Posted:

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LUNC bulls looked to rally again with 12% gains over the past day.

- Speculators bid strongly for further gains, as evidenced by a rise in Open Interest.

Luna Classic’s [LUNC] 12% pump over the past day took it above the 23.6% Fib level ($0.00006296), as bulls looked to rally again. Despite a slight retracement, the short-term momentum remained with buyers.

Read Luna Classic’s [LUNC] Price Prediction 2023-24

Meanwhile, Bitcoin [BTC] continued its volatile movement. Over the past 24 hours, the king coin rose to $27.8k, dipping to $27.2k before stabilizing at $27.4k as of press time.

Can this bullish rally go one step further?

The latest bullish rally looked to reverse LUNC’s extended bearish market structure. The previous rally on 19 August quickly caved to the selling pressure, with price declining to the $0.000055 price zone.

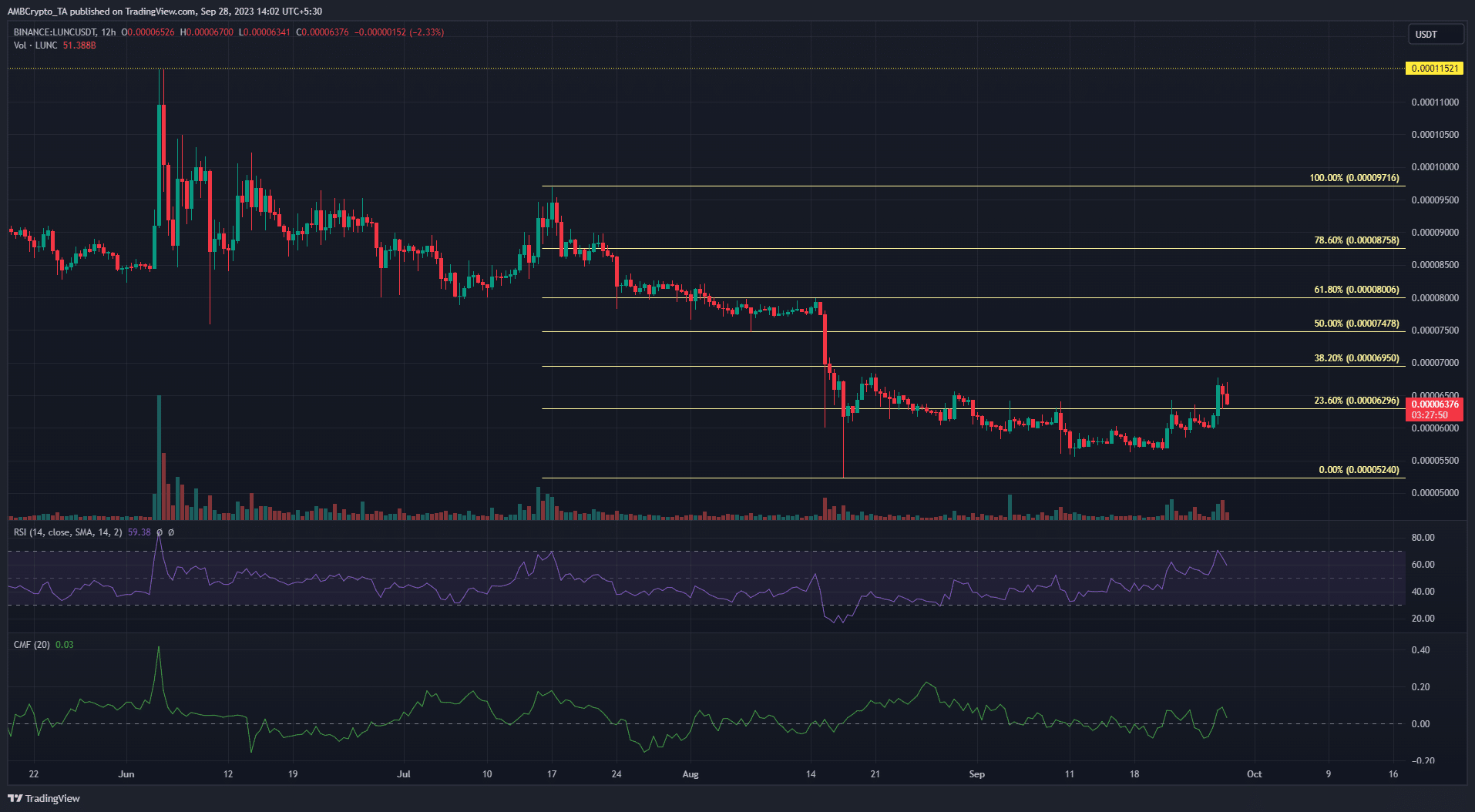

Plotting the Fibonacci retracement levels from the recent high on 17 July to the recent low on 17 August showed key price levels for consideration.

With the recent pump taking LUNC above the 23.6% Fib level, bulls could look to build on by targeting the $0.0000695 price level (38.2% Fib level). However, if bears push price below the 23.6% Fib level again, then Luna Classic could settle into a range between $0.0000524 and $0.00006296.

In the meantime, buyers were encouraged by the Relative Strength Index’s (RSI) reading of 61 which signaled strong buying pressure. Similarly, the Chaikin Money Flow (CMF) was positive, reflecting decent capital inflows.

Futures market reacted positively to price pump

How much are 1,10,100 LUNCs worth today?

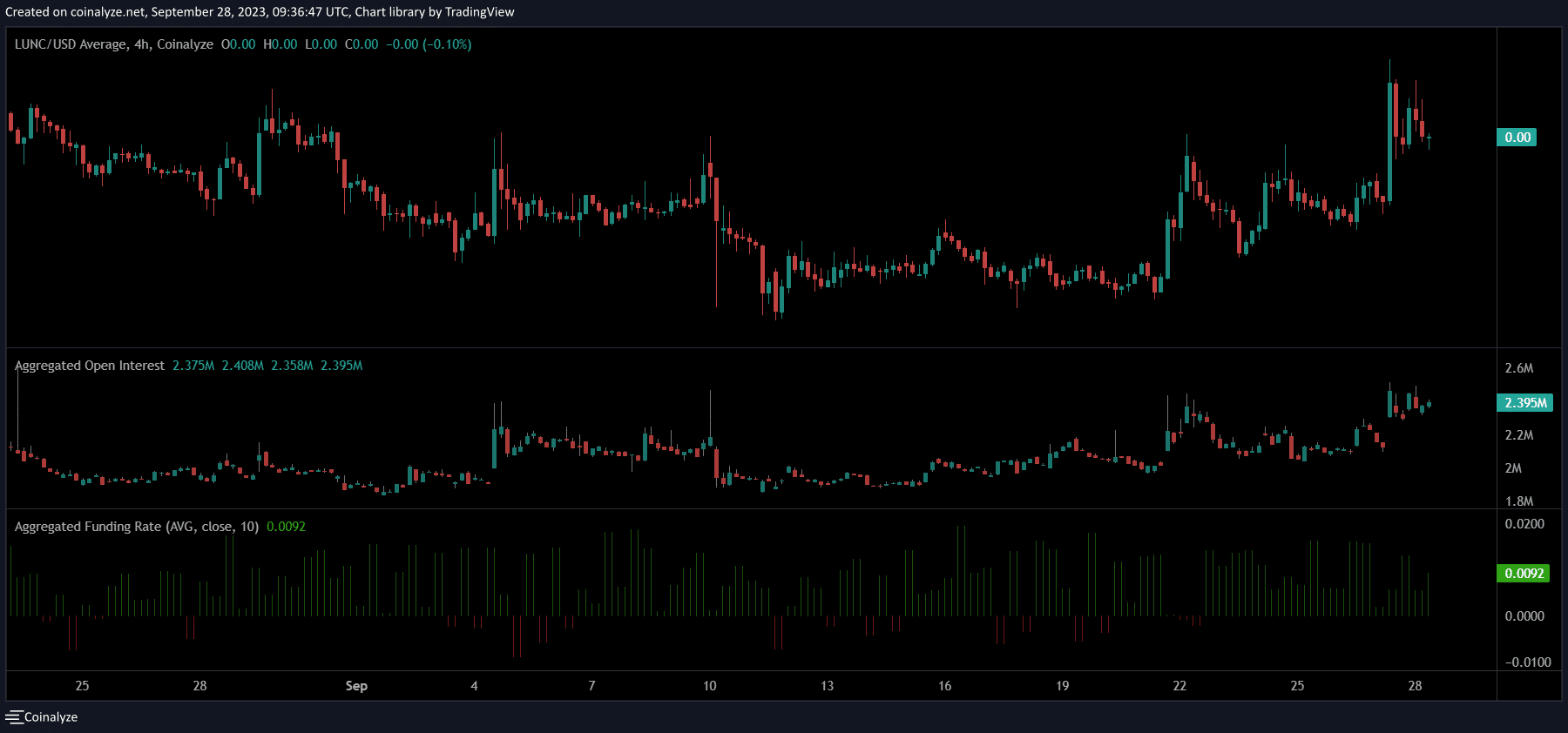

The sharp rise in Open Interest (OI) hinted at the willingness of market speculators to back further bullish gains. Data from Coinalyze showed that the OI rose by 5.89% over the past 24 hours. This saw the OI jump from 2 million to 2.4 million.

Similarly, the funding rate was positive, highlighting the good possibility for buyers to register more gains in the short term.