- 1inch experienced a notable decline in network activity in Q3.

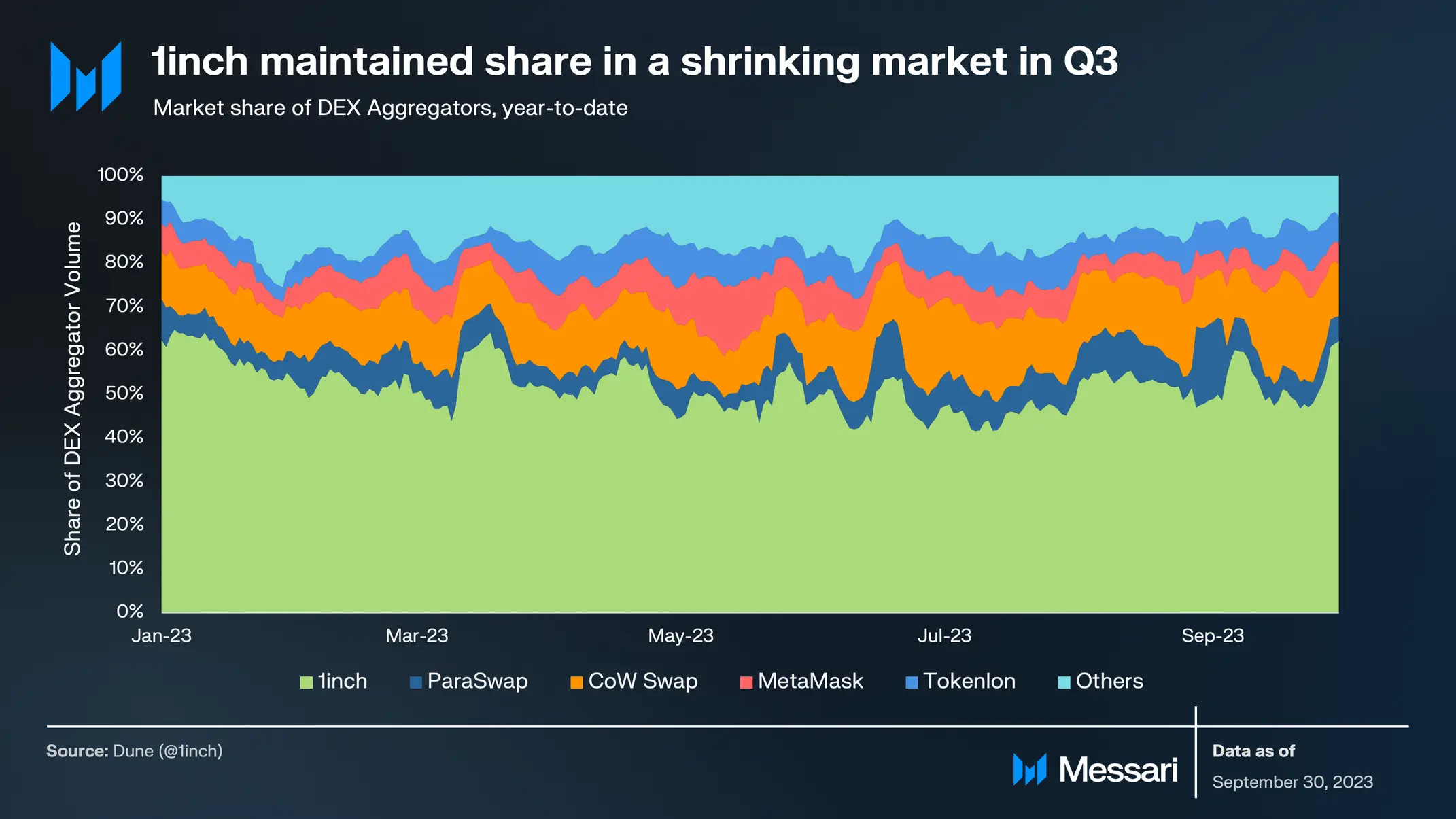

- However, it continued holding on to the largest market share in terms of DEX aggregator volumes.

Decentralized exchange aggregator 1inch Network [1INCH] witnessed a decline in network activity in the third quarter of the year, Messari found in a new report.

Is your portfolio green? Check out the 1INCH Profit Calculator

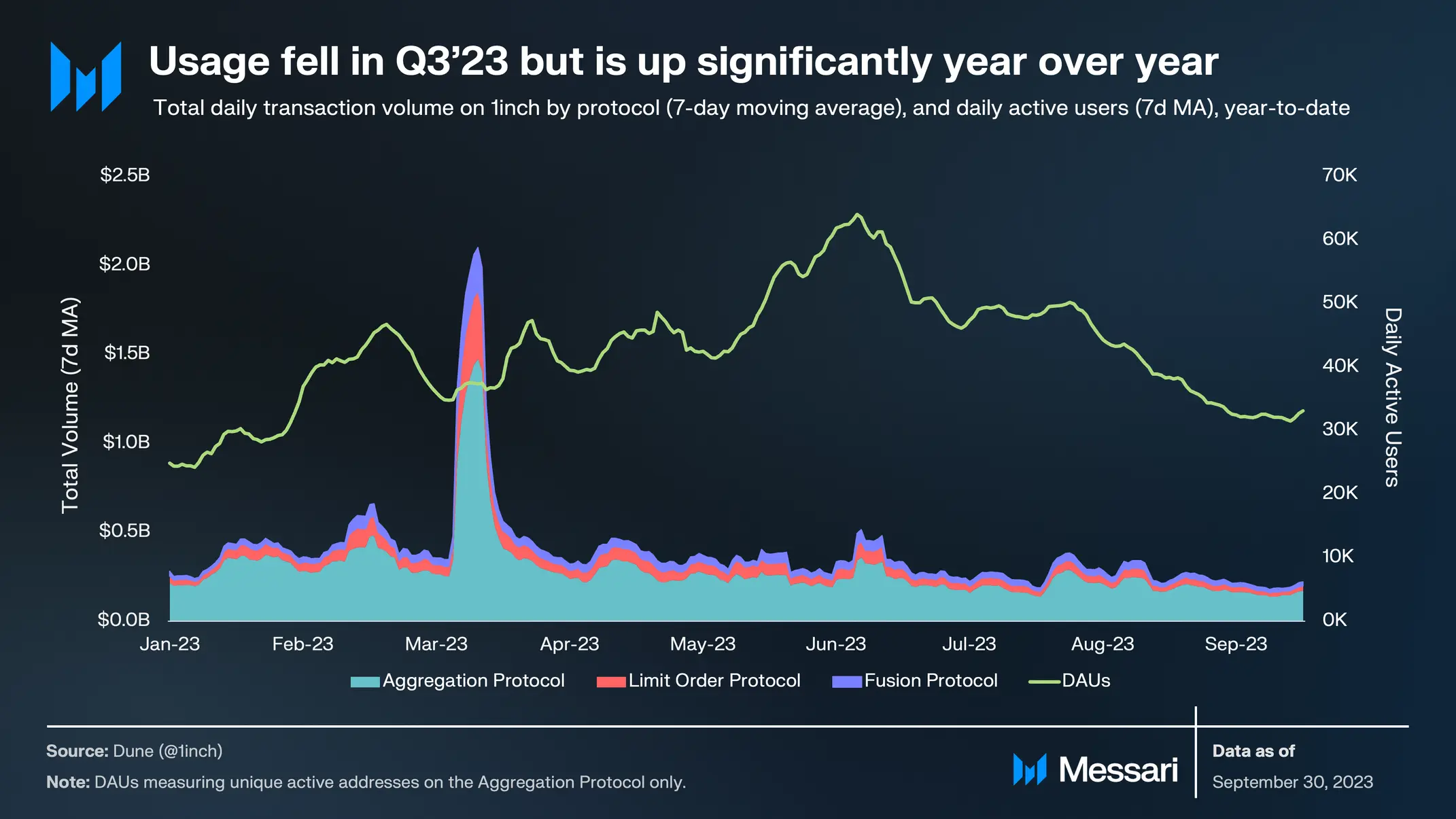

According to the on-chain data provider, the average count of daily active addresses on the protocol fell by 16% between July and September. During that period, the address count on 1inch totaled 40,000. In Q2, this was 46,000.

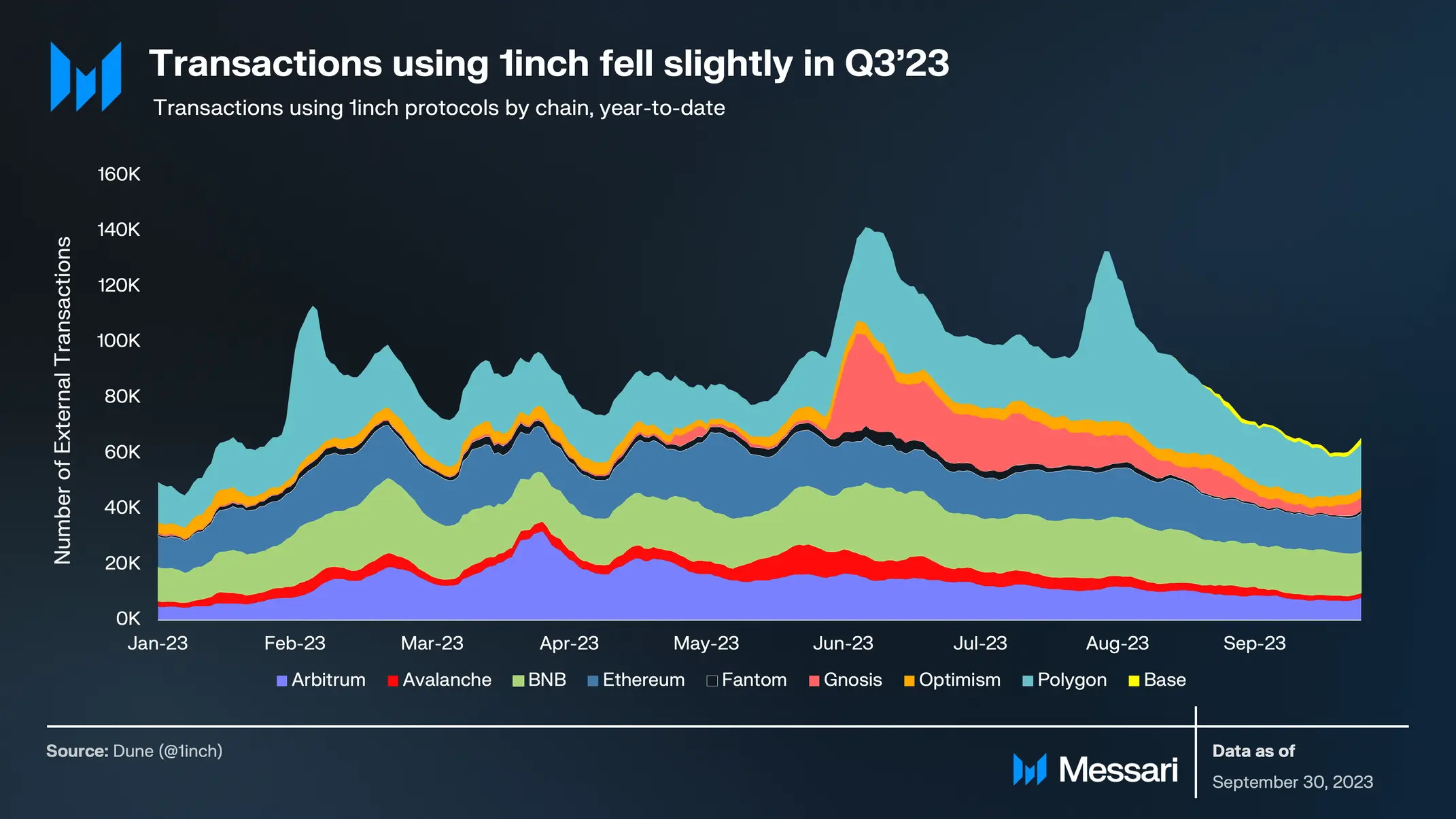

Messari found further that in Q3, more than 50% of 1inch’s users were on its “largest two markets by DAUs, Polygon, and BNB.” However, the number of users on these markets slightly decreased by 8% on Polygon and 7.4% on BNB Chain.

On the Arbitrum [ARB] and Avalanche [AVAX] networks, 1inch witnessed a daily active user decline of 36% and 46%, respectively, last quarter.

Optimism [OP] offered some respite as 1inch recorded a 14% growth in user count on the leading Layer 2 (L2) network. This brought its daily active users to over 2,700 on Optimism [OP] in Q3, Messari noted.

Due to the fall in user count, transaction volume on each 1inch protocol also declined during the quarter.

1icnh consists of the Limit Order Protocol, 1inch Fusion, and Aggregation Protocol. The Limit Order Protocol allows users to place limit orders on decentralized exchanges [DEXes], while 1inch Fusion offers gasless execution and instantaneous order matching for these limit orders.

The Aggregation Protocol assists users in aggregating liquidity from multiple DEXes and finding the best swap based on users’ desired token pair and amount.

According to Messari:

“Volume fell in each protocol in Q3, led by the Limit Order Protocol volume falling 37% to $3.3 billion in volume. Volumes via 1inch Fusion fell 29% to $2.7 billion in the quarter, and volume on the Aggregation Protocol fell 25% to $17 billion.”

Moreover, the report added that transaction volume assessed by blockchain networks also plummeted. On Arbitrum and Avalanche, 1inch’s transaction volumes fell by 39% and 45%, respectively.

However, some growth was recorded on Polygon [MATIC], Gnosis [GNO], and Optimism.

Read 1inch Network’s [1INCH] Price Prediction 2023-2024

Despite the headwinds witnessed during the quarter under review, Messari noted that,

“1inch retained its greater-than 50% market share again this quarter.”

This occurred in spite of the 16% decline in transaction volume across DEX aggregators recorded in the quarter.