Lincoln Financial Field, affectionately called “The Linc”, has been at the centre of plenty of chaos over the years.

The Philadelphia stadium — home of the Eagles — has seen the city’s notoriously rowdy American football fans throw batteries, climb lampposts and trash its surroundings. It even briefly had a jail for fans to sober up after brawls, though it didn’t rival its predecessor’s jail-and-courtroom combo.

A different type of mess is now surrounding Lincoln National Corp, the Radnor, Pennsylvania-based insurance company that lends the stadium its name. Its stock has slid 31 per cent in March, and has lost 68 per cent of its value over the past year.

Some of Lincoln’s share-price tumble came after it took a Q3 charge of around $2bn, largely because it adopted new accounting assumptions. These new estimates reflect a smaller number of policyholders letting their coverage lapse in the future, which would force the insurer to pay out more policies. (For readers who are inclined to learn more, this 2016 academic paper covers why it’s good for insurers when people let their life-insurance policies lapse.)

That might seem like an idiosyncratic one-time accounting quirk. But the slide didn’t stop there.

Other big life insurers have been under pressure too: Prudential Financial is down 18 per cent this month, AIG is down 20 per cent and MetLife has declined 21 per cent. Pet insurer Trupanion (not shown below, as it’s not a lifer) is down 29 per cent in just one week, after its chief financial officer announced plans to resign.

There are a handful of broad market stresses on life insurers. One that stands out in the harsh light of the regional-banking mess is that they own large portfolios of fixed-rate bonds. And like US banks, those portfolios have experienced unrealised losses as the Federal Reserve has raised rates.

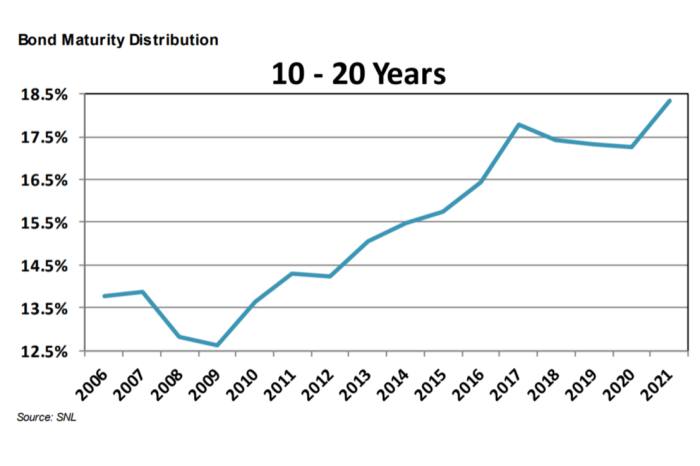

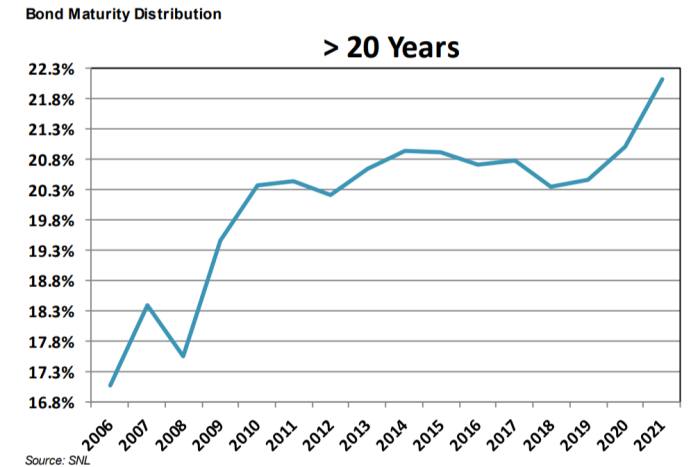

Many life insurers have spent the past decade investing in longer-dated bonds in an attempt to boost yield when rates were near zero, as Piper Sandler’s John Barnidge pointed out in a late 2022 note:

A few examples from 2022 annual reports: Lincoln had roughly $12bn of net unrealised losses on its $111bn available-for-sale bond portfolio. Prudential had more than $23bn, or 7.5-per cent of its AFS portfolio, AIG had nearly $30bn of unrealised losses on its $226bn portfolio, and MetLife had $29bn, or 12 per cent of its AFS bonds.

One important caveat applies to this part of the story, however.

Safe assets’ unrealised losses are mainly worrisome if those assets need to be liquidated. Treasuries and safe bonds presumably have no default risk, so investors are guaranteed to have their principal repaid if they hold them to maturity.

But life insurers have also been using riskier assets to combat low Treasury yields. Depending on the insurer, those holdings may become less forgiving over time.

The chart below, from Piper Sandler’s Barnidge, shows the quality of just insurers’ bond portfolios over time. Lower numbers mean higher quality, and all investment-grade bonds get a score of 1 or 2:

Lincoln Financial again proves to be a helpful example. It reported in its latest 10-K that it had $16.9bn of commercial-mortgage loans on its books at the end of 2022. The largest share of commercial mortgages — more than 27 per cent — are in California, home of Silicon Valley Bank’s panicky venture capitalists, and more importantly many of their portfolio companies.

In its latest earnings report, Lincoln’s management also cited unexpectedly low returns on $3bn of “alternative investments” as a drag on profits. The investment income from Lincoln’s portfolio of alternatives, which may include venture capital, hedge funds, real estate and oil and gas portfolios according to the 10-K, was literally decimated from the prior year:

That decimation — meaning it is one-tenth of its prior size — happened even as Lincoln’s alternative investments made up a larger share of its portfolio:

Income is certainly crucial for insurers’ business, but lower-than-expected investment returns don’t create the type of stress experienced by SVB Financial and its peers this month. Those were classic depositor runs, driven by flighty depositors getting spooked and racing to withdraw their money before others, which could force sales of underwater securities and crystallise the losses.

That’s where life insurers differ significantly from the banks; their liabilities aren’t really comparable to deposits that can be withdrawn on demand.

Insurers can experience sudden changes in their liabilities when they change their actuarial assumptions, the way Lincoln did with its predictions about policy lapses. Prudential, for example, saw a drag on its 2Q22 results from an increase in reserves on its individual-life-insurance business. That reflects, rather morbidly, fewer policyholders giving up their coverage before dying, along with higher mortality rates from Covid-19’s shift to an “endemic” disease.

And life-insurance policyholders can also decide to withdraw their cash and cancel their policy, so a slow-moving run is technically possible.

But for life insurance policies and some types of annuities, people have to pay “surrender fees” to withdraw the cash value of their policy. Insurers sometimes have waiting periods of 30 days or longer before customers get their cash, according to CreditSights. That creates significantly more protection from withdrawals than most banks have on their deposits.

What’s more, three of the big life insurers under pressure — MetLife, Prudential and AIG — have in the past been named as systemically important financial institutions. Those designations have since been withdrawn, but the category was required to stress test for “run” scenarios, meaning “this isn’t some nebulous or unknown risk factor” for life insurers, writes CreditSights analyst Josh Esterov.

Still, the CreditSights analysts don’t think it’s impossible for an individual insurer to experience a run. So they estimated how much money policyholders would need to withdraw before life insurers need to worry about raising additional liquidity:

On an industry aggregate basis, in a given year we’d need to see somewhere between a 35% — 70% increase in surrender activity to breach this threshold. On a name-specific basis this is still well within the realm of possibility, but it’s unlikely such an event would be a systemic issue as opposed to an idiosyncratic issue.

In other words, insurers would need to see a lot more withdrawals before the industry as a whole needs to start worrying about liquidity.

That liquidity could have a range of different sources, the analysts add: “This is likely the point where insurers would consider strategic alternatives for raising capital (FHLB borrowing, selling securities, etc).”

That highlights another possible lifeboat for insurers that find themselves in trouble: The Federal Home Loan Banks, a popular financing option for regional banks under stress, can also lend to many life insurers. Approximately 216 US “insurance groups” can borrow from the FHLB system, according to CreditSights.

It’s important that the analysts cite “insurance groups” and not individual insurance companies, because life insurers’ corporate structures and regulatory environments are very different than banks’.

In the US, life insurers are regulated by individual state governments. This means bigger insurers operate multiple different operating companies, split up by state, all under the umbrella of one unregulated holding company.

If an insurer’s state subsidiary runs into trouble it has more options than a bank would, Esterov told FT Alphaville:

[Insurers] have a lot of freedom at the [holding company] level for how they want their company to look. It’s at the [operating company] level where things get very highly regulated. What you can see is because of that. You almost never see debt issuance at the [operating company] level.

Let’s say insurers decide to raise capital from public markets, issuing new debt or equity instead of selling investments at a loss or borrowing from a FHLB. They could borrow at the holding-company level and transfer funding to troubled operating companies, Esterov says. Because regulators don’t allow the funding to go back to the holding company, they treat it like equity financing, he added.

But for an isolated or small operating-company failure, insurers may have another option, which is to say f**k it and bail. As Esterov told Alphaville:

It’s very possible that [a hypothetical insurer’s] New York company is in distress and the Florida company is doing fine . . . At the holdco level, whatever capital exists, the insurer can support the opco or walk away. The ability to walk away, if [the subsidiary is] not a significant operating company, can be very helpful.

But there’s reputational risk.

To quote a problematic American novel: “Until you’ve lost your reputation, you never realise what a burden it was or what freedom really is.”

Philadelphia’s unruly sports fans, at least, know this well.