- OP may have confirmed a structure shift after breaking above the double-bottom neckline at $0.85.

- Large Transactions Volume surged, signaling whale interest even as holder profitability remains nearly evenly split.

Entering into the 4-hour time frame, it was evident that after a successful crossing of the neckline of the double bottom pattern, Optimism [OP] appeared to have triggered a potential notable shift in its structure.

Previously, the $0.85 neckline acted as stiff resistance. Once broken, OP climbed to $0.89 and briefly stabilized above it.

If OP’s price kept hovering above the $0.85 level, then a trend reversal could be in the offing. Depending on event recognition, $1.00 was the next milestone to watch out for.

One level to rule them all: OP’s $0.85 must stand

Initial indications from the MACD indicated a bullish crossover, a revelation that on the market, there was a continued buying force.

That said, $0.85 must hold to keep momentum alive.

If support at $0.85 did not hold, the price could retrace back to $0.78, the low established in the double bottom.

If prices dropped below $0.78, it would raise a question on whether the reversal was correct and put OP in a position of further losses, even to $0.70.

So, OP’s immediate trend depends heavily on the $0.85 zone acting as firm support in the coming sessions.

Number of large transactions and holder profitability

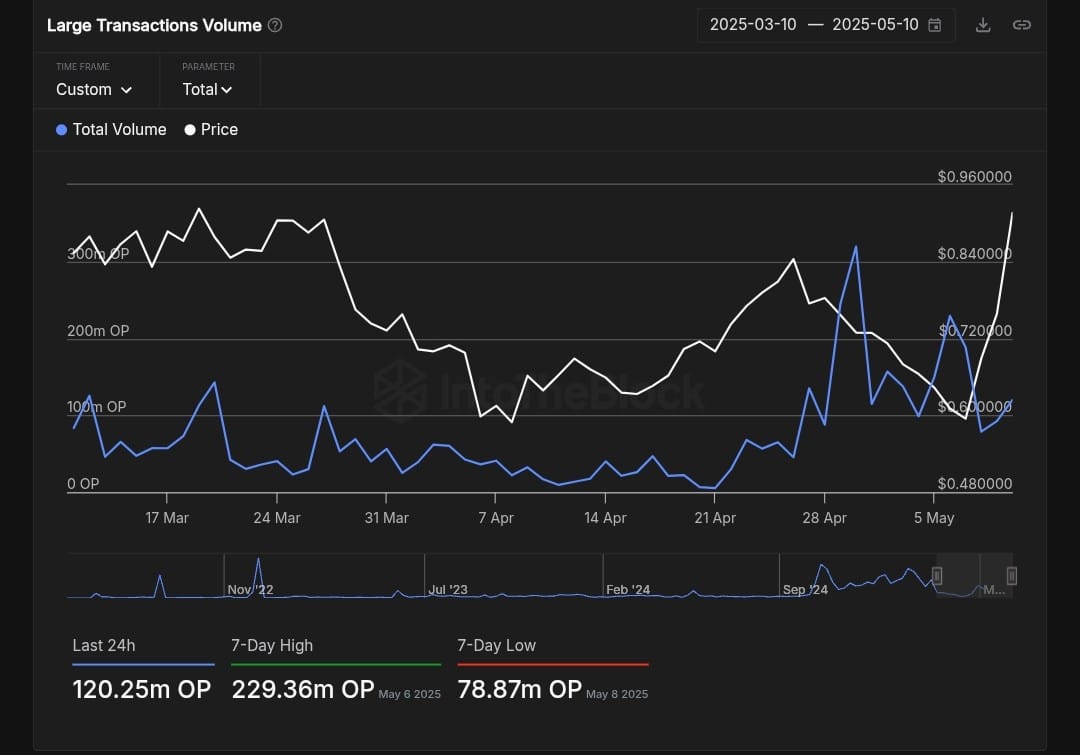

On-chain data from IntoTheBlock revealed that Large Transactions Volume peaked at 120.25 million OP in 24 hours.

Weekly volume ranged between 78.87 million and 229.36 million OP—an impressive $150 million spread.

The price surged past $0.85 and reached approximately $0.90, coinciding with increased trading volumes. This rise in activity suggests that large-scale investors played a significant role in driving the market upward.

If this trend continued, it might bring up more bullish enthusiasm.

However, if transaction volume were to decline, it could jeopardize the current trend. So far, the increase in transaction volume seems to be supporting the recent rise in OP’s price.

Half winning, half bleeding

Meanwhile, around $0.9026, 48.30% of Optimism holders made a profit while almost an equal percentage, 48.82%, continue to make losses.

Only 2.88% were at breakeven—an unusually narrow band that often leads to sudden directional moves.

The support cluster lies between $0.79–$0.82, while a red zone of resistance stands tall at $1.01–$1.04.

If OP continued to rise, it would face resistance between $1.01 and $1.04, where the large red cluster indicated substantial unprofitable positions lined up for liquidation.

The market’s structure suggested that OP may stabilize around its current bracket.

If the price were to rise above $0.93, it could induce an uptrend; and a further drop under $0.85 might bring another look at more serious support levels.