Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Big housing associations in England have warned that building new affordable homes is becoming financially impossible, worsening the downturn in property supply.

Higher interest rates have not only slowed commercial developers’ output but also stretched the financing model for affordable housebuilding, which has become more reliant on private sector loans owing to cuts in government funding.

“We can’t build houses,” said Clare Miller, chief executive of Clarion, the UK’s largest housing association, which manages 125,000 homes. “We have built nearly 10,000 over the past five years and the vast majority of these have been for affordable tenures, but finances are no longer working.”

How to pay for new affordable homes — of which England needs 145,000 a year to meet demand, according to the National Housing Federation — will be a key issue in the general election expected this year. Labour, the main opposition party, has promised the “biggest boost to affordable housing for a generation”.

The slowdown in activity by non-profit housing associations, which build and run much of the UK’s affordable housing, has also caused concern among private developers. They fear its impact on the construction sector, supply chains and the ability of both to recover and deliver badly needed homes when the market bounces back.

FT Survey on UK investment

Have you found a great British bargain? Tell us the UK stocks that you think are worthy of including in your Isa – and why via a short survey

“In previous downturns, housing associations made countercyclical investments that helped sustain a level of housing delivery and kept more of the construction supply chain in business,” said Rob Perrins, chief executive of FTSE 100 developer Berkeley Group.

He added that housing associations were “currently not able to perform that crucial role and the industry is losing capacity, which will take a long time to build back up again”.

UK commercial housebuilders built about a quarter fewer homes in 2023 than the year before, according to equity analysts at Investec, with building rates forecast to be flat in 2024.

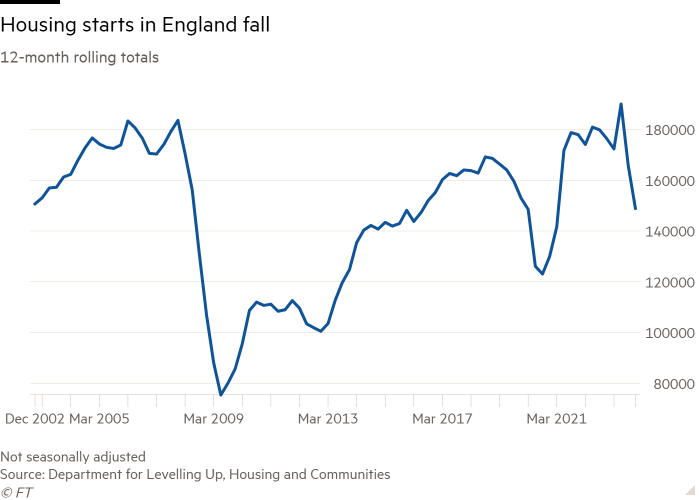

Since last year, housing associations across England have cut their forecasts for building over the next five years by 64,000 homes, according to government data. Separate official figures released last week showed housing starts in the fourth quarter of 2023 were half the 10-year average.

Paul Hackett, chief executive of Southern Housing, one of the largest housing associations, said the group had stopped all new development for 2024 and 2025. He added that the sector would probably struggle to build for the next several years — creating a widening gap between affordable housing needs and the supply.

Government grants typically funded only one-fifth of the cost of building new affordable homes, Hackett noted.

A record 109,000 households in England were living in temporary accommodation between July and September last year, according to the most recent government data. More than 1.2mn households are on the waiting list for a social home.

“There is a time bomb that is being created by the inability of housing associations to respond to needs,” said Hackett. “It is the human consequences. It is only going to get worse.”

Alongside interest rates — which traders expect the Bank of England to cut from 5.25 per cent to 4.5 per cent this year — housing associations have been hit by fast-rising construction costs. The need to spend on fire safety works, fix mould problems and make environmental upgrades in their existing portfolios has added to the demands on their budgets.

Nick Walkley, UK president at real estate advisers Avison Young and former chief executive of Homes England, the government’s housing delivery body, said: “It feels like the system is ‘maxed out’ because there isn’t enough public subsidy in there . . . restarting is going to be really difficult.”

Housing association bosses have called on the government to increase financial support and agree a new long-term rent settlement. The current agreement has been modified in five of the past eight years to reduce the maximum rent increase, according to the National Housing Federation (NHF), which represents housing associations.

“The rent setting policy in England is verging on madness and runs against creating the long-term stable funding environment we need,” said Andy Hulme, chief executive of housing association Hyde.

The housing department said 696,100 new affordable homes had been delivered since 2010 and that it was “working closely with housebuilders and the wider sector on our long-term plan for housing to deliver more affordable homes to rent and buy”.

Limits on rental income have compounded the long-term effect of a near two-thirds cut to government funding for new social and affordable housing under the 2010-15 Conservative-Liberal Democrat coalition government.

Alistair Smyth, NHF director of policy, said funding for affordable housing was “now inextricably linked to interest rates because of the shift in the funding model since 2010”.

“The model for building new social homes is not holding up well to the change in interest rates, because it is so dependent on private sector finance, the cost of which is largely determined by interest rates,” he added.