Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When millennials first emerged, blinking, into the adult world in the 2010s, they quickly bonded over shared adversity. First scarred by a rocky labour market in the aftermath of the financial crisis, they then realised that a decade of hard work and careful saving would no longer translate into home ownership as it had done for their parents.

It was a grim decade, but at least they had each other, and were united against a common foe in the shape of the wealthy, homeowning baby boomer generation.

But the winds that whipped up a perfect storm of intergenerational conflict are changing. Demographically and electorally, boomers are now a fading force. And as the targets of millennial ire increasingly recede from view, they may soon be replaced by another privileged, property-owning elite much closer to home: millennials who have benefited from family wealth.

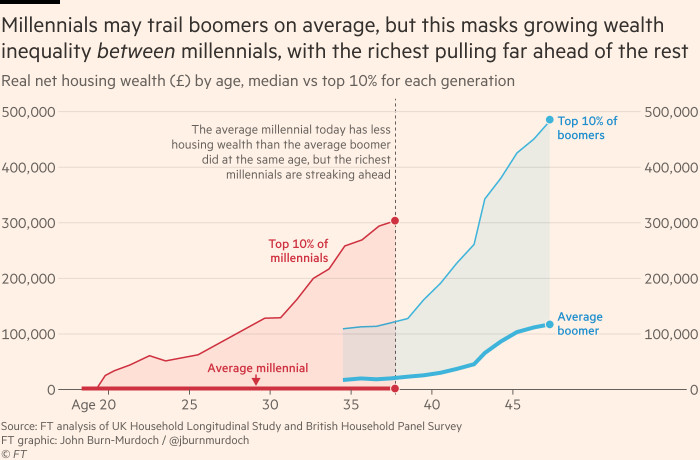

The millennials vs boomers discourse usually centres on the fact that, despite earning more than their parents’ generation, today’s young adults have been unable to translate that into home ownership and wealth more broadly. In the UK and US alike, the average millennial had accumulated less wealth in real terms by their mid-thirties than the average boomer at the same age. But this aggregate picture obscures what is happening at the top end of the distribution.

In the US, while the average millennial had 30 per cent less wealth than the average boomer by age 35, the richest 10 per cent of the cohort are now about 20 per cent wealthier than their boomer counterparts were at the same age, according to a recent study by researchers in Cambridge, Berlin and Paris. Not all millennials are created equal.

My analysis finds a similar picture in the UK. The average millennial still has zero housing wealth at a point where the average boomer had been building equity in their first home for several years. But the top 10 per cent of thirtysomethings have £300,000 of property wealth to their names, almost triple where the wealthiest boomers were at the same age.

So, while it’s true that in both countries the average young adult today is less well off than the average boomer was three decades ago, that deficit is dwarfed by the gap between rich and poor millennials, which is widening every year.

And if one reason that intergenerational conflict between young and old has proved so fierce is the sense of injustice, then the intra-generational divide promises to be just as bitter.

The fact that some thirtysomethings now own pricey homes in London, New York and San Francisco, despite it taking the average earner 20 to 30 years to save up the required deposit in these cities, gives away the open secret of millennial success: substantial parental assistance.

Research from property broker Redfin in February showed that 36 per cent of young Americans had financial help from family when buying their first home. Seemingly, home ownership in the US is becoming increasingly hereditary, just as it is in Britain.

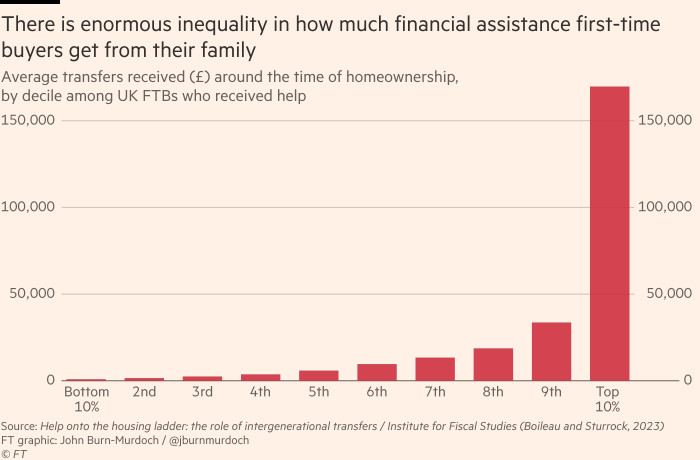

Bee Boileau and David Sturrock at the Institute for Fiscal Studies found that more than a third of young UK homeowners received help from family. Even among those getting assistance there are huge disparities, with the most fortunate 10th each receiving £170,000, compared with the average gift of £25,000.

And these gifts are not just one-off boosts; they compound over time. Say a British millennial in the top 10 per cent of gift recipients bought a home with a top 10 per cent price tag. Putting that gift towards their deposit would save them an additional £160,000 over a 25-year mortgage term due to the lower loan-to-value ratio afforded by a larger deposit and the resulting lower interest costs. This doubles the value of the gift received.

One can hardly blame parents for helping their offspring, or children for accepting assistance, but the growing role of such transfers in determining millennial wealth trajectories is likely to have significant social and political fallout.

Millennials have had one another’s backs until now, but as the wealth gap between those with and without deep-pocketed parents becomes increasingly visible, generational solidarity may start to fracture.