One thing to start: Alex Mashinsky, the founder of bankrupt cryptocurrency lender Celsius Network, has been arrested by US authorities and charged with fraud and market manipulation.

And one big invitation: Due Diligence Live is back. Join us in London on October 17 as we gather some of the biggest names in finance and dealmaking including UK Competition and Markets Authority chief Sarah Cardell, Bain Capital’s John Connaughton and BDT & MSD Partners co-heads Byron Trott and Gregg Lemkau. Find the full agenda and tickets here.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

Bob Iger hopes for a dealmaking sequel

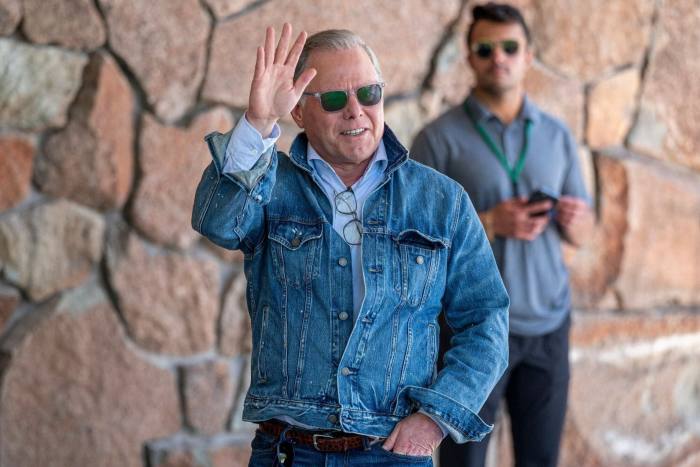

As the fleet of private jets touched down in Sun Valley, Idaho, and the crowd descended upon the annual “billionaire summer camp”, Bob Iger appeared relaxed in a white T-shirt and athletic shorts.

But the casual dress code at Allen & Co’s yearly conference (Warner Bros Discovery chief David Zaslav arrived decked out in a Canadian tuxedo), belied the high-stakes nature of the weekend for the second-time Disney boss.

In an interview with CNBC on Thursday, Iger revealed that the entertainment juggernaut was open to a possible sale of certain traditional TV assets, a portfolio that includes cable networks ABC and ESPN.

“They may not be core to Disney,” he said, stipulating that the company would consider finding a strategic partner for ESPN, potentially via a joint venture or by selling a stake to a strategic partner. “Everything’s on the table,” he said in regards to the sports network.

(DD readers may remember Disney’s quarrel with activist Dan Loeb over ESPN.)

It’s the latest move by Iger to turn around the entertainment giant, which has haemorrhaged money on its streaming service, since taking back the top job in November from his successor Bob Chapek.

Company executives also floated the idea of selling streaming service Hulu, which it owns a majority stake in, people familiar with the matter told the Financial Times in March.

Turnaround efforts have now kicked into high gear, the FT’s Christopher Grimes and Andrew Edgecliffe-Johnson report, as his renewed two-year contract has been extended until 2026.

That gives him more time to cement his legacy anew as Disney combats challenges on multiple fronts — including an ongoing fight with Florida governor Ron DeSantis and other Republicans, a series of box office flops and falling cable television revenues.

The coming months will also be critical in the hunt for a successor following Chapek’s rocky tenure — which lasted just 33 months — was marked by poor performance and accusations that Iger had undermined him.

Iger’s Sun Valley entourage included Dana Walden, co-chair of Disney Entertainment, film chief Alan Bergman and theme parks head Josh D’Amaro — all of whom are considered potential successors.

Iger spent his first term as chief executive on a dealmaking streak, snapping up some of the most valuable franchises in Hollywood history — including Pixar, Marvel and Lucasfilm — much to the envy of his rivals.

But Disney’s $71bn purchase of Fox’s entertainment empire would later leave a blight on Iger’s otherwise impressive record, as investors, including billionaire activist Nelson Peltz, complained it had left the entertainment group saddled with debt.

Iger is now struggling to play the hero as Disney embarks on an aggressive $5.5bn cost-cutting drive, which will eliminate about 7,000 jobs.

Hiving off underperforming assets will only be half the battle, though. The real challenge, as Lex notes, will be making its streaming platform Disney+ profitable.

AT&T dials up debt

US telecoms company AT&T has a debt load larger than many countries — $137bn to be precise.

But it also has billions of dollars in what could be called “hidden debt”, which was recently revealed through an accounting rule overhaul.

How could these substantial liabilities remain out of sight? The explanation is complex.

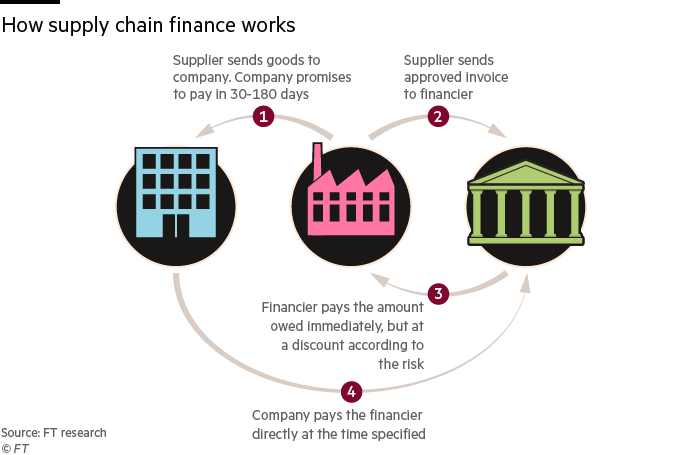

Longtime readers of DD will be familiar with supply chain finance, also known as reverse factoring — a practice under which companies make deals with financial institutions to expedite payments to suppliers.

The once-niche method of juicing balance sheets became notorious when specialist firm Greensill Capital imploded in 2021. But it retains benefits, too.

One huge perk enjoyed by major corporations: when a company using supply chain finance owes money to a financial institution, accountants don’t class these facilities as debt.

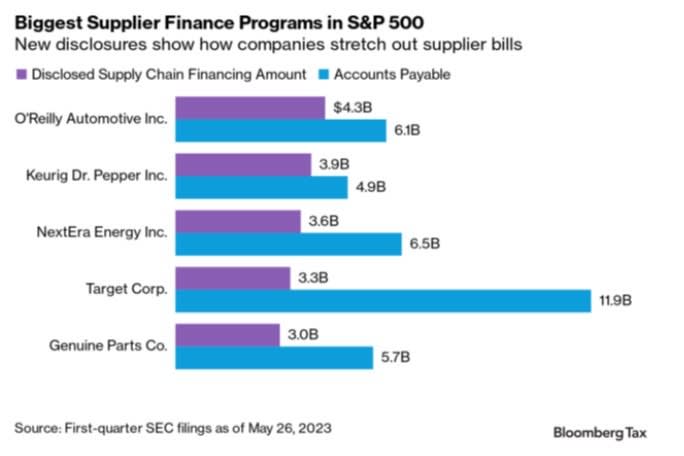

In the US, the Financial Accounting Standards Board has made efforts to close this loophole, requiring scores of American companies to disclose their supply chain finance programmes for the first time in their first-quarter results this year.

AT&T is among the biggest users of such financing, ranking alongside the likes of Keurig Dr Pepper and Target. It far outstrips telco rival Verizon in its usage of such facilities.

Bloomberg recently calculated $64bn of hitherto “hidden leverage” revealed across corporate America through these disclosures.

Despite having what can be broadly termed “payables finance” programmes stretching to nearly $13bn, DD’s Robert Smith noticed AT&T was conspicuously absent from the top five.

Robert dives deep into the weeds in this Alphaville post to explain why. We recommend reading it in full.

The man at the centre of the Trafigura scandal launches his defence

The Indian-born businessman that Trafigura accused of being the mastermind behind a $590mn nickel fraud left the commodities world waiting almost half a year before filing his defence.

But Prateek Gupta made his message clear on Wednesday: Trafigura were the ones who “devised and proposed” the scheme to present trades of nickel that were, in fact, of something else.

The first account of events from Gupta’s side laid bare a shocking accusation that Trafigura allegedly asked his companies to work in cahoots to trick the Singapore-based commodity trader’s lender Citibank.

According to Gupta’s filing, he held a flurry of meetings in Mumbai and Dubai in 2019 with Sokratis Oikonomou, Trafigura’s then head of nickel, and Harshdeep Bhatia, one of their senior traders in India, in which his two counterparts proposed the allegedly duplicitous trading arrangement.

Trafigura said the defence wasn’t credible and would “vigorously” continue to pursue its claim, setting the stage for a blistering trial in London’s High Court where the case will be heard.

Gupta still has a lot to answer for. His case denied that he was the “de facto or legal controller” of three firms he alleged Trafigura suggested introducing to the trading structures.

Just the day before Gupta’s defence was released, the FT’s Cynthia O’Murchu and DD’s Kaye Wiggins reported that the father of Aman Chourasia, the owner of a Hong Kong sandwich shop and founder of Spring Metals, one of the three firms, used to be employed at one of Gupta’s companies.

Even so, the scandal has sent shockwaves through the global commodity trading world, especially given the alleged fraud spans more than 1,000 containers of non-existent nickel.

Trafigura had been on the back foot to explain how its due diligence procedures let an alleged fraud of that scale go unchecked. Now, Gupta has put it on the defensive.

Job moves

-

Allen & Overy’s global managing partner Gareth Price, whose term was due to run until at least April, is leaving the firm “for personal reasons” ahead of its planned merger with US rival Shearman & Sterling.

-

Rothschild & Co has named Mark Connelly as a managing director and head of equity capital markets in North America. He joins from Houlihan Lokey, and was UBS’s co-head of equity capital markets before that.

-

Morgan Stanley has hired veteran investment banker Daniel Cohen from Truist Financial Corp, per Reuters.

Smart reads

The strong silent type BNP Paribas’ “introvert” boss Jean-Laurent Bonnafé spoke to the FT’s Sarah White on challenges from the energy transition to his own succession.

Rooms for rent Real estate billionaire Stephen Ross’s Related Companies has struggled to fill units in its tower for New York’s elite. Now it’s offering steep discounts, The Wall Street Journal reports.

Golf courses and Gucci Brazilian property developer JHSF Participacoes is on a mission to make Boa Vista — a gated community 62 miles west of São Paulo — into an exclusive enclave for the ultra-rich, Bloomberg reports.

News round-up

Goldman Sachs offloads $1bn of Marcus loans to Varde (Reuters)

Saudi Wealth Fund weighs buying another top football club in Europe (Bloomberg)

Exits of diversity executives shake faith in US companies’ commitments (FT)

GAM’s largest shareholder backs Liontrust takeover (Financial News)

SEC dealt legal setback in effort to tame crypto market (FT)

Exxon to buy Denbury in $4.9bn deal (Reuters)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Francesca Friday, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com