- Solana crosses 400B transactions as real network usage and TPS remain industry-leading.

- Hot capital inflows surge $4.72B in a week, SOL price eyes $150 amid mixed technicals.

Solana [SOL] just blew past 400 billion transactions — and it didn’t stop there.

In a week that saw hot capital surge by $4.72 billion, its sharpest inflow since January, the high-speed blockchain reignited investor appetite and sent $SOL sailing above $150 for the first time since March.

The rally has cooled slightly, but Solana’s bullish momentum is back on-chain and on fire.

Solana is on a power run!

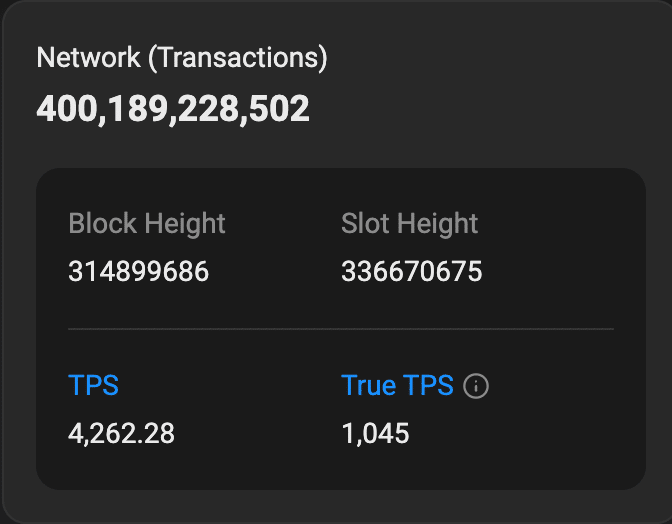

Solana has officially crossed 400 billion lifetime transactions, having clocked in at over 400,189,228,000 – a staggering figure that puts its high-throughput narrative on full display.

The network is currently humming along at 4,262 transactions per second (TPS), with a True TPS of 1,045 — still leagues ahead of most Layer-1s.

The distinction matters: True TPS filters out vote transactions and reflects actual user and dApp activity. This isn’t just noise on-chain; it’s real usage, and it backs up the recent capital inflow and market rally.

Hot capital sees biggest spike since January

On the 28th of April, hot capital — the value held by coins moved within the last 24 hours to 1 week — surged to $9.46 billion, its highest level since mid-March.

That’s a $4.72 billion jump in just seven days, marking the most aggressive weekly inflow since the 23rd of January.

The chart showed a clear thickening in younger coin bands, suggesting active rotation and renewed speculative appetite.

Solana’s price outlook

Solana maintained its footing near $147 at press time, up 0.70% in the past 24 hours. However, momentum indicators flashed mixed signals.

The RSI hovered at 59.5, just shy of the overbought zone, suggesting weakening bullish pressure. Meanwhile, the OBV dipped slightly from its April highs, hinting at reduced accumulation despite recent gains.

If buying volume doesn’t pick up, SOL may struggle to break past the $150 resistance.

Conversely, holding above $145 could keep bulls in control — at least in the short term — as hot capital flows continue to support price stability.