Also in this letter:

■ Accel on D2C’s next opportunity

■ Digit IPO opens on May 15

■ Smaller IT firms up their M&A game

Groww moves domicile to India from the US

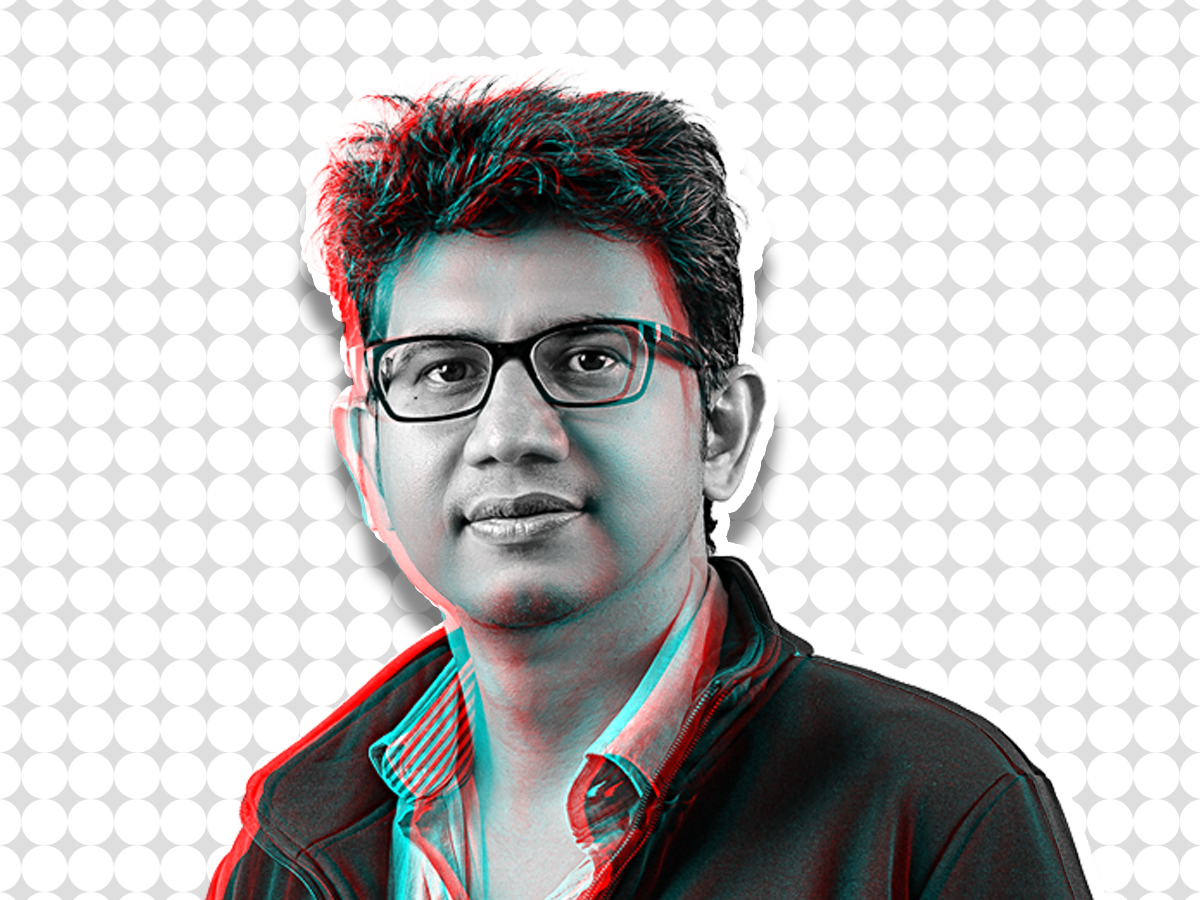

Lalit Keshre, cofounder and CEO, Groww

Wealth management platform Groww has completed moving its domicile to India from the US, founder Lalit Keshre said. Here are the details.

Homecoming: Groww — a Y Combinator-alumnus with its parent in the US — has formally moved its domicile to India, CEO Keshre said on X, formerly Twitter. This makes Groww the second major fintech startup after Walmart-backed PhonePe to have completed the migration back home.

CEOspeak: “As of March 2024, Groww has completed its domicile transition back to India. For our customers, we have always been an India-based organisation for all practical purposes since day 1. With this update, the Groww group and its subsidiaries are completely based in India,” Keshre said in his post on X on Thursday.

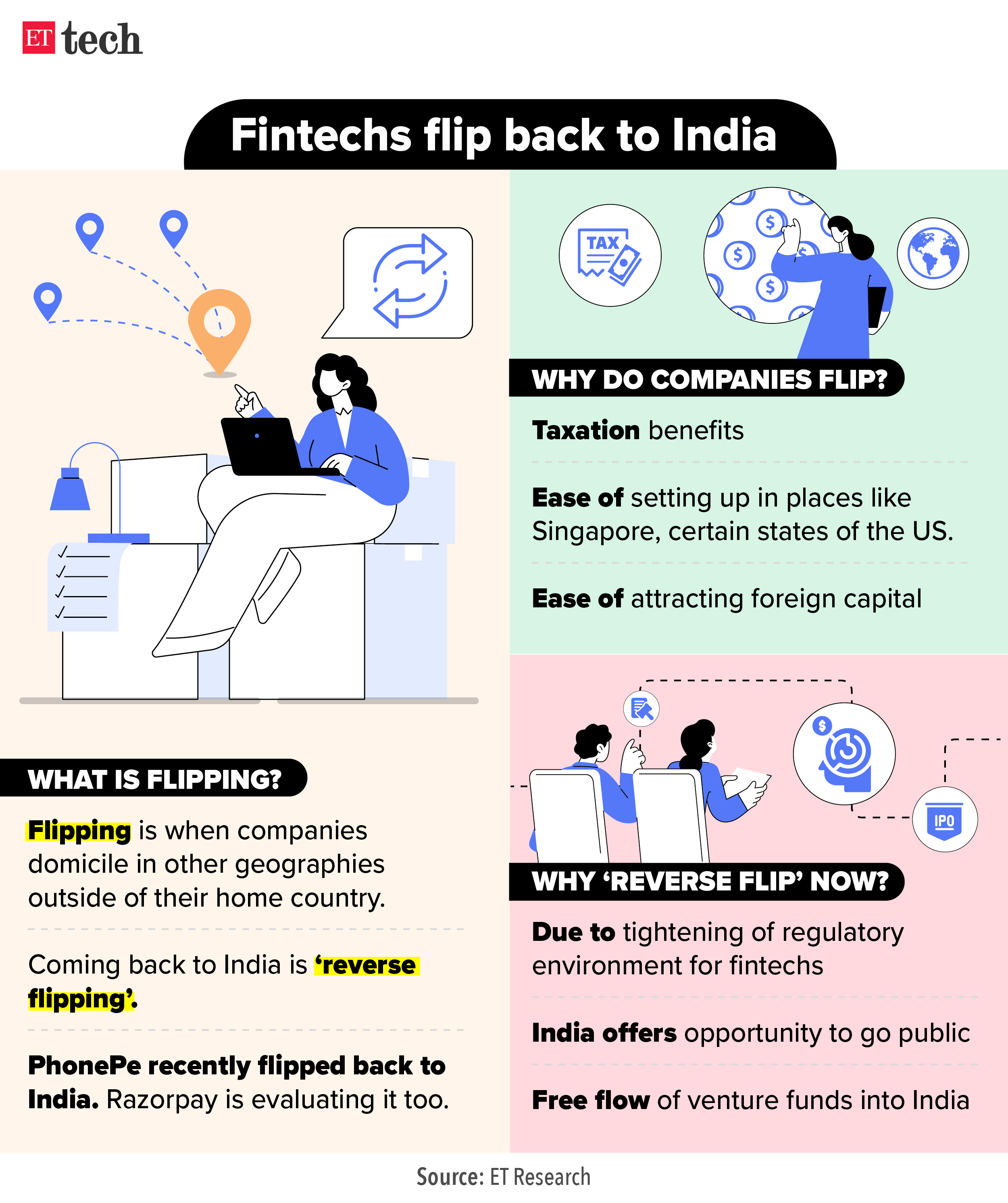

Long queue: Several startups have lined up to ‘flip back’ from the US and Singapore to India. Fintechs like Pine Labs and Razorpay, along with quick-commerce firm Zepto, edtech Eruditus, ecommerce firms Meesho and Udaan are also planning to move their holding companies to India. They are in various stages of the process currently.

Also read | More startups India-bound, map ‘reverse flip’

Why does it matter: For fintechs, the reason is clear: the regulator wants startups in the sector to have holding companies in India, including subsidiaries. Secondly, these firms see more value in a domestic IPO market compared to overseas, prompting serious consideration about the benefits of moving the parent entity to India.

Tax googly: It’s costly. Razorpay may have to fork out $300 million in taxes to the US Internal Revenue Service, but its chief executive Harshil Mathur said the company has accounted for the same already. The exact payout depends on multiple factors, including the company’s valuation.

Razorpay was last valued at $7.5 billion while the same for SoftBank-backed Meesho is nearly $5 billion. Meesho, which is domiciled in the US, is raising a new round, and part of the proceeds will go towards the tax payout for moving the parent to India.

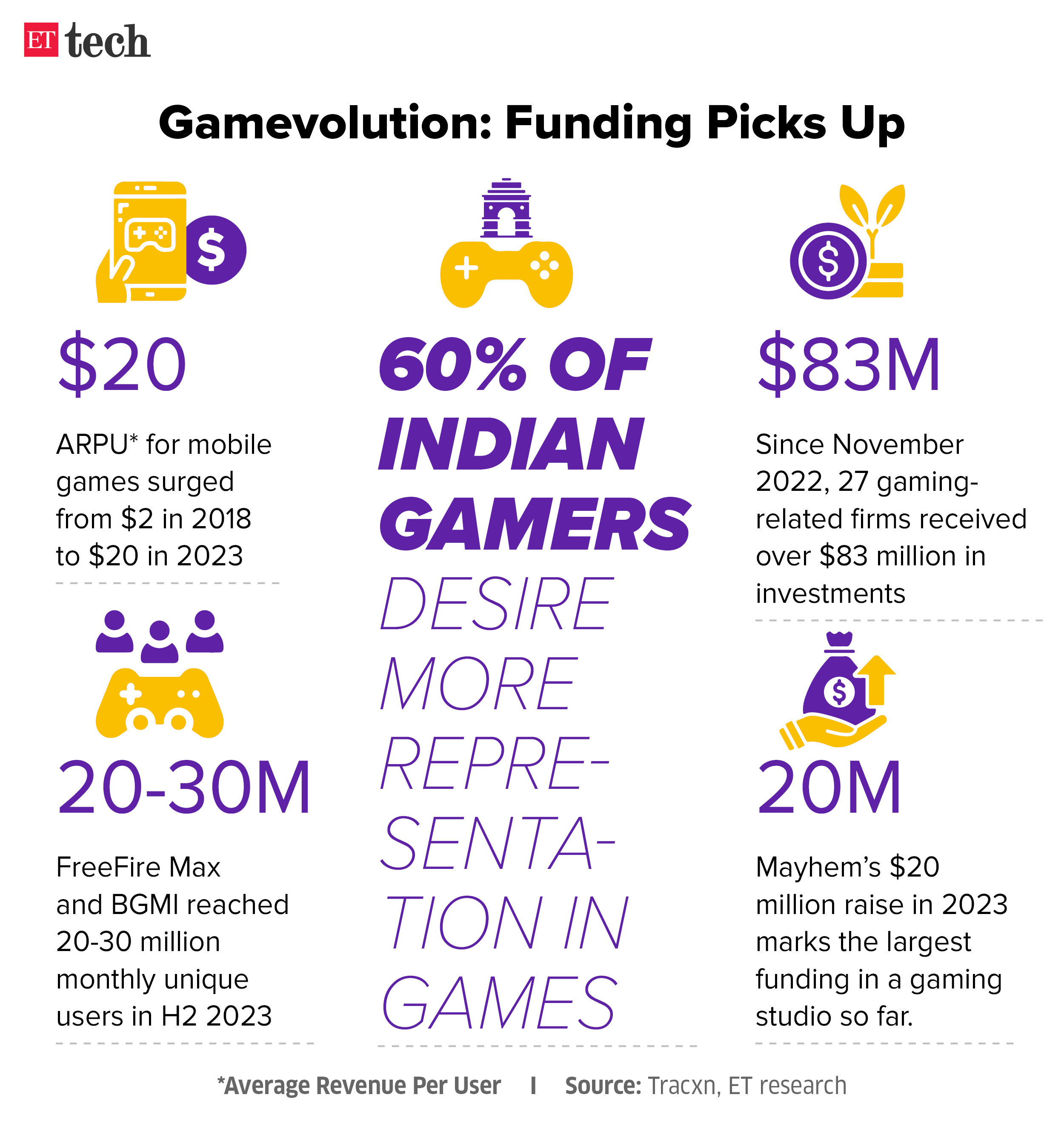

Investors eye gaming bets as Indian studios develop complex games

Investors are increasingly getting interested in Indian gaming studios that are working on complex, investment-heavy projects, as both the consumers of such games and the talent pool making them are maturing rapidly.

What’s happening: These games, unlike casual ones such as Ludo, are called midcore and hardcore games and require major investments, as well as complex technological work, to produce. They are often rated ‘AA’ or ‘AAA’, which signifies their high development and marketing values.

Local entrants: In recent times, firms like Mayhem Studios and LightFury Games have taken on the task of building such games. Since November 2022, 27 gaming and gaming-adjacent firms have seen investments of over $83 million, according to data from Tracxn.

A good chunk of this has come from diversified investors like Peak XV Partners, Nexus Venture Partners and Blume Ventures.

Zero representation: International publishers like Krafton, Garena, Activision, Riot Games and Epic Games dominate the midcore to hardcore gaming segment in India, with popular titles like FreeFire Max, Battlegrounds Mobile India (BGMI), Fortnite and Call of Duty. Many of these games make tens or hundreds of millions of dollars in annual revenue from India, industry executives said.

Omnichannel next big opportunity for D2C firms: Accel’s Prashanth Prakash

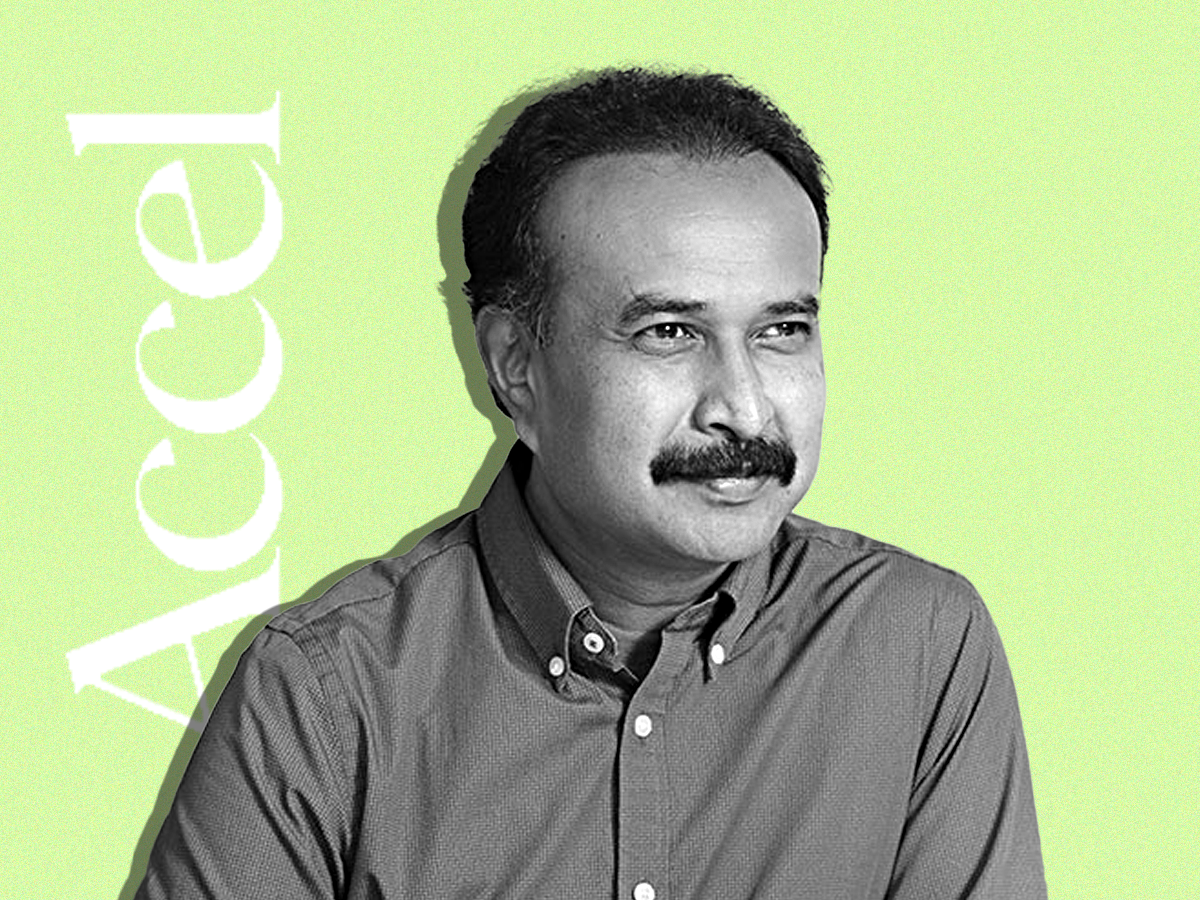

Prashanth Prakash, partner, Accel

Omnichannel is the next large opportunity for D2C firms, venture fund Accel’s founding partner Prashanth Prakash told us on Thursday.

Start online, expand offline: D2C brands should still start with online as that would allow them to iterate around product-market fit and brand-building much quicker than taking an offline approach, Prakash said. But after reaching a certain scale, they should look to expand offline to boost sales. There are about 100 brands making around Rs 100 crore, and scaling them to Rs 1,000 crore would be massively helped by a shift offline, he added.

The big picture: As the Indian retail market scales to $2.2 trillion in size by 2030, about 90% of it will remain offline, a joint report by Accel and Fireside Ventures and market research firm Redseer said. There are about 110 cities across India where consumers have both the purchasing power and the awareness to make purchases, Prakash said.

The bottom line: The cost of setting up such stores and the complexity of managing them will be worth it, Prakash said, as an offline presence can hugely improve the chances of “converting” a customer.

Other Top Stories By Our Reporters

Kamesh Goyal, chairman, Digit Insurance

Digit IPO opens on May 15, looks to raise Rs 1,125 crore | New-generation insurance company Digit is set to hit the public markets on May 15, looking to raise Rs 1,125 crore through a fresh issue of shares and an offer for sale of 54 million equity shares. The initial public offering (IPO), which will close on May 17, comes almost two years after the firm filed its draft prospectus with the markets regulator in August 2022.

With eye on tech spend revival, smaller IT firms up their M&A game | India’s IT services sector is witnessing a flurry of merger and acquisition activities, with several small and midsize firms announcing deals in the past four months. These range across segments, from consulting and startups to engineering services, data and analytics.

GenAI production deployments on the rise in India | About 20% of generative artificial intelligence (gen AI) proofs of concept (PoCs) in India went into production in fiscal year 2024, as per estimates by consulting firm EY India. Additionally, 15-20% of domestic enterprises and 30-40% of global capability centres (GCC) of multinationals have rolled out gen AI PoCs, an analysis of the last two quarters showed.

Global Picks We Are Reading

■ How good is OpenAI’s Sora video model — and will it transform jobs? (FT)

■ AI Challenger Mistral Set to Nearly Triple Valuation to $6 Billion in Six Months (WSJ)

■ OpenAI Is ‘Exploring’ How to Responsibly Generate AI Porn (Wired)