This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

Good morning and welcome back to Energy Source, coming to you from London.

The UK is gearing up for a general election expected at some point this year, with energy policy shaping up to be a crucial part of the campaign.

Both the ruling Conservative party and the opposition Labour party support the UK’s legally binding goal of net zero emissions across the economy by 2050.

But they have different visions of the pace and shape of the route there, with Labour aiming to decarbonise the electricity system by 2030 compared to the Conservatives’ 2035 target, and planning not to award new oil and gas exploration licences.

Sir Keir Starmer, leader of the Labour party, donned his hi-viz jacket and hard hat for a trip to North Wales on Monday, to pledge his party’s support for one clean energy technology in particular: floating offshore wind.

The technology is at an early stage in the UK as elsewhere, but Labour is hoping it can create “tens of thousands of skilled jobs” across the country.

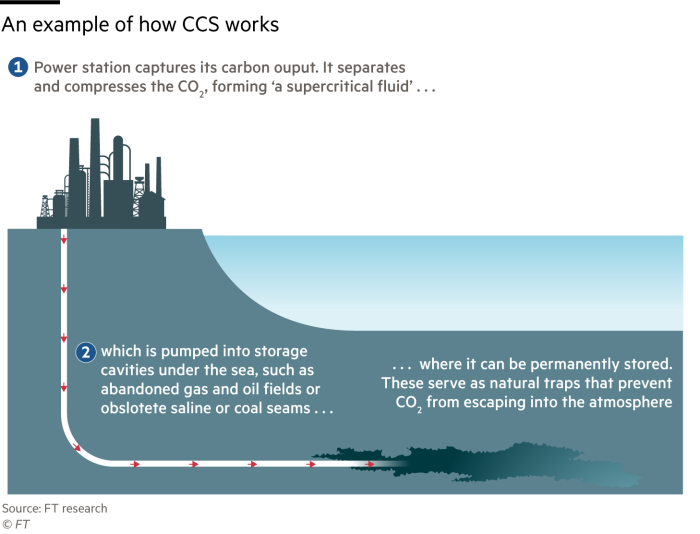

I stick with UK clean energy progress in today’s newsletter, looking at efforts to get carbon capture and storage projects off the ground.

Meanwhile, my colleague Shotaro Tani digests the findings of an intriguing Wood Mackenzie report into how to try and cut emissions from liquefied natural gas.

Elsewhere in the FT, this fascinating piece by Alexandra Heal and Jana Tauschinski delves into the murky world of oil slicks, and how to monitor them.

Enjoy reading.

A crucial few months ahead for UK’s carbon capture goals

Britain’s ambitions to capture and store a large chunk of its carbon dioxide emissions took a step forward last week, with the government granting planning permission to a 60.5km carbon dioxide pipeline.

If all goes to plan, Italian energy giant Eni’s proposed HyNet North West Co2 pipeline between Flintshire, north-east Wales, and Cheshire, north-west England, will gather emissions from planned hydrogen plants and other sites, and send them out towards depleted gasfields in Liverpool Bay.

Claudio Descalzi, Eni’s chief executive, said the approval was a “significant step” towards setting up a British carbon capture industry, adding that Eni was working to decarbonise industrial activities “at a competitive cost and with a fast time to market”.

The announcement was the latest sign of activity in the UK’s carbon capture plans. Earlier this month Net Zero Teesside Power said that it had picked contractors for its planned carbon capture-fitted power station being developed by BP and Equinor.

Yet whether the nascent industry turns into reality rests on talks taking place behind the scenes, with a crucial few months ahead. The government has been in negotiations since March last year with developers of the first batch of projects it wants to get up and running.

The complex process involves dozens of parties: ministers are trying to work out how pipeline and storage owners should set up and charge for the new service, and at the same time strike subsidy deals with emitters to help them bear the costs of fitting carbon capture equipment.

They are taking it step-by-step geographically, aiming to get one polluting region hooked up to storage pipes and caverns at a time. If it all comes together, final investment decisions for the first projects, covering networks on the east and west coast, should be made in September.

That would be a significant milestone for the global industry as well as the UK, helping to demonstrate a commercial path for an industry that is being relied on around the world to decarbonise industries struggling to quit fossil fuels.

Projects in negotiations would cover about one-third of the 20mn-30mn tonnes of carbon dioxide the UK government wants to capture every year by 2030, to help meet its legally binding goal of net zero carbon emissions by 2050.

“An awful lot of good, detailed work has been done on the business models and legislation to get to where we are,” says Ruth Herbert, chief executive of the Carbon Capture and Storage Association trade group. “All eyes are now on the [first] final investment decisions.”

Yet there is little room for delay given the ambitious goals for the technology, while the next batch of projects are waiting in the wings. This year is a “critical year for maintaining decision pace”, says Graeme Davies, head of the Viking carbon capture and storage project being developed by Harbour Energy and BP in the Humber region.

Meanwhile, the CCSA has been pushing the government to set out plans for more financial support beyond the £20bn already announced in March 2023, to give certainty to investors beyond the current batch of projects.

In a warning becoming increasingly familiar to the UK’s chancellor, the CCSA said in briefing papers last year that developers face increased competition from other opportunities around the world. “Almost a third of projects surveyed are considering relocating their projects overseas,” it added.

Efforts to get the industry off the ground are taking place against a slump in the UK’s carbon price, removing the pressure to install carbon capture technology for some emitters.

The UK government says it is “working closely with industry to maintain our ambitious timetable” and Britain is “well-positioned to be a world leader” in the emerging industry, with the North Sea potentially able to hold up to 78bn tonnes of CO₂.

Talks coming to a close in the next few months will be a crucial test of those prospects.

Taxing LNG for decarbonisation

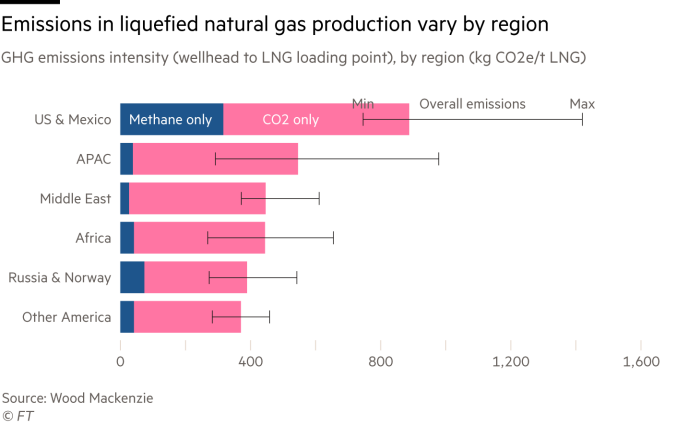

Energy majors have been keen to position liquefied natural gas as a “transition fuel” which can be used as a cleaner alternative to coal as countries develop lower carbon sources of energy.

But its climate credentials have come under the spotlight in recent months, highlighted by the pause on permits for new export projects by the Biden administration in the US.

Natural gas emits less CO₂ than coal when burnt, but its main component, methane, is a more potent greenhouse gas than carbon dioxide, albeit shorter-lived.

Emissions can happen throughout the LNG value chain, from extraction and production of gas to liquefaction and shipping.

“Not much is being done” in the LNG industry to curb methane emissions because “there is just no incentive whatsoever”, said one LNG trader. “No one is being charged and no one is able or willing to pay a premium” for more green but also more expensive LNG, the trader said.

What can accelerate the decarbonisation of the industry? Wood Mackenzie, in a recent report, looks at whether taxing LNG imports based on their greenhouse gas emissions is one way of fostering change.

Its conclusions are not straightforward: emission taxes limited to Europe would not be enough to “motivate LNG players to act decisively to reduce all GHG emissions”, it warns.

Only if widened to a global scale “would a substantial tax provide the economic incentive for the industry to invest in more costly abatement options”.

But global adoption is unlikely, as emerging Asia, which is set to see substantial demand growth in the coming years, “will remain wary of higher LNG prices and be reluctant to follow suit”, the report says.

The likely result? A bifurcarted market, with higher prices in countries and regions where tax are applied. LNG trade flows will be optimised to mitigate the impact of carbon taxes, limiting the scope of industry-wide decarbonisation.

As ever with energy, it’s complicated. (Shotaro Tani)

Power Points

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu and Tom Wilson, with support from the FT’s global team of reporters. Reach us at energy.source@ft.com and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here