Introduction: China’s consumer price drop adds to deflation fears

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

While most of the advanced world is struggling with inflation, China has the opposite problem.

The world’s second-largest economy has dropped further into deflation territory, with consumer prices falling last month, new data released last weekend shows.

China’s consumer price index (CPI) dropped 0.5% on a monthly basis in November, showing that prices of a basket of goods and services fell compared with October.

CPI was also 0.5% lower on an annual basis, China’s National Bureau of Statistics (NBS) reported, which is the steepest drop since November 2020.

The drops have disappointed investors, as they indicate rising deflationary pressures as domestic demand remains subdued.

Kyle Rodda, senior financial market analyst at capital.com, says:

Chinese stocks have sunk as investors digest the weekend’s disappointing price data. Deflation is deepening, and while debate rages about why, the trend is undeniable: consumer prices are falling, and producer prices have been negative for more than a year. The data simultaneously indicates anaemic demand and the eroding profitability of Chinese companies.

The latest pledges of deeper fiscal support from last week’s Politburo meeting have amounted to little and may be considered insufficient to spark the economy out of this rut.

China has already dropped into deflation back in August, before prices rose again in September – but that recovery proved temporary, with prices also having dropped in October.

Zhang Zhiwei, chief economist at Pinpoint Asset Management, said deflationary pressures have increased because of weak domestic demand, adding:

“This highlights the importance of more supportive fiscal policy.”

In another sign of deflation, China’s manufacturers are cutting prices too. China’s producer price index fell 3% year-on-year, compared with October’s 2.6% drop, which is the 14th decline in a row.

The data, released last weekend, has knocked stocks today. China’s CSI 300 index, which tracks stocks on the Shanghai and Shenzen exchanges, fell as much as 1.4% today.

But the economic picture may be brightening in the UK, after a troubled year.

Manufacturing body MakeUK has reported a pick-up in business confidence.

And encouragingly, manufacturers reported that export orders surpassed domestic orders for the first time in four years. That suggests that companies are taking advantage of either faster growing or new markets.

Fhaheen Khan, senior economist at Make UK, said:

“After the economic and political shocks of the last few years there is some semblance of stability returning for manufacturers.

While growth is not exactly supercharged, the positive announcements in the Autumn statement can at least allow companies to plan with more certainty without having to constantly fight fires.”

Key events

Anglo American share price picks up amid takeover chatter

Alex Lawson

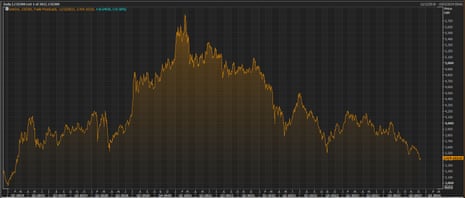

Mining company Anglo American has seen a tentative recovery in its share price on Monday after takeover chatter buoyed the London-listed business.

Shares rose 1.5% to £18.29, valuing the business at £24.5bn, after a pummelling last week which exposed the company to a potential bid. Anglo’s stock is down nearly 45% this year, and the shares suffered their biggest one day fall since the financial crisis on Friday, down 19%, when the miner slashed its production outlook.

Anglo, which is among the 20 biggest companies on the FTSE 100, said difficulties at its mines in Peru and Chile had led to the cut in its forecasts for copper production. Brokers at Jefferies, Barclays and RBC have cut their target price for the stock in response.

Analysts noted that that £30bn had been lost from the value of the company, which is also listed in Johannesburg, since South African Duncan Wanblad, a company insider, had taken over as chief executive from longstanding boss Mark Cutifani in April 2022.

Jefferies analysts have said that Anglo may become “involved in the broader trend of industry consolidation” and suggested Glencore could be a potential suitor.

Glencore took over Xstrata, the company which made an abortive attempt to merge with Anglo in 2009. Xstrata was later subsumed into Glencore.

Anglo notched up profits of $4.5bn in 2022 but issues with iron ore and copper production have hit performance and it is in the process of a cost cutting exercise, which has seen it cut $500m of cuts including job losses.

The company also owns diamond miner De Beers, which has experienced a downturn in the diamond and platinum sectors amid weak demand and too much stock in the market.

OIL Occidental Petroleum to buy Permian producer CrownRock for $12bn

More consolidation in the energy sector has just been announced, with US producer Occidental Petroleum winning an auction to buy CrownRock, an energy producer in the west Texas area of the Permian basin.

Occidental is acquiring CrownRock in a mixture of cash and stock in a transaction valued at approximately $12.0 billion, including taking on CrownRock’s debt.

Occidental says the deal will add 170,000 barrels of oil equivalent per day to its output, and also give it around 1,700 undeveloped locations where fossil fuels can be produced.

To fund the transaction, Occidental will issue $9.1bn of new debt and $1.7bn of shares.

But it is also lifting its dividend by $0.04 to $0.22 per share.

Some Occidental Petroleum news to start off the week:

(1) $OXY has agreed to purchase CrownRock (a Permian Basin oil producer) for $12 billion.

(2) To pay for it, Oxy will issue $9.1 billion in debt and about $1.7 billion in common stock.

(3) Oxy’s quarterly dividend will…

— Kevin Carpenter (@kejca) December 11, 2023

The pound has risen this morning, at the start of a busy week for central bankers.

Sterling has climbed by almost half a cent against the US dollar to $1.259, having fallen by a cent and a half last week.

It’s also up half a eurocent against the single currency, at €1.169.

The Bank of England (BoE), the US Federal Reserve and the European Central Bank are all expected to leave interest rates on hold this week.

But the BoE could take a hawkish tone, with three of its nine policymakers expected to vote for a rate hike to 5.5%.

Matthew Ryan, head of market strategy at global financial services firm Ebury, says:

“The MPC is expected to leave interest rates unchanged on Thursday, although we think that it will try to push back against market pricing of a full cut in the first half of 2024. The voting split among committee members will also once again be key.

“This vote was split 6-3 in favour of no change in November and could remain unchanged this time around as the bank reinforces its stance of higher rates for longer.

“We think both data and central bank communications are likely to be supportive of the pound, underlining the story of demand resilience and high wage growth that should keep UK rates elevated for longer than elsewhere.”

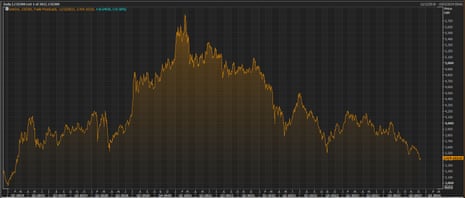

Back in the markets, the aluminium price has dropped to its lowest level in over three months.

China’s drop into deflation could hint at lower demand for raw materials such as aluminium, used in a wide range of products including consumer goods, window frames and aeroplane parts.

Aluminium dropped to $2,125 per metric ton this morning, the weakest since August 21, Reuters reports.

Sky: Shein holds talks with LSE to dangle prospect of London listing

Sky News are reporting that the chairman of fast-fashion giant Shein has held talks with the London Stock Exchange about the possibility of staging a blockbuster public listing in the City.

Donald Tang’s meeting with LSE executives comes despite Shein having filed papers in the US paving the way for a flotation in New York.

Sky News’s Mark Kleinman writes:

City sources said the discussions were focused on the possibility of a listing in the UK, with one saying that the Singapore-based behemoth was continuing to explore various options for raising capital through a public share sale.

A US listing remains the likeliest outcome for Shein, according to bankers and people close to the company, while a dual listing in both financial centres is said to be unlikely.

EXCLUSIVE: The chairman of Shein, the Asian fast-fashion behemoth which last month filed documents to pave the way for a blockbuster New York listing, met executives from the London Stock Exchange last week to discuss the option of a UK flotation. https://t.co/9hJSl6g1oY

— Mark Kleinman (@MarkKleinmanSky) December 11, 2023

UK productivity is being supported by a relatively small selection of highly productive companies, while many firms are running at below average productivity.

That’s the conclusion from new data released by the Office for National Statistics today, which shows that 70.6% of UK employees work in firms with labour productivity below the mean.

But there is also a long tail of workers in firms with very high labour productivity, the ONS says.

Its research shows that, at the top end, 1.5 million people are employed in firms with productivity of over £150,000 approximate gross value added (aGVA) per worker.

China’s currency has fallen to a three-week low after the latest CPI data showed deflation in the country worsened in November.

Reuters has the details:

The yuan weakened to a three-week low in both the onshore and offshore markets on Monday, with the former last at 7.1791 per dollar.

Alvin Tan, head of Asia FX strategy at RBC Capital Markets, explains

“The lack of a strong revival in the economy suggests that weak inflation will persist, and more policy support is indeed required.”

UK house asking prices are being pushed down by “a mixture of desperation & realism” from sellers, reports property agent Emma Fildes of Brick Weaver:

The Jan sales started early this year with avg ASKING prices dropping by 1.9% on last month. An extra 0.4% drop on the 20y avg for Dec. A mixture of desperation & realism is causing some sellers to reprice to attract their target customers so they can also move on @rightmove pic.twitter.com/mv5w3TvmAV

— Emma Fildes (@emmafildes) December 11, 2023

Appearances can be deceiving thou – according to @rightmove prices are only down 1.1% on last year. Which means some sellers are still factoring in getting chipped. This makes prices look outwardly more resilient then they truly are. It’s vital to understand ur micro mkt pic.twitter.com/zN9F0I6Rcd

— Emma Fildes (@emmafildes) December 11, 2023

Heathrow passenger numbers approach pre-Covid levels

Passenger numbers at Heathrow are creeping closer to their levels before Covid-19 disrupted the travel sector.

Passenger numbers at the UK’s largest airport were just 2% below pre-pandemic levels last month, with 6.1 million passengers using its terminals in November.

That’s only slightly below the 6.2m in November 2019, and 10% more than a year ago – but below the 6.9 million who used Heathrow in October.

Demand for flights to North America peaked before Thanksgiving, with more than 50,000 passengers flying across the Atlantic from Heathrow on November 17, the last Friday before the holiday.

Diwali celebrations also sparked a surge in travel to India.

Heathrow CEO Thomas Woldbye said:

“For so many, holidays and cultural festivities are all about spending quality time with friends and family. Last month saw passengers travelling to celebrate Thanksgiving and Diwali with their loved ones, and we are making final preparations for the Christmas getaway.

Heathrow predicts that passenger numbers will be strong in December, with departure numbers predicted to peak in the week before Christmas Day.

It emerged yesterday that Saudi Arabia could take effective majority control of Heathrow, with other investors considering selling their stakes.

Ethiopia could become Africa’s latest defaulter

Ethiopia is on the verge of becoming the latest African country to default on its debts since the Covid-19 pandemic hit the global economy.

Ethiopia’s government warned on Friday that it will not meet a $33m interest payment that is due to be paid to holders of a $1bn international bond.

If it misses the payment, then Ethiopia would be on track to default after the grace period of 14 days expires, joining Zambia and Ghana as sovereign debt defaulters.

Ethiopia’s finances have been hit by the cost of the pandemic, and also the civil war in its northern Tigray region, leaving it with double-digit inflation, and a shortage of hard currency.

Today, a senior finance ministry official said Ethiopia will hold an investor call with its international bondholders on Thursday,

Last month, Ethiopia agreed an interim debt-service suspension deal with its official creditors, which gave it some breathing space.

The finance ministry said in a statement on Monday that it would “seek a broadly similar treatment” from the holders of its single $1bn international bond, which matures in December 2024.

It says:

“In light of recent agreements entered with our other external creditors around external debt service suspension, it would be important to treat all our creditors equitably”

Eyob Tekalign, State Minister of Fiscal Policy and Public Finance, told Reuters in a text message that “authorities’ intention is to remain current on our obligations”, adding:

“We will have a call with our Eurobond investors on Thursday December 14th.”

The FTSE 100 started the week on the back foot, dragged lower by the mining sector as figures from China over the weekend showed the economy swung deeper into deflation,” says AJ Bell investment director Russ Mould.

Mould adds;:

“An indicator of depressed domestic demand and a very different story to the inflationary pressures faced in the rest of the world, the data inevitably hit the miners given the world’s second largest economy is such a rapacious consumer of commodities.

However, Anglo American has shaken off its earlier losses and is now up over 1% – perhaps buoyed by the speculation of a possible takeover offer down the road….

UK house asking prices fall: what the experts say

Here’s some expert reaction to Rightmove’s report that UK house asking prices have dropped nearly 2% month-on-month.

Tom Bill, head of UK residential research at estate agent Knight Frank, says politics is the major source of uncertainty in the property market:

“It’s not often that November is busier than September in the UK property market but it was this year. The economic backdrop has stabilised in recent weeks and gentle downwards pressure on mortgage rates means that transaction volumes should be higher over the next six months than the last six.

The main uncertainty facing the property market has gone from ‘when will the bank rate peak?’ to ‘when will the general election take place?’”

Victoria Scholar, head of investment at interactive investor says Rightmove’s report, predicting a 1% drop in prices in 2024, are a reality check:

December is typically a slow time of the year for housing transactions amid the Christmas celebrations and school holidays. However, this year, the fall was above average, highlighting the strain from higher mortgage rates, a weak consumer and broader cost-of-living pressures that are deterring individuals and families from buying a property.

While the latest data from Halifax and Nationwide painted a rosier picture, Rightmove’s figures are a reality check, showing how ‘higher for longer’ interest rates continue to dampen demand for property transactions.”

Jeremy Leaf, north London estate agent, says the drop in asking prices shows that sellers are showing realism to attract buyers.

Leaf adds:

‘Asking prices are not values but often an agent’s aspirational starting point to marketing. Overall, sales agreed are down as transactions are inevitably taking longer bearing in mind weaker demand and higher base rates. However, recent reductions in mortgage rates, and inflation not rising quite as rapidly, has given the market a bit of a kick when needed.

‘Looking forward, the Christmas period is likely to be quieter at least until Boxing day which is always a great time for attracting interest on the portals and although much interest is aspirational, we always find plenty of genuine interest too.’

The jump in UK companies going bust is proving lucrative for insolvency experts Begbies Traynor.

Begbies Traynor has reported that revenues grew by 13% in the six months to 31 October, while adjusted profits rose 10%.

Begbies said the number of businesses going insolvent in the UK rose by over 17% to 24,326 in the year to the end of September – which is generating more work for its insolvency team.

It told shareholders:

We anticipate that activity levels in our largest service line of insolvency will continue to increase in tandem with the indicators of corporate financial stress in the UK, resulting from the current interest rate and inflation environment.

This gives the board confidence that the insolvency team will continue to deliver growth through the second half of the current year and thereafter.

The London stock market is open…. and mining stocks are falling, as investors fret about the weakness of China’s eocnomy.

Anglo American are the top faller on the FTSE 100 share index, down 2.2%, extending Friday’s 19% tumble after the company revealed plans to slash mineral production to cut costs and lift profitability.

That’s despite speculation by analysts that Anglo American faces a possible takeover or merger approach.

Glencore (-1.5%), Fresnillo (-1.4) and Rio Tinto (-1%) are also in the FTSE 100 top fallers.

Hong Kong’s Hang Seng index has also been hit by deflation jitters, down over 1% in late trading.

Stephen Innes, managing partner at SPI Asset Management, says:

Hong Kong stocks remain entrenched in a prolonged decline, hurt further by a significant drop in consumer prices in China, marking the steepest decrease in three years.

This development has intensified worries about potential deflation impacting corporate earnings and profit margins, dragging down the region markets in a negative feedback loop.

Average price tag on a home tumbles by nearly £7,000 in December

The UK’s housing market is also undergoing a bout of deflation.

Rightmove has reported that the average asking price of a UK home tumbled by nearly £7,000 in December, to £355,177, a drop of 1.9%.

Rightmove also reports that average asking prices set by new sellers are 1.1% lower than a year ago, with the number of sales agreed this year around 13% lower than the same period in “the more frenetic” 2022.

Prices in seven out of 11 regions are higher than a year ago, Rightmove reports, adding:

The North West leads the way, up by 1.5% compared to last year, while the South East is the worst performer at 3.7% below 2022.

Here’s the full story:

Tim Bannister Rightmove’s Director of Property Science, has said:

“2023 has been an interesting year, with very little straight forward, yet far from the negative market it might have been given the broader economy.

Whilst there has been a lower transaction level than the previous few years and some adjustment in values, attractively priced property is selling. Very prime coastal property has held firm and sold well and sensible sellers who are realistic about guide prices are achieving positive results. There is less risk taking and the fluctuation of mortgage rates has made it a bumpy road for some, but as we turn towards 2024, we are hopeful that activity will continue despite a general election.

Our advice to both buyers and sellers is to be realistic with expectations, it is potentially an easier market for buyers in prime areas with more choice and less pressure. Vendors; get organized, take early interest seriously and above all pitch values at an attractive level from the outset.”

Introduction: China’s consumer price drop adds to deflation fears

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

While most of the advanced world is struggling with inflation, China has the opposite problem.

The world’s second-largest economy has dropped further into deflation territory, with consumer prices falling last month, new data released last weekend shows.

China’s consumer price index (CPI) dropped 0.5% on a monthly basis in November, showing that prices of a basket of goods and services fell compared with October.

CPI was also 0.5% lower on an annual basis, China’s National Bureau of Statistics (NBS) reported, which is the steepest drop since November 2020.

The drops have disappointed investors, as they indicate rising deflationary pressures as domestic demand remains subdued.

Kyle Rodda, senior financial market analyst at capital.com, says:

Chinese stocks have sunk as investors digest the weekend’s disappointing price data. Deflation is deepening, and while debate rages about why, the trend is undeniable: consumer prices are falling, and producer prices have been negative for more than a year. The data simultaneously indicates anaemic demand and the eroding profitability of Chinese companies.

The latest pledges of deeper fiscal support from last week’s Politburo meeting have amounted to little and may be considered insufficient to spark the economy out of this rut.

China has already dropped into deflation back in August, before prices rose again in September – but that recovery proved temporary, with prices also having dropped in October.

Zhang Zhiwei, chief economist at Pinpoint Asset Management, said deflationary pressures have increased because of weak domestic demand, adding:

“This highlights the importance of more supportive fiscal policy.”

In another sign of deflation, China’s manufacturers are cutting prices too. China’s producer price index fell 3% year-on-year, compared with October’s 2.6% drop, which is the 14th decline in a row.

The data, released last weekend, has knocked stocks today. China’s CSI 300 index, which tracks stocks on the Shanghai and Shenzen exchanges, fell as much as 1.4% today.

But the economic picture may be brightening in the UK, after a troubled year.

Manufacturing body MakeUK has reported a pick-up in business confidence.

And encouragingly, manufacturers reported that export orders surpassed domestic orders for the first time in four years. That suggests that companies are taking advantage of either faster growing or new markets.

Fhaheen Khan, senior economist at Make UK, said:

“After the economic and political shocks of the last few years there is some semblance of stability returning for manufacturers.

While growth is not exactly supercharged, the positive announcements in the Autumn statement can at least allow companies to plan with more certainty without having to constantly fight fires.”