Posted:

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH entered a price consolidation similar to Q1 2023 price action.

- Massive buy interest at $1580 – $1600, as sellers target $1680 and $1700.

The crypto market has remained quiet overall since the August slump. In particular, Ethereum [ETH] extended its price consolidation above $1600 – a mid-range level in Q1 2023. A recent AMBCrypto report explored the possibility of whale action as a likely determinant for ETH’s next key price move.

How much are 1,10,100 ETHs worth today?

What’s next for ETH?

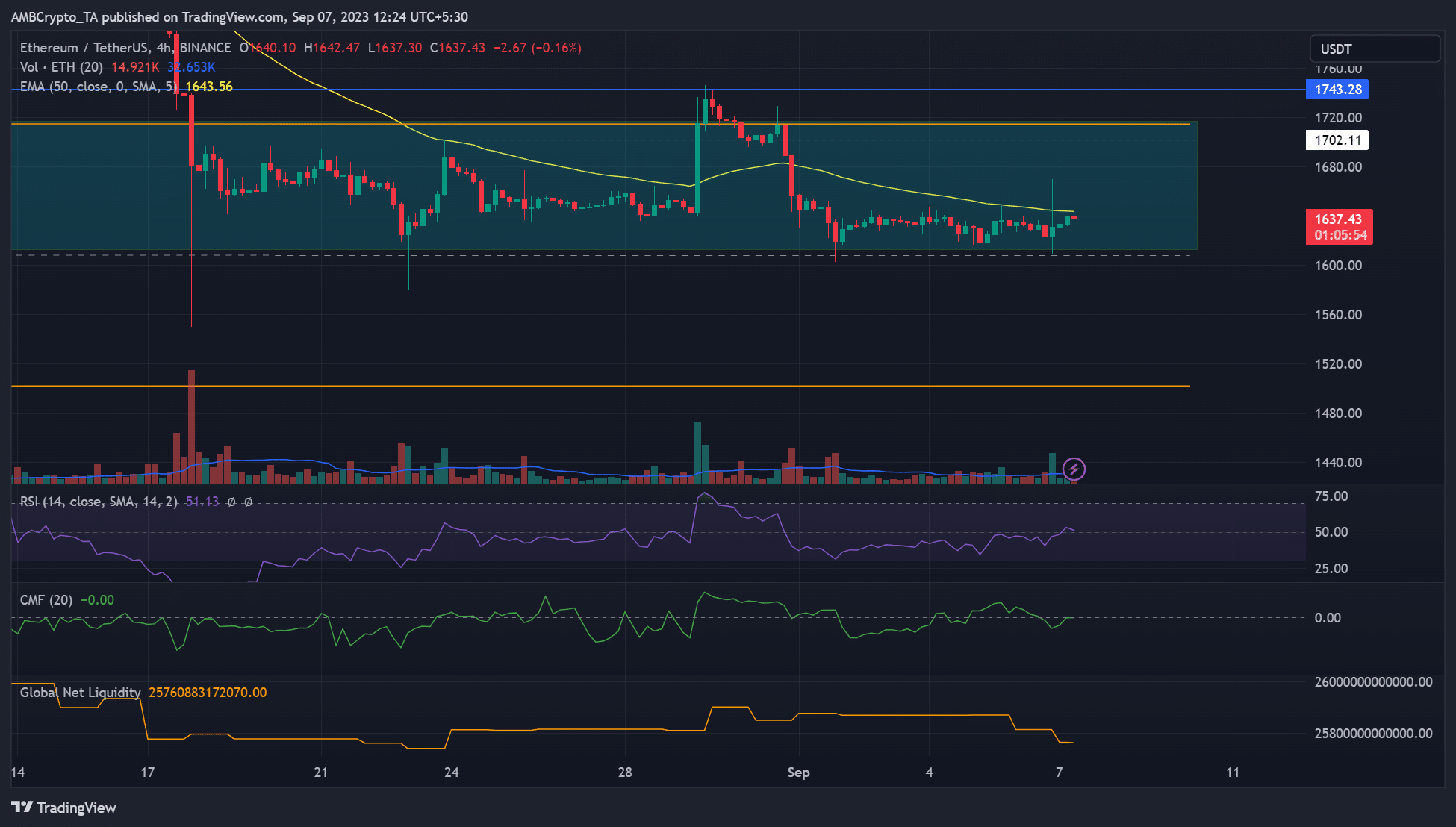

We established that Ethereum’s current price action coincided with the Q1 2023 range formation of $1500 – $1715 (orange parallel channel). In early September, ETH could not cross above the 50-EMA (Exponential Moving Average) on the 4-hour chart.

So, the 50-EMA was a crucial dynamic resistance in the short term. But bulls have defended the mid-range level near $1600 since August, constricting ETH on the upper range in the past two weeks.

A little sell-pressure could be on the cards based on key technical indicators. The Global Net Liquidity has been flat since 1 September but dipped from 5 September. It meant the global finance market tightened from 5 September and could affect capital inflows, as shown by the eased CMF over the same duration.

Meanwhile, the RSI hit the median level and could face rejection, especially after price action hit the 50-EMA dynamic resistance. To the south, the $1580, $1550, and range-low of $1500 are key levels to watch.

On the other hand, bulls could push forward but falter at the range-high near $1700.

Massive buying interest at $1600 – $1580 area

According to Mobchart, a real-time order flow tracking platform, there was considerable buying interest for ETH at $1600, $1580, and $1560 on Binance Exchange (Spot), as shown by the extended green lines.

On the sell side, short-sellers targeted $1700 and $1680. However, the cumulative delta was sideways, meaning neither buyers nor sellers had absolute market control. That calls for caution.

Is your portfolio green? Check out the ETH Profit Calculator

On the liquidation side, key liquidation levels existed at $1645, $1670, and $1703. This meant the price could react at or near these levels as ETH hovers above $1600.

Below $1600, the price could react at or near $1612, $1597 or $1588.