs 50 crore and above, has had a storied growth.

Luxury homes worth Rs 4,319 crore were sold in CY2023 as against Rs 2,859 crore in 2022, according to data from JLL India. This surge in sales value was accompanied by a rise in the number of transactions, with at least 45 luxury homes sold in 2023, compared with 29 in the previous year.

“There is a significant evolution in India’s luxury market, marked by a surge in HNIs and UHNIs. Notably, there is now a shift, with consumers, who once sought luxury abroad, turning their attention to India,” says Anurag Mathur, partner at Bain & Co. “As global brands expand their reach, indigenous luxury brands are also growing. This dynamic landscape signals a promising trajectory of growth,” he adds.

Experts say social media has contributed to the growth of brands, particularly in apparel and fashion sectors. Says Mathur: “Social media has extended the reach of brand messages significantly. By collaborating with celebrities, brands have become more accessible to a wider audience.”

Will this momentum sustain in 2024 and beyond? Gopal Asthana, CEO of Tata CLiQ, says the growth of the luxury market is for the long-term. “Ecommerce plays a crucial role for luxury brands, given that wealth is spread across the country,” says Asthana, adding that Tata CLiQ Luxury, with its pan-Indian reach and consumer-friendly policies, has been enabling and encouraging the shift in buying luxury online. On Tata CLiQ Luxury, the top performing categories last year were apparel, footwear and watches.

As affluence grows, people’s tastes and preferences also change. This is particularly noticeable in the younger generation, say many companies. Neeraj Walia, MD and CEO of Montblanc India, says that despite the prevalence of gadgets, a culture of writing and journalling continues to expand in the luxury space. “A significant proportion of young individuals are thriving financially and are becoming luxury buyers. The younger generation seeks products with personal connections and meaningful stories behind them. Our limited-edition lines, such as Writers Edition and Masters of Art, resonate well with this demographic,” he adds.

FASHION MOMENT

Apart from India-first innovations by brands and the launch of the luxury mall, Jio World Plaza, in Mumbai, one of the defining moments in the calendar was Dior’s show—the fashion house included India in its seasonal calendar and turned a marigold-decked Gateway of India into a runway for its pre-fall 2023 collection.

Designer Sabyasachi Mukherjee, too, says 2023 was “very significant” for him, as it saw the opening of his largest flagship store in Mumbai and the launch of his jewellery boutique at Taj Krishna in Hyderabad. His global collaborations include a limited-edition lipstick collection with Estee Lauder and the launch of eyewear with Morgenthal Frederics. He flags a concern as well: “Infrastructure and distribution channels required for a luxury boom are still a challenge, but once we bridge that gap, India will be on the rise.”

To smoothen the journey, the IndoFrench Chamber of Commerce & Industry (IFCCI) has launched a committee with brands such as Louis Vuitton, Dior and Hermès on it to make them understand the opportunities in India and to create a synergy with Indian craftsmanship which is now going global. “India is a key market and a priority for a lot of foreign companies, including those in the luxury sector. Meanwhile, Indian designers like Rahul Mishra and Gaurav Gupta are regulars at the Paris Fashion Week,” says Payal S Kanwar, director general, IFCCI.

“There is an intersection of brands looking at India and Indian craftsmanship going out of the country. A lot of new, small-scale luxury players are also looking at entering India.”

DESPITE CHALLENGES

Lack of quality retail space is a major challenge for brands that want to expand in India. Pushpa Bector, senior executive director at DLF Retail says despite that barrier and intermittent challenges stemming from disruptions in the supply chain since 2020, the luxury retail industry witnessed significant growth in 2023, particularly in segments such as high-end fashion, accessories and jewellery. Brands made more “concerted effort” last year to resonate more effectively with Indian consumers. “They undertook measures such as aligning pricing structures with global standards and diversifying product offerings in local outlets to cater to diverse tastes,” she adds.

Even the opening of the Ram temple in Ayodhya proved to be a blessing for the Spanish luxury porcelain brand Lladró—the sales of its Ram Darbar collection, costing Rs 2.3 lakh for the open edition and Rs 13.45 lakh for the limited-edition set, jumped three times in the first quarter of 2024, y-o-y, says Nikhil Lamba, CEO, Lladró India. In August, the company will launch a limited-edition sculpture of Lord Hanuman as part of its Spirit of India collection. Its limited edition Lord Balaji, launched in 2018 with just 299 units, saw a 38% appreciation in price last year and now costs Rs 33 lakh each. There are less than five unsold pieces globally. Swiss watch exports to India will confirm that time has indeed come for luxury in the country. The export of Swiss watches to India has jumped to 218.8 million Swiss francs ($240 million) in 2023, a 16% jump from 2022, according to the Federation of the Swiss Watch Industry (FH).

In an earnings call for Q3 FY2024, Pranav Saboo, CEO of luxury watch retailer Ethos Watch Boutiques, said its operational revenue was up 22.4% to `281.2 crore from `229.7 crore, year on year. “We aim to reach sales of 100,000 watches per year over the next 10 years at an average of CHF 2,500 per watch ex-factory price.”

It’s not just watches. Sales of Swiss chocolate retailer Läderach have surged over five times since its launch in India last year, says Riti Gupta, spokesperson for Läderach India. Gupta says global brands are flocking to the country, recognising the potential of its luxury market and driven by a rising affluent class and their desire for high-end experiences.

“This momentum is fuelling our expansion plans, and we should be able to announce the opening of more stores this year,” she says. Bector of DLF Retail says expectations for 2024 remain buoyant, with optimism prevailing across the board. “Growth is expected to be driven by the burgeoning segment of affluent Indian consumers as well as a youthful demographic keen to embrace luxury products,” she says.

“With brands expected to refine their strategies and offerings to meet the evolving preferences of the Indian market, the stage is set for another year of robust expansion and innovation in the luxury landscape.”