US stocks and government bonds sank and the dollar strengthened on Monday after last week’s blockbuster jobs report raised the likelihood of further interest rate increases.

Wall Street’s blue-chip S&P 500 closed 0.6 per cent lower and the tech-heavy Nasdaq Composite lost 1 per cent as the most recent non-farm payrolls report continued to dim sentiment.

Concerns that borrowing costs may still have further to rise were stirred on Monday after Raphael Bostic, president of the Fed’s Atlanta branch, said the January jobs report could lead to a higher peak in interest rates.

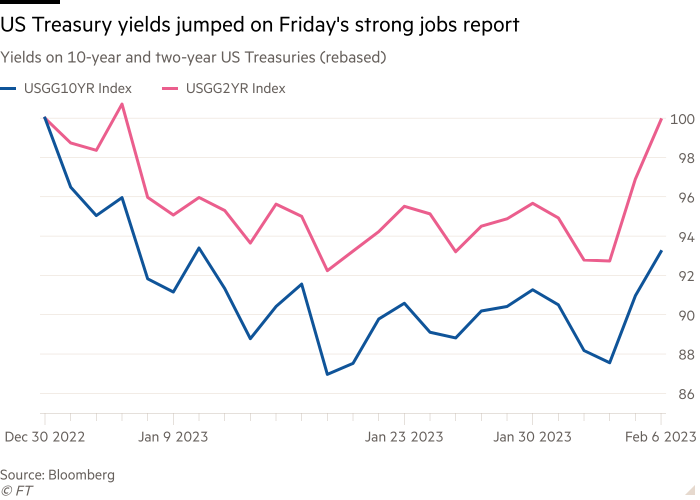

Bostic’s warning on Monday afternoon prompted a sell-off in US government bonds to pick up steam. The rate-sensitive two-year Treasury yield was up 0.19 percentage points to 4.49 per cent, while the yield on the benchmark 10-year Treasury rose 0.12 percentage point to 3.65 per cent.

US equities fell on Friday after the jobs report, but gained over the week as the Federal Reserve raised its main policy rate by only a quarter percentage point, the smallest amount since March.

The report showed that the US added 517,000 jobs in January, much higher than the 185,000 anticipated by Wall Street economists. The unemployment rate fell to a 50-year low at 3.4 per cent and average earnings increased.

“The US labour data shocked” and the number of jobs created “makes it more probable that the Fed will keep hiking”, said Steve Englander, a strategist at Standard Chartered.

A measure of the dollar’s strength against a basket of six other currencies added 0.7 per cent on Monday, but Refinitiv data shows that the currency has slipped about 6 per cent over the past three months as US rate rises have slowed.

Englander said the jobs report on its own was unlikely to unwind the negative view of the dollar, but that “alarming inflation signals” when January’s numbers are released later this month might do the trick. Inflation declined for a sixth consecutive month in December, coming in at an annual rate of 6.5 per cent.

Europe’s region-wide Stoxx 600 fell 0.8 per cent, as did Germany’s Dax, with sentiment also eroded by weak December eurozone retail sales figures. London’s FTSE 100, which last week hit a record high, fell 0.8 per cent.

The yield on the 10-year German Bund added 0.11 percentage points to 2.30 per cent, reversing a decline last week.

Traders had recently rushed back into government bonds on hopes that the current cycle of rate rises may be nearing its end, even though the European Central Bank and the Bank of England last week raised rates by half a percentage point.

Most Asian equities declined on Monday as a rally in January for Chinese equities fizzled out and heightened US-China tensions deflated sentiment. Hong Kong’s Hang Seng index fell 2 per cent, while China’s CSI 300 shed 1.3 per cent.

Prices for the international oil benchmark Brent crude added 1.3 per cent to $80.99 a barrel after losing 7.8 per cent last week. US benchmark West Texas Intermediate rebounded 1 per cent to $74.11 a barrel after falling 7.9 per cent in the previous week.