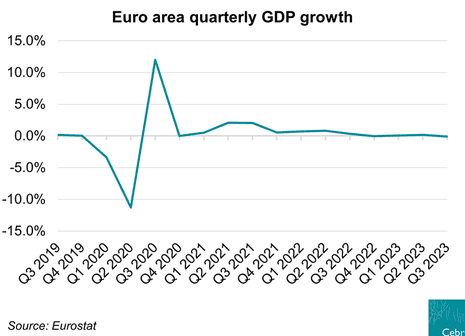

Eurozone shrank in last quarter

Newsflash: The eurozone economy shrank in the last quarter, a worse result than expected.

Eurozone GDP fell by 0.1% in July-September, data just released by Eurostat shows, worse than the stagnation which economists expected.

This highlights how Europe’s economy is being held back by high interest rates, the cost of living crisis, and weaker demand from the global economy.

The wider European Union grew by 0.1%.

Latvia (+0.6%) recorded the highest increase compared to the previous quarter, followed by Belgium (+0.5%) and Spain (+0.3%).

The highest declines were recorded in Ireland (-1.8%), Austria (-0.6%) and Czechia (-0.3%).

Germany, the eurozone’s largest member, shrank by 0.1% during the quarter.

And as we’ve covered this morning, France only grew by 0.1% while Italy’s GDP stagnated.

Key events

Back in the UK, the number of home sales has dropped by 17% year-on-year.

New figures from HM Revenue and Customs (HMRC) show that an estimated 85,610 home sales took place in September 2023.

That was also a 1% drop compared with August, as high UK interest rates continue to hit demand.

Property sales hibernate till rates/prices drop further – UK residential transactions show the 1st month on month decrease in seasonally adjusted fig’s, dropping down to 85,610 in Sep 2023, 17% lower than Sep 2022 & 1% lower than Aug 2023 pic.twitter.com/7kQQ8jvEBF

— Emma Fildes (@emmafildes) October 31, 2023

High interest rates, low consumer demand and negative global sentiment are all weighing on the eurozone economy, says Richard Flax, chief investment officer at Moneyfarm.

Following this morning’s GDP and inflation reports, Flax says:

“Today’s slew of data releases provides a broad overview of the underlying health of the European economy (or the lack thereof). The preliminary reading of the Eurozone CPI has shown headline inflation falling to its lowest levels in over two years, as price pressures continue to ease, primarily with lower energy prices. Headline inflation dropped to 2.9% YoY, well below the 3.1% expected, while core CPI, which strips out volatile food and energy prices, eased to 4.2% (within expectations) from 4.5% previously.

“While inflation has eased thanks to the ECB’s aggressive hikes, the central bank’s tightening has also had an impact on the wider economy, with GDP falling by -0.1% in Q3 2023 – worse than the stagnation predicted by economists. In YoY terms, Eurozone GDP is currently growing at +0.1%, but another decline in Q4 would place the region in a technical recession. The high interest rates, low consumer demand and negative global sentiment are certainly weighing on the economy. Germany shrank by 0.1% in Q3, while Ireland, Austria and Czechia clocked bigger declines at -1.8%, -0.6% and -0.3% respectively.”

Deutsche Bank’s chief European economist, Mark Wall, points out that underlying inflation in the eurozone is running at twice the ECB’s target, saying:

“Euro area inflation dropped more than expected again in October, falling below 3% for the first time since mid-2021. The ECB will hold this news at arm’s length.

Core inflation remains above 4%, twice the target level of inflation. The ECB needs to see wage inflation slowing and this could take a further six months.”

Pushpin Singh, senior economist at the Centre for Economics and Business Research, warns that growth in the eurozone will be sluggish this year and in 2024.

Singh explains:

“Today’s Eurostat figures reveal a quarterly contraction in the Eurozone economy for Q3 2023. The currency bloc continues to be affected by elevated inflation and the ECB’s response to higher interest rates, the impacts of which continue to feed through to the economy.

The ECB, trying to balance the need to fight inflation with the desire to avoid unnecessary economic harm, opted to pause its monetary tightening campaign at its latest Governing Council meeting last week.

Nonetheless, key interest rates in the currency bloc are expected to remain elevated as the ECB looks to stamp out lingering price pressure, and this will likely act as a drag on growth. As such, Cebr forecasts that the Eurozone economy will face sluggish growth over this year and next.”

ING: Eurozone recession this year is certainly possible

There is a “realistic” prospect that the eurozone falls into a technical recession in the second half of 2023, says ING analyst Bert Colijn.

Colijn argues that the 0.1% drop in eurozone GDP in the last quarter is not a meaningful decline, but that there is a broad stagnation in the region.

Eurozone GDP slightly negative in 3Q, making a technical recession this half year realistic. Still, Irish data had a big impact on the number and are prone to strong revisions, so it could well be that we end up at a flat reading for Eurozone GDP. Broad stagnation it is for now pic.twitter.com/COWUV8aEgn

— Bert Colijn (@BertColijn) October 31, 2023

He explains:

The drop of 0.1% quarter-on-quarter in eurozone GDP is not very dramatic. It was led by Irish GDP falling by 1.8% – a figure which is often subject to dramatic revisions. Germany experienced a small decline of 0.1%, while Italy stagnated over the quarter. Growth in France and Spain remained positive but still lower than last quarter. All in all, growth continued to trend around zero in the third quarter.

While a technical recession is certainly possible in the second half of this year on the back of the third-quarter GDP reading and a weak start to the quarter according to first business surveys, we don’t see too much reason for real alarm so far. It does look like the economic environment is weakening at the moment, but no sharp recession is in sight either. Still, continued economic and geopolitical uncertainty alongside the impact of higher rates on the economy will weigh on economic activity in the coming quarters.

Eurozone GDP slightly negative in 3Q, making a technical recession this half year realistic. Still, Irish data had a big impact on the number and are prone to strong revisions, so it could well be that we end up at a flat reading for Eurozone GDP. Broad stagnation it is for now pic.twitter.com/COWUV8aEgn

— Bert Colijn (@BertColijn) October 31, 2023

Here’s a handy chart showing how European countries fared in the third quarter of the year:

⚠️European countries 2023 Q3 GDP QoQ

🇱🇻 Latvia: 0.6

🇪🇸 Spain: 0.3

🇫🇷 France: 0.1

🇸🇪 Sweden: 0

🇱🇹 Lithuania: -0.1

🇩🇪 Germany: -0.1

🇪🇺 Euro area: -0.1

🇪🇪 Estonia: -0.2

🇨🇿 Czechia: -0.3

🇦🇹 Austria: -0.6

🇮🇪 Ireland: -1.8#MM pic.twitter.com/nhRoikN410— MacroMicro (@MacroMicroMe) October 31, 2023

The 0.1% drop in eurozone GD in the last quarter was partly caused by a sharp decline in Ireland.

Irish GDP shrank by 1.8% in July-September, Eurostat reports, a notable decline, following 0.5% growth in Q2.

However, Irish GDP is volatile, and heavily influenced by the activity of multinational companies based in the republic.

Over the last year, both the eurozone and the European Union have only grown by just 0.1%.

Moody’s Analytics economist Kamil Kovar says the eurozone is undergoing “what can be best described as stagnation”.

Growth is far from healthy, but neither it is an outright recession, he adds.

#Eurozone $GDP growth came in at slightly negative -0.1%, and -0.0% when excluding Ireland. So bit worse than expectations, but not by much.

This time around there was great degree of equalization across countries, with neither country standing out in either direction.

1/4 pic.twitter.com/8yuFfB9NEq

— Kamil Kovar (@CrisisStudent) October 31, 2023

From longer perspective eurozone is undergoing what can be best described as stagnation: Far from healthy growth, but neither it is an outright recession.

That leaves plenty space for pessimists and optimists to see what they want to see.

2/4 pic.twitter.com/i6qU2Xcl3y

— Kamil Kovar (@CrisisStudent) October 31, 2023

The big question is where next?

Sure, there is plenty of arguments for gloom in the high-frequency data – retails sales are declining or stagnating, industrial production is declining and sentiment is weak across the board.

3/4

— Kamil Kovar (@CrisisStudent) October 31, 2023

But one thing worth noticing is that final domestic demand had the best quarter in the year, with consumption and investment adding to growth, while NX dragged.

This might be bounce before further wreaking. Or it might be increase in real wages riding to the rescue.

4/4 pic.twitter.com/lPMQHrKzax

— Kamil Kovar (@CrisisStudent) October 31, 2023

The fall in eurozone GDP and the inflation rate suggests the interest rate increases across the region since summer 2022 are having an impact.

It takes the pressure off the European Central Bank to lift rates any higher, argues Joshua Mahony, chief market analyst at Scope Markets.

Mahony says:

Yesterday’s lower than expected inflation data out of Spain and Germany shaped expectations for today’s wider eurozone figure, with the latest CPI figure of 2.9% (from 4.3%) further easing any pressure on the ECB to tighten further.

With eurozone growth coming in at an uninspiring -0.1% for the quarter, there is a feeling that tightening undertaken over the course of the past year has brought to the kind of soft landing and disinflationary environment the ECB has been aiming for. Their hope is that we do not see economy weaken to the point that they come under pressure before inflation has been brought under control.

Mathieu Savary, Chief European Strategist at BCA Research, says:

“European inflation fell below expectations.

The deceleration is strong and supported by various factors such as advantageous base effects, slowing wages, muted inflationary pressures and tame inflation expectations for next year.

While it will make the ECB comfortable, it is still too early to bet on an imminent rate cut.”

Eurozone inflation falls to 2.9%

Inflation across the eurozone has fallen by more than expected, to the lowest in over two years.

Euro area annual inflation is expected to be 2.9% in October, down from 4.3% in September, according to a flash estimate from Eurostat.

That’s the lowest eurozone inflation reading since July 2021, and takes it closer to the European Central Bank’s target of 2%.

The Eurozone’s preliminary annual CPI rate for October was recorded at 2.9%, a new low since July 2021. It was expected to be 3.1%, compared to the previous 4.3%.

Eurozone Q3 GDP preliminary annualized rate 0.1%, expected 0.20%, previous value 0.50%.

— FxGecko (@FxGecko_Global) October 31, 2023

Food, alcohol & tobacco is expected to have the highest annual rate in October (fallinng to 7.5%, compared with 8.8% in September), followed by services (4.6%, compared with 4.7% in September).

Non-energy industrial goods inflation slowed to 3.5%, compared with 4.1% in September,

And energy prices fell by 11.1% year-on-year, a sharper fall than the 4.6% drop in September.

Eurozone shrank in last quarter

Newsflash: The eurozone economy shrank in the last quarter, a worse result than expected.

Eurozone GDP fell by 0.1% in July-September, data just released by Eurostat shows, worse than the stagnation which economists expected.

This highlights how Europe’s economy is being held back by high interest rates, the cost of living crisis, and weaker demand from the global economy.

The wider European Union grew by 0.1%.

Latvia (+0.6%) recorded the highest increase compared to the previous quarter, followed by Belgium (+0.5%) and Spain (+0.3%).

The highest declines were recorded in Ireland (-1.8%), Austria (-0.6%) and Czechia (-0.3%).

Germany, the eurozone’s largest member, shrank by 0.1% during the quarter.

And as we’ve covered this morning, France only grew by 0.1% while Italy’s GDP stagnated.

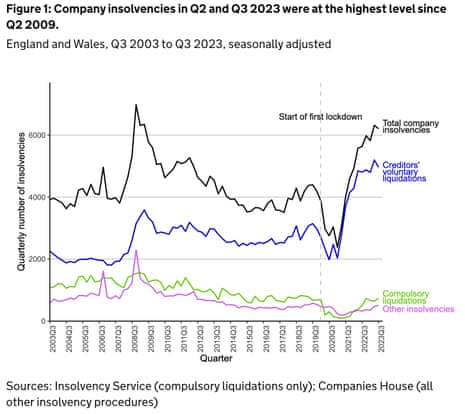

UK company insolvencies have soared this year

Back in the UK, company insolvencies have been running at the highest level since 2009 over the last six months.

There were 6,208 company insolvencies registered in July-September, the Insolvency Service reports, a 2% drop compared with the 14-year high set in April-June.

Last quarter there were 4,965 creditors’ voluntary liquidations (CVLs), where a company’s directors choose to wind up their firm.

The last two quarters have both seen the highest quarterly insolvency numbers since the second quarter of 2009, and “the highest numbers of CVLs since the start of the series in 1960”, the Insolvency Service says, adding:

The numbers of compulsory liquidations and administrations increased to levels last seen before the coronavirus (COVID-19) pandemic.

Mark Ford, partner in restructuring and recovery services at professional services firm Evelyn Partners, says:

“Despite a slight tick down in the third quarter from the second, company insolvencies have soared this year to levels not seen since the financial crisis of 2007/08 against a grim backdrop of continuing cost increases, a harsh and uncertain macroeconomic environment and continuing friction in supply chains and trading conditions.

While insolvencies fell on the quarter they are significantly up on the year, and the first three quarters’ insolvency data does not paint a pretty picture of the challenges facing UK businesses as we head towards the end of 2023.

Portugal’s GDP shrinks by 0.2%

Newsflash: Portugal’s economy shrank in the last quarter.

Instituto Nacional de Estatística, Portugal’s statistics body, reports that the Portuguese GDP fell by 0.2% in July-September, following a 0.1% rise in April-June.

Weaker external demand weighed on GDP, due to a drop in exports of both goods and services, including tourism.

INE adds:

The contribution of domestic demand moved from negative to positive in the third quarter, with increases in private consumption and investment.

On an annual basis, Portugal registered year-on-year growth of 1.9% in the third quarter of 2023, after increasing 2.6% in the previous quarter.

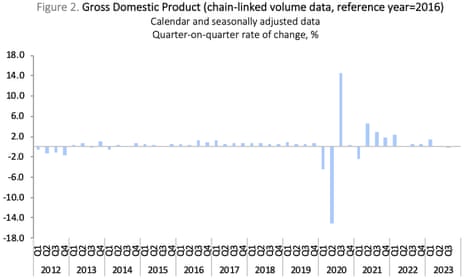

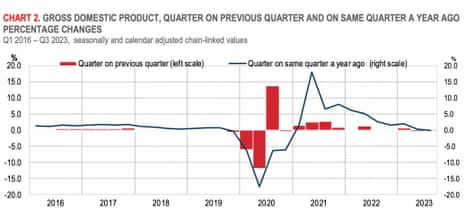

Italy’s economy stagnates in Q3 but dodges recession

Breaking: Italy’s economy stagnated in the last quarter, as it narrowly avoided a recession.

Italian GDP was flat in July-September compared with April-June, statistics body Istat reports, slightly weaker than expected.

That follows a 0.4% contraction in April-June, and means Italy has avoided shrinking for two quarters in a row (a technical recession).

The economy was also unchanged on a year-on-year basis.

Istat reports that agriculture, forestry and fishing shrank, while industry grew.

Domestic demand had a negative impact on GDP, while net exports had a positive one.