Accidents happen. Insurer Direct Line revealed more than just a scrape on Wednesday. The UK motor specialist said a December cold snap added £90mn in extra claims from such mishaps as burst pipes.

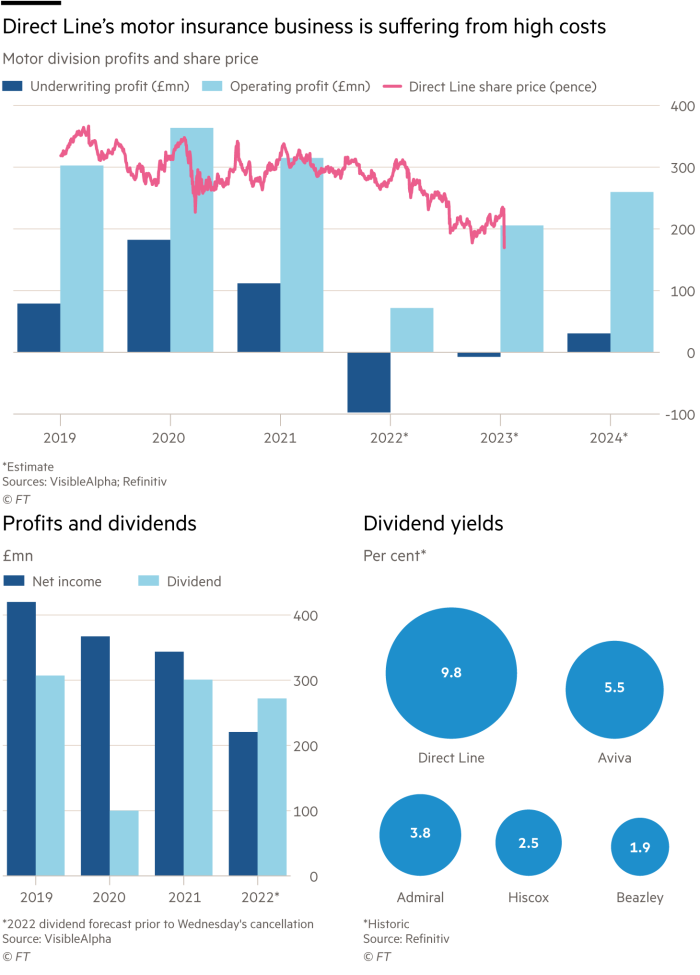

Weather-related claims for the year would be £140mn, double the initial estimate. Remaining dividends for 2022, confirmed in November, would have to be scrapped. Shares plunged 28 per cent.

It is the latest bump in the road for UK non-life insurers, which have been struggling with the rising cost of motor claims. Direct Line already warned on profits in the summer, scuppering a plan for £50mn in buybacks.

Lex was among pundits that judged this put the dividend in doubt. Management led by chief executive Penny James gambled it was not. That bet has backfired spectacularly.

Inflation has been pushing up the cost of claims as car parts and labour become more expensive. Direct Line should be raising prices to offset this. But third-quarter trading failed to demonstrate required discipline. Motor premiums are still falling faster than policy volumes.

Plainly, Direct Line fears losing market share in this fiercely competitive industry. It now has little choice but to increase charges.

The shares reflect the malaise. They trade at 7 times forecast earnings for this year, just under half the valuation of peer Admiral. If Direct Line can achieve its 2023 payout — which is increasingly in doubt — its shares would yield an impressive 13 per cent. A stretched balance sheet may make that impossible.

Direct Line said capital would now be at the lower end of guidance, with a solvency ratio of 140 per cent. Even with a 30 per cent cut in this year’s dividend — which the company still expects to pay in full — the ratio might only recover to 150 per cent by the end of the year, thinks Citi.

That would still be the lowest year-end figure recorded by Direct Line since the measure started in 2015. Insurance is all about seeing potholes ahead. The failure of Direct Line to do so is disappointing.

Our popular newsletter for premium subscribers is published twice-weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.