- AVAX has not yet broken its bearish structure on the one-day chart

- Coming days could see a dip, and the demand zone highlighted is a key area of interest

Avalanche [AVAX] witnessed a strong bounce from the $31-support zone. It fell to $31.12 on 8 January, but has gained 24% since then. The network also hit a record-breaking number of monthly active users.

Avalanche’s network also saw a surge in NFT activity. It is expected that new NFT mints contribute significant volume and activity to a network. This could attract creators to the network and fuel greater demand for AVAX.

Market structure hasn’t flipped bullishly yet

The one-day price chart has been bearish since 27 December, when AVAX fell below the low at $43.34. At press time, the recent lower high of the downward move since then was at $39.45, marked in green.

A daily session close above this level has not occurred yet. If it does, it would make the $33.08-$35.87 (cyan box) a bullish order block. While the structure was technically bearish, the descending trendline resistance (yellow) has been broken.

A move above $39.45 and a dip to the bullish order block or the descending trendline to retest it as support would offer an ideal buying opportunity. The Fibonacci levels (pale yellow) marked the $42.76 and $45.93-levels as firm resistances.

Chances of another dip in search of liquidity seem good

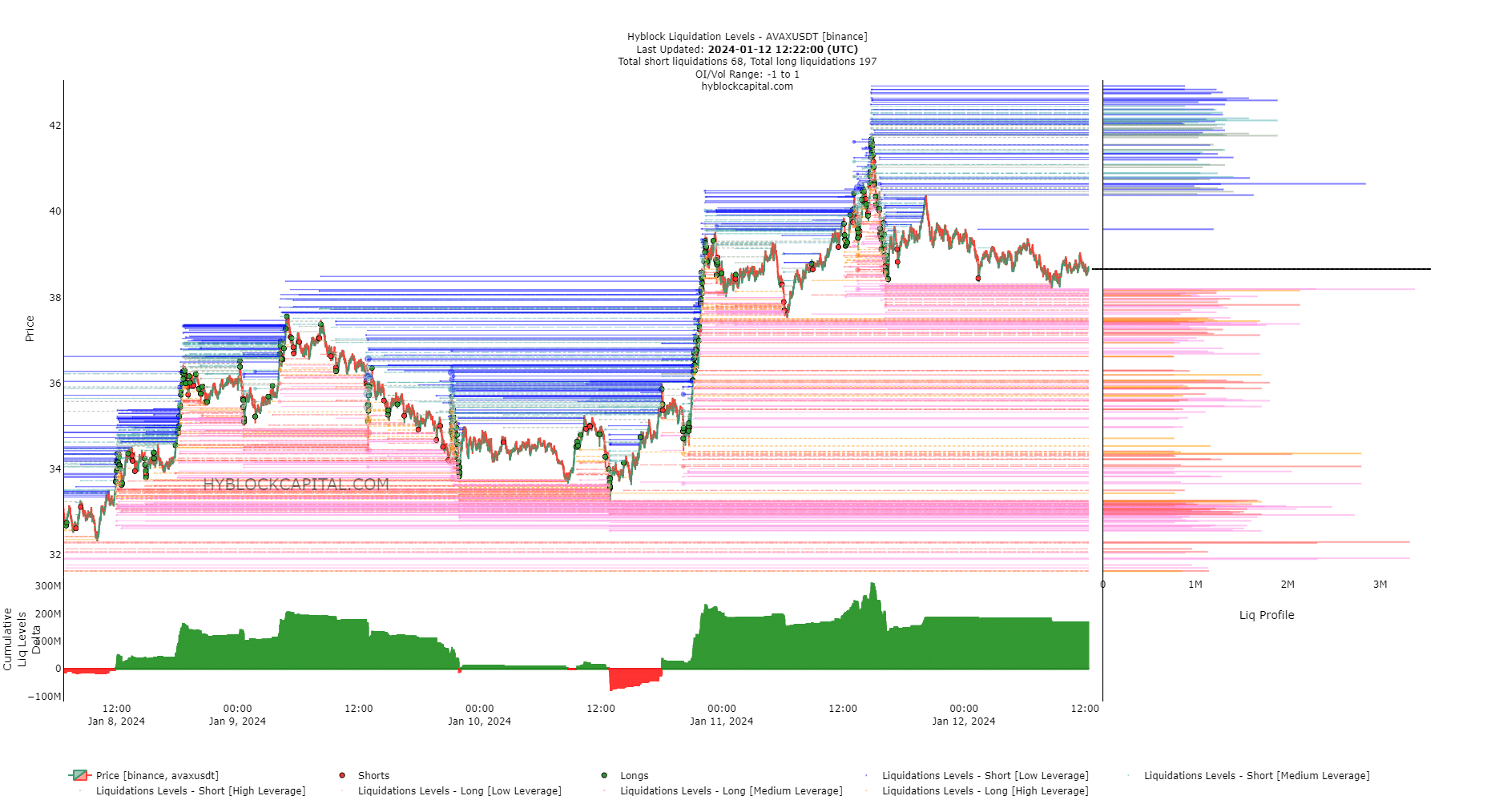

Source: Hyblock

AMBCrypto analyzed the data from the liquidation levels chart from Hyblock. The Cumulative Liq Levels Delta has been positive over the past 24 hours. This suggested that the long liquidation levels were more in number. It presented an attractive opportunity for prices to hunt liquidity by dropping south and forcing longs to close.

How much are 1, 10, or 100 AVAX worth today?

To the south, the $38.2 and $37.7-levels had multiple liquidation levels of $2 million or more. Further down, the $35.7-$36.3 range also has a considerable number of liquidation levels. Hence, in the short-term, traders must beware a drop in prices. From a 1-day price action perspective, a move to $35 would be ideal as it would be a good place to long AVAX.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.