Italy approves 40% windfall tax on banks

The Italian government is hitting the country’s banks with a new windfall tax, to help families through the cost of living squeeze.

Italy’s cabinet yesterday approved a 40% windfall tax on bank profits this year, with the proceeds earmarked to help mortgage holders and cut taxes.

Deputy prime minister Matteo Salvini told a news conference:.

“One only has to look at the banks’ first-half 2023 profits, also the result of the European Central Bank’s rate hikes, to realise that we are not talking about a few millions, but we are talking one can assume of billions.”

Italy’s banks (like those in the UK) have benefited from rising interest rates over the last year.

Last moth Intesa Sanpaolo, Italy’s biggest bank, lifted its profit outlook for the current year after beating forecasts with a €2.27bn net profit for April-June.

Campaigners in the UK have also been pushing for a windfall tax too.

Fran Boait, executive director of campaign group Positive Money, wrote back in February:

Just like oil and gas companies, banks are cashing in on the cost of living crisis, and should be subject to the same taxes on their unearned windfalls.

The former Bank of England deputy governor Sir Charlie Bean has supported the plan, suggesting that it could raise tens of billions of pounds. If the government increased the existing surcharge on bank profits from 3% to 35%, in line with the energy profits levy, this would raise £67bn over the next five years.

A bank windfall tax must avoid the loopholes the energy levy contained, which BP and Shell have exploited in recent months. The oil giants have been allowed to avoid paying the tax in full by chucking loads of money into fossil fuel exploration.

Key events

Shares in Italian banks are sliding, after the country’s cabinet agreed to impose a 40% windfall tax on their profits this year.

Intesa Sanpaolo’s shares have tumbled almost 8%, while Unicredit are down over 6%.

Italy approves 40% windfall tax on banks, to be limited to 2023

Context: Italian banks have been enjoying a huge rally this year due to good profitability, robust CET1 ratios, generous distribution strategies. Unicredit alone is +70% YTDhttps://t.co/i4WncdTrNg

— Joumanna Nasr Bercetche 🇱🇧 (@CNBCJou) August 8, 2023

Italy approves 40% windfall tax on banks

The Italian government is hitting the country’s banks with a new windfall tax, to help families through the cost of living squeeze.

Italy’s cabinet yesterday approved a 40% windfall tax on bank profits this year, with the proceeds earmarked to help mortgage holders and cut taxes.

Deputy prime minister Matteo Salvini told a news conference:.

“One only has to look at the banks’ first-half 2023 profits, also the result of the European Central Bank’s rate hikes, to realise that we are not talking about a few millions, but we are talking one can assume of billions.”

Italy’s banks (like those in the UK) have benefited from rising interest rates over the last year.

Last moth Intesa Sanpaolo, Italy’s biggest bank, lifted its profit outlook for the current year after beating forecasts with a €2.27bn net profit for April-June.

Campaigners in the UK have also been pushing for a windfall tax too.

Fran Boait, executive director of campaign group Positive Money, wrote back in February:

Just like oil and gas companies, banks are cashing in on the cost of living crisis, and should be subject to the same taxes on their unearned windfalls.

The former Bank of England deputy governor Sir Charlie Bean has supported the plan, suggesting that it could raise tens of billions of pounds. If the government increased the existing surcharge on bank profits from 3% to 35%, in line with the energy profits levy, this would raise £67bn over the next five years.

A bank windfall tax must avoid the loopholes the energy levy contained, which BP and Shell have exploited in recent months. The oil giants have been allowed to avoid paying the tax in full by chucking loads of money into fossil fuel exploration.

The 12.4% drop in China’s imports last month is partly due to some commodity prices having dropped compared to last year.

Oil, for example, is rather cheaper than in summer 2022.

Xu Tianchen, senior economist at the Economist Intelligence Unit, explains:

“For example, China is importing more oil but at lower prices, as a result the volume of crude oil accelerated in July, but the import value slowed.

Similar logic holds for grains and soybeans.”

China’s economy is being pulled down by weaker global demand and a domestic slowdown, says Jim Reid, strategist at Deutsche Bank.

Here’s his take on today’s trade data from China:

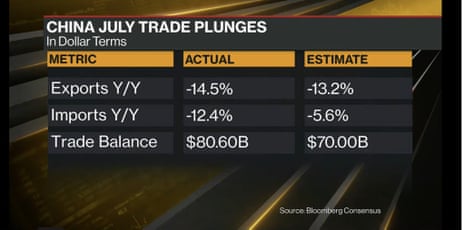

Early morning data from China showed that exports dropped for the third consecutive month, sliding -14.5% y/y in July (v/s -13.2% expected; -12.4% in June) and recording its biggest drop since July 2020, highlighting that the world’s second biggest economy is being dragged lower by weakness in global demand and a domestic slowdown.

At the same time, imports contracted -12.4% y/y in July (-5.6% expected) compared to a -6.8% drop in the previous month.

Stocks in China are lower today as investors digest the slowdown in trade last month.

The Chinese CSI 300 index is down 0.3%, while Hong Kong’s Hang Seng index has dropped by 2%.

The FT points out that the Hang Seng China Enterprises index was down 1.8% following Tuesday’s trade data release.

Louis Tse, managing director of Hong Kong-based broker Wealthy Securities, said:

“There’s a lot of selling happening today on the back of this export data.”

Economist Alicia García-Herrero says today’s Chinese trade data is a shock to the markets:

#China‘s July #trade data has shocked markets: plummeting exports (much worse than in June), even more than imports (YoY) both with double-digit negative growth. Recent #RMB appreciation from stimulus announcements wiped out with this worrisome data (1/2)

— Alicia GarciaHerrero 艾西亞 (@Aligarciaherrer) August 8, 2023

Exports fell much more to the US (and the EU to a lesser extent). Hard to tell if derisking or waning demand. The fact that exports to Russia also fell 8% may point to the latter (2/2)

— Alicia GarciaHerrero 艾西亞 (@Aligarciaherrer) August 8, 2023

Reuters: China’s July imports from Russia fall for first time since Feb 2021

Today’s customs data also shows that China’s imports from Russia dropped in July, Reuters reports.

This is the first monthly decline since February 2021 when imports of oil and other goods began steadily rising after the outbreak of conflict in Ukraine, Chinese customs data showed.

China’s imports from Russia shrank 8% to $9.2bn last month from a year earlier, in contrast to 15.7% growth in June, according to Reuters calculations based on data from the General Administration of Customs. China has been buying discounted Russian oil, coal, and certain metals.

Exports to Russia expanded 52% in July to $10.28bn, much slower than the 90.9% growth registered in June.

While China’s exports to Russia held up relatively well compared with subdued demand elsewhere, they were a small portion of overall exports, at only 3% in January-July.

The value of bilateral trade between the two dropped to $19.49bn in July from June’s $20.83bn, which was the highest since the Ukraine war began.

China’s trade slumps, threatening hopes of recovery

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A tumble in China’s trade last month has reignited concerns that the world’s second-largest economy is stumbling.

China’s imports and exports fell much faster than expected in July, new trade data today shows, indicating weak economic activity and subdued domestic demand

Imports dropped 12.4% in July year-on-year, customs data showed on Tuesday, much worse than the 5% fall which economists expected.

Exports also fell faster than expected, contracting by 14.5%, after June’s 12.4% fall.

Inbound shipments saw their biggest decline since January, when COVID infections shut shops and factories, Reuters reports.

This slowdown in trade will put more pressure on Beijing to provide fresh stimulus to prop up demand, as the initial economic bounce following the relaxation of pandemic restrictions in late 2022 fades.

It could also be a sign that global economy demand is slowing, meaning less demand for Chinese exports.

Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd, said the deepened slump in imports “is a reflection of weak domestic demand,” adding:

“The overall consumption and investment growth probably both stayed quite weak in China.”

Julian Evans-Pritchard, head of China Economics at Capital Economics, explained:

“Most measures of export orders point to a much greater decline in foreign demand than has so far been reflected in the customs data.

“And the near-term outlook for consumer spending in developed economies remains challenging, with many still at risk of recessions later this year, albeit mild ones.”

It could also indicate that inflationary pressures will continue to ease in the coming months.

BIG plunge in trade

China said Tuesday that exports fell by 14.5% in July from a year ago, while imports dropped by 12.4% in U.S. dollar terms https://t.co/yq8ayERKG2— Joumanna Nasr Bercetche 🇱🇧 (@CNBCJou) August 8, 2023

Also coming up today

Britain’s retail sector stumbled in July too, new figures show, forcing retailers to slash their prices to drum up business after dismal summer weather and ever-higher interest rates combined to depress consumer spending in July.

The monthly health check of high street and online spending patterns from the British Retail Consortium and the consultancy KPMG reported a steep annual drop in the volume of sales and an increasing number of retailers offering promotional offers to woo consumers reluctant to part with their cash.

The agenda

-

7.45am BST: French trade data for June

-

11am BST: US NFIB Small Business Optimism Index

-

1.30pm BST: US balance of trade for June

-

1.30pm BST: Canada’s balance of trade for June