- Vitalik warned that Ethereum’s growing complexity may threaten decentralization; Pectra upgrade triggers key debate.

- ETH whales showed mixed strategies as price stagnates, reflecting uncertainty ahead of Pectra rollout.

As the Pectra upgrade looms – arguably Ethereum’s [ETH] boldest leap since the Merge – Vitalik Buterin is asking hard questions about where all this complexity leads.

Meanwhile, the market seems unsure whether to cheer or flinch. Whales are divided, price action is sluggish, and the network feels like it’s pausing mid-stride.

Is this the weight of overengineering starting to show?

Pectra on deck, but is Ethereum building a castle on sand?

As Ethereum gears up for the highly anticipated Pectra upgrade – set to expand blob capacity, streamline validator ops, and bring in long-requested UX enhancements – Vitalik Buterin is sounding a different kind of alarm.

In a new blog post, Ethereum’s co-founder warns that the protocol may be drifting toward unsustainable complexity, urging a return to simplicity before it becomes a liability.

“Even a smart high school student is capable of fully wrapping their head around and understanding the Bitcoin protocol. A programmer is capable of writing a client as a hobby project.”

The implication? Ethereum’s current architecture is edging away from that level of accessibility… and it’s a problem.

While Pectra does offer tangible improvements, Buterin questions whether piling on features at the base layer is the right long-term strategy.

He points out that Ethereum is increasingly reliant on a small group of highly technical contributors, which risks “centralizing control and raising the barrier to entry for new developers.”

“Simplicity should be seen as a core value, just like decentralization.”

Pectra may polish the protocol, but unless the community embraces a minimalist mindset, Ethereum could be building a future that’s brilliant – but brittle.

Whale watch: Mixed signals in murky waters

If Ethereum’s codebase is complex, its whales are even harder to read. While Buterin talks about clarity, large holders are doing anything but showing conviction.

On-chain data paints a picture of hesitation, one that is more akin to a poker game than a market strategy.

Take the whale who just scooped up 3,029 ETH at $1,895. That’s a $5.74M bet… now sitting $142K in the red.

Yet since March, the same wallet has walked away with $300K in profit by buying dips and flipping tops. Not bad, but hardly a vote of long-term confidence.

Meanwhile, in just the past few hours, two whales borrowed a combined $5M in USDC from Aave to buy ETH – while another wallet quietly pulled 2,250 ETH off Binance.

A bullish sign? Maybe. But then there’s the short whale who’s doubled down with a 10,000 ETH ($17.9M) short, now $510K underwater.

And let’s not forget the long-term staker who finally unstaked 5,180 ETH after two years – only to lock in a $255K net loss.

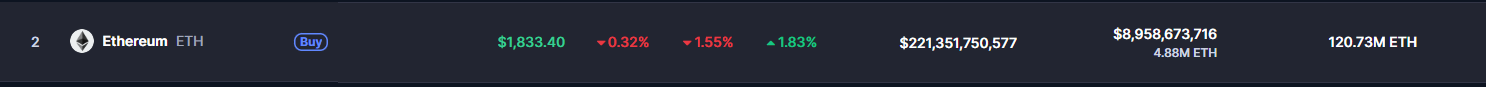

Price? Barely moved – up just 1.83% this week. The big fish are swimming, but no one’s steering.

What history tells us

Ethereum’s major upgrades tend to follow a familiar pattern—anticipation, volatility, and eventual price movement.

When the Merge launched in September 2022, ETH initially dropped over 20% within days. However, it rebounded months later, supported by macro tailwinds.

The Shanghai upgrade in April 2023 unlocked staked ETH. Markets expected a surge in selling pressure, but ETH instead jumped over 10% in the following week. Investors appeared relieved by the smooth implementation.

This trend highlights short-term volatility followed by gradual, meaningful repricing once speculation settles.

Pectra, though less headline-grabbing than the Merge, introduces scalability improvements, better validator experience, and expanded rollup capabilities.

Whether it sparks a rally or simply strengthens Ethereum’s foundation, history suggests markets rarely react instantly to technical advancements. Instead, the impact unfolds over time.

Breakout or breakdown?

At press time, ETH was hovering around $1,846 with muted volatility, as RSI held steady at 58, neither overbought nor oversold. The MACD hinted at bullish momentum, but just barely.

Whales seem split because ETH itself is. With fundamentals improving but concerns over complexity rising, price is treading water.

This sideways churn may signal compression before a breakout, or the start of a longer consolidation phase.