Gold appears to be well-positioned for a strong pump that could carry it to new all-time high prices in 2023—and beyond. As you know, I’ve been following and writing about the precious metal market for a very long time, and I see a number of unique catalysts at the moment that could contribute to higher gold prices. If you’re underexposed or have no exposure, it may be time to consider changing that.

Below are just three potential catalysts.

Emergence of a Multipolar World and Rapid Dedollarization

I’ll begin with what I believe to be the biggest risk that could be beneficial for gold prices: dedollarization. In last week’s commentary, I wrote about the end of the petrodollar and the possible emergence of a multipolar world, with U.S. on one side and China on the other.

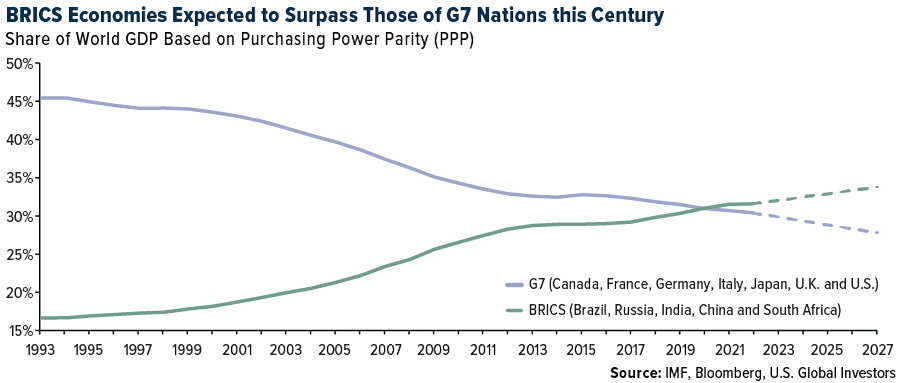

Take a look at the chart below. The purple line shows the combined economies of G7 nations (Canada, France, Germany, Italy, Japan, the U.K. and the U.S.) as a share of global GDP, in purchasing parity terms. The green line shows the same, but for BRICS countries (Brazil, Russia, India, China and South Africa). As you can see, G7 economies have steadily been losing their economic dominance to the BRICS—China and India, in particular. Today, for the first time ever, the leading developed countries contribute less to global GDP than the leading emerging countries.

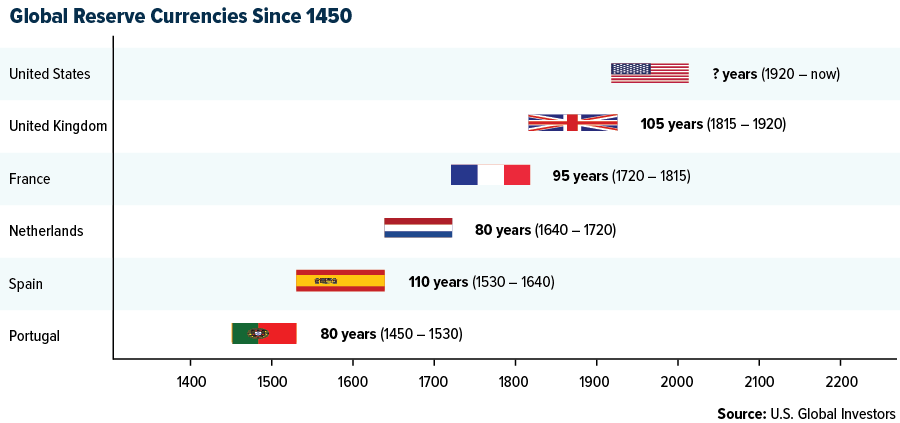

The implications of this could be multi-faceted, but for our purposes here, let’s focus just on currencies. Since the end of World War I, the U.S. dollar has served as the world’s reserve currency, and since the 1970s, crude oil and other key commodities—including gold—have traded globally in greenbacks.

That may be set to change with the rise of a multipolar world in which half of all commodities are traded in U.S. dollars, the other half in another currency—the Chinese yuan, perhaps, or a BRICS currency of some kind, or a digital currency such as Bitcoin.

An increasing share of commodities is already being settled in non-dollar currencies. This week, China settled a liquid natural gas (LNG) trade with France in yuan for the first time ever as the Asian giant seeks to expand its economic influence around the world. Since Russia’s invasion of Ukraine last year and the international sanctions that followed, Russia’s de facto reserve currency has been the yuan, according to Kitco News.

Some economists believe the time is right for a major competitor to the dollar to step up. Jim O’Neil, the former Goldman Sachs economist who coined the acronym BRIC, wrote an essay last weekend urging BRICS nations to challenge the greenback’s dominance, saying that shifts in U.S. monetary policy create dramatic fluctuations in the value of the dollar that affect the rest of the world.

Gold would be a direct beneficiary of dedollarization since it’s priced in the greenback. Gold is trading at or near all-time highs in a number of currencies right now, including the British pound, Japanese yen, Indian rupee and Australian dollar, and it would likely be hitting new highs in USD terms as well were the dollar to be devalued.

Acceleration of the Liquidity Crisis and Return of Quantitative Easing (QE)

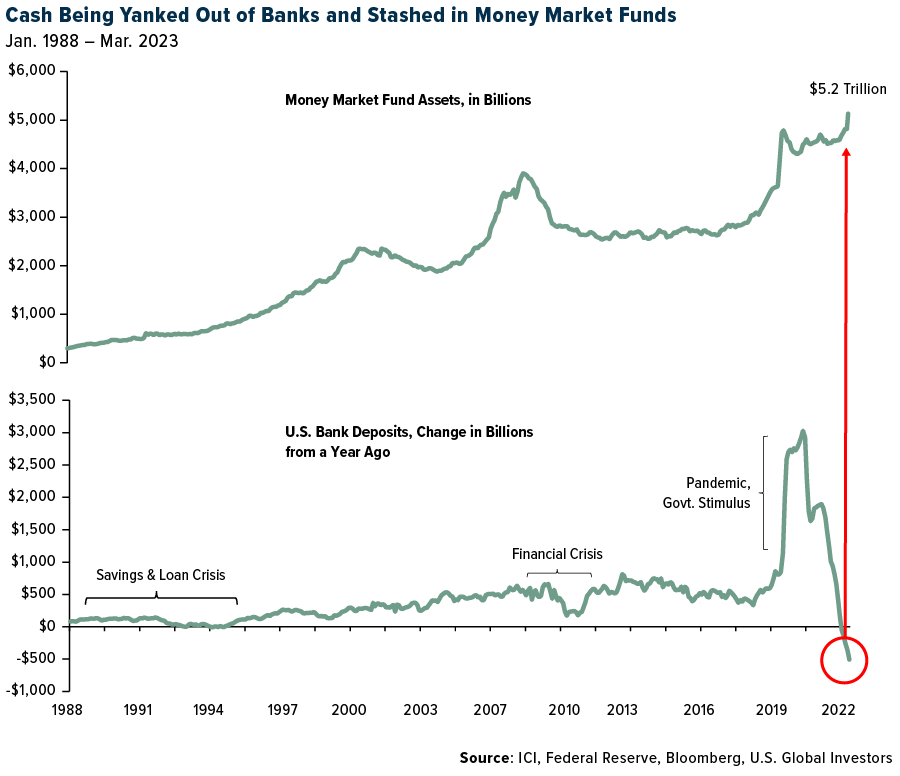

The next potential catalyst has to do with the ongoing shakiness of certain segments of the traditional financial sector. Pressured under an estimated $620 billion in unrealized losses, the U.S. banking industry has seen the failure of two large firms this year—Silicon Valley Bank (SVB) and Signature Bank—and a significant erosion in depositors’ confidence.

As a result of these failures, people and companies have withdrawn tens of billions of dollars from banks. In March, bank deposits were down more than $500 billion compared to the same month in 2022, a more dramatic year-over-year change than the savings and loan crisis in the 1980s and 1990s and the financial crisis.

Where is all this capital going? Money market funds, which are perceived to be safer and, in many cases, deliver higher yields than savings accounts right now. A record $5.2 trillion now sit in these funds, according to the Investment Company Institute (ICI), and the stockpile is expected to get much higher.

Many regional and community banks were already facing a liquidity crunch due to massive unrealized losses, and the sudden withdrawals will only amplify things. As reserves drop, banks will become less and less willing to lend to households and businesses, slowing the economy even more than the Federal Reserve’s rate hikes.

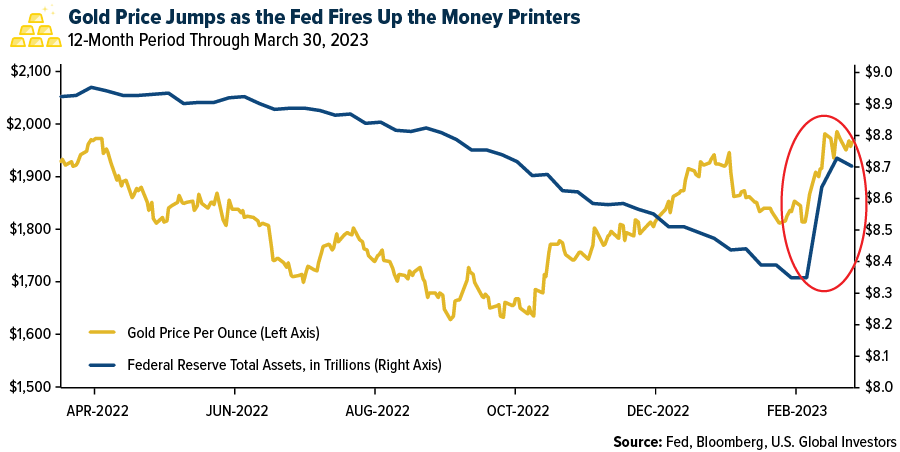

In the event that the liquidity crisis expands into a full-blown recession, the Fed will have no other choice than to pivot and begin another cycle of quantitative easing (QE). The central bank has been trying to unwind its balance sheet, but in an effort to stabilize the banking sector, it added nearly $400 billion in the two weeks ended March 22. Over the same period, the price of gold jumped 8.6%, reversing its 2023 losses.

Two Cold Wars

The final catalyst on my list involves worsening diplomacy between the U.S. and its allies and Russia and China. Relations between the West and the East are about as bad as I remember them ever being, and they could get way worse before they get better.

In recent interviews and webcasts, I’ve been saying that the U.S. is facing two Cold Wars right now with Russia and China. I hope that these conflicts remain “cold,” but there’s always the possibility that they become something more—in which case, I would want to have exposure to gold.

I won’t spend a whole lot of time on this topic, but I want to point you to a recent article that appeared in Foreign Affairs. According to the article’s two contributors, Chinese Leader Xi Jinping appears to be shoring up his country’s military readiness by increasing the defense budget and building new air-raid shelters in key cities and “National Defense Mobilization” offices. “Something has changed in Beijing that policymakers and business leaders worldwide cannot afford to ignore,” the piece reads.

Whether the military build-up is a precursor to an invasion of Taiwan or something else remains to be seen.

What I do know is that investors have put their trust in gold in times of geopolitical risk and uncertainty. I’ve always advocated for the 10% Golden Rule, with 5% in physical gold (bars and coins) and the other 5% in high-quality gold mining stocks, mutual funds and ETFs.

Not everyone knows where to start, however, and that’s why we created the ABC Investment Plan. With just a small initial investment and an affordable monthly contribution, you can begin investing in our funds. The ABC Investment Plan is an automatic investment plan that uses the advantages of dollar-cost averaging—a technique that lets you invest a fixed amount in a specific investment at regular intervals—together with financial discipline to help you work toward your financial goals.

Index Summary

- The major market indices finished up/down/mixed/flat this week. The Dow Jones Industrial Average gained/lost x%. The S&P 500 Stock Index rose/fell x%, while the Nasdaq Composite climbed/fell x%. The Russell 2000 small capitalization index gained/lost x% this week.

- The Hang Seng Composite gained/lost x% this week; while Taiwan was up/down x% and the KOSPI rose/fell x%.

- The 10-year Treasury bond yield rose/fell x basis points to x%.

Airlines and Shipping

Luxury Goods and International Markets

Energy and Natural Resources

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was XRP, rising 25.81%.

- Crypto Exchange Kraken signed a multi-year global pact with Formula One team William Racing, marking the trading platform’s first major sponsorship deal even as sports tie-ups with digital asset firms become increasingly unpopular. Kraken’s logo will be placed on the halo and rear wing of William’s car for the rest of the 2023 season, writes Bloomberg.

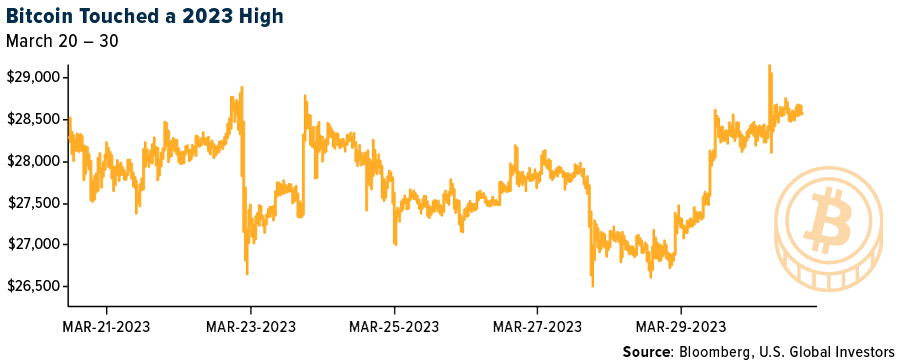

- Bitcoin renewed its climb toward $30,000 with risk appetite rising across global markets and concern about the fallout from Binance’s legal woes waning. Bitcoin rose as much as 4.9% to $28,638 on Wednesday, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Stacks, down 15.48%.

- Galaxy Digital, the company founded by Michael Novogratz, posted a fourth-quarter loss but said that the company’s liquidity position remains intact after the recent turmoil in the banking sector. The net loss was $2.8 billion, compared with net income of $521.3 million in the year-earlier period. The loss was primarily attributed to unrealized losses on investments in its investment portfolio during the slump in token prices, writes Bloomberg.

- Sushi Swap CEO Jared Grey is no longer feeling “inspired” after a wave of regulatory crackdowns on crypto exchanges, including the DEX that he manages, has put immense pressure on the crypto industry.

Opportunities

- Michael Novogratz, the founder of crypto financial services firm Galaxy Digital Holdings, said crypto markets “feel strong” this year, due to sellers’ exhaustion and the easing of restrictions in China, with Hong Kong warming up to the digital-asset sector. Even though trading crypto has been banned in mainland China, the city of Hong Kong last year unveiled a plan to make itself as a center for digital assets and so-called Web3 firms, writes Bloomberg.

- A new Hong Kong-based fund plans to raise $100 million this year to invest in digital asset startups, as the city seeks to become a regional fintech hub. The fund will be led by Ben Ng, a venture partner at the Asian private equity firm SAIF Partners, and longtime tech investor Curt Shi. The two have secured at least $30 million in funding commitments, writes Bloomberg.

- As much as $5 trillion may transition to new forms of money such as central bank digital currencies and stablecoins by 2030, of which roughly half could be linked to blockchain technologies, according to a Citigroup research study.

Threats

- The U.S. took its most forceful move yet on Monday to crack down on crypto exchange Binance Holdings and its CEO, Changpeng Zhao. The CFTC alleged in federal court in Chicago that Binance and its CEO routinely broke American derivatives rules as the firm grew to be the world’s largest trading platform. Binance should have registered with the agency years ago and continues to violate the CFTC’s rules, writes Bloomberg.

- Sam Bankman-Fried was charged with bribing Chinese officials, adding a new dimension to the U.S. government’s case against the FTX co-founder. The new charge was unsealed Tuesday in a revised indictment by federal prosecutors in Manhattan. Bankman-Fried is accused of authorizing the payment of $40 million to one or more Chinese government officials in order to get them to unfreeze accounts at Alameda Research, writes Bloomberg.

- U.S. banks already hesitant to work with crypto customers are now even warier of providing services to the industry after a string of regional-lender collapses. The closure of crypto friendly Silvergate and seizure of Signature Bank has left crypto firms struggling to find new banks for depository and payment services, Bloomberg says.

Gold Market

This week gold futures closed the week at $1,987.70, down $14.00 per ounce, or 0.70%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.66%. The S&P/TSX Venture Index came in up 3.68%. The U.S. Trade-Weighted Dollar fell 0.54%.

Strengths

- Everything is playing in gold’s favor: A banking crisis, falling rates, high inflation, pressure on the dollar, hot Asian demand and technical momentum as it flirts with breaching the $2,000 an ounce level for the first time in over a year.

Weaknesses

- The worst performing precious metal for the week was gold, down 0.70%. Gold prices in India, the second largest consumer, are up 15% from the prior year and that has led to a pullback in demand going into next month which is a key demand period. The cash market for gold is currently trading at a discount.

- Galiano Gold reported Q4/22 financial results with adjusted earnings per share (EPS) of -$0.03 (versus the consensus estimate of $0.01) on a lower realized gold price and higher finance costs from production of 34,100 ounces gold with an all-in sustaining cost (AISC) of $1,191 an ounce.

- Overall, inflation pressures were significantly underestimated in 2022 with only 30% of producers achieving original guidance and average AISC coming in +$100 an ounce higher than expectations. For 2023, companies have rebased costs higher, outlining an additional +3% increase in guided costs versus 2022.

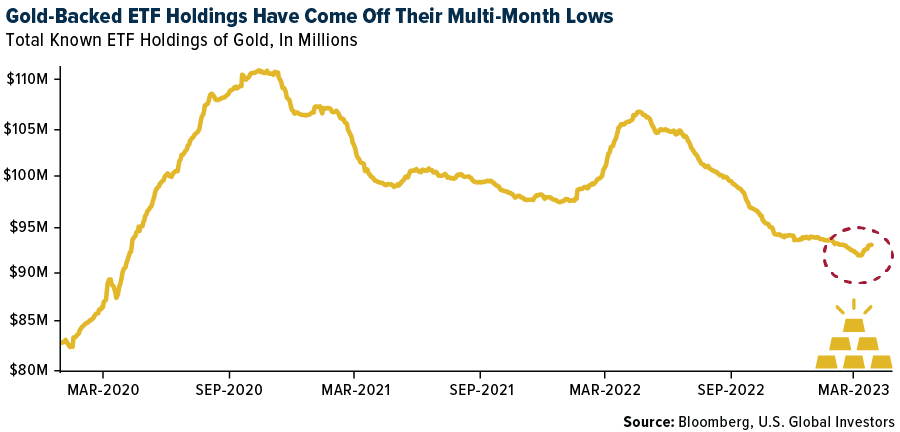

Opportunities

- With investors shifting to accumulate gold over the past two weeks as evidenced by net inflows into physical gold ETFs, the chief economist and global strategist at Euro Pacific Capital believes investors may be running out of time to purchase gold below $2,000 per ounce. Banking stress, a weaker dollar, and falling bond yields are driving investors to follow the lead of many central banks around the world that bought record amounts of gold.

- Gold is near its highest price in nearly a year, with the copper/gold ratio declining by 4% year-to-date. Historically, this ratio has exhibited a close correlation with the cyclical/defensive ratio; however, the latter is +12% YTD. Gold equities should continue to benefit at this point in the cycle.

- Barrick Gold and the Papua New Guinea government and partners have agreed to resume operations at the Porgera gold mine at the earliest opportunity according to Bloomberg. Upon operational restart, the plant and operations have been on care and maintenance since 2020, the mine is expected to ramp up to around 700,000 ounces per year. This should be a positive as it brings a second operating gold mine to the Papua New Guinea outside of the presently established operations of K92 Mining. Barrick has the confidence to return to this jurisdiction.

Threats

- Analysts are taking down their platinum group metals (PGM) basket price forecasts by 20% on average between 2023-2030 to reflect a faster-than-expected decline in ICE vehicle sales through 2030 and a growing perpetual palladium/rhodium surplus that emerges by 2025. Recalling ICE vehicles are one of the primary demand drivers for platinum/palladium/rhodium (given use in ICE vehicle catalytic converters), and growing penetration of EV’s poses a strong demand-side threat to PGMs.

- Only 33% of operations were able to execute on mine site cost guidance in 2022 with average miss of $50 per ounce gold. Company-wide, producers saw average AISC of +$100/oz above original guidance, with only 30% of producers able to achieve guidance, representing a record low versus the prior five-year average of 75%.

- CoinDesk data shows that the top cryptocurrency by market value rose almost 72% to $28,500 this year, its best quarterly gain in two years. The cryptocurrency’s market value is $542 billion after the rally. After falling 76% since November 2021, some experts predicted Bitcoin could fall to $12,000 this quarter three months ago. The rebound has put Bitcoin ahead of Ether, the second-largest cryptocurrency by market value, which is on track for a 50% quarterly gain. Gold has uneventfully only gained 8% this year, reflecting it hasn’t seen a major jump in price due to current stress, but people are noticing.