The billionaire Issa brothers and their private equity partners TDR Capital stumped up just £200mn for their 2020 deal to buy Asda, the UK supermarket chain valued at £6.8bn, corporate filings reveal.

Mohsin and Zuber Issa and TDR used a complex chain of asset sales and debt deals that left them on the hook for just £780mn of the mega buyout, the FT reported in 2021.

But a series of filings by businesses owned by the brothers and TDR in the tax havens of Jersey and Luxembourg show that all but £200mn of that sum was provided by loading more costs on to their already heavily indebted petrol stations business, EG Group.

Now, EG is racing to cut its debts and Asda might end up as the business that comes to its aid.

Petrol station raid

The UK’s biggest leveraged buyout in more than a decade was masterminded by an investment partnership that already owned EG, one of the world’s biggest petrol station businesses, with nearly 6,000 sites in Europe, Australia and the US.

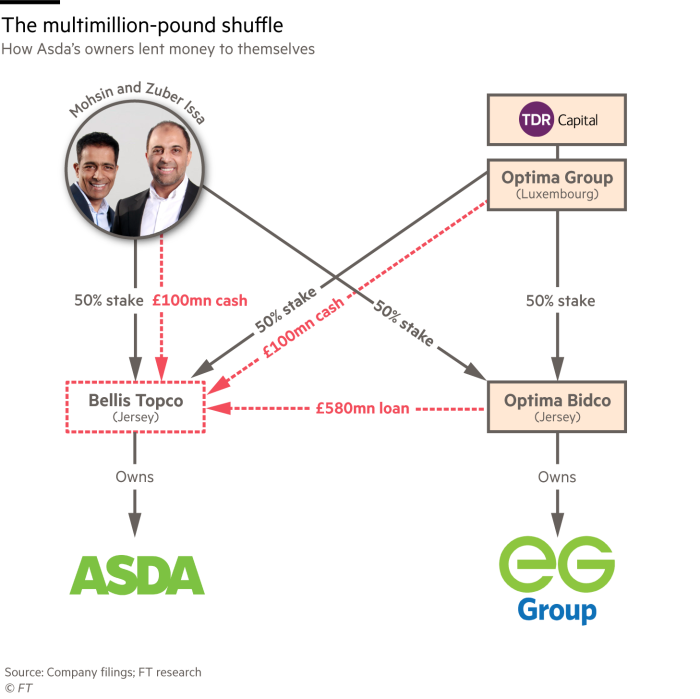

The offshore filings examined by the FT show that the Issa brothers and TDR were able to pay such a small fraction of the purchase price for Britain’s third biggest supermarket chain because EG’s parent company, Optima Bidco Jersey, loaned more than half a billion pounds to Asda’s parent company, Bellis Topco, also based in Jersey.

To raise the money for the loan, Optima Bidco sold two batches of preference shares — which pay a fixed dividend and do not confer voting rights — in 2020, worth €405mn and $316mn.

It then lent £580mn of the proceeds to Bellis Topco, leaving the Issa brothers and TDR with just £100mn each to find.

But the unsecured loan has landed EG, which already had €8bn of debt, much of that due for refinancing in 2025, with new financial burdens.

Although the loan has a 12 per cent interest rate, there is no fixed date for repayment, the filings show. Meanwhile, servicing Optima’s more than £1.7bn in total outstanding preference shares is becoming more costly. They pay an annual coupon of 8 per cent, set to rise to 10 per cent this year and 12 per cent next year.

EG disclosed in its 2021 annual report that it had lent $112mn to Optima in two instalments in June and November 2021 “in order for them to meet their obligations to preference shareholders”.

It did not say how much interest it was charging its parent company, but said it was “comparable with commercial rates of interest”.

At the same time, EG’s core earnings fell 15 per cent in the last three months of 2022, partly because of currency fluctuations and partly because of falling sales in Australia and the US. In a report published in March alongside these results, EG said it was committed to “significant deleveraging” and was looking for ways to “put in place a sustainable capital structure”.

EG Group told the Financial Times it had “delivered a highly resilient financial performance in 2022 despite macroeconomic headwinds” and that core earnings had grown that year after the effect of currency fluctuations were stripped out.

“Given our well-diversified, sustainable business with a strong asset backing, we can access multiple pools of liquidity to help reduce the overall debt,” it said, adding that it was planning to cut spending on buying, refurbishing and rebuilding sites.

TDR declined to comment.

How to solve a problem with a merger

One option could involve a deal with Asda, which took on £3.7bn of junk-rated debt to help pay for the Issas and TDR to buy it.

According to two people with knowledge of their plans, the Issa brothers and TDR are considering selling EG’s UK operations to Asda. One of those people estimated any deal could value the UK petrol stations business at about £3bn.

Since the Issa brothers and TDR own both companies, they would in effect be selling to themselves, but the deal would bring in fresh cash for EG Group to pay off some of its debts.

The business empire controlled by TDR and the brothers is “heavily leveraged on [the EG Group] side and modestly on the [Asda] side”, so selling the petrol company’s UK operations to Asda would mean “rebalancing and deleveraging”, a person close to the owners said.

“The cost of debt has gone up and they need to do something about it,” they added.

Selling part of EG to Asda would “undoubtedly mean more leverage for Asda” just as interest rates rise, one of the supermarket’s bondholders said. “Would they really want to bring a lot more debt to market at this point in time?”

Sense of urgency

Rising interest rates, the preferred equity costs and EG’s 2025 debt refinancing deadline have brought a new urgency to discussions about deleveraging.

Selling its UK operations to Asda is one of several options to cut the debts of a company that stands to be hit by government rules phasing out the sale of new petrol cars within the next decade.

In March, EG agreed a $1.5bn deal to sell 415 of its US petrol station sites to a real estate investment group and rent them back, using the upfront cash to pay off some of its debts.

That deal, which involves about 15 per cent of EG Group’s freehold sites, went against the company’s longtime strategy of owning its own real estate.

Another option is to sell more of EG’s overseas units and focus on its UK operations, potentially revisiting plans to buy another UK retailer, after talks to acquire the chemist Boots fell apart last year. Another possibility that has been discussed is that the Issa brothers, who are 50 and 51, sell their stakes in Asda and EG to TDR, enabling them to retire or start new businesses.

EG is “actively exploring further options, including potential scale asset disposals and further real estate monetisation”, the company told the FT.

Legacy issues

TDR marketing from last year aimed at potential investors highlighted how lucrative the partnership with the Issa brothers has been.

According to the firm’s presentation, one of its funds, which originally invested €234mn in EG Group, received a €1.2bn windfall on this deal. A person with knowledge of the details said TDR received this payout in 2018 and the brothers separately received a similar amount two years earlier when they first partnered with the firm.

The presentation also said that within a year of the Asda buyout, TDR had already made almost 20 times its original investment on paper.

The Issa brothers, meanwhile, are now asking themselves how they will spend the final decades of their careers and what their legacy might be, one close associate said.

During EG’s boom years, when the company loaded up on cheap debt to fund a breakneck expansion, the brothers sometimes defied business norms.

They bought themselves two private jets using interest-free loans from EG in 2018 and in 2020 Deloitte resigned as auditor of the group over governance concerns. At that time, the company had no external board members and Deloitte was concerned about delays in appointing any.

“I think they’re better behaved now,” one lender to EG said. “Zuber and Mohsin are super hardworking self-made guys; they just needed a bit of direction. I think now they’re acting a bit more like a corporation, a company with non-executive directors and proper governance.”

In 2021, they brought in retail veteran Lord Stuart Rose as chair of both EG and Asda, and appointed former Land Securities chair Dame Alison Carnwath to both boards. Former BP executive John Carey joined EG’s board in 2020.

“Their options are varied and there are a lot of decision makers around the process — you’ve got TDR, each brother, the board members,” an adviser to EG Group said. “For these guys it’s their life’s work and they’ve got a lot of thinking to do.”

But creditors will not wait forever, the adviser added. “At some point in the not too distant future they have to be very clear with the market . . . People are going to want to know what is going on.”