(Reuters) -Nashville-based independent music company Concord has agreed to buy British song investor Hipgnosis Songs Fund for $1.40 billion, the companies said on Thursday, gaining rights to the catalogues of artists including Shakira and Neil Young.

Hipgnosis Songs Fund launched a strategic review last year after a shareholder revolt in October led to a board overhaul.

Its investors will get $1.16 per share in cash, representing a premium of about 32% to Wednesday’s closing price, based on current exchange rates.

Hipgnosis shares, which have fallen more than 45% from their 2021 peak, rose 31% to 92.5 pence ($1.15) in early trading.

The deal with Concord, backed by the board of Hipgnosis, has to be approved by shareholders.

In October, they rejected the fund’s proposed $440 million deal to sell 29 catalogues to Hipgnosis Songs Capital – a partnership between Blackstone (NYSE:) and the fund’s investment adviser Hipgnosis Song Management (HSM).

Concord will take over the management of Hipgnosis’ assets after the deal completes and following a “short transition” period with HSM, it said.

Concord is indirectly controlled by Alchemy Copyrights, which acquired music copyright-focused investment firm Round Hill Music Royalty Fund last year under the chairmanship of Robert Naylor.

Naylor joined Hipgnosis Songs Fund as chairman in November after the board overhaul and has since focused on attracting potential bidders.

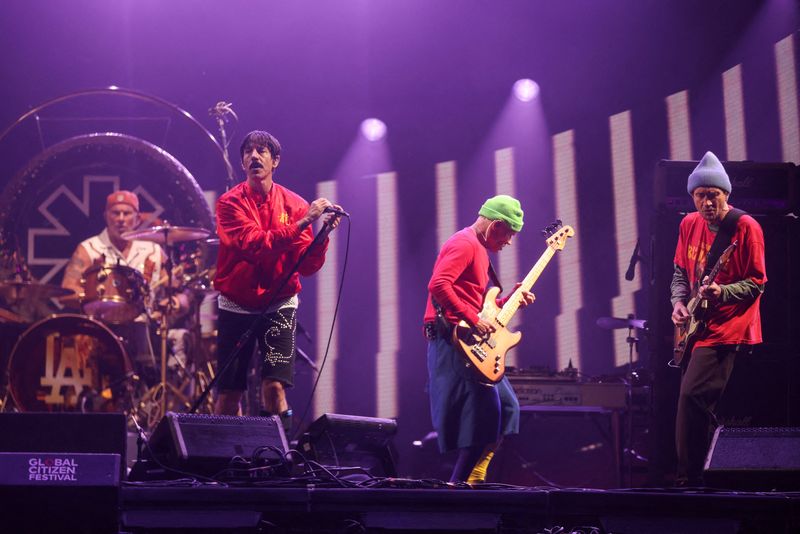

Hipgnosis Songs Fund also owns songs such as “Shape of You” by Ed Sheeran and rights to catalogues of other major artists such as Blondie and the Red Hot Chili Peppers.

Concord, through its music publishing arm, counts songwriters such as Daft Punk and Mark Ronson as part of its current roster, according to its website.

Concord said Apollo Global Management (NYSE:) will help finance the deal through debt and a minority, indirect equity interest in the Concord-controlled acquiring firm.

($1 = 0.8021 pounds)